Background

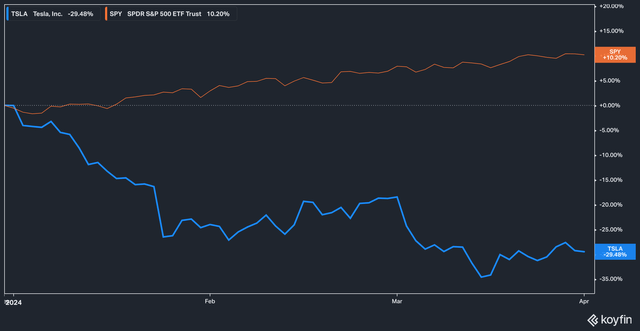

2024 has not been kind to Tesla, Inc. (NASDAQ:TSLA), the maker of electric automobiles which bulls like to brand as primarily a tech company. While the broader S&P 500 (SP500, SPY) has returned 10% year-to-date, Tesla’s stock has fallen by nearly 30%.

Tesla vs SPY, YTD (Koyfin)

The dismal performance this year has even prompted the Wall Street Journal to speculate whether Tesla (and Apple Inc. (AAPL), for that matter) deserve to be counted among the ranks of the so-called Magnificent Seven.

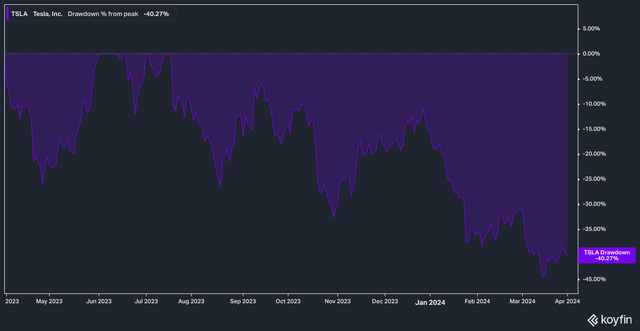

The upcoming first quarter results (set to be released as of this writing on April 23rd) are prompting speculating and soul-searching among investors, who want to know whether the pain the company has experienced since peaking in July 2023 (on a drawdown from peak basis the stock is currently down 40%) will continue.

TSLA Drawdown From Peak (Koyfin)

Analyst Estimates & Deliveries

Rightly or wrongly, the market generally places the expectations of analysts in high regard. In Tesla’s case, analyst expectations have been trending downward, which is alarming. Per a recent article from Bloomberg:

Tesla Inc. may be headed for a gloomy milestone as waning demand for electric vehicles and elevated interest rates take a toll on sales.

Analysts rapidly lowered their projections for this week’s deliveries report as the quarter came to a close. Some on Wall Street are even braced for Tesla’s first sales decline since the early days of the pandemic.

On average, analysts surveyed by Bloomberg estimate that Tesla delivered 449,080 vehicles in the quarter. That would be down more than 7% from the company’s record showing in the fourth quarter, which tends to be the best time of year for sales. The key will be delivering more cars than the 422,875 managed in the first three months of 2023 and avoiding a first year-over-year drop since the second quarter of 2020.

Well, on April 2nd Tesla released a few bits of information about its first quarter operations, and they were markedly worse than analyst expectations.

According to the press release, in Q1 2024 Tesla produced 433,371 total vehicles and delivered 386,810–a delta of more than 50,000 vehicles per Bloomberg’s analyst estimate. The stock reacted to the news by dropping roughly 5%.

The company had the following to say about the decline in numbers:

The decline in volumes was partially due to the early phase of the production ramp of the updated Model 3 at our Fremont factory and factory shutdowns resulting from shipping diversions caused by the Red Sea conflict and an arson attack at Gigafactory Berlin.

The Berlin Gigafactory arson case was indeed serious — it shut down operations at the plant for a week.

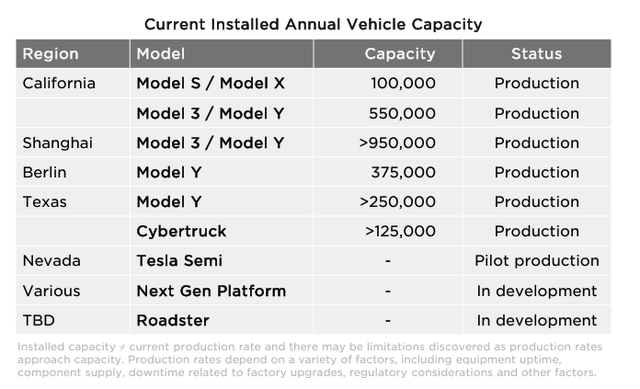

Thankfully, we can do some rough math to determine just what impact the shutdown probably had on the company’s deliveries. According to the investor presentation for the year ending 2023, the Berlin Gigafactory has a production capacity of 375,000 vehicles per year.

Tesla Gigafactory Capacity (Tesla Investor Presentation, dated Jan 24, 2024)

In a 52-week year, this means that the factory produces roughly ~7,200 vehicles per week when operating at max capacity. Even accounting for a delay in firing up production (let’s say the number was more like 10,000), this number seems small compared to the overall difference between expected and reported deliveries. Based on this, something we’ll be on the lookout for in the next earnings call will be any additional color the company provides around the cited Fremont factory ramp-up and shipping issues caused by lack of access to the Red Sea.

Also, something to keep an eye on in the upcoming earnings is the fact that the first quarter of 2024 will be the first full reporting period for the Cybertruck. The rollout of the long-awaited battery EV, or BEV, truck has not been without issues: some drivers have stated that the vehicles have begun to rust, vehicles have been reported delivered with body defects, and more.

Even beyond the first quarter of 2024, there seem to be storm clouds on the horizon for investors–in late March, for example, Tesla rolled out a new requirement that staff must now perform a demonstration of the Full Self Driving [FSD] capability.

This requirement might not seem on the surface like it would slow deliveries down much, but it is likely to create a near-term bottleneck in the delivery process. Elon Musk had this to say in a recent Bloomberg article about the new requirement:

“I know this will slow down the delivery process, but it is nonetheless a hard requirement,” Musk said, citing unfamiliarity with the Tesla system’s capabilities. “This is very important.”

Lastly, these latest earnings won’t do much to tamper the narrative that Tesla is losing market share to BYD Company Limited (OTCPK:BYDDF) in China, something that Tesla bears have long warned about.

Current Valuation

Even with the 5% decline in response to disappointing delivery figures (and the broader slide in stock price in 2024), Tesla remains quite expensive.

TSLA Forward PE vs MSFT, GOOG, F (Koyfin)

Often touted as a tech stock by bulls rather than an automaker, the stock commands a premium even by tech standards. Today Tesla trades at 57x forward earnings estimates, while Microsoft Corporation (MSFT) and Alphabet Inc. (GOOG, GOOGL) trade at 34x and 22x earnings, respectively. Meanwhile, Ford Motor Company (F) trades at just 7x forward earnings estimates.

Eventually, this valuation may become a problem: at some point, it could become the case that the market decides to no longer award Tesla such a premium if many of the company’s tech promises (such as energy production, full self-driving aka FSD, etc.) fail to materialize as expected or experience repeated delays.

The Bottom Line

We have concerns about Tesla’s ability to deliver at a level that would justify its current valuation. Between shrinking Chinese market share (the largest EV market in the world, it should be noted), concerns around the Cybertruck, and an expected delivery bottleneck in the form of in-person FSD demonstrations, we think that the risk for Tesla shareholders today is elevated.

Read the full article here