The company and my growth thesis for the company and the sector

Marriott Vacations Worldwide Corporation is a publicly traded timeshare company that was formerly part of a division of Marriott International. The company boasts several upper upscale resort brands that are renowned for their exceptional standards, positioning it as one of the leaders in this market segment. Its brands include Marriott Vacation Club (with more than 70 properties on several continents), Sheraton Vacation Club, Westin Vacation Club, Grand Residences by Marriott, The Ritz-Carlton Club, St Regis Residence Club, and Hyatt Vacation Club.

Brands owned by Marriott Vacations (Marriott Vacations)

In addition, the company provides temporary property exchange and property management services. The two other companies involved with Marriott Vacations Worldwide Corporation are Interval International and Aqua-Aston Hospitality.

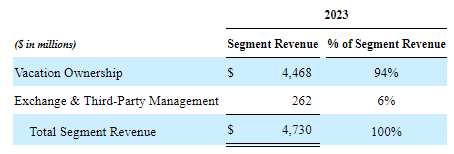

The company operates in two distinct segments, but which complement each other in delivering value to the end customer, which are: Vacation Ownership (includes timeshare sales, consumer property financing, and resort management) and Exchange & Third-Party Management (includes operating exchange programs and property management for other timeshare and resort companies). The core of the business is Vacation Ownership, as can be seen in the graph below

Revenue from each segment of the company (Marriott Vacations)

The Rise of the Sector and the Company

The timeshare property market is expanding, and there is no shortage of drivers that imply a thesis of prolonging this expansion. Initially, we can say that there is a growing demand from consumers who adhere to the residential timeshare business model, as this business model presents itself as a viable option for families who wish to own a property at a fraction of the original cost.

Another fact to take into consideration is the rate of increase in workers’ salaries at levels above inflation, the tendency is for this amount to be allocated to discretionary activities.

Corroborating the thesis of market expansion through new consumers in the high-end resort sector, around 15% of new timeshare residence owners are first-time visitors. The reason for this increase is precisely the on-site approach to visitors, which allows them to capitalize on the positive and relaxing atmosphere of the resorts during the timeshare sales process.

The total value of the timeshare market in 2023 was valued at approximately $18.83 billion, with forecasts to reach a total value of $31.08 billion by 2030, achieving a CAGR of approximately 7.58%. In the United States, the average price of a timeshare unit is $22,180, and according to my estimates, approximately 15.25 million Americans will own a timeshare by 2030.

Now, intrinsically, Marriott Worldwide estimates that there are approximately 48 million families in the United States that they target as potential customers for purchasing timeshare vacation homes. Marriott highlights in its communications that these potential customers do not represent risks to the financing provided by the company, in accordance with its activities mentioned above. In this way, the company communicates that potential growth in the market would not result in major negative consequences on the margin. Corroborating this fact, the company highlights that the customer base it intends to win has an average FICO score of 735.

Occupancy rates at Marriott resorts remain high while the company predominantly uses the prepaid model, which in addition to maintaining cash flow predictability and improved liquidity, also avoids cancellations. The occupancy rate in 2023 was 88%, 1% lower than in 2022.

Therefore, with the explicit objective of generating stronger cash flow and generating value for shareholders through share repurchases and dividend payments, the company plans to accelerate the growth and development of the brand by capitalizing on strategic and profitable acquisitions, expansion of its marketing channels (guiding communication with Millennials and GenX, who represent around 64% of sales) and development of a more efficient sales system through the implementation of the use of AI for targeting.

Now, in the exchange and third-party property management segment, Marriott Worldwide plans to increase its distribution channels in order to expand the exchange system and its zone of influence in property management around the world.

Fundamental Analysis

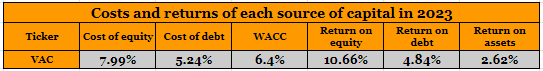

To begin my fundamental analysis of Marriott, as usual, I will highlight the company’s capital structure, as well as the sources of capital used to finance its operations, the costs of these sources, and their profitability.

