The US Securities and Exchange Commission (SEC) has tried regulating the crypto space through enforcement actions in the last three years.

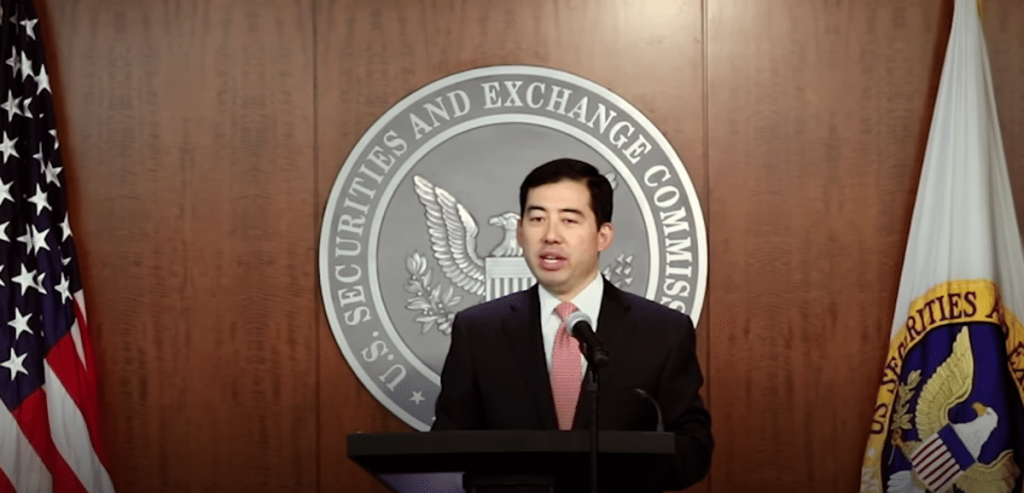

In the opinion of the agency’s commissioner, Mark Uyeda, this shortsighted approach makes it harder to bring much-needed clarity to the nascent industry.

During the Friestad Memorial Lecture in London, Uyeda expressed his opinions.

The SEC commissioner suggested that the agency should have established clear guidelines regarding acceptable and unacceptable behavior in the cryptocurrency industry. This would have given investors the necessary clarity to navigate the emerging industry.

In contrast, the SEC, led by former blockchain professor Gary Gensler, has taken an enforcement approach, which Uyeda sees as a deviation from the expected norm of operation.

“Unfortunately, the SEC did not take this approach and instead is pursuing a case-by-case approach through enforcement actions. As a result, it will take years to reach any type of legally binding precedent, as matters will need to wind their way through the courts before reaching the courts of appeal level,” Uyeda added.

The Republican commissioner, who joined the SEC in 2006, stated that the agency has intentionally side-stepped the chance to propose rules for the crypto space despite a slew of directives the agency gave in the past two years.

To him, the SEC’s slew of enforcement actions as a regulatory policy shows that it is not keen on providing a chance for the public to make an input.

Securities’ Law Only Applies to ‘Securities’?

Gensler-led SEC has been fixated on the idea that all cryptocurrencies (bar Bitcoin and Ethereum) are securities.

According to a June 8 post, the SEC listed 67 top crypto brands as asset securities. In the list were Solana, Binance Coin (BNB), Cardano, Matic, Filecoin, and several others.

seems the SEC thinks Solana, Cardano, Polygon, Cosmos, Algorand etc are ALL securities

this gets Coinbase, Robinhood etc involved as well

time to put the interchain bullsh*t aside and unite against the war on crypto

the SEC is unhinged and must be stopped pic.twitter.com/Win17xRJOP

— mert | helius.dev (@0xMert_) June 5, 2023

Over the months, the top government regulator has maintained its position on these digital assets being securities.

However, Uyeda disagrees with this notion.

The commissioner believes the federal securities law only applies to an asset if the instrument in question has been deemed a security.

Uyeda argues that the SEC has been unable to clarify the issue, making it difficult for market participants and the courts to analyze the issue properly.

The US regulator has continued to point to the famous Howey Test as its premise to come down hard on supposed defaulters.

The Howey Test surmises that an investment contract means a contract, transaction, or scheme wherein a person invests money in a common enterprise with hopes of making a profit down the line from the efforts of the issuing party.

Defaulting crypto firms like the Binance and Coinbase exchanges have already felt the brunt of the regulator’s ire. Both exchanges have called on the SEC to provide clear roadmaps on its expectations to make needed adjustments.

https://twitter.com/DigitalChamber/status/1718659268432556446?s=20

Meanwhile, the US Chamber of Digital Commerce stated that the SEC’s regulation-by-enforcement approach is stifling innovation and forcing market participants to relocate offshore amid an uncertain regulatory climate.

Read the full article here