The Time to be Greedy is when Others are Fearful

Recent events in the Middle East have caught investors flat-footed over the past weekend and as I write this weekend is off to a rocky start. After an Iranian strike last weekend, Israel is expected to retaliate and seems to be making good on that promise. Passions are running high, which may translate into volatility in the stock market. If the situation escalates, the S&P500 (NYSEARCA:SPY) is likely in the middle of a correction that has not run its course.

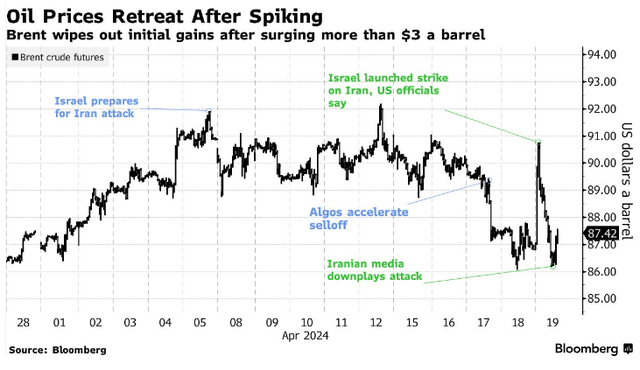

Let’s delve more deeply into our current crisis, before we put it into historical context. There has been an escalation of the Middle Eastern conflict since the beginning of the month, with the recent events having a notable impact on the price of oil, but not to an extent seen in prior historical conflicts in the region. Overall, the price action in oil has been subdued:

bloomberg

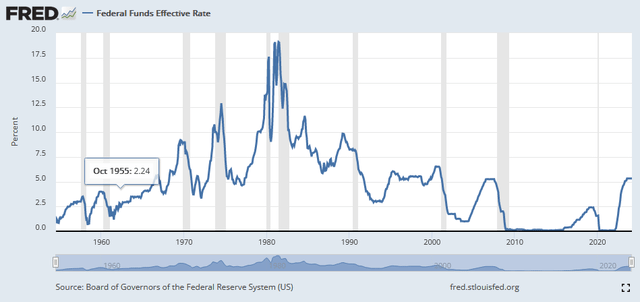

Of course, the price of oil running up would soon cause gas prices to increase: an inflationary pressure. The Fed is still maintaining a ‘wait and see’ approach. After multiple interest rate increases, the current effective Federal Funds rate is 5.33%. The market has been salivating all year at the prospect of interest rates being cut, a prospect that suddenly appears more distant. Traders are now expecting only a few rate cuts (one or two) in the coming year. Should oil continue to climb, it would only heighten pressure for the Fed to keep rates higher for longer, a bearish possibility.

Fed Funds Rate (Board of Governors of the Federal Reserve)

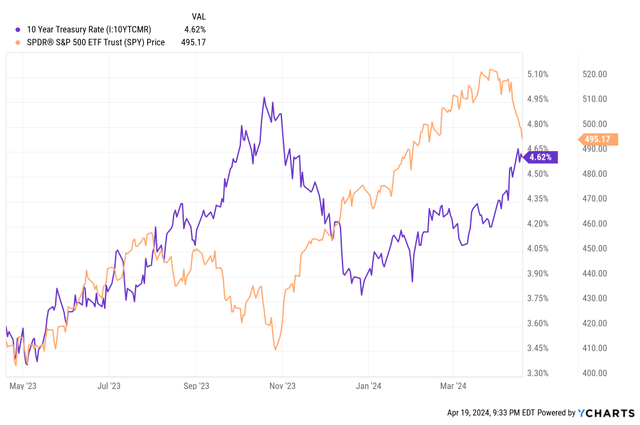

Interestingly, while the stock market has only suffered a 4-5% decline in the S&P 500 (SPY), the bond market has been flashing red. Below is a chart of the 10-Year Treasury yield, which has been trending higher for nearly a month. The stock market has taken a fall, beginning to catch up with the bond market. Bond prices move inversely to yields, thus prices on Treasury bonds have been falling as geopolitical uncertainty is leading to volatility in commodity prices, which will likely worsen if the situation in the Middle East escalates.

10 Year Treasury Rate Vs. S&P 500 Index (YCharts)

The market is clearly in a period of transition. In the short-term the odds of a deeper correction are high, as tensions in the Middle East could immediately spill over into the price of oil, crashing stock and bond prices together. We are seeing the beginning of that as tech stocks sensitive to interest rates are beginning to crash. A market darling, Nvidia (NVDA) fell 10% on Friday alone and nearly 15% this week. While long-term investors will ultimately be rewarded, now is not the time to buy yet.

There is a quote by Warren Buffett: “to be fearful when others are greedy and to be greedy only when others are fearful.” This adage is repeated nearly to the point of hyperbole so what, dear readers, could I possibly add that hasn’t been said one million times before?

