The S&P 500/SPX (SP500) had another constructive week, successfully consolidating and cementing its place above the critical 4,500-4,600 support zone. A resilient economy continues pointing to a soft landing scenario. Moreover, the cooling inflationary atmosphere should enable the Fed to decrease interest rates soon, allowing for a more accessible monetary environment to stimulate economic growth. The economy and the stock market should also benefit from accelerating expansion in critical segments like AI and other growth sectors. Therefore, the SPX and other major averages should have another constructive year, achieving new ATHs in 2024.

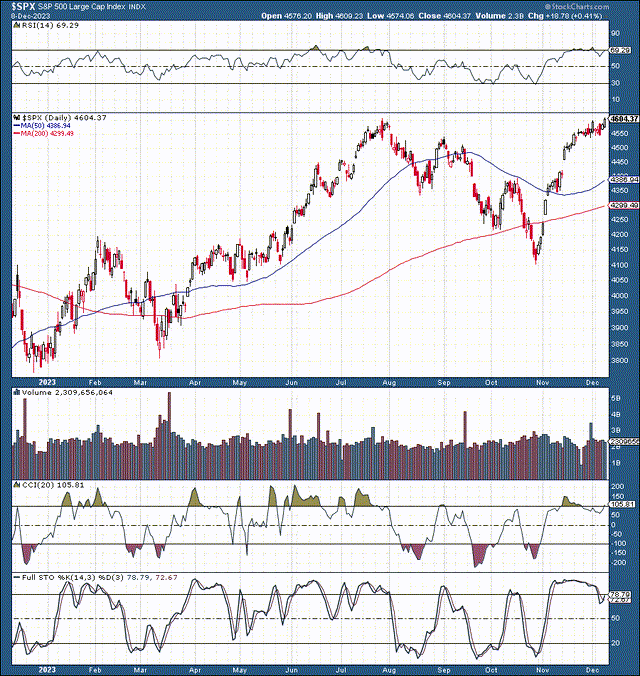

SPX: 1-Year Chart

SPX (StockCharts.com)

The SPX has had a constrictive consolidation phase in recent weeks. However, with the RSI still around 70, stocks are overheated now. Other technical gauges imply that the consolidation/pullback phase may continue before proceeding higher. Moreover, this data-packed week will reveal the most recent CPI inflation numbers, which could cause a sell-the-news/profit-taking scenario in the near term. Despite the prospects for near-term transitory volatility, there is a strong probability for more upside in the intermediate and long term.

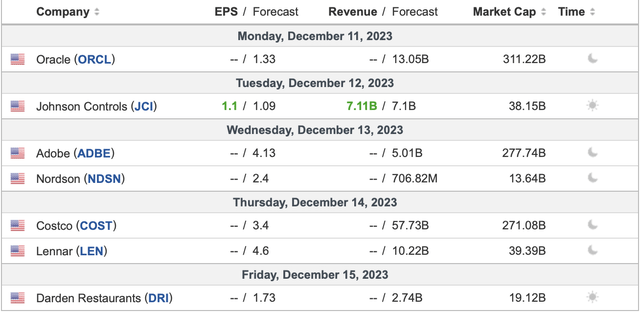

Several Stocks to Watch on the Earnings Front

Earnings (Investing.com)

We have several significant companies reporting this week. The shortlist includes Oracle Corporation (ORCL), Adobe Inc. (ADBE), and others. Oracle and Adobe could continue benefiting from the AI wave, and we may see better-than-expected earnings this week. Also, if we see transitory selloffs in the tech heavyweights, it could lead to buying opportunities soon.

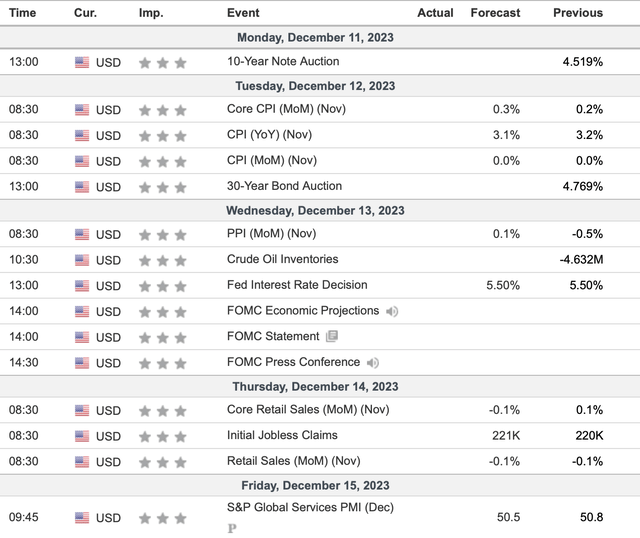

Crucial Data Week Ahead

Economic data (Investing.com)

We have many pressing data points this week. Critical data on board includes a 10-year and 30-year note auction, CPI/PPI inflation figures, crude oil inventories, FOMC rate decisions, statements, press conferences, retail sales, and more.

