Shares of International Game Technology (NYSE:IGT) have been a solid performer over the past year, rising about 10%. However, they have fallen over 10% in the past months, given some concerns about the health of the consumer, which could weigh on gaming industry dynamics. IGT is delivering well, expanding margins, strengthening its balance sheet, and appears poised for ongoing growth. At less than 10x free cash flow, I view shares as attractive.

Seeking Alpha

In the company’s third quarter, it earned $0.52 in adjusted EPS, $0.04 ahead of consensus, while revenue of $1.06 billion beat estimates by 3%. Excluding its Italy divestiture, revenue is up 4% from last year. The company generated 21% EPS growth thanks to ongoing margin expansion efforts. Operating income rose 10% to $239 million as margins expanded by 220bp, thanks to improved R&D discipline, supply chain improvements, and normalized results in its digital business following an acquisition. Importantly, management expects ongoing margin accretion through 2025.

IGT operates across three segments. First, lottery revenue rose 5% to $601 million thank to strength in Powerball and Mega Millions play, as well as growth in Italy. This marked the third quarter with EBITDA margins over 50%. IGT essentially provides services to help jurisdictions run their lotteries, receiving a share of revenue in keeping with the level of ticket sales. In the quarter, instant ticket sales were up 0.2% while multi-state jackpots were up 25.2% for 3.1% blended growth, given how weighted the business is to instant sales.

Multi-state sales can be volatile, depending on the size of the jackpots. The higher Powerball and Mega Millions jackpots get, the more ticket sales tend to accelerate—we have all witnessed the media and social frenzy when these jackpots approach or pass $1 billion, pulling in more casual gamblers. There is a degree of luck quarter to quarter on how long the games go without a winner, pushing up the jackpot, though changes to the games over the years have reduced the odds in an effort to make big jackpots more likely.

Interestingly, this part of the lottery business benefits from higher interest rates. The below snapshot is from the Powerball. The advertised jackpot represents the payment if you choose to receive the jackpot over 30 years, rather than today’s cash value. That future payout is tied to the level of interest rates (similar to an annuity). Higher rates than several years ago means that the same cash value leads to a larger headline “jackpot.” Given bigger jackpots tend to pull in more buyers, the fact that higher rates are making jackpots larger than they used to be should support ongoing buying activity, all else equal.

Powerball

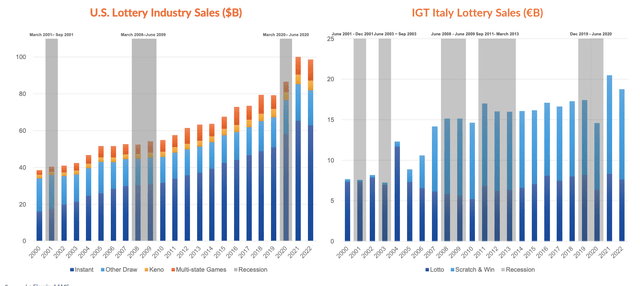

It is also worth emphasizing the lottery business is fairly noncyclical. In recessions, growth often slows, but historically, we have not seen declines in the US. While lottery spending is completely discretionary, it is inexpensive, and consumers tend to continue with their existing spending routine even in weaker economic conditions. In Italy where IGT has a large lottery business, there has been slightly more cyclicality (COVID business closures were also more of a headwind in 2020, but this should not repeat in typical recessions), but again, the business is fairly stable.

International Game Technology

This business is supported by long-term contracts with lottery organizations, providing secure future cash flow. IGT has a 6-year remaining life on lottery contracts, on a revenue-weighted basis. During the quarter, IGT signed contracts with California, extending that relationship through 2033 and with Kentucky through 2036. The longevity of its contracts, and continued history of re-signing with key counterparts provide an attractive and stable business profile.

Next, IGT’s gaming revenue rose by 8% to $403 million. This unit sells slots and other machines to casino. Its installed base grew by 1% to 52,627 units. This leads to ongoing software sales as it provides updates and licensing for its games, creating high-margin recurring revenue stream. In keeping with this, operating margins rose 550bp as the company rationalized R&D, has lower supply chain costs, and is receiving more system and software sales. Operating income was 23%; IGT has a 2025 target of 28-30%. Essentially, it is halfway to its targeted margin improvement. At that level, the company’s free cash flow will rise a further $60 million per year.

In the quarter, IGT shipped 9,158 units. ASP was down slightly to $15,100 due to less favorable mix. 586 of its shipped units were new, and the remainder were replacement. Now, this segment is more exposed to the economy as it is tied to casinos choosing to refresh machines. In a downturn, they may try to extend the life of their machines. I would note that equipment sales in the US are less than $5 billion, which is just a reaction of the $124 billion spent at casinos last year. This is not a primary way for casinos to reduce spending.

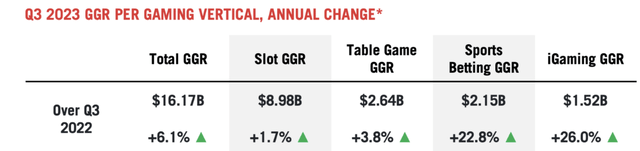

Additionally, at the moment, casinos are seeing growth. Last quarter, gross gambling revenue rose by 6%, with growth across the board.

