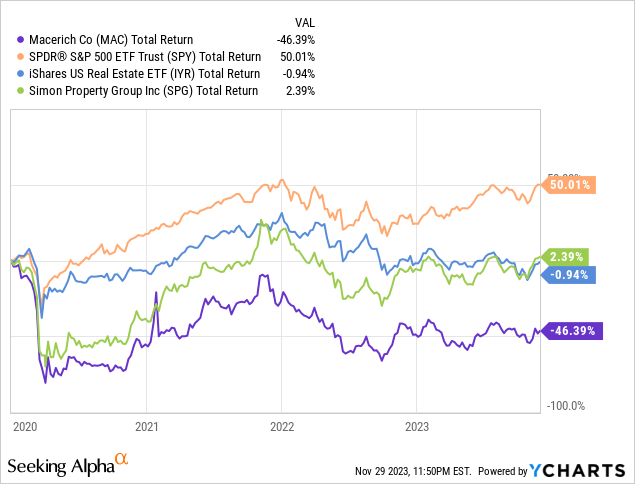

Macerich (NYSE:MAC) was heavily impacted by the Covid-19 pandemic. Shares have delivered a total return of -46.4% since the start of 2020. Comparably, MAC’s closest peer, Simon Property Group (SPG), has delivered a total return of 2.4% while the iShares US Real Estate ETF (IYR) has returned -1%.

MAC’s business has recovered from the Covid-19 induced challenges, but the stock continues to trade at depressed levels.

The stock currently trades at a very cheap valuation. However, despite an improved operating environment and significant debt reduction, the company remains highly levered.

I believe investors should wait for further balance sheet improvement and signs of FFO growth before buying MAC.

Company Overview

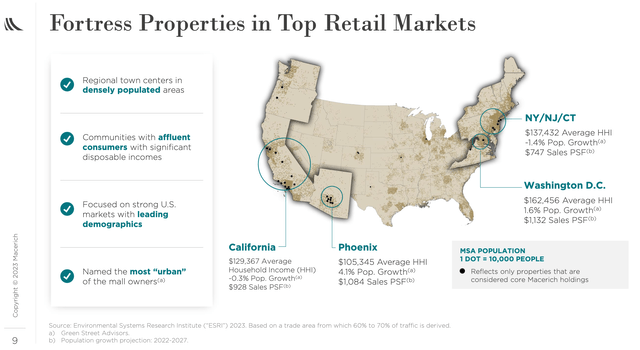

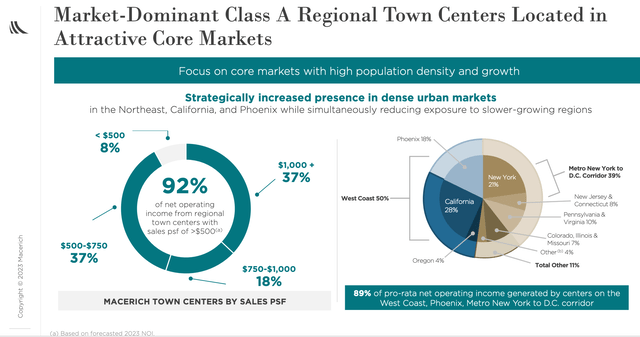

MAC is a REIT focused on regional town centers throughout the U.S. The company owns or has interests in 47 million square feet of gross leasable area (“GLA”) including 44 regional town centers, three community shopping centers, one office properly, and one redevelopment property.

MAC’s real estate portfolio is focused on class A properties in urban markets with high average household incomes. Key markets include California, Phoenix, Washington, DC, and the NYC metro area.

MAC Investor Presentation MAC Investor Presentation

Recovery From Pandemic-Induced Challenges

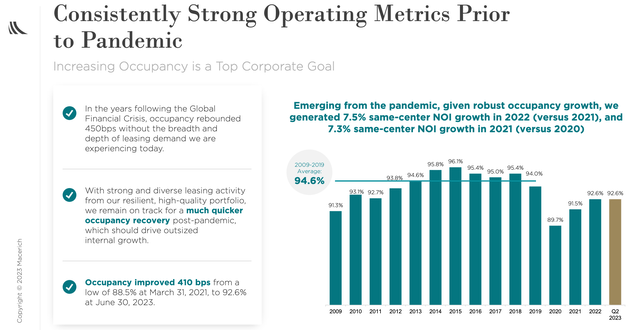

MAC reported peak occupancy in 2015 with an occupancy rate of 96.1%. Occupancy stayed fairly high over the next few years. In 2019, just prior to the Covid-19 pandemic, MAC reported occupancy of 94%.

