Note:

I have previously covered Seanergy Maritime Holdings Corp. (NASDAQ:NASDAQ:SHIP), so investors should view this article as an update to my previous work on the company.

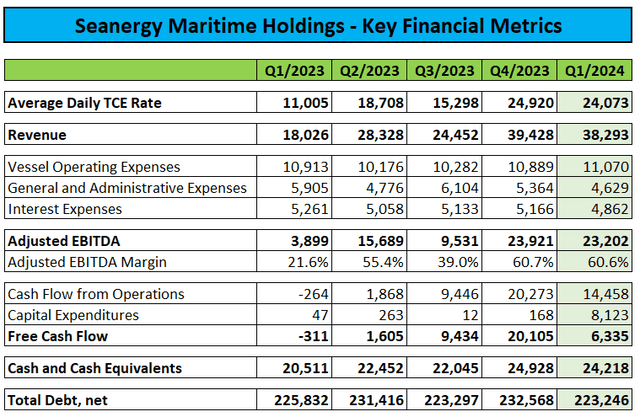

Last week, leading dry bulk shipper Seanergy Maritime Holdings (“Seanergy” or “Seanergy Maritime”) reported Q1/2024 results well above consensus expectations as charter rates remained firm throughout the historically weak first quarter, as also outlined by management in the press release:

(…) contrary to regular seasonality, the first quarter of 2024 was the strongest of the past decade for Capesize earnings. Brazilian iron ore exports rose about 12% year on year and were the highest since 2019, while coal seaborne trade remained at very high levels. The limited vessel orderbook of the past years seems to be contributing to a gradually improving supply and demand balance, while the geopolitical uncertainty related to the Red Sea crisis has also been marginally constructive for Capesize earnings.

Company Press Releases

Seanergy Maritime generated $14.5 million in cash flow from operations and ended the quarter with $24.2 million in cash and $223.2 million in debt (net of deferred financing costs).

The company declared an aggregate cash dividend of $0.15 per share for Q1:

Continuing its quarterly dividend payments, the Company has declared a quarterly cash dividend of $0.025 per common share for the first quarter of 2024 payable on or about July 10, 2024 to all shareholders of record as of June 25, 2024. In addition, the Company has declared a special dividend of $0.125 per common share to all shareholders of record as of June 25, 2024 which will be paid on or about July 10, 2024.

However, the increased payout comes at the expense of additional dilution for common shareholders. Since the beginning of the year, Seanergy Maritime has sold approximately 0.6 million new common shares into the open market for gross proceeds of $5.1 million.

On the flip side, the company also repurchased 0.1 million shares for an aggregate purchase price of $0.8 million.

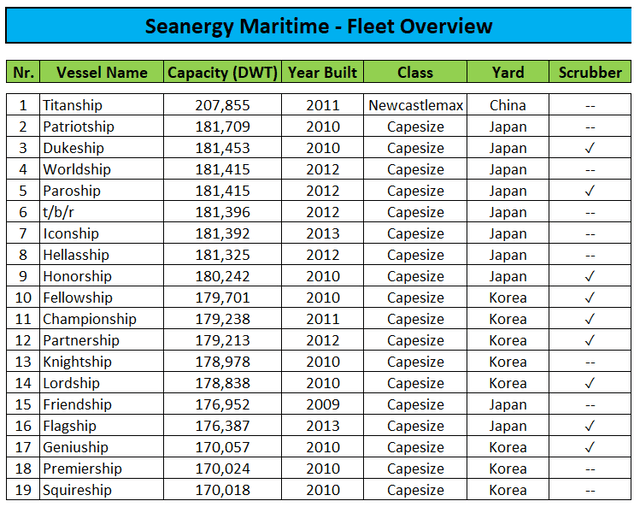

Seanergy Maritime continues to expand its fleet with two additional Capesize carrier purchases so far in 2024, as outlined in the company’s annual report on form 20-F:

On February 5, 2024, we agreed to acquire a 181,392 dwt Capesize bulk carrier, built in 2013 in Japan, which will be renamed M/V Iconship. The purchase price of $33.7 million is expected to be funded through a combination of cash on hand and debt financing. The M/V Iconship is expected to be delivered between April and June 2024. (…)

On March 18, 2024, we agreed to acquire a 181,396 dwt Capesize bulk carrier, built in 2012 in Japan. The purchase price of $35.6 million is expected to be funded through a combination of cash on hand and debt financing. The vessel is expected to be delivered between July and October 2024.