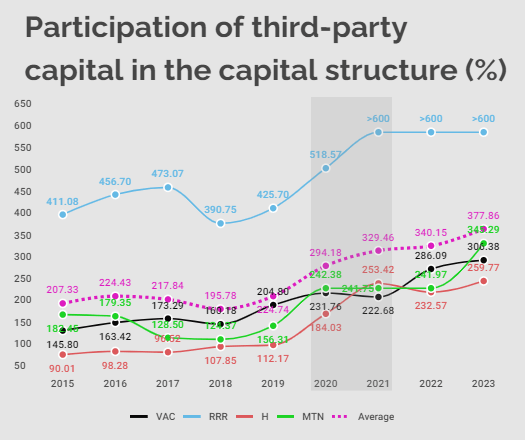

Author

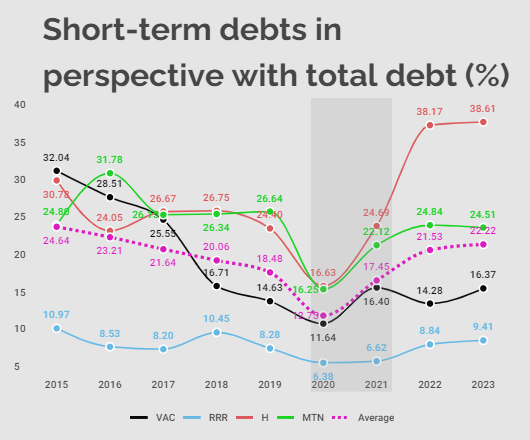

It is evident from the analysis of the third-party capital participation index that Marriott follows the sector trend, always using a preponderance of third-party capital in perspective with its own capital. It is interesting to highlight the significant increase in the use of third-party capital in relation to equity, especially in 2021 and 2019.

In addition to indicating that companies in the sector are leveraging themselves with greater intensity after the pandemic, there is no noticeable difference between Marriott and the sector.

Author

As we can see now and will prove later, through the analysis of profitability in the DuPont Model, Marriott uses leverage to enhance the return to shareholders and is successful in this task. However, it is necessary to analyze the composition of debt, since generating resources to cover long-term debts is a much more accommodating situation than generating resources to collect short-term debts, even if this leverage is generating positive returns for shareholders.

Author

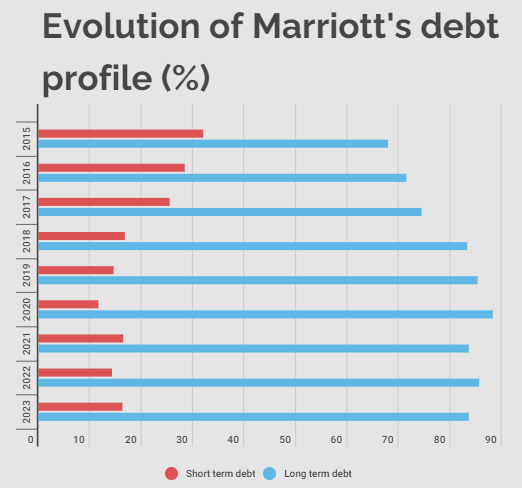

Marriott’s debts are at levels in line with good debt practice, indicating adequate management of its obligations. Below I will exemplify Marriott’s debt profile in a graph that makes it easier to visualize. Note that there are two points at which this difference in debt maturities manifests itself, which was from 2017 to 2018 when Marriott increased its long-term debts.

