Investing Environment

US equity markets reached new all-time highs in Q1 supported by a resilient US economy, a general trend of disinflation and an acceleration in corporate profits growth. Given mostly benign economic data offering little indication that a recession is near, interest rate markets pared back the number of expected Federal Reserve rate cuts in 2024. The S&P 500® Index (SP500, SPX) rose 10.56%, continuing the strong rally that began in late October of last year. There was broad-based strength across sectors. Communication services, financials, energy, industrials and technology stocks were each up double-digit percentages. Higher yielding sectors (real estate, utilities and consumer staples) trailed.

The market’s move higher has been an unusually smooth one. In Q1, the S&P 500® Index experienced only three down days of one percent or greater. Over the five-year period from 2019 to 2023, the average quarter had nine such days. There are plenty of risks that could upset the apple cart, whether geopolitical or macroeconomic. The ongoing conflicts in the Middle East and Ukraine continue to rage, and inflation—though trending lower—remains above the Federal Reserve’s 2% target. Markets during the first three months of the year showed relatively little concern, however. Earnings—the bedrock of business values—are growing soundly once again, and the recession that many predicted would have started by now has yet to emerge. However, volatility has picked up in April as we write this letter.

Performance Discussion

In Q1, the portfolio performed in line with our total return expectations—delivering a strong total return comprised of premium income (a portfolio current yield that is greater than or equal to 2X the average current yield for stocks in the S&P 500® Index) and solid capital appreciation. Our Core Value, Dividend Recovery and Dividend Growth holdings drove our overall return as bond proxies and fixed income securities trailed the broad equity market.

Our top contributors were nVent Electric (NVT), Corebridge Financial (CRBG) and Lamar Advertising (LAMR). nVent Electric provides electrical connections and protection solutions. These are mission-critical elements in commercial electrical and mechanical systems and civil infrastructure. nVent has shown consistent and steady growth since the pandemic, having reported 12 consecutive quarters of year-over-year sales growth supported by the secular tailwinds of electrification, sustainability and digitalization. Growth has come from a combination of volumes and pricing, with the company successfully offsetting inflation with pricing. Due to the low cost of its products relative to a project and high failure costs for customers, nVent has good pricing power and sustainable margins. In the recent quarter, the company’s data centers business (~14% of sales) was a standout, growing 20% year over year, as the acceleration in artificial intelligence infrastructure investments has created increased demand for the company’s liquid cooling solutions. Though nVent is no longer selling as cheaply as when it first drew our interest, the stock still sells at a lower P/E multiple than the S&P 500® Index despite better earnings growth.

Corebridge, a life insurance and retirement solutions company, was previously a unit of AIG and a September 2022 IPO. AIG still owns ~51% of the company following its recent secondary sale in November 2023, equaling 9.1% of shares outstanding. Since adding Corebridge to the portfolio in Q1 2023, it’s been among our top performers as the “higher for longer” interest rate environment has driven an increase in spread income. Our investment thesis has been that Corebridge would benefit from the current interest rate environment following ZIRP (zero interest rate policy) and would also have plenty of room to improve its competitive position and wring out efficiencies to improve ROE now that it is a standalone entity that is no longer part of a large inefficient and capital-constrained parent. Even after recent stock price gains, Corebridge yields 3.2% on its dividend, with a double-digit free cash flow yield. In addition to Corebridge’s regular dividend, the company paid two special dividends in 2023 totaling $1.78, which is 7.6% on the March quarterending stock price. Besides dividends, we expect free cash flow will be used to ensure holding company liquidity, retire diluted shares and support modest growth expectations.

Lamar Advertising—our largest position—operates outdoor advertising structures such as billboards, digital billboards and transit ads. Results have been relatively steady, with strength in local/regional sales lifting the top line, while margin improvement drove better-than-expected earnings growth. In addition to returning cash to shareholders (the dividend yields 4.7%), management is focused on delevering the balance sheet given limited M&A opportunities. While the company’s growth can ebb and flow, over the long term, the company has experienced average annualized organic growth in the high single digits, supplemented by small tuckin acquisitions. With a record of consistently generating free cash flow and prudent capital allocation that includes high return of capital to shareholders, this stock fits our process.

