Shares of Extra Space Storage Inc. (NYSE:EXR) have had a booming rally over the past two months, rising about 50%, which has brought them back to the flatline over the past year with this rally unwinding what had been a significant weakness. While the company operates a very defensive business, unless investors expect long-term interest rates to decline, I would take advantage of the recovery to reduce holdings.

Seeking Alpha

In the company’s third quarter, adjusted funds from operation fell by 8.6% to $2.02 from $2.21 a year ago. These results do include the dilutive impact of its Life Storage acquisition. After being $0.10-$0.15 dilutive this year, it should boost FFO by 1% during Q1 2024 when $100 million in synergies are met. This is only marginally accretive, and EXR will need to generate increased revenue from these properties to make this transaction a truly worthwhile one.

Unadjusted FFO was $1.69 in the quarter. This $0.33 difference included $0.07 of non-cash items relating to its exchange of Life Storage debt and amortization of intangibles. Additionally, there was $0.26 or $54 million of integration expenses relating to the merger. Given this was a multi-billion dollar transaction and that Life Storage is now fully integrated into EXR’s systems, this is a reasonable expense level, and as we think about valuing the business, I would look past this one-time expense.

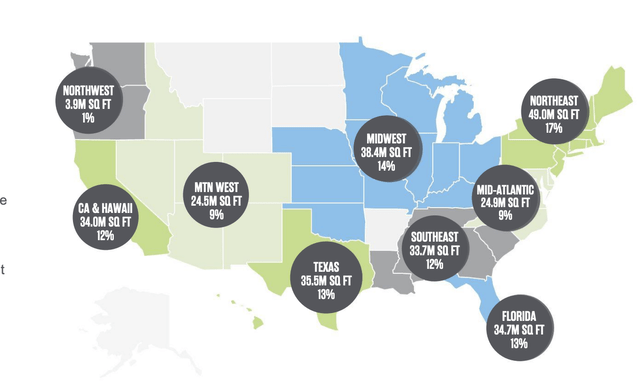

Extra Space is now the leading self-storage company in the country with about 14% market share in what is a highly fragmented industry. Given its large scale, EXR operates across the country, as you can see below. California, Texas, and Florida are its largest markets, each comprising about 1/8th of the business.

Extra Space Storage

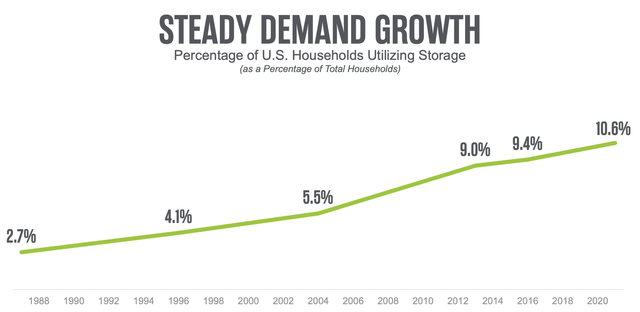

Thanks to its geographic diversification, EXR is not excessively exposed to any market; rather, it is tied to national trends in self-storage, operating 3,651 locations, 52% are wholly-owned, 13% are joint ventures, and 35% are managed. This is an industry that has proven its durability with revenue that has been stable during downturns and increased penetrations with 1 in 10 households using a storage unit. Thanks to these favorable dynamics, Extra Space has grown its dividend for 13 years, and over the past five, it has delivered a 14% dividend growth rate.

Extra Space Storage

While there are many short-term use cases for self-storage; for instance, a college student storing their furniture during the summer between semesters or a family between moves, a significant share of Extra Space’s business comes from more permanent users. 61% keep their unit for over a year and 45% over two years. The average tenant has held their unit for 34.4 months, up 1 month from last quarter. Especially as people get older, there can be items that are hard to part with for sentimental reasons but don’t need to be kept in a house. With the aging of the baby boomer population, this has made self-storage an increasingly appealing product, driving relatively low turnover. This has also helped keep rental rates elevated for existing customers.

While the existing customer base has been solid, we are seeing some slowing in new-customer signups as the COVID boom in self-storage fades. While same-store revenue is up 3.9% year-to-date, it has been decelerating all year, coming in at 1.9% during the third quarter. Occupancy averaged 94.4% during the quarter, a healthy level, but 100bps lower than last year with the business now operating on a more normalized footing.

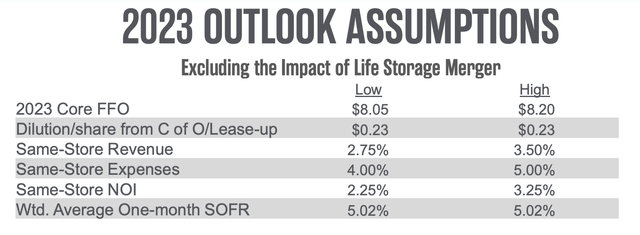

Alongside Q3 results, management refreshed guidance, trimming its EPS range by $0.05 on both ends while increasing the low-end of its same-store revenue guidance by 0.25%. This guidance implies that same-store revenue growth will remain positive in Q4, likely up by about 0.8%. That points to continued deceleration, though not as bad as had been feared, helping to contribute to the share price recovery.

Extra Space Storage

One challenge for the business is that the 2.2% rent growth is not keeping up with expenses. On a same-store basis, expenses rose by 5.7%, leading to a modest 0.7% increase in net operating income. Payroll and property operating expenses rose by 1.7%. Property taxes rose by 4.9% while marketing rose by 20% and insurance rose by 31%. While insurance is less than 5% of expenses, it is driving about 20% of the expense growth, negatively impacted by the business’s large exposure to Florida where insurance rates have risen materially.