Author

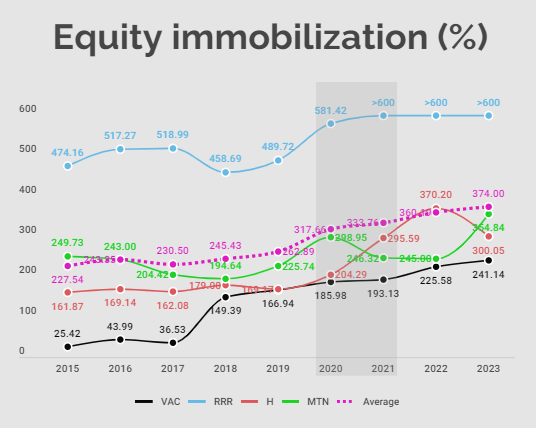

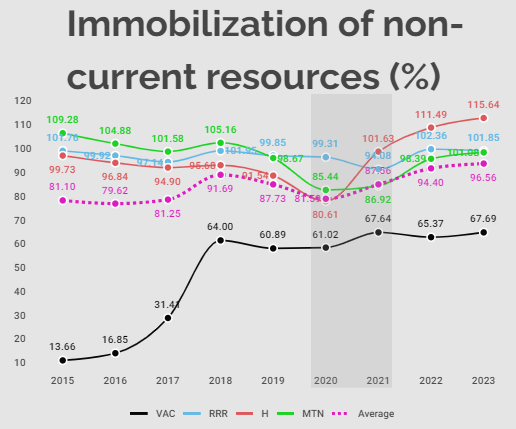

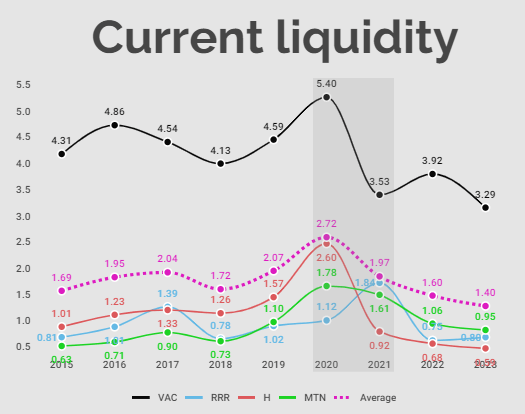

Still regarding Marriott’s capital structure, there are two very important indicators, which will result in two unique elements in corporate finance, they are: equity immobilization and the immobilization of non-current resources.

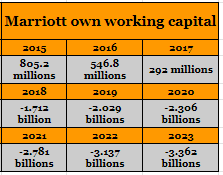

From these indicators, two fundamental concepts will emerge to understand the company’s equity situation, which are own working capital and net working capital. Firstly, I will analyze the immobilization of Marriott’s equity capital, and thus highlight its own working capital, which is nothing more than the amount of equity capital that is not immobilized and, therefore, free for the company to use in its working operations.

If, however, its own working capital is negative, this means that Marriott has tied up all of its own capital and even more of its third-party capital. In this way, Marriott will depend exclusively on third-party capital to finance its working operations. This isn’t necessarily a bad thing, since Marriott can use long-term debt to finance both a portion of its fixed assets and its daily operations, this will result in strong net working capital, but I’ll look at that next.

Author

It is noted that Marriott gradually increases the amount of capital in non-current assets, mainly in goodwill. It’s natural for this to happen, as the company has a notable history of acquisitions, as mentioned during the qualitative analysis, and naturally, this premium over book value is evidenced in the balance sheet.

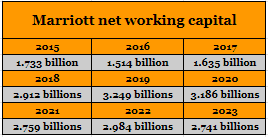

Therefore, it is evident and demonstrable in the following table that Marriott does not have its own working capital, which by its very nature is not callable, unlike third-party capital.

Author

It is clear that a company that enjoys high working capital is capable of guaranteeing asset security in its operations, but this does not mean that a company that does not have it, such as Marriott, necessarily has a bad equity position, since it may have a high net working capital, arising from long-term obligations.

Therefore, we have seen that Marriott depends on third-party capital for part of its fixed assets and all of its short-term operations financing. The questions we must ask and that will be answered as our fundamental analysis continues are:

- Does Marriott have enough net working capital to finance its daily operations from long-term obligations?;

- Because the company’s main source of financing is third-party capital, are there liquidity problems in relation to the solvency of these obligations?;

- Is this leverage helping the profitability of shareholder capital?

To answer the first of these questions, I will highlight the immobilization of non-current resources, that is, the immobilization of equity capital and long-term liabilities.

Author

The graph above reveals that Marriott maintains a significant amount of net working capital in relation to other companies in the sector, and this is a relevant competitive advantage. Marriott appears to keep an average of 65% of its non-current resources in permanent assets.

This means that in 2023, approximately 32.31% of its non-permanent resources were used to finance its operations in the short term, allowing it a relative financial cushion in relation to its competitors. Below I will show you, my dear readers, the amount of dollars that Marriott maintains as net working capital, and then how this capital is formed with the disclosure of its components.

