Earnings of Hanmi Financial Corporation (NASDAQ: NASDAQ:HAFC) will likely decline this year on the back of margin contraction. Pressure on asset yields was already visible during the first quarter. I’m expecting the company to report earnings of $2.18 per share for 2024, down 16.8% year-over-year. Compared to my last report on the company, I’ve reduced my earnings estimate as I’ve decreased both my margin and loan growth estimates. The year-end target price suggests a high upside from the current market price. Additionally, Hanmi is offering quite a high dividend yield of over 6%. The company’s valuation shows that the market has overreacted to the prospects of an earnings dip. Based on the total expected return, I’m maintaining a buy rating on Hanmi Financial Corporation.

Loan Growth to Improve From the 1Q Level But Remain Below the Historical Average

Hanmi Financial’s loan portfolio size slipped by 0.1% in the first quarter of 2024 after growing by a strong 4% in the second half of 2023 (8% annualized). Although it missed my expectations, the first quarter’s performance does not worry me as I think Hanmi’s operating conditions remain feasible. There is a good chance that loan growth will turn positive again soon. However, given the first quarter’s performance, there’s a chance that loan growth this year will remain below the five-year compounded annual growth rate of 6.1%.

Although Hanmi serves multi-ethnic communities, it is focused to a large degree on the Korean community in the U.S. Loans to American subsidies of Korean companies make up 14% of the loan portfolio. Further, the company has a Corporate Korea program whereby it tries to attract customers. This initiative is responsible for a large part of the recent growth, as can be gleaned from the first quarter’s conference call.

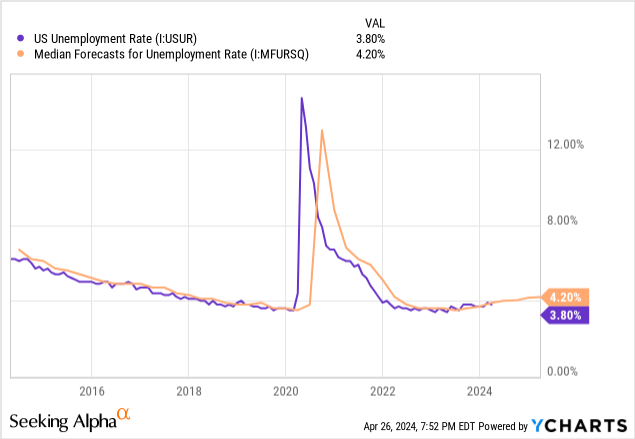

Hanmi Financial operates in California, Texas, Illinois, Virginia, New Jersey, New York, Colorado, Washington, and Georgia. As Hanmi’s markets are quite geographically diverse, it is appropriate to take the national average as a proxy for the company’s various markets. As shown below, professional forecasters estimate that the country’s unemployment rate will continue to remain better this year compared to previous years.

In my last report on the company, I projected loan growth of 4.1% for the year, or 1% every quarter. I’ve decided to keep my growth expectations unchanged for the last three quarters of 2024. As the loan growth missed my expectations for the first quarter, I’m reducing my full-year loan growth to 3.0% in 2024. Further, I’m expecting deposits to grow in line with loans. The following table shows my balance sheet estimates.

| Financial Position | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E |

| Net Loans | 4,549 | 4,790 | 5,079 | 5,896 | 6,113 | 6,295 |

| Growth of Net Loans | (0.4)% | 5.3% | 6.0% | 16.1% | 3.7% | 3.0% |

| Other Earning Assets | 657 | 762 | 924 | 862 | 878 | 896 |

| Deposits | 4,699 | 5,275 | 5,786 | 6,168 | 6,281 | 6,569 |

| Borrowings and Sub-Debt | 208 | 269 | 353 | 479 | 455 | 310 |

| Common Equity | 563 | 577 | 643 | 638 | 702 | 731 |

| Book Value Per Share ($) | 18.3 | 19.1 | 21.1 | 21.0 | 23.1 | 24.3 |

| Tangible BVPS ($) | 17.9 | 18.7 | 20.7 | 20.6 | 22.8 | 23.9 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Changing the Margin Estimate After the First Quarter’s Disappointing Performance

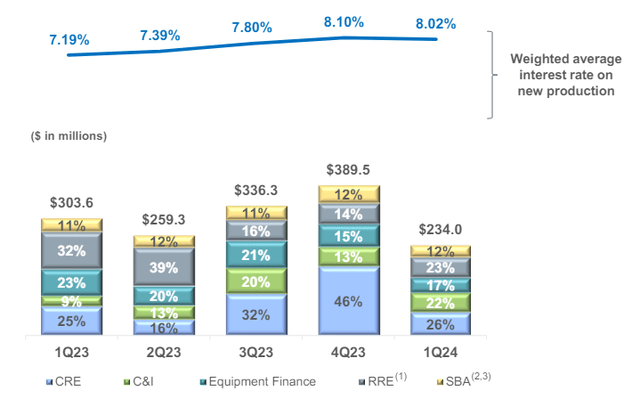

The net interest margin declined by 14 basis points in the first quarter of 2024, which was worse than my expectations given in my last report on the company. Even though the Fed funds rate hasn’t been cut yet, the company was already originating loans at lower rates during the first quarter, as shown in the earnings presentation and copied below.

1Q 2024 Earnings Presentation

This means that the pressure on the average asset yield has already started to build. I’m anticipating 50-75 basis points Fed funds rate cuts in the year ahead, which should add to the pressure on the yields. As mentioned in the earnings presentation, a sizable 28% of the loan portfolio reprices within 1-3 months.