The pandemic resulted in a major disruption to the physical retail business, and thus the company’s occupancy rate hit a low of 88.5% in March 2021. Since then, the company has experienced a gradual recovery. The recovery continued in Q3 2023 with the company reporting occupancy of 93.4%, the highest level since the onset of Covid-19.

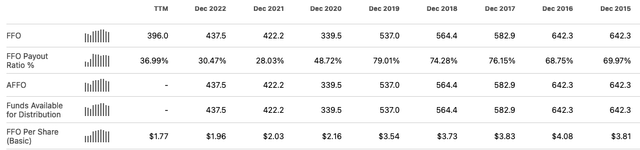

Improved occupancy has led to strong same-center NOI growth. The company reported same-center NOI growth of 7.5% and 7.3% for FY 2022 and FY 2021 respectively. For Q3 2023, the company reported same-center NOI growth of 4.8% compared to the same period a year ago. For FY 2023, MAC expects NOI growth of 3.75%-4.5% and FFO per share of $1.77-$1.83. Comparably, MAC reported FFO per share of $3.54 in 2019.

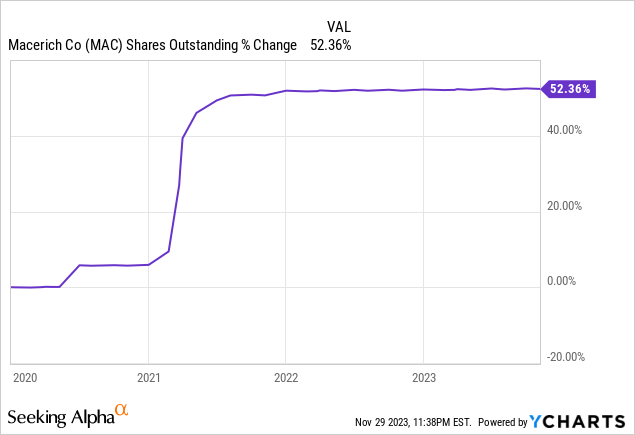

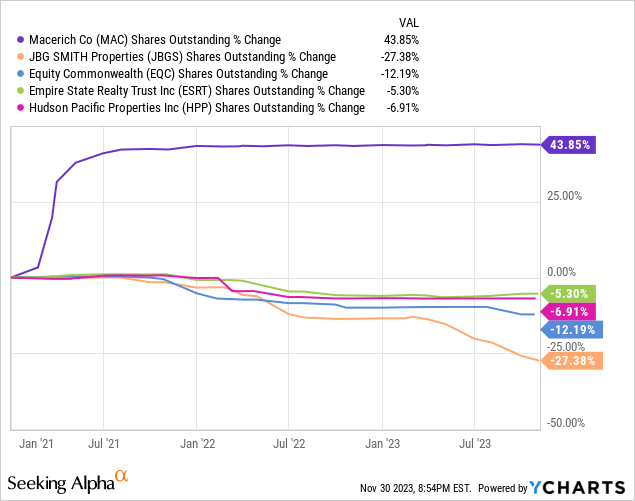

FFO per share has dropped sharply despite significant improvement in the business, as MAC has issued a considerable amount of stock over the past few years. In total, MAC has increased its share count by ~52% since the start of 2020.

