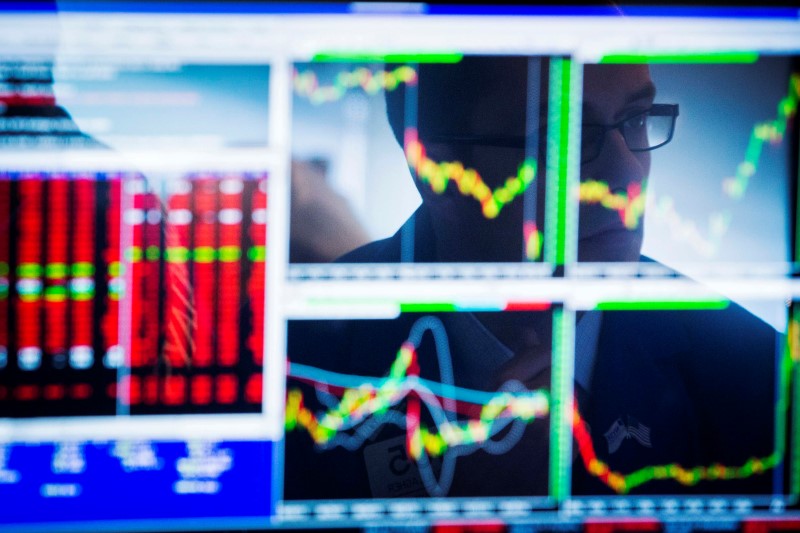

© Reuters.

APM Terminals Pipavav, a Public-Private Partnership (PPP) port and part of the APM Terminals global terminal network, reported a substantial increase in its net profit for the second quarter of Fiscal Year 2024. The company announced on Wednesday that its net profit had surged by 52% to ₹1,071.32 million ($14.3 million), up from ₹707.13 million during the same period in the previous year.

The company’s revenue from operations for the same quarter also increased by 12%, reaching ₹2,526.06 million ($33.8 million), compared to the previous year’s Q2. Furthermore, its EBITDA rose by a quarter to ₹1,506.44 million ($20.1 million), up from ₹1,201.70 million in Q2FY23, yielding a robust EBITDA margin of 60%.

In terms of cargo volumes, the port saw mixed results during this period. Container volume expanded by 16% to reach 216,000 TEUs, while dry bulk volume experienced a significant drop of 41% to 0.78 million MT. However, there was an impressive increase in liquid volume and Ro-Ro volume, which rose by 52% and a substantial 139%, respectively. In addition, the quarter witnessed a 27% rise in container trains handled.

APM Terminals Pipavav’s current annual cargo handling capacity spans across containers, dry bulk cargoes, liquid bulk, and RoRo. It continues to hold the distinction of being the first port connected to the Dedicated Freight Corridor (DFC) in India.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Read the full article here