Overall, I’m expecting the net interest margin to decline by six basis points in the last nine months of 2024. This is worse than my previous expectation given in my last report because of the first quarter’s disappointing performance, which has shown me that I previously overestimated the management’s capability to keep yields high.

Reducing the Earnings Estimate

As I have reduced both the loan growth and margin estimate for this year, my earnings estimate is now lower than before. Other assumptions I’ve used to arrive at my earnings estimate are given below.

- I’m expecting the provisions-expense/average-loan ratio to remain close to last year’s level in 2024.

- I’m expecting the non-interest income growth to be low in order to be on the conservative side.

- I’m expecting the non-interest expenses to grow by 5% in 2024, which is in line with the average for the last three years.

Previously, I was expecting the company to report earnings of $2.32 per share for 2024. My updated assumptions now lead to an earnings estimate of $2.18 per share. The following table shows my income statement estimates.

| Income Statement | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E |

| Net interest income | 176 | 181 | 195 | 238 | 221 | 203 |

| Provision for loan losses | 30 | 45 | (24) | 1 | 4 | 3 |

| Non-interest income | 28 | 43 | 40 | 34 | 34 | 35 |

| Non-interest expense | 126 | 119 | 124 | 130 | 137 | 144 |

| Net income – Common Sh. | 33 | 42 | 98 | 101 | 80 | 66 |

| EPS – Diluted ($) | 1.06 | 1.39 | 3.22 | 3.32 | 2.62 | 2.18 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Risks are Moderately High

Due to the following two factors, I think Hanmi Financial’s risk level is moderately high.

- Exposure to office loans is a big risk factor for Hanmi Financial as office building loans made up a sizable 9% of total loans at the end of March 2024, according to details given in the presentation. The work-from-home culture can hurt the debt-servicing capability of office loan borrowers.

- Net unrealized losses on the Available-for-Sale securities portfolio totaled $106 million at the end of March 2024, as mentioned in the presentation. This is a material 15% of the total equity book value.

The liability side isn’t as risky. At the end of March 2024, uninsured deposits totaled ~ $2,550 million or 40% of the total deposit liabilities, as mentioned in the presentation. However, the bank’s total liquidity amounted to $2,541 million, which almost covers the uninsured deposits.

HAFC is Offering an Attractive Dividend Yield of 6.3%

The highlight of the HAFC stock is its attractive dividend yield. The company is offering a dividend yield of 6.3% at the current quarterly dividend rate of $0.25 per share. Despite the earnings outlook, I think the dividend payout is safe due to the following reasons.

- The earnings and dividend estimates suggest a payout ratio of 46% for 2024, which is close to the five-year average of 42%.

- The company’s capital is more than sufficient. The total risk-based capital ratio stood at 15.20% at the end of March, as opposed to the minimum regulatory requirement of 10.50%. Therefore, there is barely any threat of a dividend cut from regulatory requirements.

Maintaining a Buy Rating

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Hanmi Financial. The stock has traded at an average P/TB ratio of 0.88 in the past, as shown below.

| FY20 | FY21 | FY22 | FY23 | Average | ||

| T. Book Value per Share ($) | 18.7 | 20.7 | 20.6 | 22.8 | ||

| Average Market Price ($) | 11.2 | 19.4 | 24.7 | 18.2 | ||

| Historical P/TB | 0.60x | 0.94x | 1.20x | 0.80x | 0.88x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $23.9 gives a target price of $21.1 for the end of 2024. This price target implies a 33.6% upside from the April 26 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.68x | 0.78x | 0.88x | 0.98x | 1.08x |

| TBVPS – Dec 2024 ($) | 23.9 | 23.9 | 23.9 | 23.9 | 23.9 |

| Target Price | 16.4 | 18.7 | 21.1 | 23.5 | 25.9 |

| Market Price | 15.8 | 15.8 | 15.8 | 15.8 | 15.8 |

| Upside/(Downside) | 3.4% | 18.5% | 33.6% | 48.7% | 63.8% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 7.1x in the past, as shown below.

| FY20 | FY21 | FY22 | FY23 | Average | ||

| Earnings per Share ($) | 1.39 | 3.22 | 3.32 | 2.62 | ||

| Average Market Price ($) | 11.2 | 19.4 | 24.7 | 18.2 | ||

| Historical P/E | 8.1x | 6.0x | 7.5x | 6.9x | 7.1x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.18 gives a target price of $15.5 for the end of 2024. This price target implies a 1.8% downside from the April 26 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 5.1x | 6.1x | 7.1x | 8.1x | 9.1x |

| EPS 2024 ($) | 2.18 | 2.18 | 2.18 | 2.18 | 2.18 |

| Target Price ($) | 11.2 | 13.3 | 15.5 | 17.7 | 19.9 |

| Market Price ($) | 15.8 | 15.8 | 15.8 | 15.8 | 15.8 |

| Upside/(Downside) | (29.4)% | (15.6)% | (1.8)% | 11.9% | 25.7% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $18.3, which implies a 15.9% upside from the current market price. The large upside shows that the market is undervaluing Hanmi Financial, probably because of the negative earnings outlook. Adding the forward dividend yield to the upside gives a total expected return of 22.2%.

In my last report, I adopted a buy rating with a December 2024 target price of $18.9. As I have reduced my earnings estimate, my December 2024 target price is now lower than before. Nevertheless, both the price upside and the dividend yield are still quite high. Based on the updated total expected return, I’m maintaining a buy rating on Hanmi Financial Corporation.

Read the full article here