However, this week’s most crucial event is the CPI inflation data, which may influence the Fed’s interest rate trajectory. The consensus estimate is for a drop to 3.1% in the CPI and a 4% core-CPI reading. We must avoid a number higher than the estimate, as it would imply a resurgence in inflation, prompting the probability for future rate increases to rise.

On the other hand, we may see a 3.1% CPI reading, with the core CPI coming in slightly below 4% due to moderation in oil prices and additional costs. Also, the strict interest rate environment slows inflation through higher borrowing costs. Moreover, high mortgage, credit card, car loan, and other significant borrowing rates should continue limiting growth and leading to lower inflation in the near term.

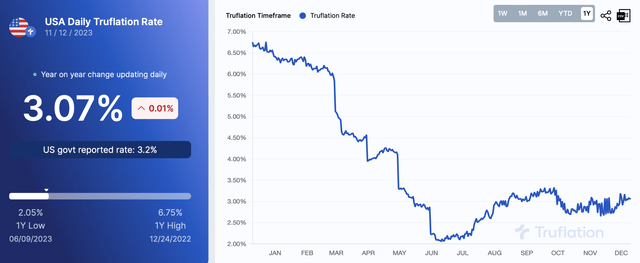

Truflation Inflation – Around 3%

Truflation (Truflation.com)

The truflation inflation (an independent, non-government, real-time inflation gauge) illustrates inflation hovering around 3%, with a low of around 2% in June/July. We’ve seen a steep drop in inflation since the highs of approximately 10% about a year ago. Despite the recent rebound, we should see a continuation of the inflation downtrend in future months. Moreover, inflation is nearing the Fed’s 2% target rate, and there is even the rising risk of deflation ahead. This dynamic implies that the Fed could shift to a more accessible monetary stance soon.

The FOMC Probabilities – Q1 Or Q2?

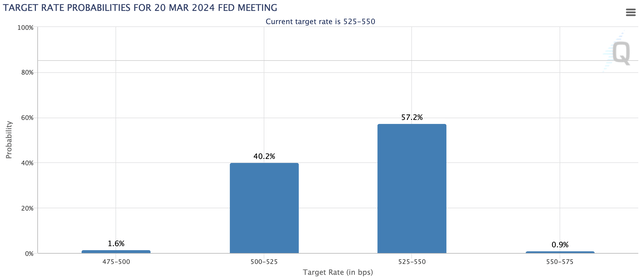

There is an overwhelming probability (roughly 98.5%) that the Fed will not raise the benchmark at this week’s FOMC meeting. Moreover, there is very little chance that the Fed will implement another rate increase unless we see a substantial and unexpected resurgence in inflation. The real question is, will we see a rate decrease in Q1 2024 or Q2? And how many rate cuts could we see in 2024?

Rate probabilities (CMEGroup.com)

About a week ago, before the “bullish” jobs report came out, there was about a 60% probability that the Fed would implement its first decrease in Q1 at the March meeting or sooner. However, we’ve seen a slight readjustment in expectations. There is a 42% chance that the first rate cut will materialize in Q1, but the likeliest scenario is Q2. There is around a 77% probability that we’ll see a benchmark decrease at the May meeting or sooner. Altogether, we may see around 100 Bps worth of rate cuts next year, with a bullish scenario pointing to about 150 Bps in reductions. This dynamic is bullish for the economy and stocks, signaling we could have another solid showing for high-quality stocks next year.

The Bottom Line – Bullish Setup for 2024

Despite the recession whispers and some market participants outlining a negative outcome for 2024, we may have another solid year for high-quality stocks. While the wall of worry remains high, the economy is highly resilient, and we see continued progress on inflation. The soft landing scenario is still the base case outcome. Moreover, the market is a forward-looking mechanism. Therefore, stocks look forward to a more accessible monetary environment.

Moreover, we have substantial growth prospects due to the expanding AI segment potential that may permeate almost every corner of our modern economy. Many high-quality companies should benefit from the easier monetary atmosphere and the AI boom, which should lead the way in the coming macroeconomic growth cycle. The fundamental backdrop remains solid, and sentiment could improve going forward. Due to the constructive technical/fundamental setup, I’m keeping my year-end 2024 SPX target at 5,250.

Read the full article here