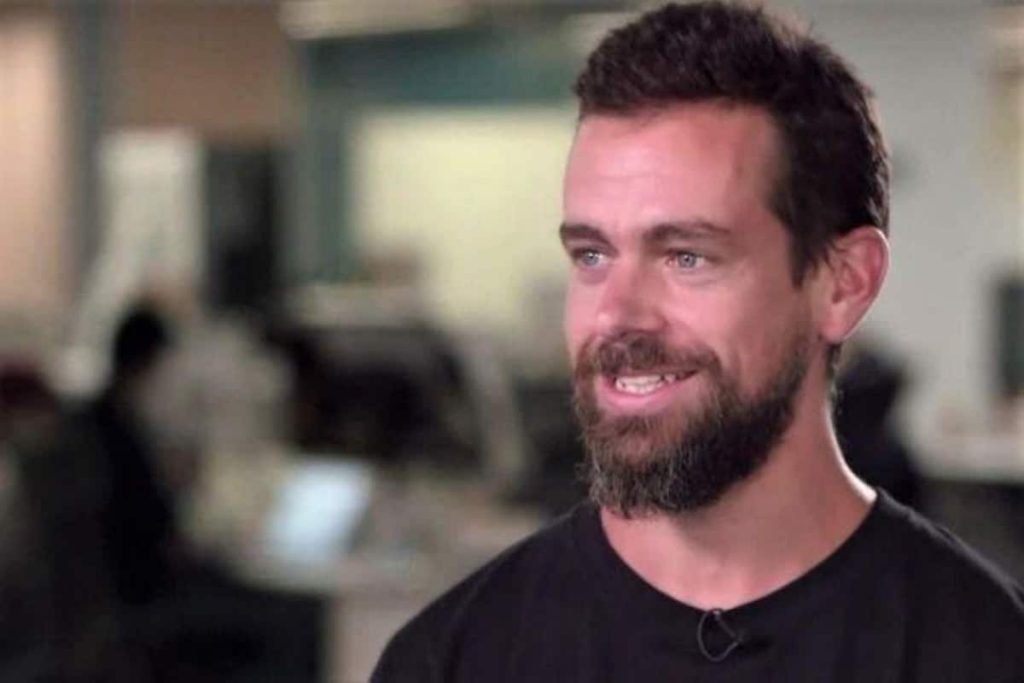

Block, the Bitcoin-focused fintech company led by Jack Dorsey, reported robust financial results for the third quarter of 2023, surpassing analyst expectations and marking a profitable period.

The firm recorded $5.62 billion in revenue for Q3 2023, a notable achievement driven by strong growth in both Cash App and Square. This success translated into a $44 million profit from its Bitcoin holdings, benefiting from the recent surge in Bitcoin prices.

In a shareholder letter shared on November 2, Dorsey outlined the company’s strategic focus and plans, particularly emphasizing its commitment to Square. He also highlighted key financial metrics from the third quarter, including the authorization of a $1 billion share repurchase program to offset dilution from share-based compensation.

During Q3 2023, Block achieved a gross profit of $1.90 billion, reflecting a substantial 21% year-over-year increase. Notably, Cash App, the mobile payment service, contributed significantly to this success, generating a gross profit of $984 million, up 27% year-over-year. Square, another integral part of Block’s ecosystem, contributed a gross profit of $899 million, reflecting a commendable 15% year-over-year growth.

Total net revenue for Q3 2023 reached $5.62 billion, marking 24% year-over-year growth. Excluding Bitcoin revenue, revenue was $3.19 billion, a 16% year-over-year increase. Transaction-based revenue and gross profit saw gains of 9%, totaling $1.66 billion and $674 million, respectively. Block processed $60.08 billion in Gross Payment Volume (GPV), a 10% year-over-year increase.

Subscription and service-based revenue also experienced substantial growth, reaching $1.49 billion, up 25% year-over-year. Correspondingly, gross profit in this category surged to $1.23 billion, a 28% year-over-year increase.

Block Reports Strong Q3 Performance with Bitcoin Revenue-Leading Growth

In the standout quarter, fintech company Block demonstrated substantial growth, reporting $5.6 billion in revenue for Q3. Bitcoin revenue played a significant role, accounting for around 43% of the total revenue. The positive performance was attributed to robust consumer demand and increased spending.

Block’s Bitcoin gross profit notably increased by 22% year-over-year, reaching $45 million. This growth was fueled by the sale of $2.42 billion worth of BTC to customers through Cash App. The company’s Bitcoin gross profit represented 2% of Bitcoin revenue.

Moreover, Block emphasized that it did not incur any impairment losses on its Bitcoin holdings in the previous quarter. As of September 30, 2023, Block’s investment in Bitcoin had a carrying value of $102 million. However, its fair value, determined by observable market prices, was $216 million, indicating a $114 million surplus over its carrying value.

The surge in BTC revenue was attributed to both an increase in the average market price of Bitcoin and a rise in the quantity of Bitcoin sold to customers.

Read the full article here