MAC Investor Presentation Seeking Alpha

Highly Levered Balance Sheet

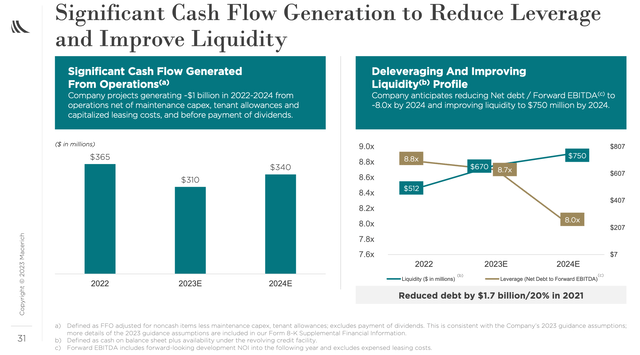

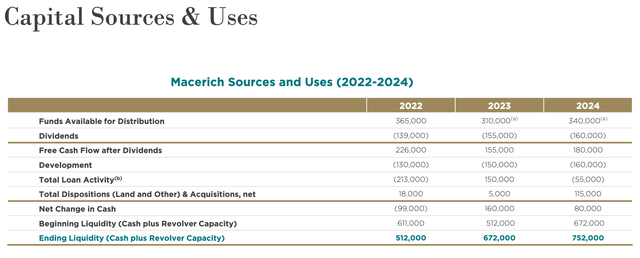

Despite significant debt reduction in 2021, MAC remains highly levered at 8.7x 2023 estimated EBITDA and 8x 2024 estimated EBITDA. Comparably, MAC’s closest peer SPG has net leverage of ~6.9x 2024 estimated EBITDA and ~6.8x 2025 estimated EBITDA.

Given MAC’s high degree of leverage, I believe the company could be exposed to challenges in the event of an economic downturn given the cyclicality of its tenant base.

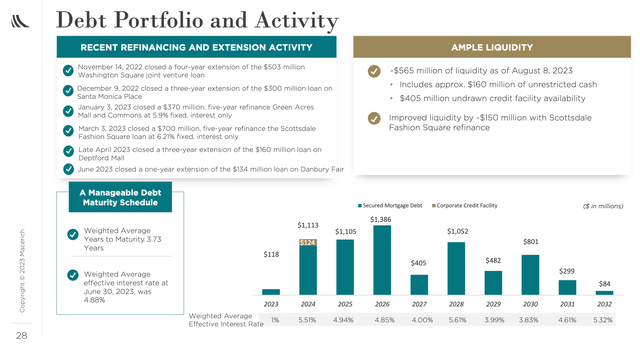

Furthermore, MAC currently has a weighted average effective interest of ~4.88% which compares to a 10-year Treasury rate of ~4.3%. Thus, MAC is heavily exposed to increases in interest expense as debt comes due and is refinanced. MAC is especially exposed to higher interest rates due to the fact that its debt portfolio has a relatively short weighted average years to maturity of just 3.73 years. Comparably, SPG’s debt has an average weighted years to maturity of 6.9 years.

During the company’s Investor Day in late 2022, the company noted a possible $150 million of proceeds from the issuance of equity to use toward debt repayment. However, that has not happened, as the company currently views the stock as undervalued. On the Q3 2023 earnings call, CFO Scott Kingsmore added additional commentary on potential equity issuances:

When we talked at Investor Day in November, I think one of the things we had and there was placeholder for equity issuance, as you noted, we don’t have any intention of issuing equity here. So, take that out of the equation, obviously, that influences the leverage targets. But, as we look at NOI growth, we think we’ll continue making progress in the next year and get in the realm of the low 8s by the time we get to the end of next year. That’s net debt to forward EBITDA. So that does take into account some forward NOI element to our redevelopment pipeline, which kind of makes sense given the fact we’re incurring a lot of cost upfront without the benefit of the NOI. So that’s our perspective, low rates by the end of next year.

While MAC is not likely to issue equity in the near term based on that statement, investors should be reminded that the company still has $151.7 million of gross sales of common stock available under its March 2021 ATM Program.

Efforts to deleverage the balance sheet are also likely to restrict the company from significantly increasing its divided payout rate over the near term, as the company expects to increase liquidity by holding onto more cash than was previously the case.

MAC Investor Presentation MAC Investor Presentation MAC Investor Presentation

Growth Prospects

Simply stated, MAC is not a growth story. The reason for this is the secular headwinds currently being experienced due to a shift from physical retail to online retail have created an oversupply of physical retail space.

Currently, consensus analyst estimates call for the company to report FFO per share of $1.77 for FY 2023, $1.79 for FY 2024, $1.85 for FY 2025, and $1.87 for FY 2026. Thus, Wall Street expects MAC to post low single-digit FFO per share going forward.

