Investment Thesis

Given a recent double in the share price of AudioEye (NASDAQ:AEYE) from $6 to $12, I believe that the stock has become overpriced and provides investors a good time to trim their positions. While the company has a strong growth trajectory, at current prices the continued growth seems to be fully priced in. Once again, there is a price for everything and I believe the stock has gotten ahead of itself. With consistent operating losses and very little cash flow, I question if the fundamentals are strong enough to justify today’s stock price.

Company Overview

The company’s main mission is to provide equal access to people with disabilities so they can have the same experience with technology as others. As a web accessibility company that “helps deliver website remediations efficiently and affordably for organizations of all sizes”, they provide software that “provides an accessible and usable web experience to the expansive and ever-growing global population of individuals with disabilities” (Annual Report, Page 2).

Many laws actually require businesses to give fair access of their website to people with disabilities. According to Title III of the Americans with Disabilities Act,

Title III of the ADA prohibits discrimination against individuals with disabilities in places of public accommodation and websites can be considered places of public accommodation under this regulation.

So, this gives AudioEye a major growth tailwind as many businesses are required by law to have websites that can accommodate to people who are blind and suffer from some disabilities. AudioEye is dedicated to “helping businesses and organizations comply with WCAG standards as well as applicable U.S. and foreign accessibility laws”.

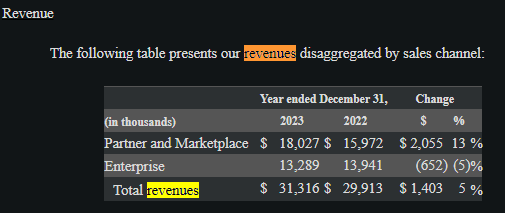

The company makes revenue in two segments: Partner and Marketplace, and Enterprise. Total revenues increased 5% in 2023, from $30 million to $31.3 million. Given just a 5% increase in revenue, I can tell that the stock has potentially gotten ahead of itself and I question whether this modest growth justifies a double in share price.

10-K

Partner and Marketplace revenues refers to a channel that “serves small & medium sized businesses that are on a partner or reseller’s web-hosting platform or that purchase our solutions from our Marketplace” (Annual Report, Page 22). Basically, SMEs purchase AudioEye’s software solutions from either directly on AudioEye’s marketplace, or through a partner’s platform. These solutions refer to CMS integrations, automated fixes, and an automated accessibility platform as shown on their main website. For 2023, Partner and Marketplace revenues made up 57.5% of total sales.

Enterprise revenues is for their larger customers, “who generally engage directly with AudioEye sales personnel for custom pricing and solutions. This channel also includes federal, state and local government agencies”. Basically the same products but simply being sold to larger customers, big corporations, and even governments. Enterprise made up the remaining 42.5% of total sales for 2023.

In conclusion, I see a business that has good growth tailwinds but is simply overpriced now. Regulations require companies to have websites that are accessible, so I don’t doubt the growth that this company will have. I like the mission to spread accessibility, but even a great story can become too expensive. Their technology and software seem advanced and well-designed based on their recognized leadership, but profits and cash flow have yet to show up in the fundamentals. Thus, it may be time to take some profits.

Fundamentals Seem Weak

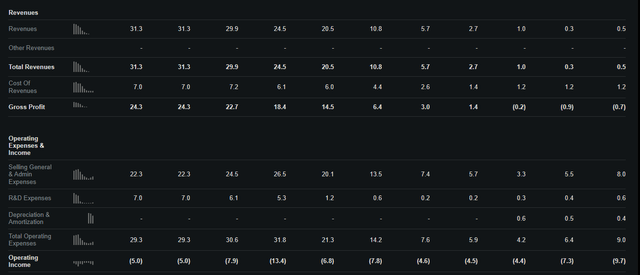

A quick scan of the financial statements shows some red flags to investors who are prefer to see strong fundamentals. While revenues have gone up 50% from 2020 to 2023, I see no increases in operating income. One would assume that at some point earnings will show, but I’m surprised to see negative earnings for the past few years despite growth on the top-line.