American Gaming Association

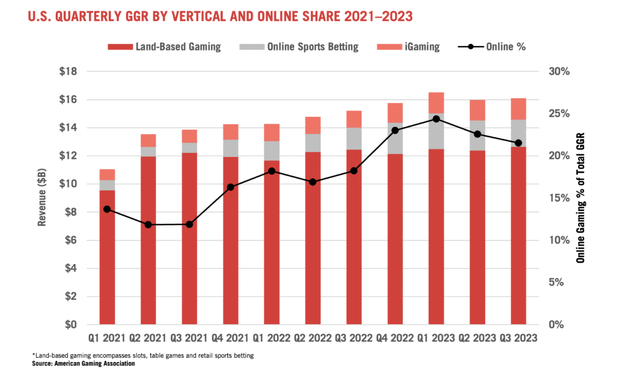

For all of the focus on online sports betting (which does not drive IGT’s business); according to the American Gaming Association, Q3 set a new record in physical gaming. This is the market that IGT’s gaming unit is serving, and so this strong level of consumer spending should support ongoing spending by casino operators on machines. The backdrop remains favorable.

American Gaming Association

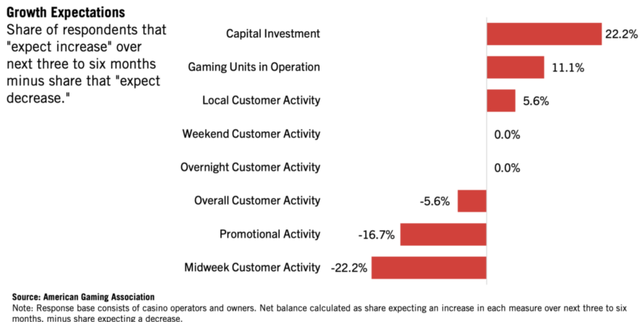

Indeed, as a result of the strong backdrop, a net 22% of gambling executives expect to spend more on capital investment in the coming months. As a consequence of this, a net 11% expect to see ongoing growth in gaming units in operations. This should translate to more machine sales for IGT, further growing its installed user base and creating the path for higher future software and system sales in coming years.

American Gaming Association

Additionally, I would note that IGT gets 80% of its gaming revenue from regional operators. Las Vegas is a small share of its business, as casinos everywhere need machines. If we see a rising casino count, this creates natural growth opportunity for IGT to increase gaming revenue as new casinos fill their floor with slots and machines. Importantly, several states are looking to do just that as they seek new forms of tax revenue. New York has created licenses for three new casinos. Bally’s (BALY) has just opened it temporary Chicago location while its larger, permanent one is set to open in 2026. While these projects will take several years to complete, the inclusion of casinos in major metro centers provides medium term growth for IGT’s business, beyond the regular upgrade cycle.

Finally, digital gaming was flat at $55 million but margins rose 660bp as iSoftBet has been integrated and benefits from IGT’s greater scale. With costs rationalized and this unit fully integrated, there should be scope for growth, given the growth in online gaming. The flat output here is disappointing, and as such, I am not assuming material revenue growth, instead assuming this unit stays flat, until proven it can grow.

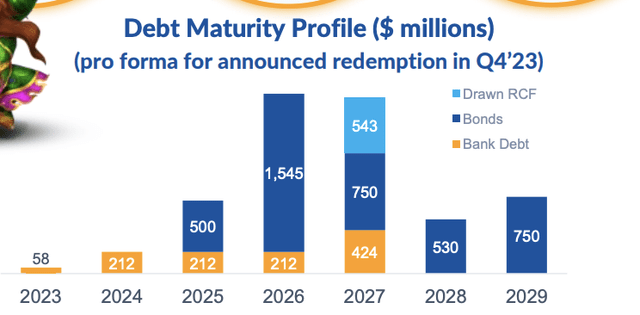

Finally, the company has brought net financial leverage to a historic low of 3x, a prudent move in today’s higher interest rate environment. IGT has $600 million in unrestricted cash and just prepaid $112 million of 2024 debt. As a you can see below, it does not have major maturities until 2025. This provides some insulation from the current interest rate environment. I view its $5.25 billion of net debt as very manageable.

International Game Technology

With strong margin expansion, IGT has been able to generate $324 million of free cash flow and $509 million adjusting for one-time items. Alongside results, management said that in Q4 it expects about $1.1 billion in revenue with lottery up low-to-mid single digital and gaming flat. Accordingly, for the full year, revenue will be at the high end of its prior range, or about $4.3 billion.

That will translate to about $600 million of normalized free cash flow. At its current share price, IGT has an 11% free cash flow yield. Its lottery business should be able to generate low-single-digit growth in keeping with nominal economic activity while its gaming unit should enjoy somewhat faster growth, particularly as it continues to benefit from higher software sales and some new casino openings. With further margin expansion, IGT should be a $700 million free cash flow business in 2025 without assuming any growth in digital. At a 10% free cash flow yield in 2025, shares have about 31% upside to $35, over the next two years. Combined with its 3% dividend yield, investors have a two-year annualized return potential of about 17%. That is compelling for a company with significant long-term contracts, improving debt metrics, and modest growth. In my view, IGT is a good stock to bet on for value-focused investors.

Read the full article here