The India Fund (NYSE:IFN) has performed well in 2024 and at the early March high was +36.5% from the October ’23 low, while at the same time paying a juicy dividend. The Indian growth story and outperformance in Indian stocks helped fuel the rally, but as with any large move, it raised concerns about valuations. Reports of “froth” have weighed, and IFN has made a large dip of over -7%. This article looks at whether the drop is worth buying, or something to avoid.

The India Fund

Before looking at the drivers of the dip in Indian stocks, it is worth looking at the composition of IFN. This is substantially different than an average passively managed ETF. For a start, it is an actively managed Closed-End Fund with an expense ratio of 1.33%. The fund is managed by abrdn Inc., who became the Fund’s adviser in 2011. According to the Factsheet, investment philosophy is

- Bottom-up stock selection

- Proprietary research driven

- Based on fundamental analysis

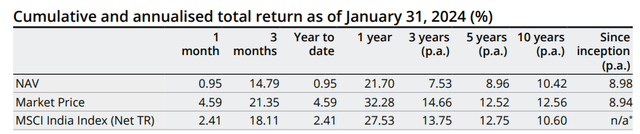

The Fund’s returns are impressive and it consistently outperforms the MSCI India benchmark (note: the below figures are from the Factsheet at the end of January 2024).

IFN Returns (abrdn)

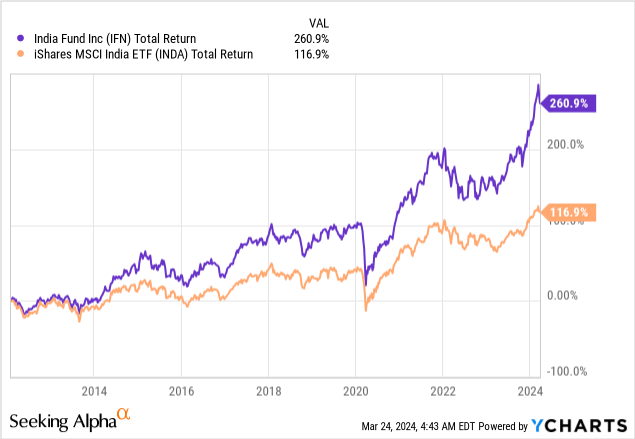

A comparison with the MSCI India ETF (INDA) shows a significant outperformance.

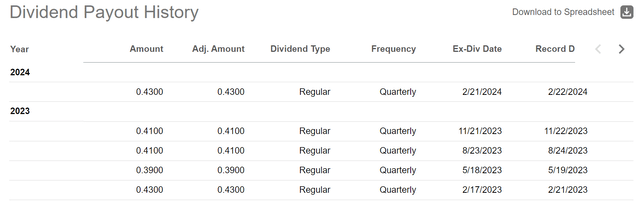

While the investment objective of the Fund is “long-term capital appreciation”, it also pays an attractive quarterly dividend which has been hovering in the $0.41-0.43 region in the past year and yields 8.33%.

IFN Dividend History (Seeking Alpha)

Note, however, according to the semi-annual report, the distributions are “made from current income, supplemented by realized capital gains and, to the extent necessary, paid-in capital, which is a nontaxable return of capital.”

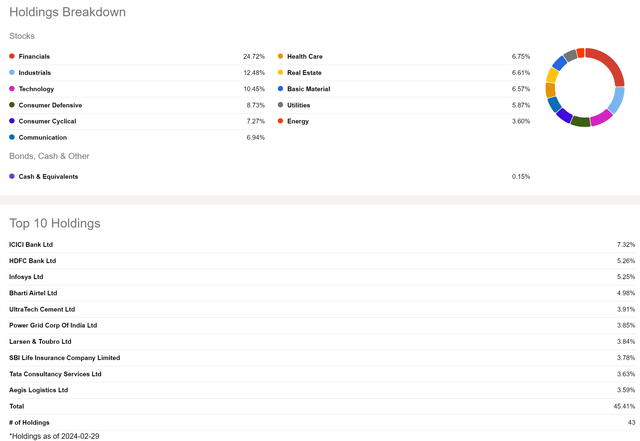

A look at IFN’s holdings shows its portfolio is mostly in Financials, with Technology in third place. It has 43 holdings and 45% of its portfolio in the top 10.