Seeking Alpha

It seems to me that the company may take longer than expected to turn sufficiently profitable, and any increases in revenues is accompanied by increases in operating expenses. While these operating losses have narrowed, I think the company will continue to run GAAP losses for some time because AudioEye seems to rely heavily on R&D and hiring great talent to grow.

If we look at cash flow, the numbers aren’t too great either. The company has lost cash up until 2023, when they finally had cash flow of $300,000 for 2023. Since then, the company has relied on external funding such from debt and equity, as shares outstanding have risen from 4 million in 2016 to around 12 million today. Even recently, they took out a loan of $7 million in November of 2023, which leads me to believe they are heavily reliant on external funding to keep their business afloat at the moment. While not too troublesome, I think AudioEye may take a while to reach a point of self-sustainability, so further external financing may lead to dilution and/or more leverage on the balance sheet.

Furthermore, what makes me think shares are overvalued is that the company took out this $7 million to repurchase shares at around $5. Today, the stock is around $12. According to the press release,

In the fourth quarter of 2023, AudioEye and its Board of Directors authorized the repurchase of up to $5M of the Company’s outstanding shares of common stock expiring in December 2025. As of March 5, 2024, the Company had repurchased 437,000 shares at an average price of $4.87.

While at $5 the shares may have been underpriced, at $12 it may now be overpriced. With a relatively unprofitable track record and modest revenue increases, the weak fundamentals show me that the current share price is excessive. Consistent dependence on external funding from debt and equity issuance shows me the company’s cash flow is not strong enough yet to sustain itself. Therefore, I question this double in share price and believe the fundamentals are too weak to justify today’s share price.

Large Competitors Pose Challenges

Growth in the future may be challenging as many competitors exist in the market today. I believe competition poses a major risk as several competitors can build compelling software products that closely match the value proposition of AudioEye. Although the company has patented protected technologies, it seems to me that with the growth of AI and Machine Learning many other companies can also closely match what AudioEye provides. I think making software these days is only getting easier, and creating an automated platform that helps websites become more accessible isn’t exactly the hardest thing to make. To me, any seriously talented software engineer team should be able to cook up a similar program in a few months which leads me to believe new competition can easily enter.

To back up my claim, I see many competitors that offer similar services. According to G2, competitors like accessiBe, UserWay, and Siteimprove are some examples that do what I believe is the same thing to AudioEye. After examining their websites, these competitors also offer WCAG compliant software that helps companies make their websites more accessible. Judging from the large amount of players, making simple text-to-speech solutions doesn’t seem to be all that hard. I can imagine if the profits are substantial enough, new entrants can craft their own automated solutions to compete directly against AudioEye.

The company highlights its competitive strengths in the annual report, giving us more color on their position,

We believe there is no fully automated solution on the market that can provide 100% compliance. Our offerings provide automated remediations with additional human assisted technologically driven enhancements. We think that as the industry develops, opaque products with unsubstantiated claims will ultimately fail.

My take is that while there may be no fully automated solution now, in the future as the market grows I expect more solutions to appear from new entrants. To me, it is unwise to assume that AudioEye is the only company capable of making compliant solutions for web accessibility. If the profits are substantial, what’s stopping big names like Microsoft (MSFT) and Google (GOOG) to enter and create their own services? With billions in R&D at their disposal, it seems to me that large competitors could enter and create a superior service.

With relatively strained resources and continued operating losses, I see AudioEye potentially operating at some disadvantage to larger players that have more resources to advertise and innovate. This is not to say that AudioEye won’t remain competitive, but I expect the growth to be challenged going forward. As long as the websites are WCAG compliant, I doubt that customers care too much about differentiation from one offering to another. I think they simply want to meet the regulatory requirements and focus their time and resources on their actual business. Ultimately, growing competition from large players poses a risk to growth for AudioEye.

