High-conviction Medical Properties Trust, Inc. (NYSE:MPW) investors have failed to lift MPW from its doldrums over the past two months since I downgraded the stock to a Hold. The caution is justified, as I reckoned the challenges that hampered MPW’s bullish thesis was more than just a hawkish Fed. I indicated that the market was likely expecting “further financial pressure on MPW’s AFFO per share,” even as MPW fell to the “A+” valuation zone.

However, its “F” momentum grade suggests dip buyers were not keen to pick up the pieces, notwithstanding its seemingly “attractive” valuation. As a result, my caution has panned out, as MPW underperformed the S&P 500 (SPX) (SPY) since my pre-earnings update. In addition, a significant event occurred that should have bolstered dip buyers to return aggressively, but they failed to do so.

Observant investors should recall that the Fed telegraphed three rate hikes in 2024, although the market seems to have planned for more. As a result, interest rate-sensitive stocks in the utilities (XLU) and real estate (XLRE) sectors have reacted positively. Consequently, MPW’s languid response to the Fed’s more dovish posture likely disappointed its high-conviction holders. With that in mind, even MPW’s recent dip buyers must ask themselves whether MPW’s “A+” valuation grade suggests a value trap, implying it could be dead money at best.

MPW’s third-quarter or FQ3 earnings release in late October 2023 didn’t assure me that things could improve significantly for the specialized healthcare REIT in 2024. The company had already downgraded its quarterly dividend payout to $0.15 per share from $0.29 per share to improve its finances while facing significant challenges with Prospect Medical Holdings and Steward Health Care. The market’s concerns over Steward are justified, as it accounted for nearly 20% of MPW’s asset and rental revenue base as of Q3.

I concur that the market has likely reflected these challenges, as it’s forward-looking. However, the tepid response from the market as it fell further in mid-November 2023 suggests that downside volatility could continue to afflict MPW. With that in mind, while a Sell rating seems too pessimistic as MPW struggles at its long-term bottom, a Buy rating is still a distance away as investors assess the company’s strategic maneuvers to reduce balance sheet risks.

There were concerns that management could have been overly aggressive in pursuing unsustainable growth in the pre-pandemic low-interest rates era. An analyst on MPW’s Q3 earnings conference enquired whether there could be “potential changes in incentives for senior management.” The analyst was concerned as MPW shifted toward reducing risks rather than pursuing growth. Accordingly, management concurred that its board “made meaningful changes to incentives, moving away from aggressive accretive growth.” As a result, the critical question remains on the significant execution risks that could hamper MPW’s return to growth. Management highlighted clearly that its near-term goal is to “return to affordable capital and potentially restart growth when appropriate.”

However, MPW is between a rock and a hard place. With its financial leverage ratio above 50%, management has little room to wriggle to restart without fixing its balance sheet risks. Management highlighted its intention to “target approximately $2 billion in liquidity transactions over the next three to four quarters.” However, the structure of how it would monetize its assets remains uncertain. MPW likely didn’t want to commit to selling its long-term assets at relatively unattractive cap rates, worsened by its battered valuation. As such, options for monetizing its assets through secured lending are expected to remain on the table. In other words, management could consider increasing its debt load while trying to borrow against its assets to navigate these challenges. As a result, I believe the market likely isn’t convinced with its commentary that MPW is undertaking the “evaluation of potential asset sales, including exploring joint venture structures, limited secured financing of assets, and potential amendment and extension of certain bank loans.”

Consequently, I believe investors are expected to remain on the sidelines, given the lack of clarity. I expect investors to demand a clear roadmap of the company’s options, allowing them to assess the possible impact on the REIT’s debt load, potential AFFO dilution, and the costs and timeline of its monetization strategy. However, with MPW facing debt maturities of nearly 18% (about $1.81B) of its overall debt profile in 2024-25, dip buyers aren’t expected to be aggressive or hold on to their positions to allow a long-term mean-reversion thesis to play out.

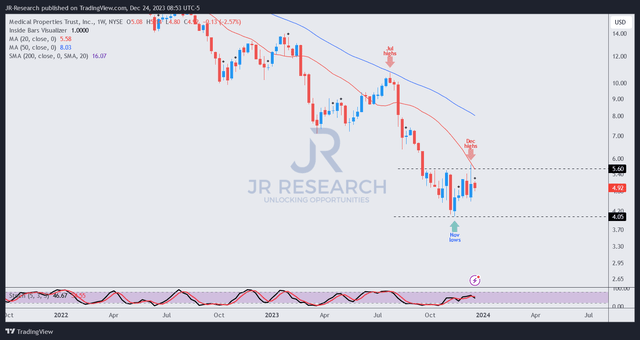

MPW price chart (weekly) (TradingView)

We could see why buyers have remained in a state of flux, as management hasn’t provided enough clarity for dip buyers to hold on to their positions. With MPW still in a medium-term downtrend, momentum investors aren’t expected to return. Seeking Alpha’s “F’ momentum grade corroborates my point, suggesting we need more dip buyers to hold on long enough to absorb intense selling pressure before MPW can turn the tide decisively.

Selling pressure was observed in early December as MPW went ex-dividend on December 6. Dip-buyers initially returned to lift MPW above the $5.6 resistance zone as the market reacted to the Fed’s dovish pause the following week (annotated “Dec highs”). However, MPW’s price action suggests selling pressure set in quickly, as it lost most of its weekly gains as the week closed.

Therefore, I assessed that a Sell thesis on MPW is likely overly bearish at the current levels. However, I find it inappropriate to assign a Buy thesis to MPW, given its fundamental challenges and unconvincing price action from tentative dip buyers not willing to hold the bag long enough.

With that in mind, I urge investors to remain on the sidelines and abstain from adding MPW to their portfolios. There are plenty of turnaround stocks to consider with less intense fundamental headwinds and more constructive price action with a dovish Fed.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here