Summary

Readers may find my previous coverage via this link. My previous rating was a hold, as I believed JELD-WEN Holding (NYSE:JELD) would not be able to perform in the near term given the challenging operating environment and inflationary pressures. The stock was also trading at a very elevated valuation that does not provide any margin of safety. I am reiterating my hold rating for JELD as the headwinds continue to persist and are expected to persist until 1H24. There is no reason to go long at this point, as there are still no visible catalysts to drive the stock up.

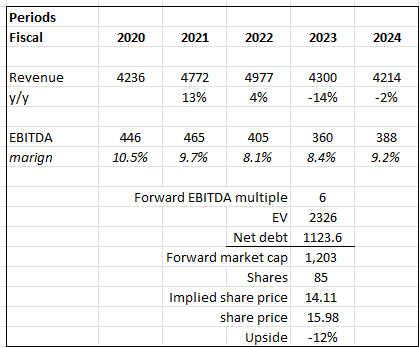

Financials / Valuation

JELD reported 3Q23 total sales of $1.077 billion. By region, North American sales were $790 million, and European sales were $286 million. 3Q23 adj EBITDA of $106 million was an improvement both sequentially and annually, likewise for EBITDA margin at 9.8% vs. 2Q23 9.7% and 3Q22 9%. Net income came in at $45.6 million, translating to operating EPS of $0.53, beating the street’s estimate of $0.34.

Based on author’s own math

I now expect JELD to see a decline in growth in FY24 as the headwind persists. However, given how strong management has executed on the margin-improvement initiatives, I have shifted my margin assumptions upwards, nearer to 2021 levels. My previous assumption was right: that JELD would see further downward re-rating of its multiple given the macro headwinds. Given the potential recovery in growth is likely to be in 1H24, I am not expecting multiples to re-rate positively now. An interesting update here is that JELD’s balance sheet has strengthened, with net debt reducing from ~$1.5 billion to $1.1 billion. This has helped to cushion the impact of the multiples reduction. Another reason I believe JELD should continue to trade at this level is because it is still much weaker than its closest peer, Masonite International (DOOR), who is outperforming JELD on almost all fronts (growth, margin, and leverage ratio). DOOR is currently trading at 6x, so there is no reason for JELD to trade at a premium.

Comments

I think the path forward is going to remain tough for JELD, especially with demand headwinds likely to persist into 2024. In North America, partners in the value chain are expected to stay more cautious towards year-end, given the macro uncertainty. I mean, how can anyone not be cautious with such a high mortgage rate starting at the housing market, which could potentially go higher? I think management guidance for North America is very telling about how bad the situation is. They now anticipate a larger yearly decline in volume in 4Q than in 3Q, driven mostly by reduced backlogs and overall market uncertainty. Despite positive indications of demand stabilization in North America in 3Q23 (management saw an uptick in repair and remodel [R&R] activity and low channel inventory), I believe that the benefits will be offset by the tougher volume comps in 4Q23 (as 4Q22 had a strong backlog). So, any beneficial effects won’t be noticeable until 1H24.

This dynamic is also evident in Europe, where difficult market conditions caused by geopolitical and macroeconomic factors continue. Volume in Europe has fallen by 14% so far in 9M23, and if this trend continues, I don’t see a big turnaround in 4Q23. In fact, going into next year, management now anticipates these dynamics to remain. Commercial construction is anticipated to remain flat in 2024, and there is still evidence that new projects are being delayed, which could affect demand. Meanwhile, European volumes are predicted to decline by low double digits as a result of weaker new residential construction.

What was surprising is that JELD did very well on the profit front, indicating that margins in the next upcycle could be structurally stronger. In 3Q23, EBITDA margins were up 80 bps and 150 bps on a pro forma basis. A 270 basis point increase in gross margins on a pro forma basis was a major contributor to the improvement. This clearly shows that company-specific initiatives were successful, as the expansion came despite a 6% drop in sales. To break it down, JELD was able to realize $30 million in cost takeout in the quarter. With their recent efforts, such as closing the Atlanta door facility in August, they expect to reach $35 million in savings in 4Q23. Also in 4Q, JELD said that two more facilities will be closing, which should result in combined annualized benefits of over $10 million. I think these efforts will have a significant impact on operating margins in the future, and I am very encouraged by their success thus far.

Over the longer term, I think management made the right decision to reinvest in the business today. My belief is that it is better to invest in a down market, where everyone else is worried about the future, so that the business will be ready for the next upcycle. There is little demand during a downcycle anyway, so more resources and focus can be allocated to reinvestments. Management stated in the earnings call that they intend to invest in automation, assets, and the workforce to support long-term targets and that they will accelerate capital expenditures to 3-4% of sales over the next few years. If we look back at JELD historical capex as a percentage to sales, it has stayed around 2+%, which is much lower than its peer Masonite (DOOR) of 3.6%. I believe this will give JELD the capacity to take advantage of the next upcycle. More importantly, these capex investments are not going to heavily impact the balance sheet, as JELD will see annualized cost savings from the three announced facility closures.

Risk & conclusion

The obvious risk here is that mortgage rates will continue to rise, wiping away any potential recovery in the near term as underlying home demand gets decimated. R&R demand is also going to remain low as consumer defer all unnecessary expenses to the future. As management is not aiming to step up on reinvestments, any missed execution here could negatively impact existing operational processes.

In conclusion, my hold rating on JELD remains unchanged due to persistent challenges and a lack of visible positive triggers. While cost-cutting measures have positively impacted profitability, ongoing macroeconomic uncertainties, especially in the housing market, continues to a concern. That said, I believe management’s decision to intensify reinvestments could bode well for the future upcycle.

Read the full article here