Investment Thesis

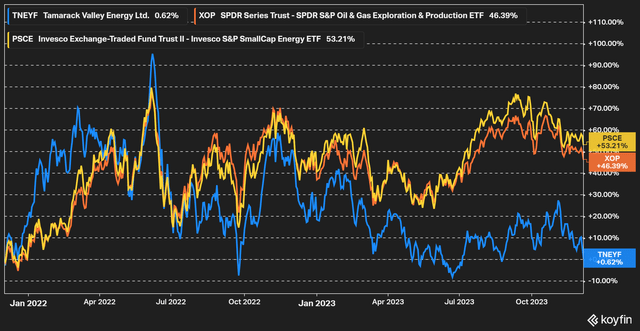

Tamarack Valley Energy Ltd. (TSX:TVE:CA) has been one of the worst performing Canadian oil & natural gas stocks over the last two years. The performance is effectively flat during the period in U.S. Dollars, while many peers are up around 50% over the last two year, some substantially more.

Figure 1 – Source: Koyfin

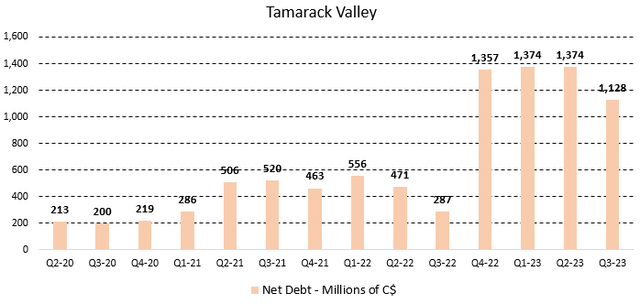

The large acquisition of Deltastream Energy Corporation last year together with some large capital investments during the first few quarters of 2023, have likely weighed on the share price. This acquisition led to a 24% increase in the share count, a substantial increase in the net debt, and for shareholder distributions to be lower compared to peers.

Figure 2 – Source: Tamarack Valley Quarterly Reports

However, the operational performance in Q3 was impressive, with substantial funds flow and free funds flow. So, with higher shareholder returns expected in 2024, I think Tamarack Valley stock is likely to outperform going forward. I have recently added the company to my portfolio.

Select Financials & Costs

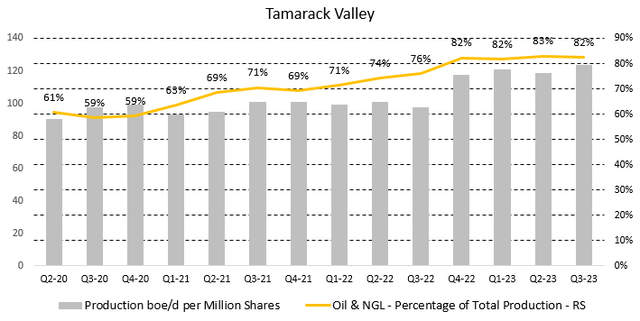

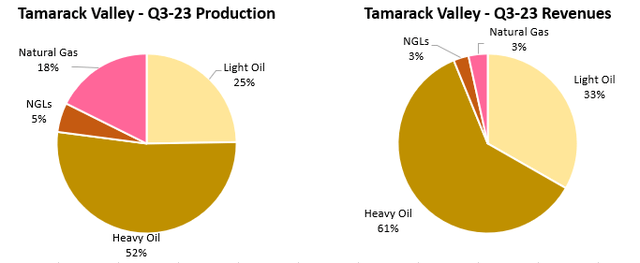

Over the last few years, production has increased substantially for Tamarack Valley, and the production per share has also increased slightly. Another positive development is that more than 80% of production now comes from liquids and more than 95% of revenues in the most recent quarter.

Figure 3 – Source: Tamarack Valley Quarterly Reports Figure 4 – Source: Tamarack Valley Quarterly Reports

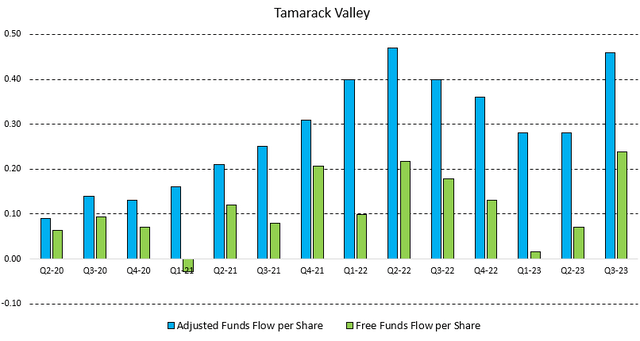

Q3 2023 was an impressive quarter for Tamarack Valley, where adjusted funds flow per share was on par with the best quarter during 2022, despite lower energy prices in Q3 23. Free funds flow per share did surpass the highest level seen in any quarter during 2022. That was partly because capital investments were front loaded in 2023, but this is still a very positive trend.