Author

The amount of capital described above corresponds precisely to non-current resources (equity and long-term liabilities) that were not immobilized, and, therefore, serve as a financial safeguard in the short term. All other companies analyzed do not have net working capital, since they have immobilized a greater amount than the resources not required/required in the long term, this is evidenced in the graph.

This means that these companies have both immobilized a percentage of short-term liabilities and require constant renewal of these short-term debts to finance their current assets. The competitive advantage that Marriott has over its competitors can therefore be seen due to the fact that it has a strong amount of net working capital.

Author

So, in this way, I have already answered one of the three questions raised above. Marriott has enough net working capital to finance its daily operations, as it has enough capital raised through long-term obligations in its current assets. In this way, the lack of own working capital is compensated by a strong net working capital.

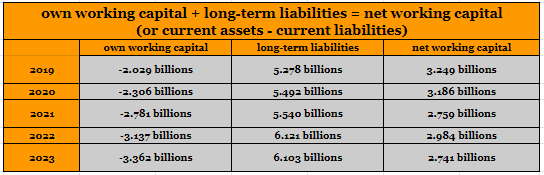

Now, I will open the way to answer the second question, which is precisely whether Marriott, due to the preponderance of the use of third-party capital, is in a favorable liquidity position.

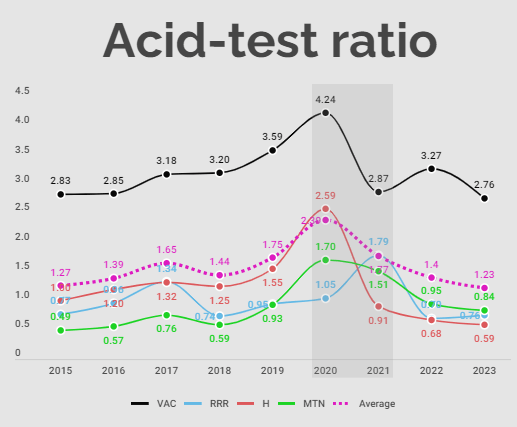

Author

Despite the downward trend, Marriott’s current liquidity remains strong over time, even more so if we compare it with the sector average. The reason behind this drop is mainly two payments of the principal amount, one in 2021 and the other in 2023, of a previously issued long-term debt, of $224 and $182 million respectively.

Author

The situation does not change much when we exclude inventories, since it is not the nature of the sector to maintain voluminous inventories. Even so, Marriott maintains a favorable liquidity position.

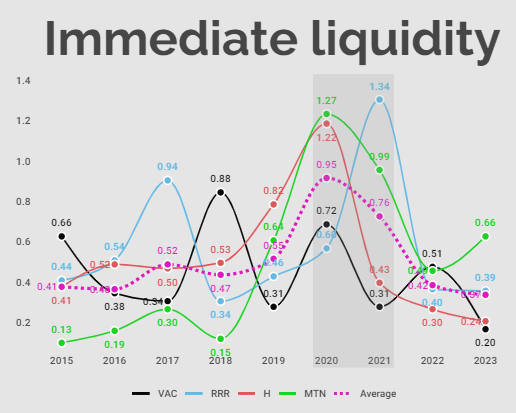

Author

Marriott’s immediate liquidity, which demonstrates the ability to pay all current liabilities with available cash resources, is below the sector average. It is visible from the proportion of receivables that the company uses a more flexible collection period, resulting in a slightly less responsive cash flow while receivables are converted into cash.

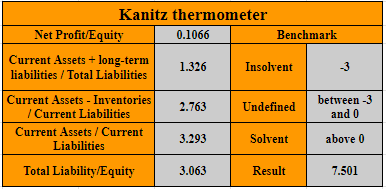

To answer the second question I asked previously, whether Marriott’s leverage poses any danger of bankruptcy, I need to use a quantitative model for bankruptcy predictions. As usual, I will use the Kanitz Thermometer.

Author

We can answer the second question as follows: even using predominantly third-party capital, Marriott has favorable liquidity levels, and a healthy debt profile and is not at risk of going bankrupt according to the quantitative methods and data we currently have. Therefore, we have not yet analyzed whether this leverage is generating positive returns for shareholders, but I can already say that it is sustainable and is not harming Marriott’s solvency. A positive point for the company’s financial management team.

