3M Company (NYSE:MMM) has performed according to my expectations since my previous update (Hold/Market Perform rating) in early October. I updated 3M investors that the MMM is in a long-term downtrend. As a result, it could turn out to be a value trap if buying sentiments don’t suggest a robust bottom, underpinning the market’s confidence in its reversal. However, MMM’s recent developments suggest that it could finally change.

Accordingly, MMM slightly performed in line with the S&P 500 (SPX) (SPY) in price-performance terms (7.8%) since then, but slightly outperformed when considering total returns (9.5%).

As a result, 3M investors could ask whether the worst is finally over, as MMM also outperformed its industrial sectors (XLI) peers since early October. I urged holders not to catch the falling knife in MMM, assessing it as a debilitating value trap. However, that doesn’t mean MMM cannot stage spurts of short-term outperformance, as the market doesn’t move in a straight line. Given its well-oversold status in early October, it explains why I didn’t assign MMM a Sell rating.

The critical question facing investors is whether they have the conviction to catch MMM’s falling knife if they have plenty of opportunities in the market. They can even consider buying SPY if they aren’t sure about dealing with 3M’s significant legal uncertainties hitting its GAAP earnings moving ahead. However, MMM bulls could also justify their thesis, indicating that the market looks forward and not backward, arguing that such challenges have likely been priced in.

The company’s third-quarter or FQ3 earnings release suggests that 3M’s legal woes could have reached a nadir (at least in the near term). 3M reported an adjusted EPS of $2.68, but a GAAP EPS of -$3.74. It’s a marked improvement from Q2’s GAAP EPS of -$12.35 as the company attempts to lift itself from the malaise engendered by its legal liabilities.

3M has reached its PWS settlement, which is expected to be within $10.5B to $12.5B, spread over 13 years. However, we still need to assess the outcome of the final hearing, which isn’t expected until February 2024. In addition, the company recently received a pivotal ruling from the US Court of Appeals for the Sixth Circuit over a class action lawsuit, which lifted MMM’s buying sentiments. Accordingly, the decision involved the “rejection of a lower court’s ruling that would have allowed nearly 12 million Ohio residents to sue these companies collectively in a class action lawsuit.” As a result, I gleaned that the positive response is a step in the right direction for 3M as it attempts to regain momentum in its core business to recover its valuation.

3M is set to spin off its healthcare business in 2024 as it looks to unlock value, given the malaise seen in MMM, as it recovers from a 2012 low. Moreover, with the global economy not expected to fall into a hard landing, it should provide further impetus to spur 3M’s recovery, even as its China business could continue to impact its near-term performance.

Despite that, investors are likely focused on whether its GAAP earnings could take a growth inflection moving ahead, which could lift it from its material undervaluation. 3M also raised its 2023 adjusted EPS guidance range to between $8.95 and $9.15, underpinning the company’s confidence in its underlying business recovery.

There’s little doubt that MMM is materially undervalued. With a forward EBITDA multiple of 7.6x, it’s well below its 10Y average of 12x. In addition, MMM has a “B” dividend safety grade assigned by Seeking Alpha Quant, corroborating the robustness of its forward dividend yield of 6.1%. With the Fed expected to have reached the end of its hiking regime, income investors seeking more attractive yields could return to MMM if they don’t expect an imminent threat to its dividend security.

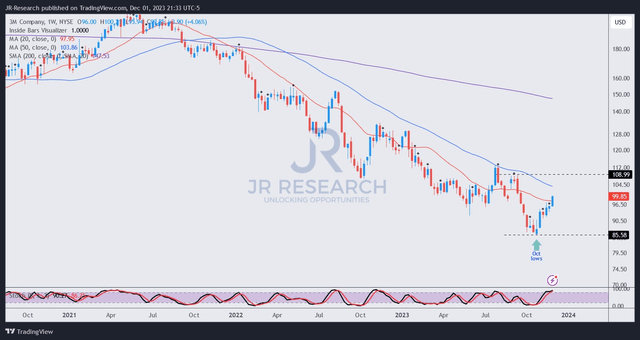

MMM price chart (weekly) (TradingView)

I gleaned that MMM likely staged a capitulation low in October 2023 ($86 level), forming a bear trap in early November. In other words, dip buyers have returned with conviction, looking to help MMM bottom out, anticipating the worst of its legal woes could be over.

Analysts’ estimates are in line, as 3M’s GAAP EPS is expected to inflect back into positive territory through 2024, corroborating the strength of MMM’s bottom.

In addition, in price-action parlance, it could also be a double-bottom bear trap (see price action glossary), suggesting peak pessimism. I now expect MMM’s $115 level to be retaken decisively, as it remains materially undervalued.

As a result, I believe it’s timely for me to turn more constructive on MMM, as the worst is likely over (Investors can’t wait for the news to tell them it’s over; by then, it might be a lot higher).

Rating: Upgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here