A Quick Take On Telomir Pharmaceuticals

Telomir Pharmaceuticals (TELO) has filed proposed terms to raise $7 million from the sale of its common stock in an IPO, according to an amended SEC registration statement.

The company is a pre-clinical stage biopharma firm developing treatments for age-related inflammatory conditions.

I previously wrote about Telomir’s initial filing here.

Given TELO’s thin capitalization, high valuation expectations and early stage of development, my opinion on the IPO is to Sell [Avoid].

Telomir Pharmaceuticals Overview & Market

Tampa, Florida-based Telomir Pharmaceuticals, Inc. is developing small molecules as an ‘oral in situ therapeutics treatment for human stem cells.’

The company is led by Chairman and CEO Christopher Chapman, Jr., M.D., who has been with the firm since November 2022 and is currently Executive Chairman of MIRA Pharmaceuticals (MIRA) and has many years of experience in the pharmaceutical industry.

The firm’s lead candidate is TELOMIR-1, and the company believes it has the potential to act as an Interleukin-17 inhibitor, which may play a role in age-related inflammatory conditions including ‘hemochromatosis and osteoarthritis as well as in post-chemotherapy health problems.’

Telomir has booked total fair market value investment of $6.9 million as of September 30, 2023, from investors.

The hemochromatosis treatment market was an estimated $901 million in 2022.

It is projected to grow at a rate of 6% from 2022 to 2029, reaching nearly $1.35 billion, according to a report in Maximize Market Research.

Several factors are expected to drive the market’s growth, including increasing awareness and diagnosis of hemochromatosis disorders, along with rising healthcare spending.

But, stringent regulatory processes and limited accessibility may delay market growth.

The market is also influenced by the increasing use of tests to detect iron overload, such as serum transferrin saturation and blood ferritin tests.

Advancements in detecting liver disease, like a simple naked-eye observable method for Glycocholic acid [GCA] detection, are expected to drive the market further.

Key players in this market include Pfizer, Global Calcium, Fresenius Kabi USA, Novartis, Sun Pharma, Teva Pharmaceuticals, Taro Pharmaceuticals, Merck KGaA, Apo Pharma, and Livealth Biopharma, among others.

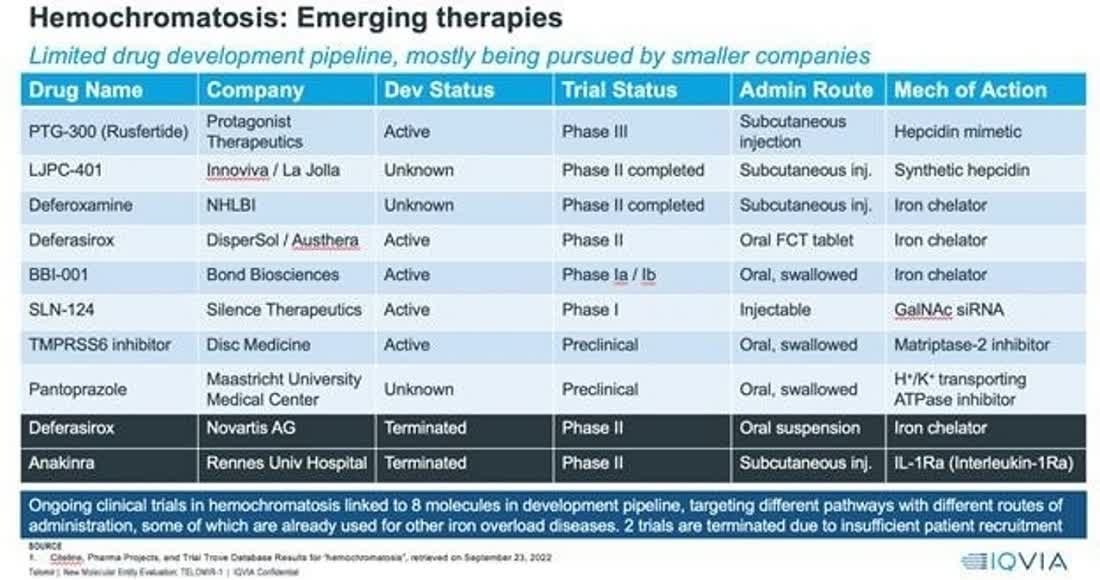

The chart below shows management’s competitive landscape for its therapy for hemochromatosis:

SEC

Telomir Pharmaceuticals’ Financial Status

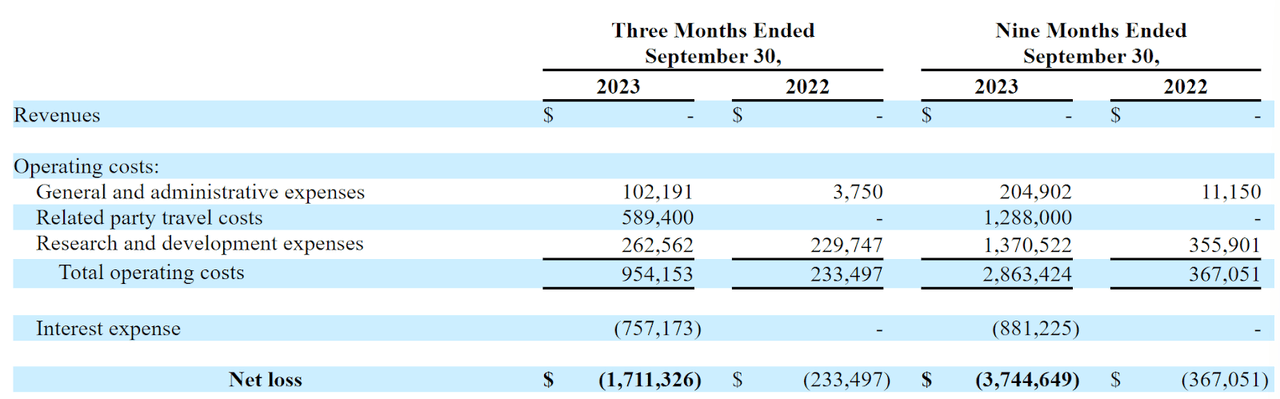

The firm’s recent financial results are typical for a pre-clinical stage biopharma in that they feature no revenue and growing G&A and R&D costs.

Below are the company’s financial results for the periods indicated:

SEC

As of September 30, 2023, the company had only $2,452 in cash and $3.1 million in total liabilities.

Telomir’s IPO Details

TELO intends to sell one million shares of common stock at a proposed midpoint price of $7.00 per share for gross proceeds of approximately $7.0 million, not including the sale of customary underwriter options.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

The company is also registering for sale approximately 6.2 million additional shares by selling shareholders, which may negatively affect the post-IPO price of the stock if sold by selling shareholders in a concentrated period on the open market.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $201.4 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 3.38%, so the stock is essentially a ‘low-float’ stock that is subject to increased volatility post-IPO.

The firm is also considered a ‘smaller reporting company’ and an ‘emerging growth company’, so the company may choose to provide substantially less information to shareholders.

Such company stocks have frequently performed poorly post-IPO.

Management says it will use the net proceeds from the IPO as follows:

approximately $2.0 million to fund our pre-clinical animal toxicology studies and CMC activities,

approximately $0.3 million for expenses associated with our initial IND application, and

approximately $0.7 million for expenses relating to our Phase I clinical trials for TELOMIR-1; and

the remaining amounts to fund working capital and general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said there are no legal proceedings that it believes would have a material adverse effect on its operations or financial condition.

The sole listed bookrunner of the IPO is Kingswood Investments.

Commentary About Telomir Pharmaceuticals

Telomir is seeking U.S. public capital market investment to advance its pre-clinical drug development efforts.

Management believes the firm’s lead candidate, TELOMIR-1, has the potential to act as an Interleukin-17 inhibitor, which may play a role in age-related inflammatory conditions including ‘hemochromatosis and osteoarthritis as well as in post-chemotherapy health problems.’

The market opportunity for treating hemochromatosis is a sub $1 billion market and is expected to grow at a moderate rate of growth in the coming years.

Management hasn’t disclosed any major pharma firm collaboration or research relationships.

The company’s investor syndicate doesn’t include any well-known institutional life science venture capital or strategic investors.

The firm is very thinly capitalized and is still at a pre-clinical stage of development, so the IPO would be extremely high-risk.

As for valuation expectations, management is asking IPO investors to pay an Enterprise Value of $201 million, an extremely high valuation expectation for a pre-clinical stage biopharma.

Given the high risks, tiny stock float, thin capitalization and ultra-high valuation expectations by management, my opinion on the IPO is to Sell [Avoid].

Expected IPO Pricing Date: To be announced

Read the full article here