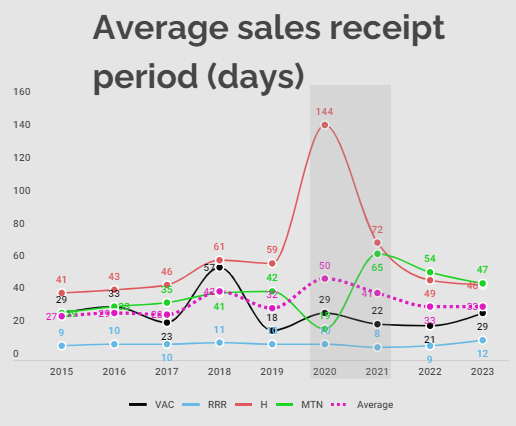

As receivables are a very important item in Marriott’s current assets, I will suggest here an analysis of the average sales receipt period. This way I will be able to tell whether there is a deterioration or not in the company’s receipt cycle.

Author

Marriott’s sales receivables have been stable since 2018, indicating predictability and security for the company’s creditors.

Now that I have analyzed the capital structure, liquidity indicators, solvency, and average terms, I will begin the analysis of Marriott’s operability and profitability, in order to ultimately answer the third question that I established at the beginning of this analysis.

Author

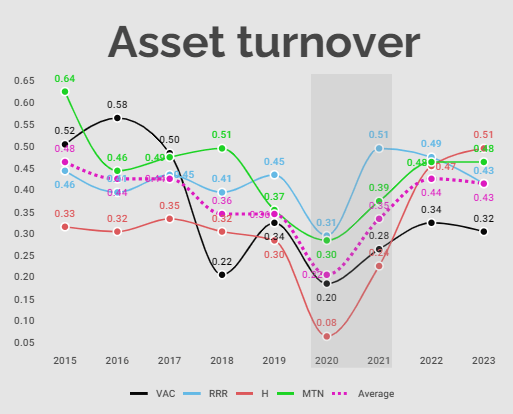

Marriott has an asset turnover below the sector average, with a sharp drop after the recognition of $2.828 billion of goodwill and $1.107 billion of intangible assets, an abrupt movement that was not immediately accompanied by an increase in revenue. This increase only proved to be palpable in the coming years (with an obvious interruption in 2020).

Asset turnover is important, but its analysis will only be complete based on an analysis of the net margin since it is only possible to obtain profitability from combining the margin with turnover. If a company has a negative margin, for example, a high turnover would be terrible. This discussion is fundamental in corporate finance, since companies that are market-oriented prioritize turnover over margin, while companies that prioritize the product prioritize margins over turnover. These questions will be answered as the analysis unfolds.

Author

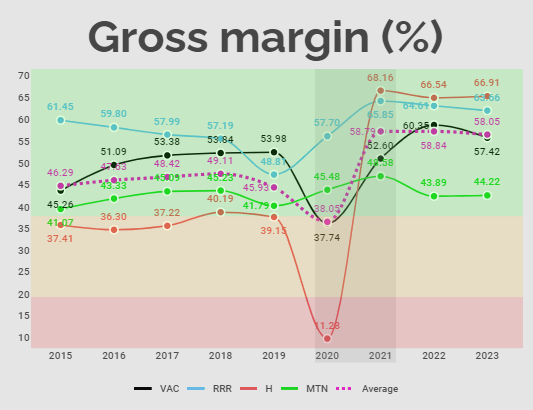

Marriott’s gross margin is at very healthy levels, ahead of the sector’s margin in almost all periods analyzed. Marriott managed to present a good gross margin until 2020, losing just 16 percentage points, almost maintaining levels of 40%, which I consider quite healthy. Currently, we see stability between 50% and 60%.

