A Quick Take On CoreCard

CoreCard Corporation (NYSE:CCRD) reported its Q3 2023 financial results on November 1, 2023, missing consensus revenue estimates.

The company provides various payment processing services to businesses and consumers located worldwide.

I previously wrote about CCRD with a Hold rating based on a shift in focus from licensing to processing.

While it is arguable as to whether the U.S. economy will fall into recession, I’m not optimistic that CoreCard Corporation will be able to meaningfully turn the business around absent strong growth from its Goldman relationship, which doesn’t look like it will happen any time soon.

Therefore, my outlook on CCRD is to Sell.

CoreCard Overview And Market

Georgia-based CoreCard provides various payment technologies and related services to companies primarily located in the U.S., Europe, and the Middle East.

The company is led by president and CEO Leland Strange, who was previously president of Quadram Corporation and has held board positions on numerous financial industry companies.

CoreCard’s primary offerings include the following:

-

Service API.

-

Various debit and credit cards.

-

Buy now, pay later programs.

-

Loyalty programs.

-

Software solutions.

-

Accounts receivable and loan transitions.

-

Private label products.

The company seeks new customers through its direct sales and marketing efforts and through partnerships and partner referrals.

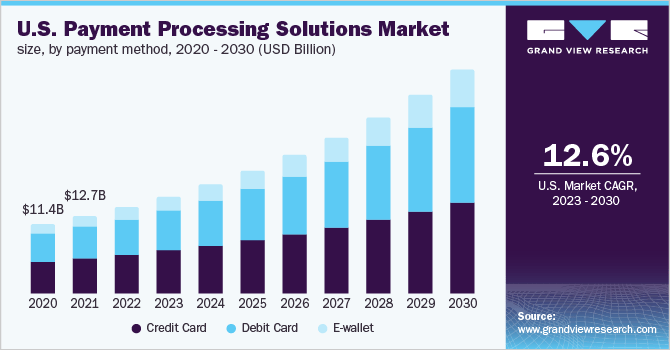

According to a 2023 market research report by Grand View Research, the global market for payment processing services was an estimated $47.6 billion in 2022 and is forecast to reach $140 billion by 2030.

This represents a forecast CAGR of 14.5% from 2023 to 2030.

The main drivers for this expected growth are continued growth in the number of smartphones used, the penetration of the Internet globally, the number of merchants seeking integrated payment processing solutions, and the entrance of new market participants with new technology offerings.

The chart below shows the historical and projected growth trajectory of the U.S. payment processing solutions market from 2020 to 2030:

Grand View Research

Major competitive vendors include:

-

PayPal.

-

Global Payments.

-

Block.

-

Wirecard.

-

Visa.

-

Jack Henry & Associates.

-

Paysafe Group.

-

Naspers Limited.

-

Others.

