Investment thesis

The fact that Crown Castle Inc. (NYSE:CCI) demonstrated a solid 20% rally over the last month, together with a generous 5.4% dividend yield, grasped my attention. The company faces near-term headwinds for the top line, but its profitability is still solid compared to its nearest rivals. I consider the top-line headwinds to be temporary and not secular. CCI looks well-rounded to capitalize on steady industry growth over the next years. My analysis suggests that the dividend yield is safe, and CCI has a solid record of dividend growth in recent years. The dividend discount model simulation suggests that the stock is attractively valued as well. All in all, I assign a “Buy” rating for CCI.

Company information

Crown Castle International is a real estate trust fund [REIT] that owns, operates, and leases shared communication infrastructure across the U.S., which includes more than 40 thousand cell towers and approximately 85 thousand route miles of fiber.

The company’s fiscal year ends on December 31. According to the latest 10-K report, it generates approximately three-fourths of its total revenue from the American “Big 3” telecom operators: Verizon (VZ), AT&T (T), and T-Mobile (TMUS). CCI operates via two segments: Towers and Fiber. Towers generated almost 70% of total sales in FY 2022.

Financials

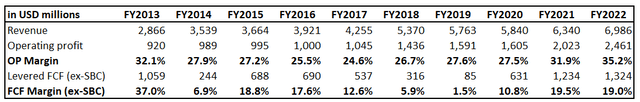

CCI’s financial performance has been solid over the last decade. Revenue compounded at an impressive 10.4% CAGR with solid profitability and free cash flow [FCF] metrics ex-stock-based compensation [ex-SBC]. The FCF margin has been relatively volatile over the decade but never negative and mostly in the double-digits.

Author’s calculations

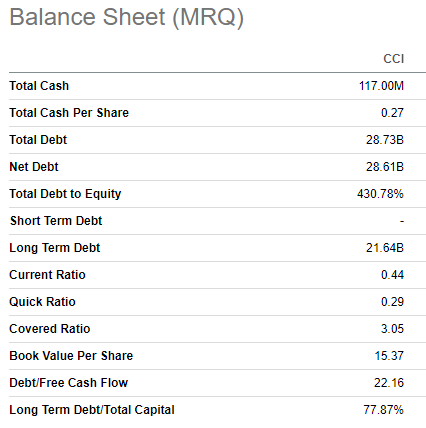

Thanks to the solid financial performance over the last decade, the management was able to implement a very aggressive capital allocation policy. CCI is in a massive net debt position with a sky-high leverage ratio, but given the company’s consistently positive and wide FCF margin, I do not consider CCI overleveraged. Despite having a highly leveraged balance sheet, the company’s strong dividend consistency gives me high conviction that the current 5.4% yield is safe.

Seeking Alpha

The latest quarterly earnings were released on October 18, when the company missed consensus estimates. Total revenue declined 4.5% YoY, and the FFO followed the top line by narrowing from $1.93 to $1.61.

On the other hand, the core rental revenue demonstrated a slight YoY increase. The Towers site rental income declined YoY by 1%, offset by a 4% growth in Fiber rental revenue. If zoomed out, for the first nine months of 2023, the Fiber segment demonstrated a solid 15% YoY growth. On the contrary, Tower site rental income has stagnated year-to-date. The profitability decline was primarily due to decreased prepaid rent amortization and higher Towers site rental operations costs.

According to the latest earnings call, Crown Castle faces headwinds in revenue attributed to the Sprint cell tower lease cancellations, reduced site rental revenues, lower tower activity levels, and a decline in straight-lined adjustment and amortization of prepaid rent. I consider these challenges primarily temporary, stemming from specific factors such as changes in business activities rather than enduring secular shifts. While the industry is close to full penetration, the mobile data market is expected to demonstrate a 3.6% CAGR for the next five years, which is favorable for CCI.

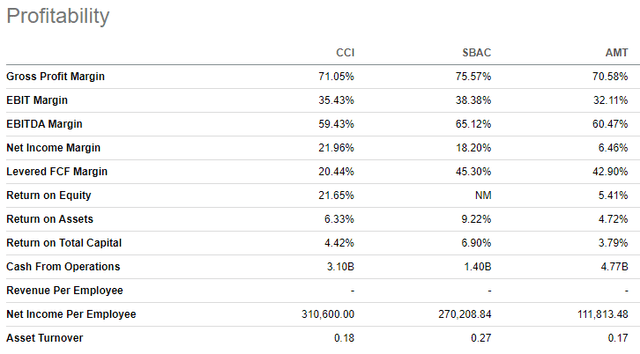

Overall, CCI’s massive scale and wide site geographical presence make the company well-positioned to capitalize on the modest but predictable and steady industry growth. The company’s two primary rivals are American Tower Corporation (AMT) and SBA Communications Corporation (SBAC). From the revenue perspective, CCI is substantially behind AMT but by far larger than SBAC. Comparative analysis of these three companies’ profitability provides mixed results, but most of CCI’s profitability metrics are in line with competitors, meaning that all three players deliver almost the same level of efficiency. The business is highly capital intensive in nature, and it will require decades to build out the same infrastructure, meaning that the positions of these three players are intact.