As a result, the company’s fleet will increase to 19 vessels with an estimated market value of approximately $640 million:

Company Press Release

Seanergy Maritime also provided preliminary time charter equivalent (“TCE”) guidance for Q2:

With regard to our guidance for the second quarter of 2024, based on current FFA levels, we expect our daily TCE to be equal to approximately $26,400, likely outperforming the Capesize market thanks to our proactive hedging strategy. Looking beyond that, for the second half of the year we have converted about 33% of our ownership days to a fixed daily rate of approximately $30,000.

Based on the outlook, I would expect the company’s Q2 results to again outperform consensus expectations and Adjusted EBITDA to approximate $25 million without assuming any material benefit from the upcoming delivery of the Iconship.

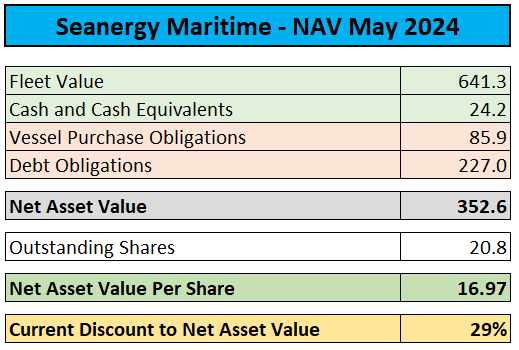

Following the recent rally to new multi-year highs, Seanergy Maritime’s discount to estimated net asset value (“NAV”) has narrowed further:

Value Investor’s Edge / Company Press Releases / Regulatory Filings

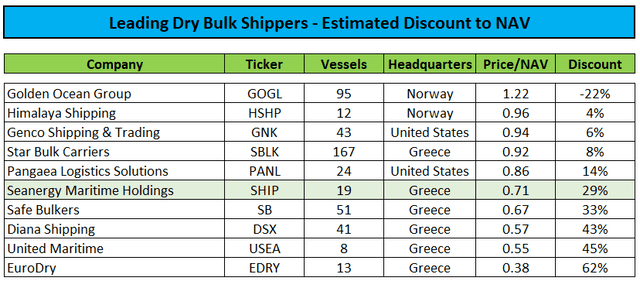

With the exception of market leader Star Bulk Carriers (SBLK), Seanergy Maritime now carries the lowest NAV discount of its Greece-based peers:

Value Investor’s Edge

While the company should continue to do well in the current market environment, I am struggling with management’s approach of selling hew shares into the open market at a still material discount to estimated net asset value.

But with Seanergy Maritime’s valuation at multi-year highs, management’s desire to take advantage of the ongoing rally in the company’s shares is somewhat understandable.

However, cheaper peers like Safe Bulkers (SB) and EuroDry (EDRY) have exhibited considerably better corporate governance in recent years but both are mostly or even exclusively focused on the mid-sized vessel classes while Seanergy Maritime is more or less a Capesize pure play.

At current levels, I wouldn’t chase the company’s shares and rather wait for a pullback.

Consequently, I am downgrading the stock from “Buy” to “Hold“.

Bottom Line

Seanergy Maritime Holdings reported Q1/2024 results above expectations and based on the company’s preliminary Q2 TCE guidance, I would expect the second quarter results to outperform consensus estimates again.

In addition, with 1/3 of available days for the second half already fixed at a TCE rate of $30,000 per share, 2024 should be a strong year for Seanergy Maritime.

The company also increased its quarterly dividend but disappointingly raised the required funds from selling new shares into the open market well below net asset value.

While shares are still trading at a material discount to NAV, a number of Greece-based peers like Safe Bulkers and EuroDry are now offering superior value amid better corporate governance.

Consequently, I am downgrading my rating from “Buy” to “Hold“.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here