China’s e-commerce giant Alibaba (NYSE:BABA) has been quite the growth company, increasing its revenues by 15x over the past decade. However, the compounded annual growth rate [CAGR] of 31% over this time has slowed down considerably to 11% for the first half of the current financial year (H1 FY24, ending September 2023).

This is reflected in its stock performance too, which is down by 17% year-to-date [YTD]. But the company is certainly putting up a fight with recent management changes. Here, I take a closer look at what these changes mean for Alibaba and its future stock performance.

Price Chart (Source: Seeking Alpha)

Management changes and more tech focus

2023 has been quite the year of changes for Alibaba’s top management, following a poor set of results for FY23 that saw its revenues contracting. In June, Eddie Yongming Wu became the CEO of the company, taking over from Daniel Zhang. After Zhang also quit as the CEO of the Alibaba Cloud Intelligence division in September, Wu took on that position as well.

In the latest move announced yesterday, Wu will now also head up the company’s China focused e-commerce business, Taobao and Tmall Group. He takes over the role from Trudy Lai, who had become CEO of the group only in March this year.

The changes come at a time of renewed technology focus for the company, and Wu has a long history as a Chief Technology Officer in various parts of the company. In his statement at the time of the latest results release, he mentions “brand-new opportunities from the ongoing AI technological transformation”.

While technology has always been critical for Alibaba, it’s interesting to note that the CFO, Toby Xu mentions it in his statement as well. He says, “we are prioritizing investment in technology and innovations for our businesses to drive new growth”, in a departure from what’s normally just a financial update.

Re-energising Taobao and Tmall Group

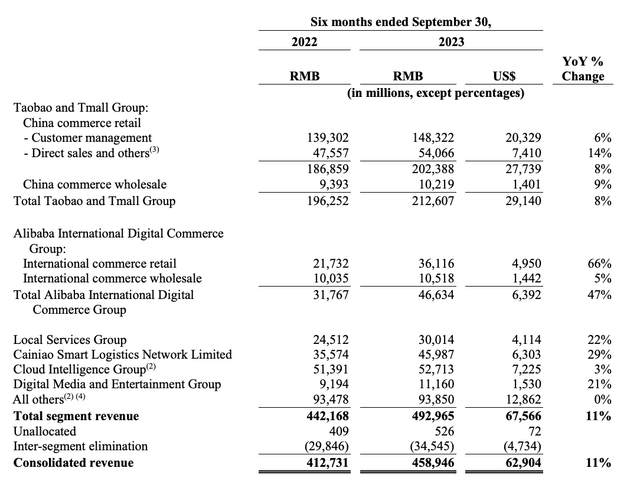

The timing of the latest move, which puts Wu at the helm of the Taobao and Tmall Group, is particularly significant for two reasons. First, the group is the company’s biggest revenue generator. It had a share of 44% in segment-wise revenues for the six months ending September 2023 (H1 FY24). It also has a huge market share of 51%, which further underlines its importance.

However, it has faced challenges recently, as revenue growth has slowed dramatically since the pre-pandemic period. In H1 FY24, the group showed just 8% year-on-year (YoY) growth compared to the 42% increase in the core commerce business, which it was then part of, in the comparable pre-pandemic period in 2019.

Revenue Statement, Six Months ending Sep 2023 (Source: Alibaba)

To give the group its due, it has seen a recovery after a contraction in FY23 due to COVID-19 lockdowns, but this can hardly be called a bounce back. In fact, it’s worth noting that in the FY23 results release, the company alludes to rising competition, besides the pandemic, as one of the reasons for the outcome.

A key emerging competitor is the Temu owner PDD Holdings (PDD). Admittedly, it’s still quite small, with revenues at just 15% of Alibaba’s for the last financial year. But there’s something to be said for its 39% growth in its last financial compared to Alibaba’s decline, which indicates that the pandemic was not the sole challenge.

Growth strategy for the segment

There seem to be some signs of improvement for the Taobao and Tmall Group, though. In the earnings release, the company says it has “achieved healthy year-over-year organic growth of Taobao app users”, and that “the number of transacting buyers and order volume also increased” in the third quarter (Q3 FY24).

It attributes these to the implementation of two of the three parts to its growth strategy for the business, namely increased content and price competitiveness. So far, however, these haven’t been reflected in the revenue figures, which grew by an even smaller 4% in Q3 FY24 compared to the 8% for H1 FY24.

Alibaba does have the third part of the strategy still up its sleeve though, and that is the use of AI applications and tools, which ties in with Wu’s past experience in technology. Specifically, it is focused on improving merchant efficiency through improvement in both the operation and monetisation platforms. AI technologies have also been extended to upgrade the advertising platform with data analysis and marketing tools, as well as AI advertising content.

Attractive market multiples

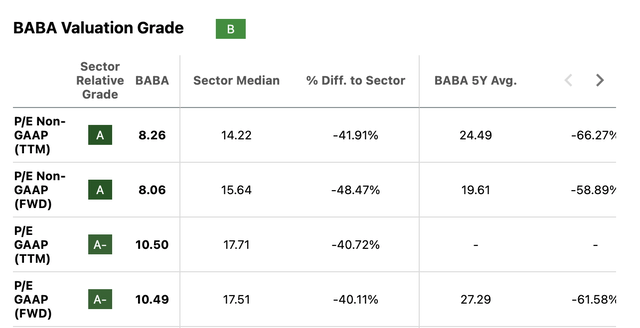

To determine where the stock stands today, however, I’d focus more on the earnings figures. Unlike revenue growth, profit figures have strengthened this year, which is a positive. The net income attributable to stockholders has risen by 28x in H1 FY24 after a week last year. If the company were to continue showing the same trend in H2 FY24 as well, its forward GAAP price-to-earnings (P/E) ratio would be at 11x, which is slightly higher than the analysts’ average estimate (see table below), but much lower than the stock’s own five-year average of 27.3x.

Source: Seeking Alpha

What next?

So can Alibaba turn around its stock fortunes in 2024? If the management changes tell us anything, it’s that the company is taking steps back to higher growth, with a focus now on the Taobao and Tmall Group, which is of particular significance in revenue terms. The group’s growth so far has been rather muted this year, but the company does have a three-pronged strategy for revival, which makes me hopeful.

In any case, balancing the underwhelming revenue figures is the improvement in earnings this year. This in turn makes the market multiples attractive against the stock’s past figures.

I would hesitate to put a number to the possible price upside, though. While investor uncertainty this year about the stock can be attributed to a lower-than-expected recovery in post-COVID-19 China and the company’s own numbers, the changes in top management have likely impacted it too. In fact, the stock didn’t react well to the latest news either, with an almost 3% decline, the biggest since its H1 FY24 results were released in mid-November when it fell by over 9%.

If management changes continue, the stock can fluctuate more than expected. However, fluctuations will likely only limit the extent of the upside. Broadly speaking, the signs look good for Alibaba’s stock in 2024. I’m going with a Buy rating on it.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here