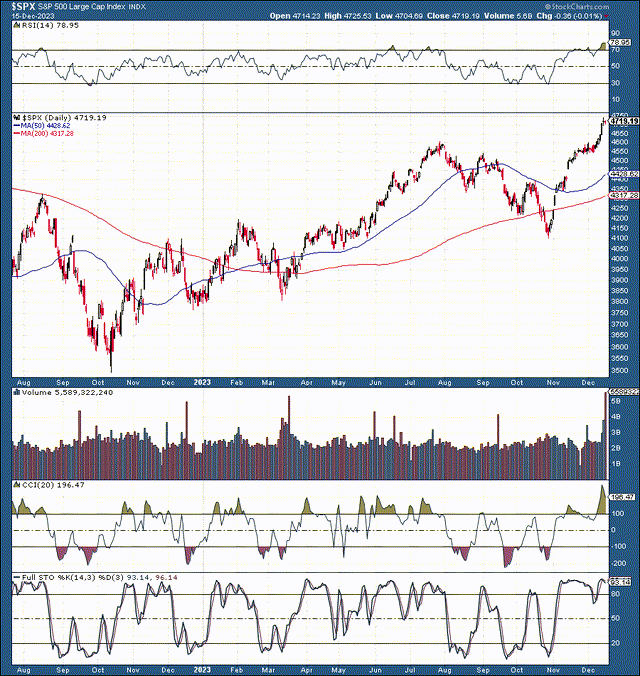

The S&P 500/SPX (SP500) has surged, moving relentlessly higher in the last two months of the year. The SPX is up by about 16% since the late summer/fall correction ended. These are exceptional gains, and while they indicate more upside in the new year, the SPX and stocks, in general, could go through a consolidation phase to cool off as we enter into the new year.

SPX (StockCharts.com)

Technically, the SPX is overbought here. The RSI is nearing 80. We’ve also seen high volume recently. This dynamic suggests that temporary buyer exhaustion may set in, and we may see more profit taking in the near term. While the bull market is still young and the uptrend remains solid, we could use a pullback/consolidation phase before stocks proceed higher.

However, the fundamental backdrop remains constructive. The Fed is pivoting toward a more accessible monetary policy, AI and other segments should provide growth, and stocks are relatively inexpensive. Higher than-expected earnings, improved growth, and other variables should enable stock multiples to expand, leading to higher stock prices in 2024.

It’s All About The Fed

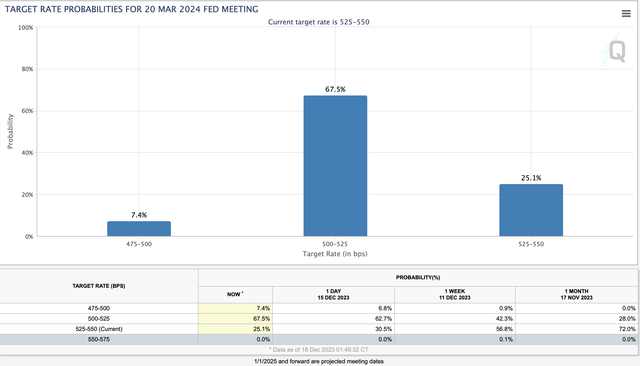

Rate probabilities (CMEGroup.com )

Much of the recent bullishness is Fed-related. This improved price action is for good reason, as the Fed’s recent dovishness has pushed the initial rate decrease expectations into Q1. There’s now a 75% probability we will see at least one 25 Bps rate cut by March 20, 2024. One month ago, there was an inverse 72% probability that the first rate cut would come in the second quarter. Also, the likelihood of a 50 Bps rate cut in the first quarter has increased to 7.4%.

The recent trend suggests that expectations continue rising for more easing next year. Also, the Fed’s QT program could end soon (next year). Thus, the Fed should stop flooding the bond market soon. After this, we will likely see increasing QE expectations, suggesting that the Fed could support the market for a long time under the right conditions. This monetary easing cycle should enable growth and valuations to flourish, leading to higher stock prices.

The AI Effect Is Just Getting Started

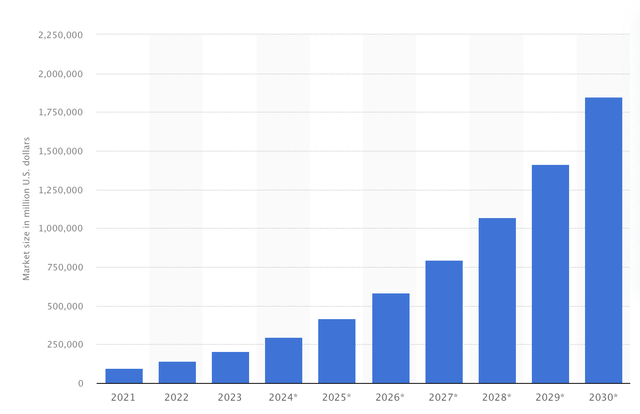

We’re still very early in the AI ball game. AI is a revolutionary industry with enormous growth potential ahead. The AI market size is expected to increase several-fold from here through 2030. Therefore, we’re only scratching the surface of AI, and many high-quality companies with substantial AI exposure should grow earnings substantially. Moreover, the AI industry could have a broad market effect, enabling AI-related growth across many sectors and industries in the coming years.