IFN Holdings (Seeking Alpha)

The PE ratio at the end of January was a rather lofty 31.84, which as we will see later, may be a headwind.

Reasons for the Rally

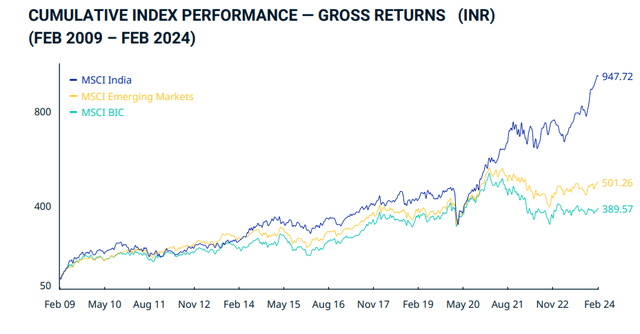

India has been the star performer in emerging markets for around a decade, but especially since 2021. Growth in India has been strong and has been exceeding estimates. The last Reserve Bank of India meeting in February highlighted “As per the first advance estimates (FAE) released by the National Statistical Office (NSO), real gross domestic product (GDP) is expected to grow by 7.3 per cent, year-on-year (y-o-y) in 2023-24, underpinned by strong investment activity.” This rosy outlook has allowed multiple expansion and fuelled a large rally. According to this MSCI Factsheet, the PE ratio of the MSCI India is 26, while the MSCI Emerging markets is only 15.16. The outperformance is clear.

MSCI India v Peers (MSCI)

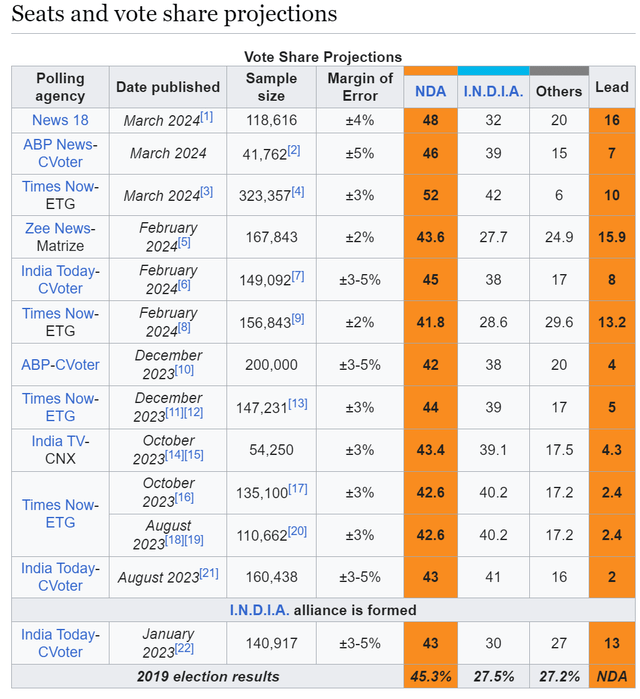

A positive backdrop is provided by a central bank which is gradually shifting dovish, much in-line with Fed policy. There’s also the issue of the 2024 election, but the polling suggests a comfortable victory for Modi’s NDA alliance similar to 2019. Markets hate election uncertainty, but the outcome looks fairly clear at the moment.

India Election Polling (Wikipedia)

Reasons for the Dip

Many steep stock market rallies are accompanied by analyst warnings of a bubble and high valuations. The rally in India is no different and small and mid-cap stocks caught the attention of Madhabi Puri Buch, who is the chairperson of the securities regulatory body Securities and Exchange Board of India (SEBI). In early March she warned,

“There are pockets of froth in the market. Some people call it a bubble, some may call it froth…It may not be appropriate to allow that froth to keep building.”