Well, there is an historical example of Warren Buffett putting his money where his mouth is:

During the tense period of the Cuban Missile Crisis in October 1962, when the United States and the Soviet Union were on the brink of nuclear war, many investors were selling off their stocks in a panic. In fact, the market briefly was down over 20%, meeting the commonly understood definition of a bear market.

Buffett’s response to the Cuban Missile Crisis is a quintessential example of his investment philosophy: to be brave when others are fearful. In October 1962, as the United States and USSR stood at the brink of nuclear war over the subject of missiles being shipped into Cuba, global financial markets were in a turmoil. Many investors were gripped by fear and began selling stocks. Selling beget selling, leading to a sharp fall in stock prices.

Amid this panic, a 32-year-old Warren Buffett saw a unique opportunity. Believing sharp market corrections to be an opportunity to buy quality stocks at a discount: Warren employed some simple game theory to analyze the problem at hand. His logic: if the worst-case scenario of nuclear war were to occur, then the stock market’s performance would be far from important. On the other hand, if the crisis were to be averted, then the sharp sell-off in stocks might be quickly recovered, and eventually gain substantially in value.

Buffett therefore put his money where his mouth was. He bought stocks, aggressively.

Of course, today we know that the ending to the story was a happy one. The USSR backed down, the missiles were removed from Cuba and the only permanent capital impairment was lost political capital for Nikita Khrushchev. Mr. Buffett, on the other hand, happily realized gains from his timely purchases for many years to come!

Similarly, recent fluctuations in the market have become abrupt (and may become more so). While the S&P 500 was recently making all-time highs, reaching 5,265 intraday only last month, it is (as of this writing) trading at 5050, a discount of 4.1%. This short-term dip in the market does not even rise to the status of a correction, which is usually defined as a greater than 10% short-term drop in the market. However, there are a few stocks that have traded sharply lower and could be reaching attractive prices.

Some stocks on my radar are:

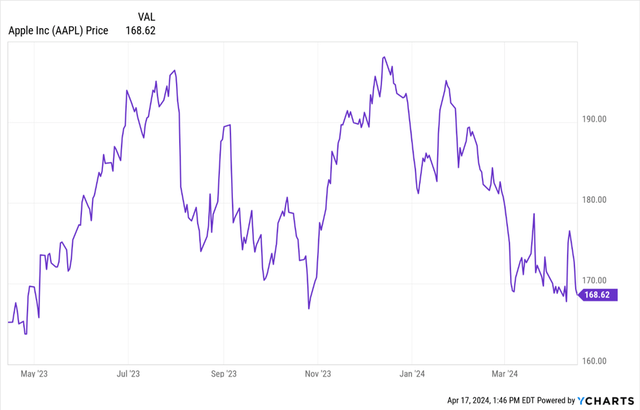

Apple (AAPL): Strong brand loyalty, a reasonable valuation and rock-solid balance sheet, coupled with an approximately 15% pull-back from all-time highs (near 52-week lows) presents a potentially compelling entry point.

Price Return of AAPL Stock (52-weeks) (YCharts)

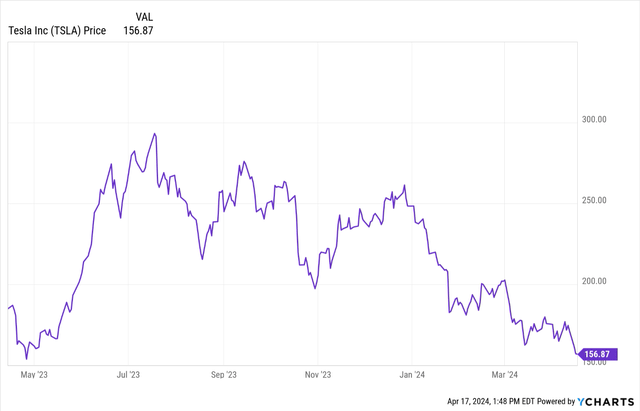

Tesla (TSLA): As a car company Tesla is likely overvalued, but as a play on full self-driving and AI Tesla could be interesting. The stock is volatile and sharply lower and making new 52-week lows the past several days, so proceed with caution.

Price Return of TSLA Stock (52-weeks) (YCharts)

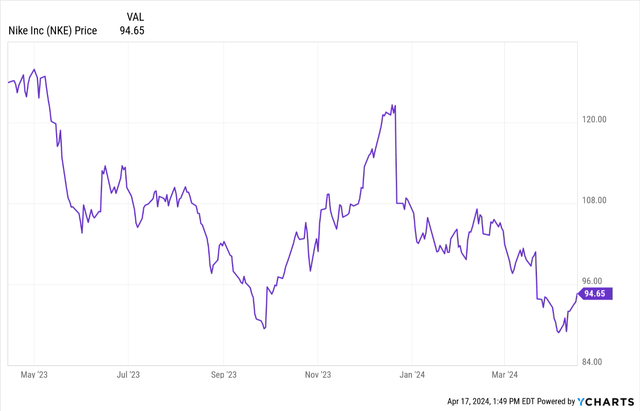

Nike (NKE): Has an amazing brand in apparel and shoes, but recent weakness in its earnings pushed the stock sharply lower. It is a bit of a turnaround story rebounding from 52-week lows but could be interesting if the global economy bounces back. Depending on risk tolerance, it could be a buy around 52-week lows, or a stock for the watchlist to see how attractive the price will become.