Author

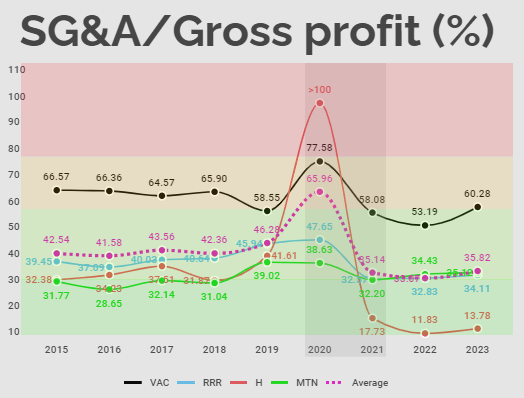

Marriott maintains high SG&A expenses in relation to its gross profit. The good news is that as this relationship is practically stable, this means that Marriott adapts the amount spent on SG&A according to revenue and consequently gross profit.

Large fluctuations here would demonstrate that the company does not parameterize SG&A expenses with what it receives, which would be terrible. It would be good to see Marriott looking for the sector average, as the levels, although not worrying, are not good either.

Author

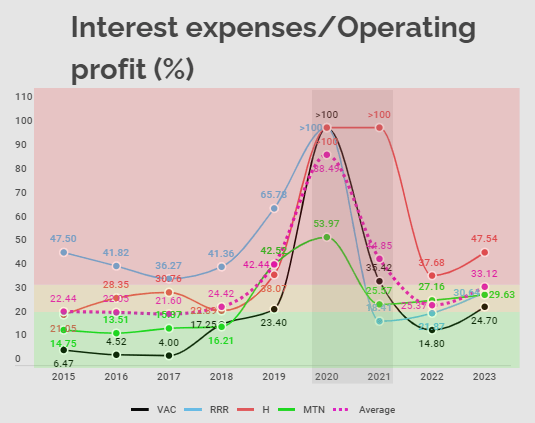

Looking at the graph above, we can see that Marriott maintains its interest expenses in relation to its operating profit (or loss) at lower levels than the rest of the sector. Even so, the company sometimes maintains higher multiples than desired (here I consider healthy levels like 20%), as in 2019 and 2023.

Author

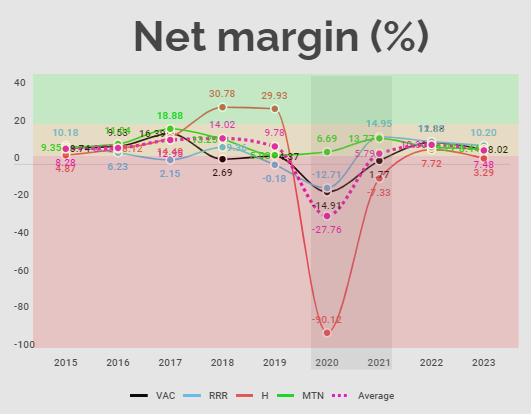

Marriott’s net margin basically follows the same pattern as the sector in which it is part, notice the similarity in the net margin that the companies analyzed presented in the period. Marriott generates an average of 5.38% in net margin every year, demonstrating that the company does not have such an adjusted operational level and there is still a lot to improve, mainly by cutting SG&A expenses, which appear to be outliers in the sector.

However, the net margin is not the only element that must be analyzed when we seek to measure the profitability of the operation for its shareholders, but rather combined with the analysis of turnover and the participation of equity capital in the company’s equity structure. Below, I will highlight each element that interferes with generating a return on share capital through the DuPont Model profitability analysis methodology.

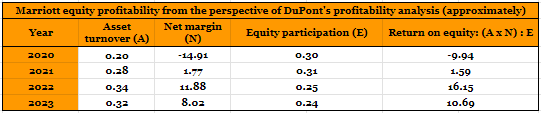

Author

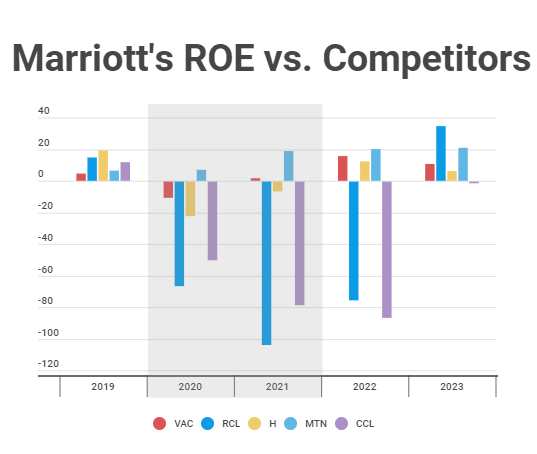

Highlighting the components that allow returns for shareholders, we can state that, mainly due to the increase in net margin since 2022, along with a less significant increase in asset turnover and a decrease in the proportion of own capital compared to that of third parties, Marriott increased shareholder returns.