CoreCard’s Recent Financial Trends

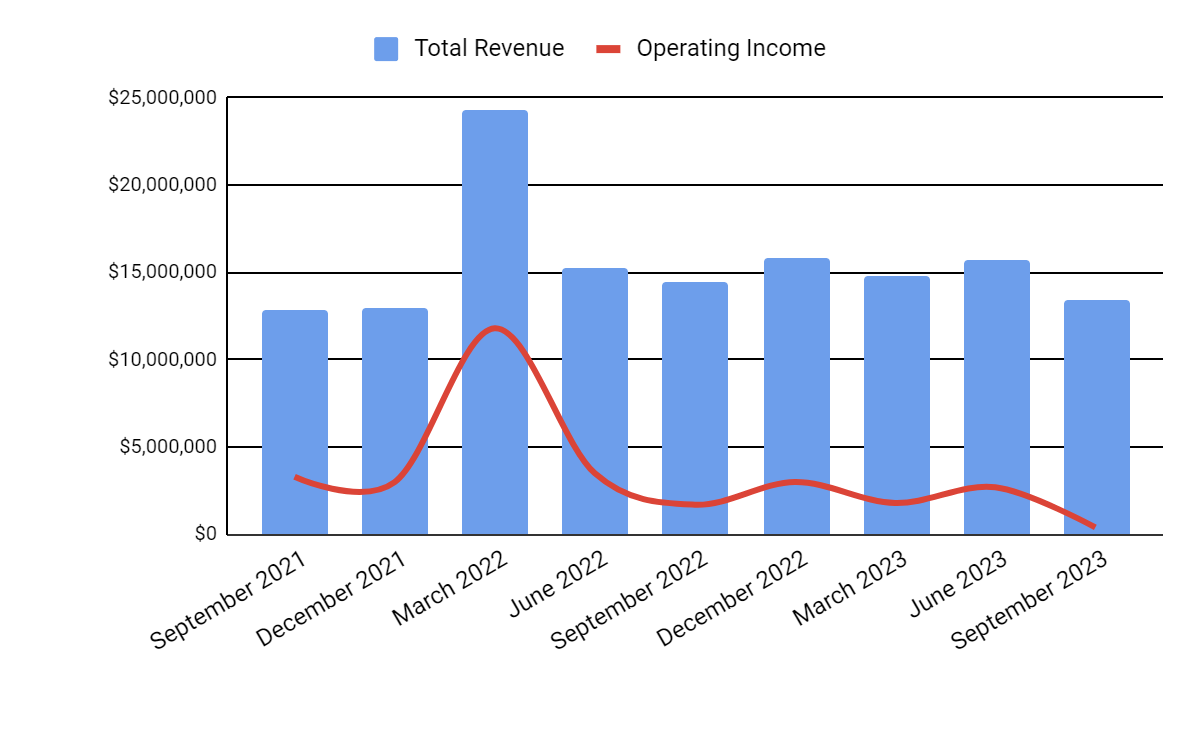

Total revenue by quarter (blue columns) has continued to decline in most quarters; Operating income by quarter (red line) has also dropped in the most recent quarter:

Seeking Alpha

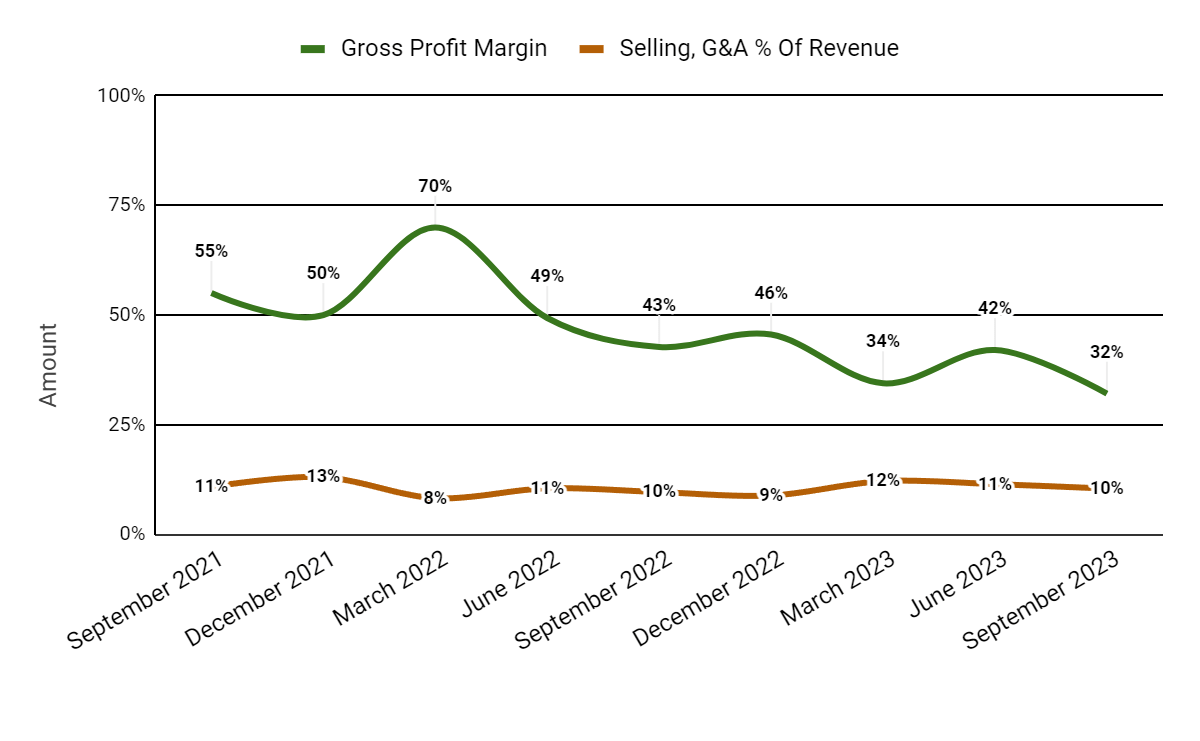

Gross profit margin by quarter (green line) has trended lower more recently; Selling and G&A expenses as a percentage of total revenue by quarter (amber line) have remained relatively flat:

Seeking Alpha

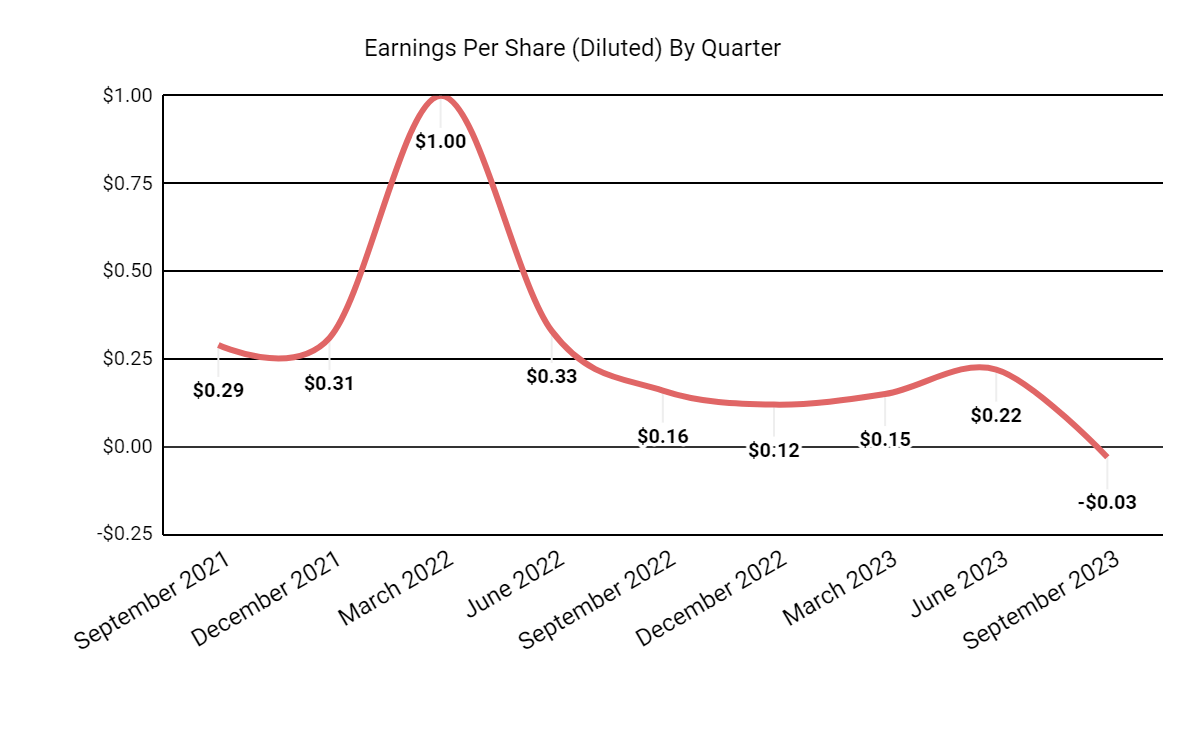

Earnings per share (diluted) have turned negative for the first quarter in nine quarters, as the chart shows here:

Seeking Alpha

(All data in the above charts is GAAP).