Price Return of NKE Stock (52-weeks) (YCharts)

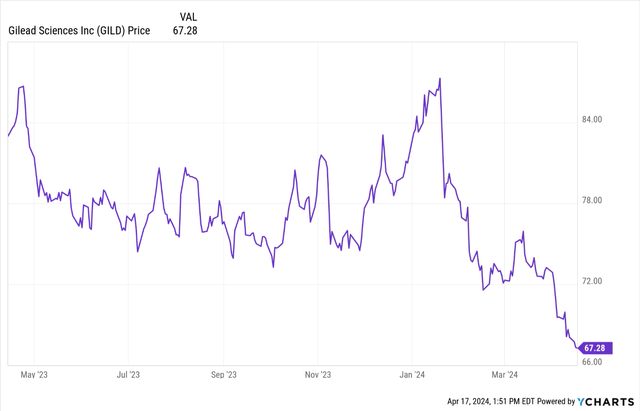

Gilead (GILD): Around last October, the market bid up Gilead’s stock in anticipation of its new CAR-T cancer treatment from the acquisition of Kite. While little has changed, the stock is relentlessly making new 52-week lows. A strong balance sheet, 4.55% dividend yield and growth prospects make Gilead a potentially strong long-term investment.

Price Return of GILD Stock (52-weeks) (YCharts)

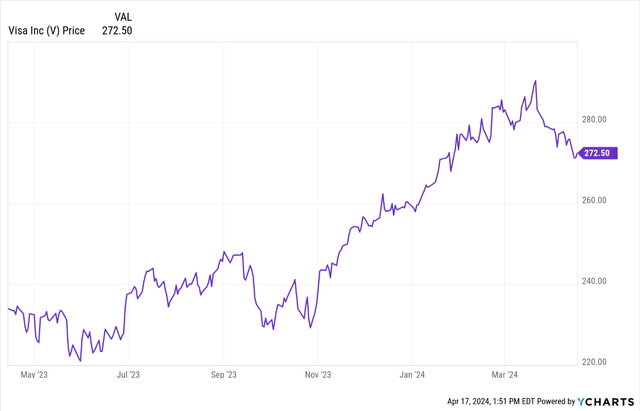

Visa (V): Has an amazing business model facilitating electronic fund transfers through its global payment network. It is a wide-moat company and has not pulled back much during this bull run but is presently about 7% below 52-week highs. If you have less patience for a turn this could be attractive.

Price Return of V Stock (52-weeks) (YCharts)

A deeper discounted cash flow (DCF) analysis is beyond the scope of this article; however, one can be found at the website *Latest Investment Research* – Valuentum Securities Inc. All these stocks are below the mid-point of their DCF valuation. While none are ‘dirt-cheap’, Gilead is probably the cheapest.

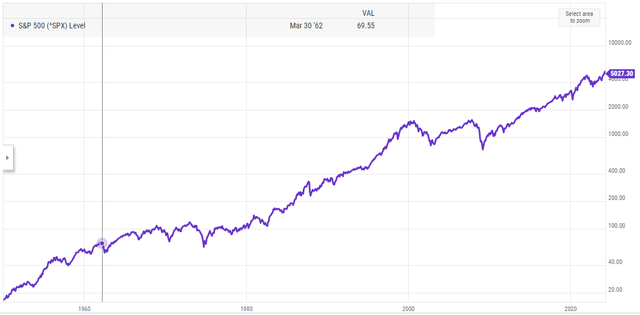

During the Cuban Missile Crisis of October 1962, the S&P 500 fell from then all-time highs of around 69 in Q1 1962, to a low of approximately 56 around October a correction of over 20% that would probably be better described as a brief bear market (these prices are adjusted for inflation – See Chart Below). However, as bad as this seemed at the time, and even though some feared that the world was ending, the market was soon to bounce back! On a logarithmic chart, it is challenging to even identify the Fall of 1962 today (S&P 500 Index – 90 Year Historical Chart).

Inflation Adjusted Price Return of the S&P 500 over 90 Years (Macrotrends)

Similarly, we are in the early stages of what could be a far greater correction. With only a 4.1% pullback, I am not ready to go all-in just yet. In fact, long-term investors should probably expect volatility in the near term.

However, markets move quickly, and your personal decisions could be different or change as conditions evolve. Considering history, we may be presented with a period in which adept investors (like ‘Uncle Warren’) make big money, while us mere mortals hold on for dear life…

Disclaimer: All investment opportunities carry inherent risk, including potential loss of principle. Carefully consider your investment objectives, level of experience and risk appetite before making any investment. The above discussion is an historical framework, not a prediction, and should not be considered investment advice.

Read the full article here