This allows us to answer the third question I proposed previously, showing that only because of the combination of a greater turnover and a more robust margin, Marriott was able to generate a greater return to shareholders through leverage.

Author Author

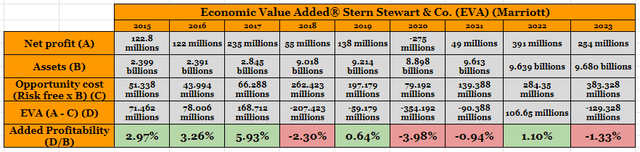

Applying the concept of opportunity cost through Economic Value Added, which, in general terms, indicates whether the company is generating the minimum profit necessary to remunerate the share capital compared to the risk-free rate, we notice a preponderance of results above the risk-free rate, especially when we exclude atypical years from our sample.

However, there is clearly difficulty for Marriott in generating results above the adopted benchmark when it more than doubled its assets through its acquisitions, when the goodwill and intangibles on its balance sheet increased dramatically. This increase did not translate into an increase in revenue in the same proportion.

This becomes evident when we consider that revenue CAGR has been 10.22% since 2015, while total assets have grown at approximately 16.08% CAGR over the same period, highlighting what we have already said previously about turnover problems, which is nothing more than Marriot’s ability to generate revenue with the asset it owns. Another fact that I cannot rule out is the increase in the risk-free rate, which grew more strongly from 2022 onwards, mainly due to a contractionary monetary policy.

Valuation

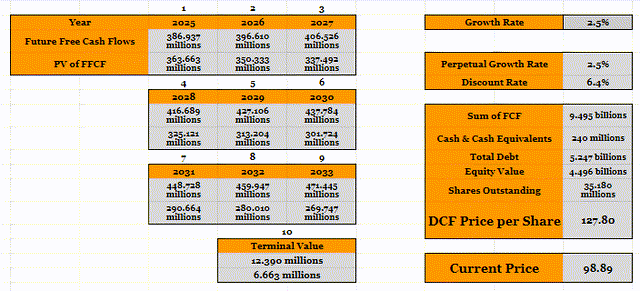

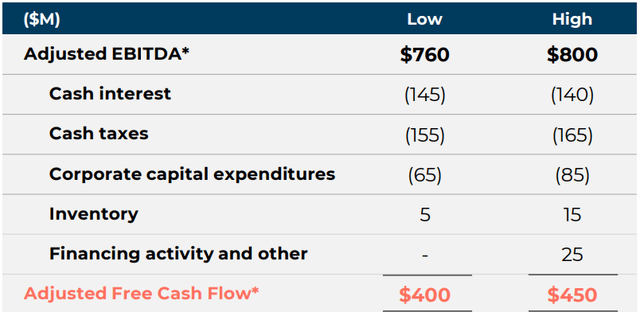

For my valuation using the discounted cash flow method, I considered that Marriott will achieve a free cash flow of approximately $377.5 million, in line with analysts’ estimates. Note that I’m being conservative here, as the company projects a free cash flow of $400 million to $450 million. As I have already demonstrated in the analysis of the capital structure, I will consider the WACC as 6.4%.

Determining adequate growth here is challenging, and to stay in line with a more conservative perspective, I will not adopt a two-stroke growth model in my analysis as I generally do. I will use the continuous growth rate of 2.5%, so as not to overvalue Marriott’s growth.

Author

Remembering that when I use Marriott’s forecast for free cash flow in 2024, which varies between $400 million and $450 million, I find a range of variation in intrinsic value between $143.89 and $179.64 (using the same 2.5% growth rate). I prefer to continue with the estimate I expressed in the table above, as the company tends to overestimate its ability to generate free cash flow.