AI Industry Revenue Estimates

AI revenue growth (Statista.com )

AI-related revenues should increase considerably in future years. In fact, we may see about a ten-fold surge in global sales. While the AI market may be around $200 billion today, it could grow to about $2 trillion by the 2030s. This dynamic should enable many companies to report much higher than expected revenues, and the AI effect should allow the growth to prosper in many segments of the economy in future years.

Earnings Growth Likely To Improve

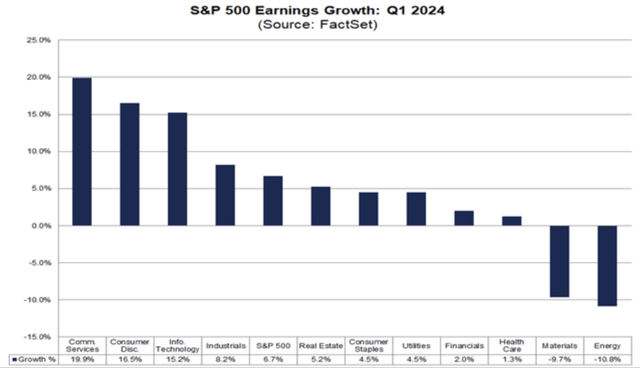

Earnings growth (FactSet Insight – Commentary and research from our desk to yours)

Earnings growth should be solid in the first quarter. Moreover, significant earnings growth should continue and accelerate as we move through 2024. The communications services segment should report growth of around 20% in Q1 YoY. Consumer discretionary and information technology also should report solid growth of about 15%-17% year-over-year. Other segments should do well. We will probably see an even stronger showing in Q2.

Broad Earnings Rally

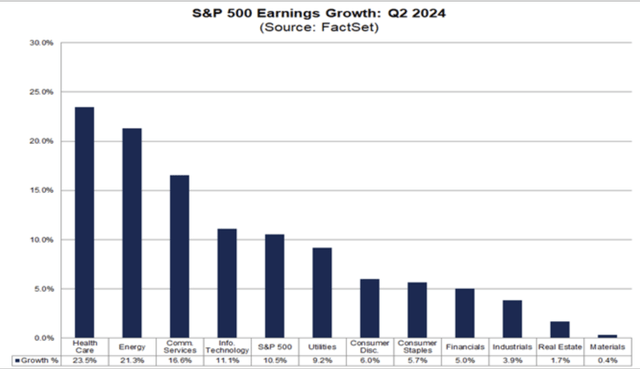

Earnings growth (FactSet Insight – Commentary and research from our desk to yours)

In some segments, Q2 2024 earnings growth estimates are for more than 20%. Healthcare, energy, communication services, information technology, and other crucial segments should continue outperforming in Q2 of next year. Moreover, we should see a broad sector earnings growth rally, with the most significant segments expected to report solid growth in Q2 2024. This bullish earnings dynamic should lead to a broad stock market rally next year.

Stock Valuations To Expand

Stocks are relatively inexpensive, especially considering we’re approaching a broad earnings growth phase and a more accessible monetary environment.

Stock valuations (WSJ.com)

The SPX is around a 21-22 P/E ratio (TTM) here, and the forward estimate is for around the 21 P/E range. However, the SPX’s forward P/E multiple may be around 20-21 due to the better-than-expected EPS growth. Moreover, we will likely see better-than-expected growth in high-quality tech stocks and the Nasdaq 100. While the Nasdaq 100’s current forward P/E ratio is around 28.5, a 10% or higher EPS growth should drop the forward P/E down to 27.5 or lower. This dynamic suggests that future upward revisions should increase earnings expectations, significantly expanding multiples and increasing stock prices.

The most explosive dynamic could materialize in the small- and mid-cap markets. The Russell 2000 valuation is only around 25 P/E. The forward P/E estimate is slightly higher, implying many analysts expect stagnant or negative growth. However, an economic recovery combined with a more accessible monetary environment could enable smaller companies to return to growth faster than expected, leading to revised estimates, improved growth, and higher stock prices in the small/mid-cap space.

The SPX should have another solid year in 2024, and my 2024 base-case year-end SPX target remains at 5,250, about 12% higher from here. The Nasdaq may increase by 15-20%, and the Russell 2000 could outperform next year, appreciating by 20-25% based on our projections.

Read the full article here