Our bottom contributors were Cable One (CABO), Philips (PHG) and Universal Health Realty Income Trust (UHT). Cable One, a small cable company operating in rural US markets, was our biggest detractor in Q1. Shares have remained weak due to concerns about competition from wireless providers and depressed subscriber growth, driven in part by fewer residential moves in a frozen US housing market. Broadband subscriber additions picked up in the latest quarter, but increased promotions and discounting reduced average revenue per subscriber, and an end to the ACP (Affordable Connectivity Program) accepting new enrollees creates an additional headwind to growing subscribers. While wireless companies are entering new markets, 5G is not currently competitive with cable’s download speeds, and based on the physics of wireless data delivery, 5G is unlikely to be competitive with cable for many years, if ever. Cable continues to have a competitive advantage with respect to network speeds, reliability and capital intensity. Despite recent growth challenges, free cash flow conversion remains solid, and the valuation is highly attractive, having a free cash flow yield of ~12% and selling below our estimate of 8X normalized earnings. We like the cable business in general due to its high recurring revenue, pricing power and healthy operating leverage.

Since Philips, a health care technology company, initiated a voluntary recall of its first-generation CPAP machine more than two years ago, investors have shunned the stock due to the uncertainty related to potential litigation liabilities. That has left the stock extremely undervalued. In January, Philips agreed with the US government on a proposed consent decree providing a roadmap of required actions and prohibitions—a process likely to take three years to conclude. As part of the consent decree, Philips is prohibited from selling CPAP or BiPAP sleep devices in the US. However, Philips may still service sleep and respiratory care devices already with health care provider and patients and may continue to sell other products in the US. Further, it does not impact the company’s sales outside the US. The overall terms are as expected, and there is now a path forward for Philips to eventually return to the market. We appreciate that until there is greater clarity on the total settlement cost, the stock may remain under pressure, but at the current asking price, shares sell at a significant discount to our estimates of intrinsic value.

Universal Realty Income Trust (UHT) is a health care REIT (real estate investment trust) specializing in health care facilities, including acute care hospitals, behavioral health centers and medical office buildings. Our initial purchase was in June 2023. Like other high income producing stocks, UHT has been out of favor given higher interest rates. Besides the stock selling at low levels relative to its historical valuation and other REITs, we liked UHT’s track record of execution, low leverage, reduced cyclicality and consistent annual dividend growth. It currently yields nearly 8%. Recent results have been strong, with revenue growth up over 5% driven by annual lease price escalators, a better mix of assets, increased occupancy and M&A. However, UHT was down in Q1 along with the broader real estate sector as interest-rate sensitive areas badly lagged the rest of the market.

Portfolio Activity

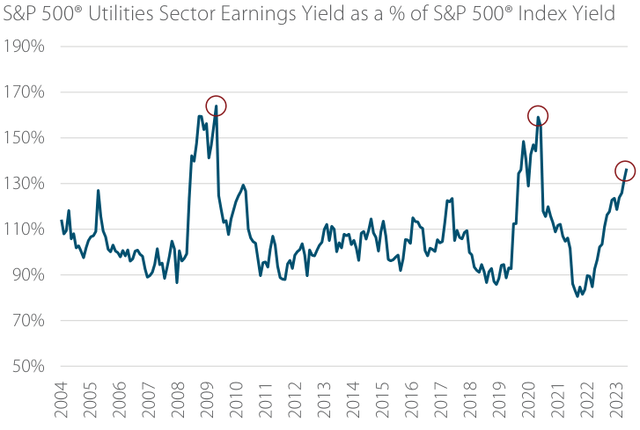

In Q1, we added two utilities to the portfolio: Alliant Energy (LNT) and Evergy (EVRG). Alliant Energy is a US-regulated electricity and natural gas utility operating in the Midwest. Evergy is a Kansas-based, fully integrated, fully electric utility. As the sector has lagged significantly over the past year, leading to an above-average earnings yield relative to the broader market (Exhibit 1), we’re finding more opportunity.

Exhibit 1: Utilities Sector: Mispriced Yield

Source: Artisan Partners/FactSet. As of 31 Mar 2024. Past performance does not guarantee and is not a reliable indicator of future results.

As a group, utilities have been out of favor for a few reasons. The interest rate environment has made bonds more appealing, and higher inflation has increased labor, equipment and commodities costs while also raising utilities’ costs of capital. Utility companies can pass on a lot of their costs to customers; however, rates are regulated, and regulators have strived to limit the rise in customers’ utility bills, which have already experienced large increases in the post-COVID inflationary period. Consequently, utilities haven’t been able to increase their ROEs as recent rates cases have gone against them.

