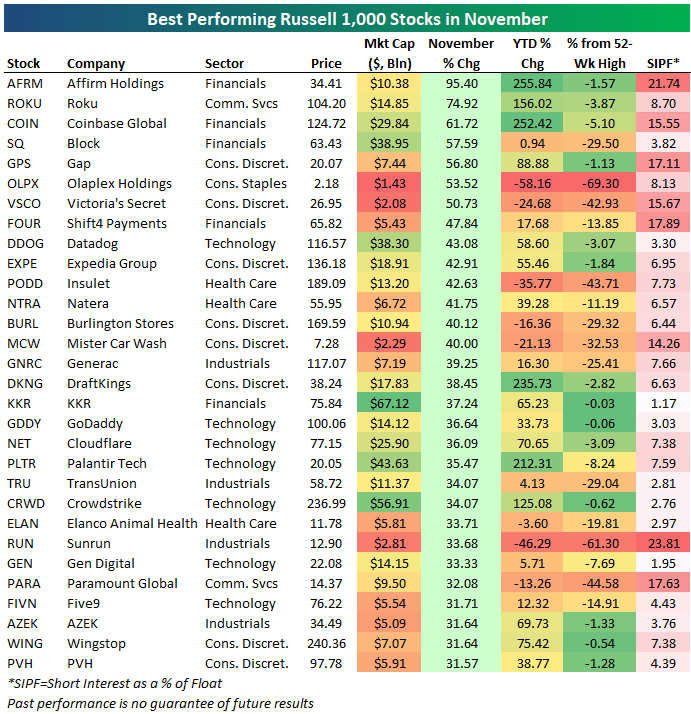

The average stock in the large-cap Russell 1000 rose 9.77% in November, and 38 stocks gained more than 30%, 14 rallied more than 40%, and seven surged more than 50%.

Below are the 30 stocks that rose the most in November. For each name, we also include its market cap, its year-to-date total return, its distance from its 52-week-high, and short interest as a percentage of float.

As shown, buy-now-pay-later company Affirm (AFRM) was up the most in November with a huge gain of 95.4%, followed by streaming company Roku (ROKU), crypto-trading platform Coinbase (COIN), and digital payments company Block (SQ). Are we back in late 2020/early 2021?

Other notables on the list of big winners include Gap (GPS) with a gain of 56.8%, Expedia (EXPE) at 42.9%, Generac (GNRC) at 39.25%, and Palantir (PLTR) at 35.47%.

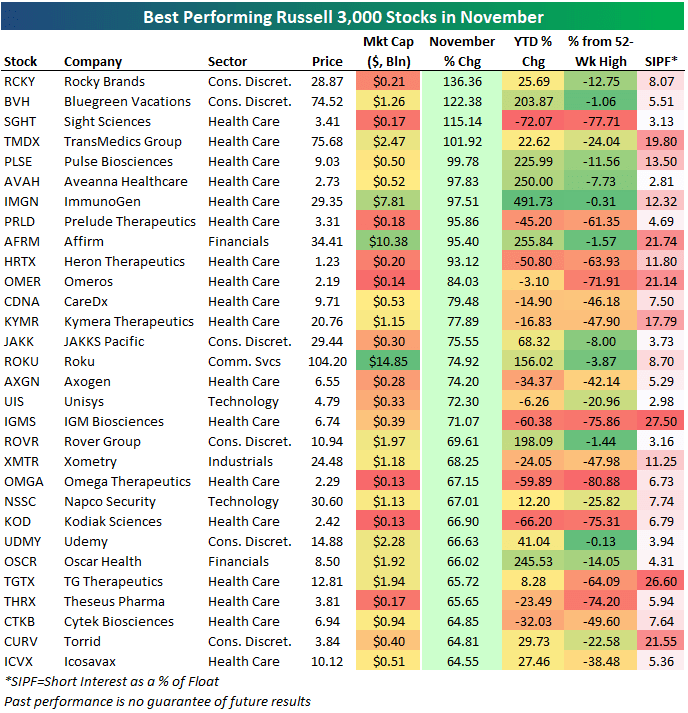

Below we’ve expanded the universe to show the top-performing stocks in the Russell 3000 in November. The Russell 3,000 includes all the stocks in the large-cap Russell 1000 and small-cap Russell 2000.

Four stocks in the Russell 3000 rallied more than 100% in November: Rocky Brands (RCKY), Bluegreen Vacations (BVH), Sight Sciences (SGHT), and TransMedics (TMDX).

Rocky Brands is a $210 million market cap retailer that sells heavy-duty boots and other apparel. Bluegreen Vacations is a timeshare company.

Sight Sciences creates medical devices and procedures for the eyes. And finally, TransMedics makes unique medical devices built to care for organs during the transplant process.

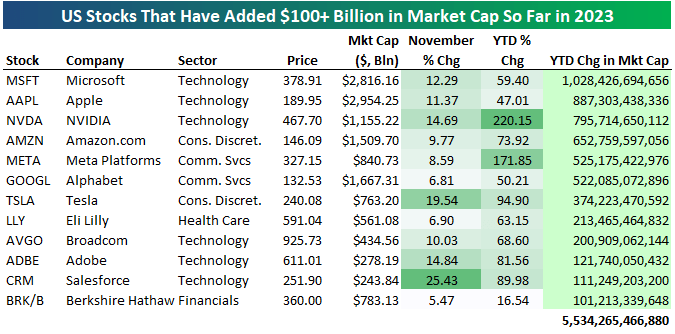

Before we go, below is a look at the stocks that have gained the most in market cap in 2023. Amazingly, twelve stocks have gained more than $100 billion in market cap this year, six have gained more than $500 billion, and one – Microsoft (MSFT) – has gained more than $1 trillion!

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here