While I believe these estimates are reasonable given upside drivers from inflation (higher rents) and increased occupancy potential, I am not sold on the fact that the company will deliver. Despite recent improvements in MAC’s underlying business, the company still has reported FFO which is well below pre-pandemic levels.

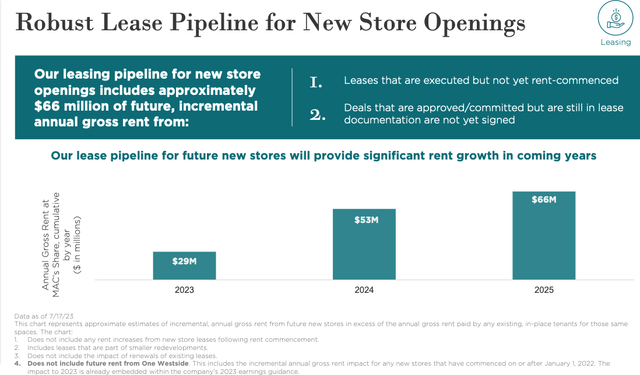

One potential driver of increased FFO over the next years is the potential for new store openings. MAC expects rents from leases that are executed but not yet rent-commenced and deals that are approved but not yet documented to account for $66 million in additional run rate rent by 2025.

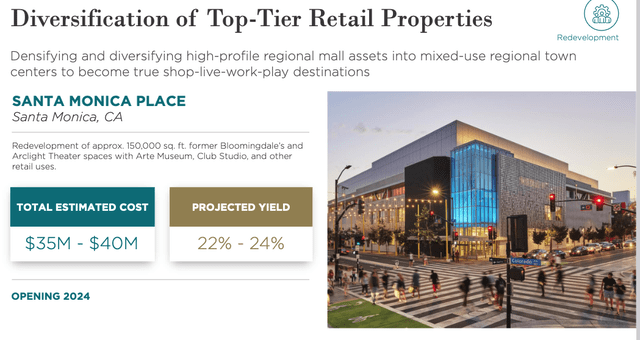

Another potential growth driver for MAC is the diversification of top-tier retail-only properties into mixed-use properties. The company plans to spend ~$155 million on its redevelopment program in FY 2024.

Seeking Alpha Seeking Alpha MAC Investor Presentation MAC Investor Presentation

Valuation

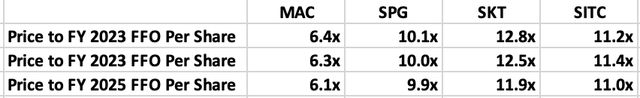

Simply put, MAC is a cheap stock. The stock trades at ~6.4x FY 2023 consensus FFO per share and ~6.3x consensus FY 2024 FFO per share. Comparably, the S&P 500 trades at ~18.6x consensus 2024 earnings.

While MAC appears to be cheap on a relative basis, it must be noted that MAC is not a growth story. In addition to recent FFO per share declines, MAC had been struggling to grow FFO per share in the pre-pandemic era. Comparably, the S&P 500 has traditionally been able to grow earnings per share at a high single-digit rate and is expected to grow EPS by ~12% over the next year.

MAC is currently trading at a substantial discount relative to its closest peer, SPG. Moreover, MAC also trades at a discount to shopping center REITS such as SITE Centers (SITC) and outlet-focused REIT Tanger Inc (SKT).

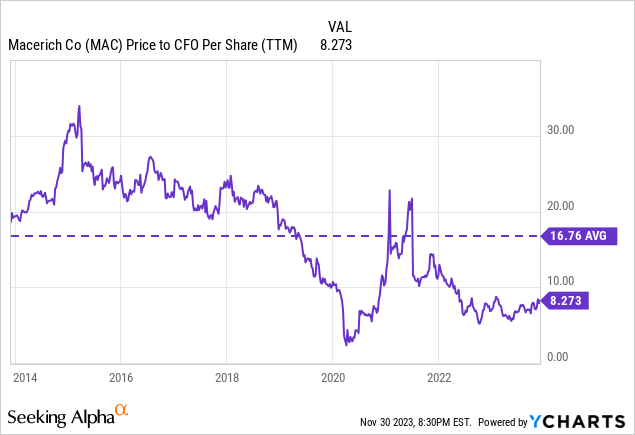

In addition to trading at attractive levels vs. peers, MAC is also trading cheap relative to its own historical norm.