Alliant Energy serves approximately 995,000 electric and 425,000 natural gas customers through two public utility subsidiaries, Interstate Power and Light (operates in Iowa) and Wisconsin Power and Light. Despite little change in the company’s regulatory or operating environments, the stock has retrenched over the past year, and it now trades for about 16X P/E compared to an average of 18X over the past 10 years and has a 3.6% dividend yield. The company continues to invest in rate base, and a positive outcome on its current rate case in September could give it a boost.

Evergy serves more than 1.7 million customers in Kansas and Missouri. In addition to the aforementioned dynamics weighing on utilities share prices, Evergy had two key rate cases in 2023, one in Kansas and the other in Missouri, that presented risk for investors. The Missouri case went better than expected, but the returns allowed by the Kansas regulator were punishingly low. Though Evergy operates in a subpar regulatory environment, the utility is a good operator, with strong customer satisfaction scores, below-average capex needs and a clean balance sheet. The regulatory environment may improve at some point, but even if it does not, Evergy trades for just 13X 2024 earnings, which is below average relative to its history and peers— and pays a dividend yielding 4.7%.

We also added Ryanair Holdings (RYAAY), an Ireland-based low-cost airline focused on the European market. The airline’s low-cost, high on-time, high-efficiency model has helped it to take share from inefficient legacy and state-sponsored carriers over the past 20 years. Ryanair keeps a net cash balance sheet to opportunistically purchase aircraft countercyclically when it can do so at cheaper prices. Additionally, the company’s economics are favorable. It has pricing power due to industry consolidation, capacity growth that is below demand growth and a lack of overlap on key routes. This leads to strong returns on equity and margins. Ryanair recently initiated its first dividend policy, and we estimate the dividend could yield 2%–3%. In addition to the dividend, Ryanair is expected to repurchase stock. Over the last decade, the company has retired 20% of its share count. This is remarkable considering it was a growth-focused airline and still had net cash after a pandemic. The stock sells at an attractive low-doubledigit P/E, but we do not need multiple expansion for this investment to contribute well to our portfolio income and capital appreciation objectives. We believe simply continued execution of the business should lead to solid returns.

Perspective

With market-cap weighted indices hitting new highs and the S&P 500® Index selling for 23X (FY1) earnings, value-conscious investors—a group in which we proudly admit to being members—may feel some trepidation regarding forward return expectations for the asset class. However, we believe it would be a mistake to focus solely on the S&P 500® Index, which has become increasingly concentrated among a few mega-cap stocks, and in our view, no longer represents the diverse opportunity set that exists within our value investment universe. As we’ve noted in prior letters and on our blog Artisancanvas.com, value is historically cheap. Aside from the pandemic years of 2020 to 2021, large-cap value hasn’t been this cheap relative to large-cap growth since the aftermath of the tech bubble. The Russell 1000® Value Index trades for 16.5X FY1 estimated earnings. The Russell 1000® Growth Index trades at 28.8X FY1 estimates. The average and median valuation spreads between these indices have been 7.8 and 6.1 percentage points over the past 26 years. Today, it’s 12.2 percentage points. We don’t know if the valuation premium for growth stocks will revert in a year or over the next 10, but we do know that the current spread positions value stocks favorably from here.