We are likely to see some moderation in expense growth next year, due in part to better comparisons, but an elevated level of expenses is likely to continue to constrain NOI growth. To offset this, Extra Space will now need to deliver on revenue synergies from its Life Storage purchase in 2024, having already fully integrated it into their systems during the quarter. Most notably, Life Storage locations have more than 100bp lower occupancy than EXR locations. Closing this gap should drive FFO increases. Additionally, rents at Life Storage are 15% below Extra Space. EXR underwrote the financial rationale for the merger assuming it can recoup half of this gap-if it can close more of this gap over time, FFO accretion should improve. This will likely be a multi-quarter process to avoid excessive attrition.

As we look forward to 2024, we have seen occupancy show signs of stabilizing in the low-to-mid 94% area. With some benefit from Life Storage, we should not see further deterioration here. I would look for rent growth to remain in the low 2% area, rather than decelerate materially further. That is because supply is slowing with just 18% of locations facing a new competitor from 28% in 2019. Additionally, its purchase of Life Storage expands its managed-not-owned platform, a capital-light way to expand operations. Against this, we are likely to see non-wage cost pressures run hotter than rents, constraining FFO growth.

One tailwind for the company could be lower interest rates. EXR carries $11.3 billion in debt, and it has $3.35 billion in variable-rate debt. With the Federal Reserve forecasting three rate cuts next year, interest expense could decline somewhat. EXR also has no 2024 maturities with $1.8 billion in debt due in 2025, reducing its need to refinance any low-cost debt in a higher rate environment. With Life Storage ceasing to be dilutive by Q1 2024, this points to about $8.30-$8.60 in 2024 FFO. Shares offer a 4.2% yield, and EXR has a coverage ratio of 1.3x. That is a secure but not excessive coverage level, which means the payout is safe, but that dividend growth is unlikely to be substantially faster than FFO growth, in my view. Overall, shares have a 5.6% forward FFO yield.

As an analyst, I am generally seeking a 10+% return. To achieve that, EXR would need to generate about 5-6% annual dividend growth, which I view as somewhat optimistic, at least for the next two years considering rent growth is running substantially below this level. It also remains to be seen if it can bring Life Storage results to EXR levels or if there will be any cannibalization from geographic overlap. Moreover, it seems to me that interest rates, not EXR’s own performance, are the primary driver of shares.

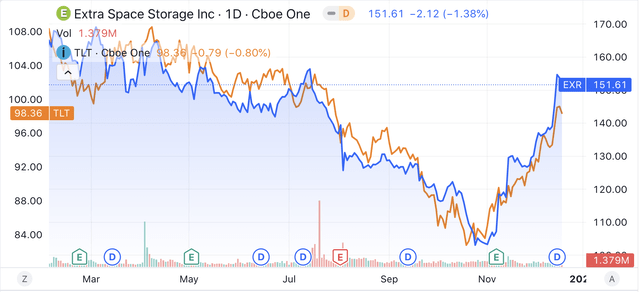

The below chart compares EXR to TLT, the ETF that tracks long-dated treasury bonds. Long-dated treasuries help set the discount rate for real estate valuations. The correlation is uncanny, though EXR may have overshot treasuries somewhat in this latest rally.

Seeking Alpha

While it seems increasingly likely the Federal Reserve will be cutting rates, with 30-year treasury yields having fallen by 100bps in just a few weeks, much of this is now discounted into markets. Indeed, while the Fed projects 3 rate cuts next year, the market has gone as far as pricing in 6 cuts. This leaves me concerned that if rates do rise back at all because markets have gotten overly optimistic about Fed easing, EXR, alongside other REITs, could underperform.

Now if you expect long-term yields to continue to decline, I suspect EXR can perform reasonably well. However, given limited FFO growth, excluding the merger impact, I would emphasize you are largely making a rate bet. At a 4.2% yield, EXR has a fairly full valuation, reflecting the quality of the self-storage industry’s long-term fundamentals. If it yielded 6%, I believe investors would be compensated for the risk of rates heading back up, but not at 4%. I would take advantage of this recovery to take some EXR off the table, and if shares fall back below $140, that can provide a better entry point.

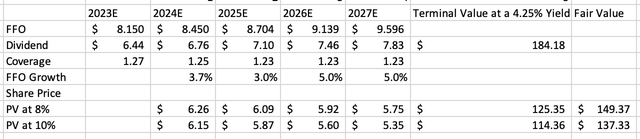

I reach this valuation based on my expectation for ~3-4% FFO growth over the next two years as it works through its Life Storage purchase and faces slower new rental activity, before it returns to a more trend-like 5% growth rate thereafter, given favorable long-term fundamentals. I assume it exits 2027 at a similar dividend yield and discount at both 8% and 10% (my preferred rate). At 10%, I would start to see value at around $140. Shares at $154 are north of even an 8% discount rate fair value.

my own calculations

As for risks to my valuation, the first upside risk would be if rates continue to fall. There could be a situation where investors accept even a 6 or 7% return on equities, which would increase fair value. If we saw an increase in lease rates or if EXR could capture the entire 15% rent differential on Life Storage properties more quickly, its growth could exceed my forecast.

On the downside, Extra Space is benefitting from relatively little new construction. If lower rates bring more construction activity, there could be increased supply in the self-storage sector, reducing either occupancy or rates and reducing cash flows. Additionally, if rates rise again, investors may demand a higher forward return, reducing present value.

Based on my analysis, for now, given the magnitude of the rate move and its sensitivity to rates, alongside current valuation, I would be a seller of Extra Space.

Read the full article here