Marriott Vacations

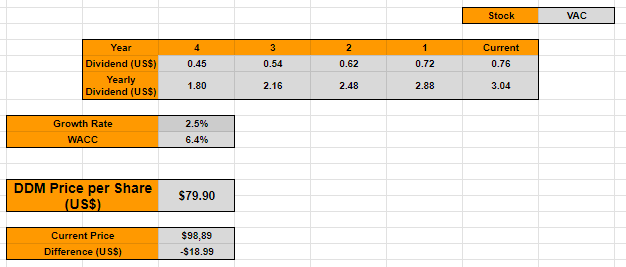

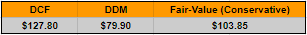

In the discounted dividend model, I used a perpetual dividend growth rate of 2.5%, and the intrinsic value of the share was $79.90. Next, I will calculate an arithmetic average between both metrics and verify that there is still an opening for purchase. Remember, I used very conservative assumptions, so the sign of dissonance between intrinsic value and the current price is a sign that by many other metrics, there should be signs of undervaluation.

Author Arithmetic mean to find the intrinsic value (Author)

Risks

The risks surrounding Marriott Vacations Worldwide are intrinsic and extrinsic, like most companies. Intrinsically, the company incurs a high level of leverage, therefore, any deterioration in its net margin or a sudden decrease in turnover can result in amplified negative returns for shareholders, as I have already reported through the profitability analysis. Additionally, there are several complaints about the use of high-pressure sales tactics and high maintenance fees.

Extrinsically, the business model presents some notable problems. As it is not such a developed market, there are still many problems with litigation, especially in relation to the cancellation and sale of rights to use properties. This high degree of litigation can bring regulatory problems to the market, causing its reputation with consumers to deteriorate.

In addition to the more common risks such as a recession and sudden fluctuations in the market, there is also the hassle of getting rid of a timeshare property. Almost 100% of the time the seller of a timeshare property results in an absurd loss of value, being sold for approximately 15% of its original value.

Another additional risk to profitability in 2024 is the change in the time preferences of high-end customers, who are choosing to travel abroad, affecting the domestic high-end market, mainly in Hawaii and Florida.

Conclusion

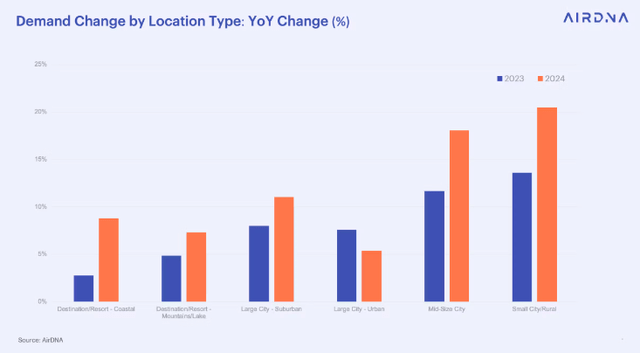

In the year 2023, we saw a combination of events that harmed the timeshare sector, but also the short-term rental market as a whole. Inflation, slow growth, record heat waves in August, hurricanes in Florida, and fires in Hawaii. In the midst of all this, trips abroad grew by around 16.7%, while domestic trips only grew by 4.5%. Therefore, in 2024 it is expected that the pent-up demand will be realized, albeit slowly, apparently more quickly than in 2023, if there really is no recession.

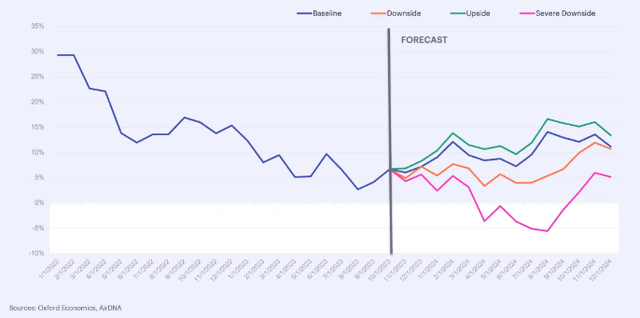

My base thesis considers a very slow and gradual recovery in 2024, mainly for high-end resorts, which will not benefit as much this year as small/medium city locations.

AirDNA Demand forecast in four different scenarios (AirDNA)

However, I consider that the share is trading at comfortable levels for purchase, with room for upside in 2024 with the recovery in demand and the company’s commitment to generating value for shareholders in the form of buybacks and dividends.

Read the full article here