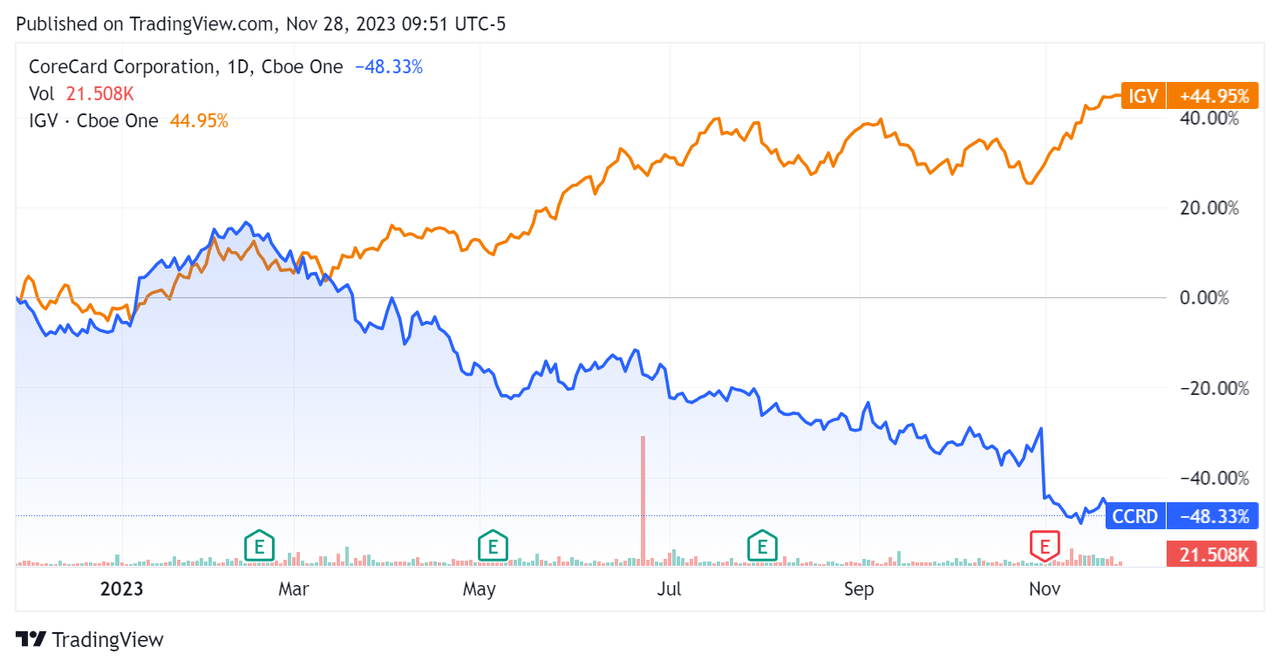

In the past 12 months, CCRD’s stock price has dropped 48.33% vs. that of the iShares Expanded Tech-Software Sector ETF’s (IGV) rise of 44.95%:

Seeking Alpha

For balance sheet results, the firm ended the quarter with $36.8 million in cash, equivalents, and short-term investments and no debt.

Over the trailing twelve months, free cash flow was $11.3 million, during which capital expenditures were $6.0 million. The company paid only $0.2 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For CoreCard

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (Trailing Twelve Months) |

Amount |

|

Enterprise Value / Sales |

1.7 |

|

Enterprise Value / EBITDA |

6.8 |

|

Price / Sales |

2.3 |

|

Revenue Growth Rate |

-10.9% |

|

Net Income Margin |

6.5% |

|

EBITDA % |

25.4% |

|

Market Capitalization |

$136,730,000 |

|

Enterprise Value |

$102,880,000 |

|

Operating Cash Flow |

$17,260,000 |

|

Earnings Per Share (Fully Diluted) |

$0.46 |

|

Forward EPS Estimate |

$0.37 |

|

Free Cash Flow Per Share |

$1.32 |

|

R&D / Revenue |

14.7% |

|

SA Quant Score |

Strong Sell 1.34 |

(Source – Seeking Alpha)