Seeking Alpha

From the investors’ point of view, CCI looks like a better investment opportunity for dividend investors since the stock’s 5.4% forward dividend yield is multiple times higher than the one offered by SBAC and is substantially higher than the 3.1% yield paid out by AMT.

Valuation

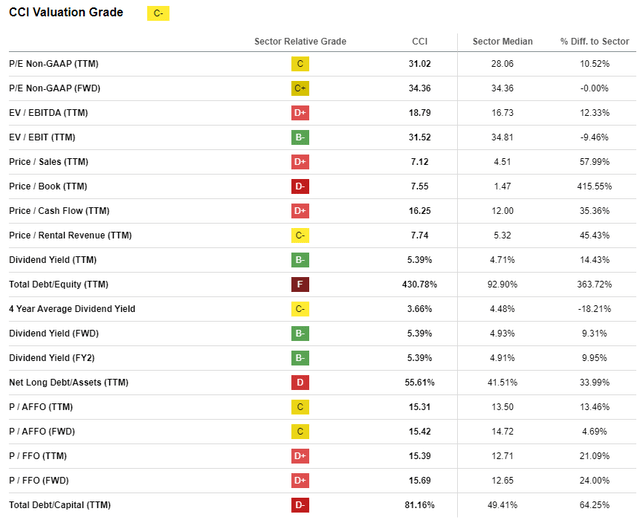

CCI tanked by 16% year-to-date, significantly lagging behind the broader U.S. stock market. Seeking Alpha Quant assigns CCI an average “C-” valuation grade, meaning the stock is approximately fairly valued. However, the comparative analysis of CCI’s valuation ratios with the sector median provides mixed results. Therefore, multiples analysis does not give me enough confidence, and I need to proceed with the dividend discount model [DDM].

Seeking Alpha

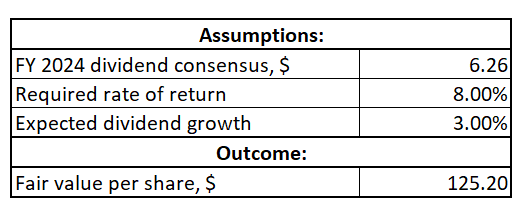

I use an 8% WACC as a required rate of return, which is a slight round down of the recommended by Gurufocus level. Consensus dividend estimates project an FY 2024 dividend payout of $6.26, which I use for my DDM simulation. Despite facing macro headwinds, CCI’s long-term dividend growth history is solid. That said, I think that sustaining a 3% dividend CAGR is doable for CCI over the long term.

Author’s calculations

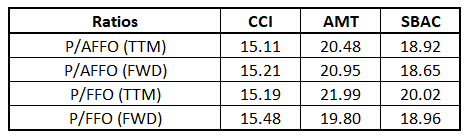

According to my DDM valuation, CCI’s fair price is slightly above $125. This indicates a modest 8% upside from the current stock price level. The upside potential looks decent, given the 5.4% dividend yield. It is also crucial to underline that CCI’s price-to-FFO/AFFO ratios look much more attractive than AMT’s and SBAC’s.

Compiled by the author based on Seeking Alpha

Risks to consider

The tighter monetary policy in the U.S. poses a near-term challenge to Crown Castle’s prospects. Being heavily reliant on capital-intensive investments in fiber and small cells means there is less room to invest in CAPEX for CCI under tight monetary conditions. Higher borrowing costs for longer could limit the company’s ability to execute its strategic initiatives efficiently. Additionally, the potential for higher interest rates also weighs on the overall economic activity, affecting demand for Crown Castle’s services as businesses may become more cautious in their capital expenditures.

The recent rapid 20% rally in CCI stock adds a layer of uncertainty to its near-term prospects. While such surges are generally good and indicate strong momentum, they also raise the risk of short-term investors seeking to realize their capital gains by selling the stock. The potential for profit-taking actions may increase stock volatility and temporarily impact the stock’s stability. That said, potential investors should be cautious about short-term fluctuations in response to recent gains.

Bottom line

To conclude, CCI is a “Buy”. The valuation is attractive, and a solid dividend yield looks safe. The company is strategically positioned to continue demonstrating modest revenue growth and wide profitability metrics. CCI looks efficient compared to its closest rivals, and the industry’s high-capital-intensive nature suggests that the “big three” market positions are safe.

Read the full article here