Author (Seeking Alpha Data)

Attractive Dividend Yield But Not A Dividend Growth Story

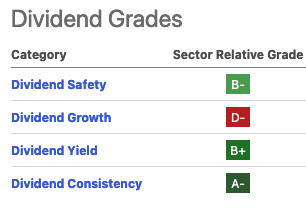

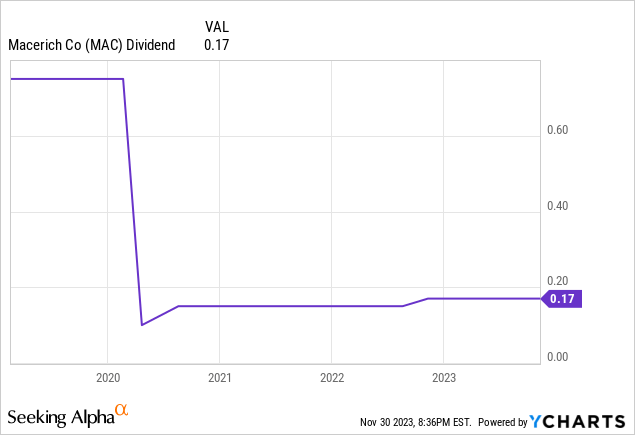

MAC currently pays a quarterly dividend of $0.17 per share and thus the stock yields ~6% based on current market prices. While this level of yield is somewhat attractive on an absolute basis, it should be noted that MAC does not have a strong history of growing its dividend and was forced to dramatically cut its dividend in 2020. Consistent with this, MAC has earned a Seeking Alpha quant score Dividend Growth score of D-.

While MAC’s dividend payout ratio as a percentage of FFO is fairly low at just 38% on a forward FY 2024 basis, the dividend is not all that safe due to the cyclical nature of MAC’s business and the high balance sheet of the company.

Seeking Alpha

No Share Repurchase Program

While MAC’s management team has publicly argued in its Q2 2023 investor presentation that the stock is “enormously undervalued”, it has yet to take action in terms of implementing a share repurchase program.

While most REITS choose to focus on dividends over buybacks, a number of REITS have executed large share repurchase programs over the past few years. One notable example is JBG Smith Properties (JBGS) which has reduced its share count by ~27% over the past three years. I recently discussed this in my piece JBG Smith: Time to Buy This Beaten Down REIT

Office REITs such as Equity Commonwealth (EQC) and Empire State Realty Trust (ERST) have also repurchased a significant portion of shares over the past few years.

MAC’s lack of a repurchase program leads to be question of management’s conviction the stock is “enormously undervalued.”

MAC Investor Presentation

Conclusion

Despite a significant recovery in its underlying business, shares of MAC have failed to recover most of their pandemic-induced losses.

While occupancy levels have recovered close to pre-pandemic levels, the company’s FFO per share remains significantly lower due to a massive increase in the share count.

MAC has significantly improved its balance sheet over the past three years, but the company remains highly leveraged. In addition to relatively high levels of leverage, MAC also faces a fairly significant maturity wall over the next few years. Currently, MAC enjoys a very low cost of financing, but this will rise as the company is forced to refinance existing debt.

While the company’s management team currently views its stock as significantly undervalued, it has mentioned the possibility of selling shares as recently as late 2022 (a time when the stock was trading at ~6.4x FFO per share which is close to current levels) and the company has $151.7 million remaining on a previously announced ATM stock offering program.

MAC trades at a cheap valuation relative to peers and its own history, but the company has struggled to deliver growth historically. MAC’s ~6% dividend yield is attractive, but the company has not been a steady dividend payer historically and was forced to dramatically cut the dividend in 2020.

The lack of a share repurchase program is disappointing given the company’s significant cash flow generation, low dividend payout ratio, and favorable view of its own stock.

I am initiating MAC with a hold rating but would consider upgrading the stock if the company initiates a large share repurchase program, improves its balance sheet, and shows that it can return to FFO growth.

Read the full article here