As with other technology and online companies, Roblox Corporation (NYSE:RBLX) saw a huge boost in business from Covid shutdowns around the globe. The online gaming platform is one of the few companies to return to growth after a period of absorbing the excess growth. My investment thesis remains Bullish on the stock following a positive Investor Day 2023.

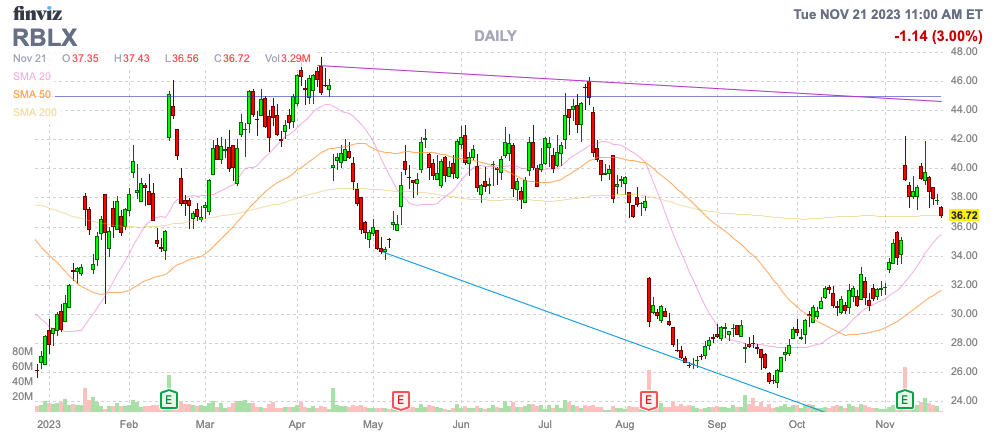

Source: Finviz

20% Bookings Growth

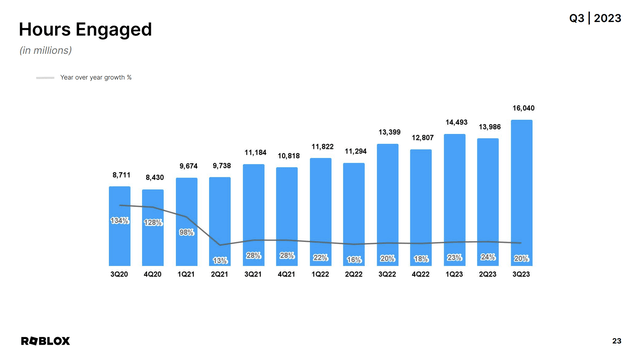

Roblox went through a period with limited bookings growth as a central focus of prior research. During this whole period, the company continued to grow usage metrics like DAUs, and Hours Engaged continued to grow at strong clips.

As an example, Hours Engaged only reported a few quarters where growth didn’t top 20% after a period during 2020 when engagement growth topped 100%. Roblox came public with a metric below 4,000 million hours per quarter and has seen the amount soar to over 16,040 million hours in Q3 ’23.

Source: Roblox Q3’23 presentation

The key to the story was the regions of growth with the key U.S. and Canada regions finally absorbing all of the Covid growth allowing the lower monetized regions to start being additive to growth. The stock has risen recently, with Roblox finally returning to reporting financial metrics with 20% growth.

At the Investor Day 2023, the company provided metrics confirming an extended period with bookings growth topping 20%, apparently catching some investors off guard. Roblox set the following general financial targets:

- 2024 bookings at FactSet level of $4.03 billion

- 2025-27 bookings growth of 20%+

- 2024 infrastructure capex at $100 million

- 2024 share dilution at 3% to 4%

- Operating margin improvement of 100 to 300 basis points over 3 to 5 years.