Figure 5 – Source: Tamarack Valley Quarterly Reports

In the chart below, we can see sales, total operating costs, and adjusted netback in C$/boe for Tamarack Valley and a few peers during Q3 23. The chart shows that the company had the lowest total operating costs, while still an impressive sales price, which in turn translated to a very competitive adjusted netback of C$54/boe in Q3.

Figure 6 – Source: Quarterly Reports

2024 Valuation

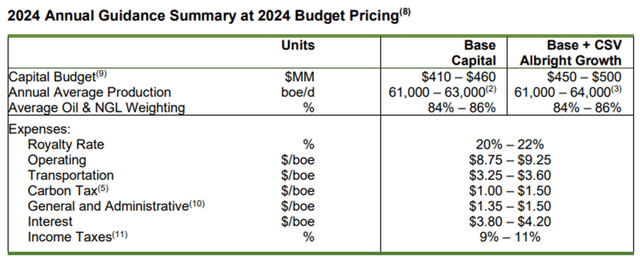

Tamarack Valley did earlier today release its guidance for 2024, which can be found here. So, with that in mind, I wanted to look at the valuation for the company. The financials are as of Q3, but I have adjusted the net debt figure to account for the C$123M received from disposition of some non-core assets. The deal was finalized this quarter.

The below table shows the main figures for 2024, where we can see, that production is expected to decrease by about 7-8% compared to 2023. That is partly due to the divestments on non-core assets and downtime in 2024 due to infrastructure investments. Costs are otherwise relatively unchanged, some line items are expected to be up marginally while other are down slightly.

Figure 7 – Source: Tamarack Valley Press Release

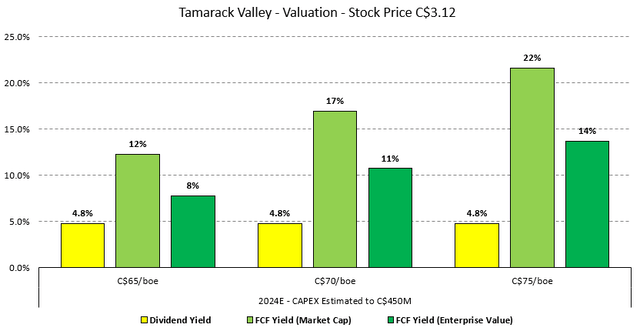

The capital budget has a wide range of C$410M to C$500M, which naturally impacts the free cash flow in 2024, but the below chart illustrates my estimated free cash flow yields for 2024 using a couple of different realized price scenarios together with a C$450M capital budget estimate.

Figure 8 – Source: My Estimated Free Cash Flow Yields

If we just focus on the market cap, Tamarack Valley is trading with a free cash flow yield around 17%, using a C$70/boe realized sales price. It is also worth pointing out that only C$330M of the capital budget is estimated to be sustaining capex. So, the free cash flow yield would be substantially higher in 2024 if the company scaled back the infrastructure and growth initiatives.

Conclusion

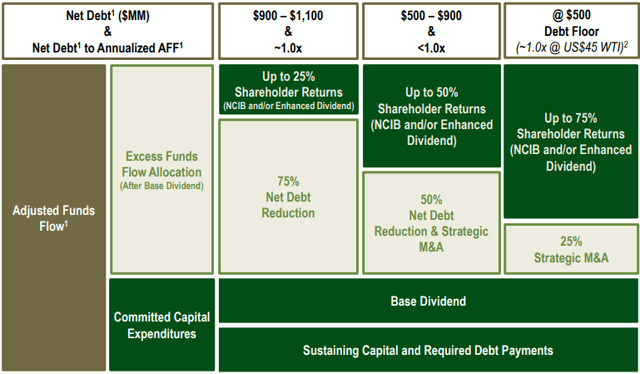

Tamarack Valley has an attractive valuation, as illustrated in the section above, naturally somewhat dependent on energy prices. The shareholder returns will increase going forward where the net debt should be below C$900M by the end of 2024 the latest, earlier if energy prices rebounds from here. Following that milestone, 50% of excess funds flow, which is on top of the base dividend that is presently at 4.8%, will then be distributed to shareholders as the figure below illustrates.

Figure 9 – Source: Tamarack Valley Corporate Presentation

With the commissioning of the Trans Mountain Pipeline, currently expected to be live in the beginning of 2024, we are likely to see a lower discount to heavy oil out of Canada. If this materializes, it will benefit Tamarack Valley, which has the majority of revenues coming from the sale of heavy oil, as illustrated in figure 4.

Shareholders of Tamarack Valley have had to wait to get higher shareholder returns, which looks poised to happen in 2024. However, should management decide to focus more on growth going forward, there is certainly the risk that this stock will continue to languish.

Following the release of the 2024 budget today together with a very weak oil price, Tamarack Valley Energy Ltd. stock has sold off excessively. So, a lot of risk looks priced in at this point, and the risk reward feels very attractive. I have consequently been buying throughout the day.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here