This was specifically aimed at small and mid-cap stocks which have more than doubled in less than a year as the chart below shows.

Nifty SME Emerge Chart (NSE Indices)

SEBI is looking to regulate this sector further and advised mutual fund trustees to assess the suitability of lump sum investments into small- and mid-cap funds and to disclose stress test results aiming to evaluate the time required to exit positions during times of market stress.

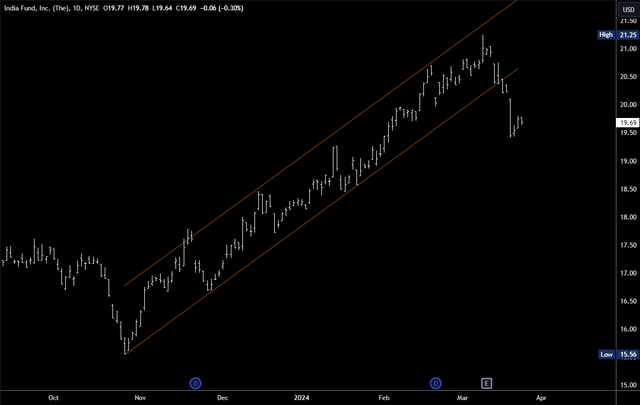

As a result, small and mid-cap stocks have dropped sharply in March and the concerns have spread to all parts of the stock market. The Bombay Stock Market is now nearly flat for the year-to-date, and stocks/indices/Funds with high valuations are particularly at risk. As IFN has a high PE ratio of 31.84, it has sold off too and has broken its trend channel.

IFN Daily Chart (Tradingview)

Is the Dip a Buy?

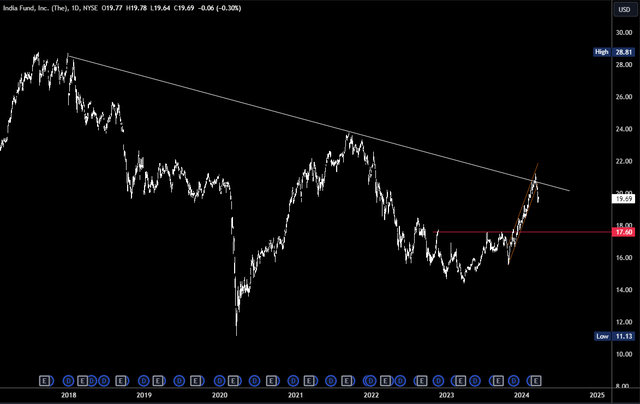

As outlined earlier, Indian stocks are performing well compared to other emerging stock markets and INF has managed to outperform the Indian benchmark. We should aim to invest in the best performing areas and assets, but not at any price. A PE ratio of 31.84 is high, especially considering the Fund has large holdings in financials, industrial and defensives. I would not therefore not buy near $20, but a further 10% drop to the $17.50 area would be attractive.

Zooming out on the IFN chart, there is potential support around $17.50 at the 2023 highs.

IFN Longer-term Chart (Tradingview)

Risks

The main risk is that the “froth” in Indian markets is priced out further and that stricter regulations curb investment. Sentiment has taken a hit and could mean prices struggle to recover again. I do think that at $17.50, IFN should be fairly well insulated against this, but there is a risk it returns to the 2023 low of $14.40.

Conclusions

Solid growth, a dovish shift in the RBI and a stable political backdrop have all helped Indian stocks make solid gains, mostly through multiple expansion. However, SEBI has expressed concerns with “froth” and high valuations are a concern. IFN has a PE ratio of around 31 and could drop further. It is an interesting and well performing Fund and would be attractive on a dip to around $17.50.

Read the full article here