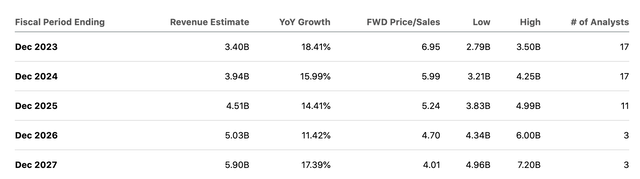

Roblox is set to hit a bookings total of $3.4 billion in 2023. At 20% growth, the bookings total would top $4.08 billion in 2024 versus the stated consensus of $4.03 billion. If the online gaming platform hits the 20% bookings growth target during the 2025-27 period, bookings will soar to $7.1 billion in 2027, while the market has a target of only $5.9 billion due to consistent projections for growth below 15% in the period.

Source: Seeking Alpha

The company is tapping into the Metaverse and augmented reality to grow the platform. In addition, AI is used widely for moderation to improve the quality of gameplay for kids.

Right now, Roblox generates ~$51 per user by monetizing just 20% of the hours on the platform. The company plans to expand into advertising in 2024 and jump into shopping in 2025, though a focus on a younger crowd would appear to make the reality for stronger growth in advertising and less on shopping.

The consistent growth in engagement and constant expansion of the monetization opportunities would suggest Roblox will probably spend a period during the next 4 to 5 years growing in excess of 20%. Despite the period of massive growth, the market continues to underestimate the prospects of Roblox.

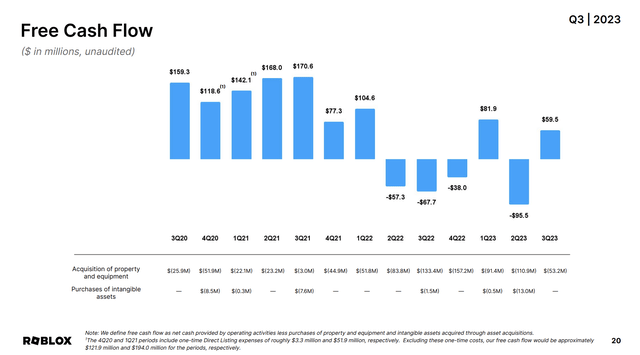

The online gaming platform has now invested aggressively into the business, allowing for a shift back to strong cash flows going forward. Some of the stock weakness over the last year has been due to the business model shifting to wild cash flow swings with multiple quarters of consuming cash.

Source: Roblox Q3’23 presentation

The reduced infrastructure spending combined with higher gross profits from the revenue/bookings growth will lead back to strong cash flows. Roblox generated $315 million in operating cash flows YTD highlighting the strong operating model as capex spending slows from the $255 million level YTD.

Not So Cheap

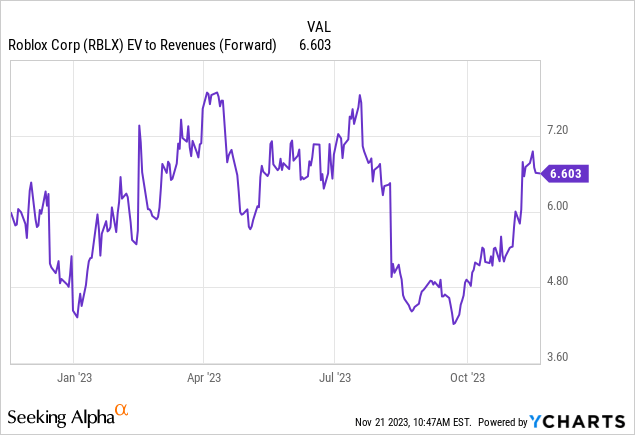

Roblox has surged back above $36 in the last couple of months. The stock trades at 6.6x forward EV/S targets, though keep in mind the sales targets appear low.

The stock now trades close to the peak multiple suggesting around 20% annualized returns based on bookings growth. The ideal situation is definitely to buy Roblox on weakness, as the stock regularly dips regardless of reporting solid growth.

Takeaway

The key investor takeaway is that Roblox has several major catalysts for growth beyond just ramping up engagement. The stock trades at an attractive level, and any dips in price should be bought up with the market constantly ignoring the ability of the online gaming platform to grow at consistent clips above 20%.

Read the full article here