|

Carefully consider the Fund’s investment objective, risks and charges and expenses. This and other important information is contained in the Fund’s prospectus and summary prospectus, which can be obtained by calling 800.344.1770. Read carefully before investing. Current and future portfolio holdings are subject to risk. The value of portfolio securities selected by the investment team may rise or fall in response to company, market, economic, political, regulatory or other news, at times greater than the market or benchmark index. A portfolio’s environmental, social and governance (“ESG”) considerations may limit the investment opportunities available and, as a result, the portfolio may forgo certain investment opportunities and underperform portfolios that do not consider ESG factors. There is no guarantee that the companies in which the portfolio invests will declare dividends in the future or that dividends, if declared, will remain at current levels or increase over time. The equity, fixed income and derivative security types referenced each contain inherent risks, including the risk of loss like all investments, and capital appreciation and income is not guaranteed. International investments involve special risks, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging and less developed markets, including frontier markets. Value securities may underperform other asset types during a given period. Securities of small- and medium-sized companies tend to have a shorter history of operations, be more volatile and less liquid and may have underperformed securities of large companies during some periods. S&P 500® Index measures the performance of 500 US companies focused on the large-cap sector of the market. Russell 1000® Growth Index measures the performance of US large-cap companies with higher price/book ratios and forecasted growth values. Russell 1000® Value Index measures the performance of US large-cap companies with lower price/book ratios and forecasted growth values. The Dow Jones US Select Dividend Index measures the performance of the US’s leading stocks by dividend yield. The index(es) are unmanaged; include net reinvested dividends; do not reflect fees or expenses; and are not available for direct investment. This summary represents the views of the portfolio managers as of 31 Mar 2024. Those views may change, and the Fund disclaims any obligation to advise investors of such changes. For the purpose of determining the Fund’s holdings, securities of the same issuer are aggregated to determine the weight in the Fund. The holdings mentioned above comprise the following percentages of the Fund’s total net assets as of 31 Mar 2024: nVent Electric PLC 2.1%, Corebridge Financial Inc 1.8%, Lamar Advertising Co 3.7%, Cable One Inc 3.4%, Koninklijke Philips NV 1.1%, Universal Health Realty Income Trust 1.3%, Alliant Energy Corp 1.7%, Evergy Inc 1.5%, Ryanair Holdings PLC 1.5%. Securities named in the Commentary, but not listed here are not held in the Fund as of the date of this report. Portfolio holdings are subject to change without notice and are not intended as recommendations of individual securities. All information in this report, unless otherwise indicated, includes all classes of shares (except performance and expense ratio information) and is as of the date shown in the upper right hand corner. This material does not constitute investment advice. Portfolio security yields are subject to market conditions and are not guaranteed. The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (MSCI) and Standard & Poor’s Financial Services, LLC (S&P). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages. The S&P 500® and Dow Jones US Select Dividend (“Indices”) are products of S&P Dow Jones Indices LLC (“S&P DJI”) and/or its affiliates and has been licensed for use. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, Inc. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). None of S&P DJI, Dow Jones, their affiliates or third party licensors makes any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. Attribution is used to evaluate the investment management decisions which affected the portfolio’s performance when compared to a benchmark index. Attribution is not exact, but should be considered an approximation of the relative contribution of each of the factors considered. Portfolio holdings are classified into five income categories: Core Value, Dividend Recovery, Dividend Growth, Bond Proxy and Capital Structure. Core Value holdings are investments consistent with the team’s value investing approach that also have an income component. Dividend Recovery holdings are investments where the current yield does not reflect the future payout. Dividend Growth holdings are investments where the dividend payout is expected to grow over a multiyear period. Bond Proxy holdings are investments in businesses which are less economically sensitive and have steady dividend polices. Capital Structure holdings are instruments that comprise non-equity parts of the capital structure (e.g., preferred securities, convertibles and bonds). This material is provided for informational purposes without regard to your particular investment needs and shall not be construed as investment or tax advice on which you may rely for your investment decisions. Investors should consult their financial and tax adviser before making investments in order to determine the appropriateness of any investment product discussed herein. Free Cash Flow is a measure of financial performance calculated as operating cash flow minus capital expenditures. Free Cash Flow Yield is an overall return evaluation ratio of a stock, which standardizes the free cash flow per share a company is expected to earn against its market price per share. The ratio is calculated by taking the free cash flow per share divided by the share price. Price-to-Earnings (P/E) is a valuation ratio of a company’s current share price compared to its per-share earnings. Dividend Yield is a financial ratio that shows how much a company pays out in dividends each year relative to its share price. Normalized Earnings are earnings that are adjusted for the cyclical ups and downs over a business cycle. Earnings Yield (which is the inverse of the P/E ratio) is the company’s per-share earnings divided by its current share price. Spread is the difference in yield between two bonds of similar maturity but different credit quality. Artisan Partners Funds offered through Artisan Partners Distributors LLC (APDLLC), member FINRA. APDLLC is a wholly owned broker/dealer subsidiary of Artisan Partners Holdings LP. Artisan Partners Limited Partnership, an investment advisory firm and adviser to Artisan Partners Funds, is wholly owned by Artisan Partners Holdings LP. © 2024 Artisan Partners. All rights reserved. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here