AudioEye Looks Overvalued – Fair Value $8

I will use company’s own guidance for my valuation here, and after accounting management’s own projections I feel the stock is still overvalued. According to their press release,

The Company expects to generate revenue of between $8.0 million and $8.1 million in the first quarter and between $34.0 million and $34.4 million for the full year 2024. Management also expects adjusted EBITDA of between $700,000 and $900,000 for the first quarter and between $3.5 million and $4.5 million for the full year 2024. The Company also expect adjusted EPS of between $0.06 and $0.08 per share in the first quarter and $0.29 and $0.38 per share for the full year 2024.

Assuming the revenues are $34 million, that’s a modest revenue growth of an extra $3 million to the top-line, or 10% sales growth. At over 40x FWD earnings, investors seem to be overpaying for just a 10% revenue growth. Furthermore, the company expects adjusted EPS to be around 30 cents for 2024. At $12 that is a FWD earnings of 40x, which is almost twice the sector median of 23x.

I believe a more fair multiple of 26x, which is more in-line with the sector median gets me a fair value of $8, rounded up ($0.30 x 26 = $8). It looks to me the stock has gotten ahead of itself and based on management’s own guidance I expect the true fair value to be $8 per share.

A final piece of evidence is that insiders did buy in at $5, but they seem unwilling to buy in at $12. Ultimately, what is smart at one price is dumb at another. Investors should see this overvaluation as an opportunity to sell and lock in profits. If valuations become more attractive, they can re-enter the stock later.

Potential Upsides

I could potentially be wrong in the competitive strengths of the company, and maybe AudioEye becomes the world leader in web accessibility solutions. In the conference call, management highlights their strong track record of improving efficiency,

The company is in a much stronger position today. We have tripled revenue and dramatically improved operating efficiency. Growth margins have improved to the high 70s and adjusted EBITDA margins have improved by approximately 80 points, to 17% in the fourth quarter. Revenue per employee is approaching $300,000. These efficiency metrics are now on the top tier of SaaS companies.

Should this trend continue it may work out to justify a $12+ share price. They are starting to generate free cash flow, and adjusted EBITDA is heading up at a nice clip. So, in the future free cash flow may catch up dramatically and their technology does seem to be award-winning high tech.

I do think management is very high grade, as they have bought back shares at attractive prices, hold significant insider ownership, and have good track record of making new products that are successful. They have plans of developing accessibility testing which could be exciting as it makes websites “more consistent in issue detection”. Continued emphasis on upgrading service offerings could allow the company to grow big enough to be self sustainable.

Earnings Preview – Q1 2024, 4/23/24

The company has announced that it will reveal Q1 earnings on April 23, 2024. Investors should keep an eye out for the following:

- Revenue increases, adjusted EBITDA, and an increase in customer count. (Guidance for Q1 is supposed to be around $8 million in sales)

- Management’s commentary on new product progress, specifically the Accessibility Testing feature

- Free cash flow figures should continue to grow and remain positive, as management has mentioned before

- Progress on expanding their business in Europe, where “the European Accessibility Act requires businesses in the EU to have accessible websites and mobile apps by June of 2025”

If the company continues to meet their targets and analyst consensus, investors may see shares continue to hold up. But, I believe the expectations are sky high and could potentially set the company up for disappointment. My take is that investors should trim now and secure profits, and if Q1 2024 earnings are a disappointment they can choose to re-enter at more attractive prices. If Q1 2024 turns out to be as expected, I think shares will likely remain flat or slightly up a little. Either way, the stock seems overvalued from a long-term perspective and should be trimmed.

Trim AudioEye

Put simply, I like the company but I don’t like the price. The management seems high grade and products seem good, but at a certain price that valuation becomes too excessive. In the long-term, I believe the market weighs things appropriately, and I expect it to weigh AudioEye at around $8 per share. Thus, overvalued shares should be sold and investors can lock in nice profits.

Read the full article here