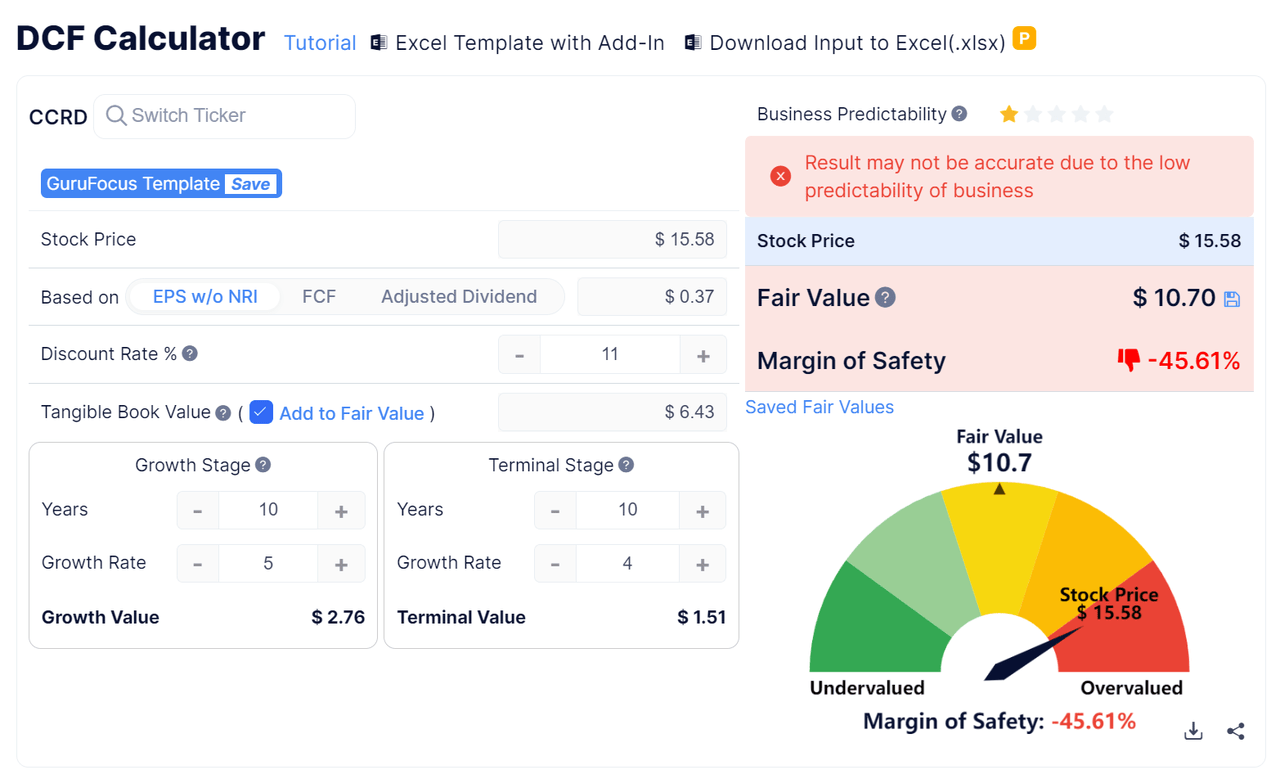

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

GuruFocus

Based on the DCF, the firm’s shares would be valued at approximately $10.70 versus the current price of $15.58, indicating they are potentially currently overvalued.

Commentary On CoreCard

In its last earnings call (Source – Seeking Alpha), covering Q3 2023’s results, management’s prepared remarks highlighted “working on the development of a new platform” without providing further details.

Management said it is continuing “to see nice growth from all customers, excluding Goldman [Sachs].”

Analysts asked leadership about the current pipeline, its The Goldman Sachs Group, Inc. (GS) activity, and a jump in deferred revenue.

Management didn’t directly respond with a characterization of the firm’s pipeline.

The Goldman Sachs activity is reduced as GS has slowed down its efforts in that regard. Card issuance continues to grow, although delinquency concerns are an issue.

Deferred revenue rose from a timing of payments from existing customers, with most of it being recognized in 2024.

Total revenue for Q3 2023 fell 7.6% year-over-year, while gross profit margin dropped 10.7%.

Selling and G&A expenses as a percentage of revenue increased 0.8% YoY, but operating income fell by 76.5% due to lower revenue and “higher costs from hiring in India and in our Colombia office…in addition to continued infrastructure investments in our processing environment.

The company’s financial position is good, with ample liquidity, no debt, and solid free cash flow.

Looking ahead, management will need to find a replacement for the lost Goldman revenue and generate new business from card issuers since that is its primary revenue determinant.

Given a generally weakening macroeconomic environment and a lackluster consumer, issuers may tighten their standards and reduce card issuance activities in the period ahead.

While there is room for disagreement as to whether the U.S. economy will fall into recession, I’m not optimistic that CCRD will be able to meaningfully turn the business around absent growth from its Goldman relationship.

Therefore, my outlook on CoreCard Corporation is to Sell.

Read the full article here