Investment Thesis

2024 is said to be the Year of the Dragon. In Chinese culture, the dragon is a highly auspicious symbol, revered, and known to be a symbol of fortune.

After years of lagging global markets, I believe 2024 could be the year the Dragon in the Chinese economy awakes, as I take the cue from a series of steps the Chinese government has been taking to reinvigorate the sagging Chinese economy and its financial markets. At the same time, the Chinese economy is also taking steps to arrest the depressed sentiment surrounding its history of policies and decision-making. Depressed sentiment combined with an improving outlook provides the potent recipe of the contrarian trade, in my view.

In terms of exposure to the Chinese economy, I believe the KraneShares CSI China Internet ETF (NYSEARCA:KWEB) is best suited to provide that exposure. In addition to my contrarian outlook on the overall economy, China’s e-commerce industry is expected to post its first year of growth. This makes KWEB a likely potential candidate to benefit from this trade in 2024, the year of the Dragon.

For reasons that I have mentioned below, I rate KWEB as a Buy.

About the KraneShares CSI China Internet Fund

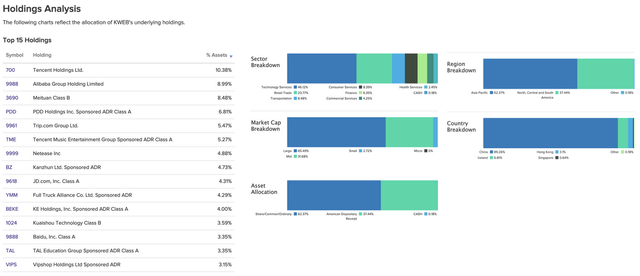

The KWEB fund’s assets are owned and managed by NYC-based asset management firm KraneShares. The fund offers access to Chinese internet companies that usually operate within the e-commerce space in Chinese markets or on a global scale. As seen in Exhibit A below, the fund invests its assets in a broad range of Chinese e-commerce and technology companies that are either listed in Chinese markets or listed in U.S. markets via ADRs (American Depository Receipts).

According to the fund’s prospectus, KWEB achieves its objective by tracking the CSI Overseas China Internet Index, which is “free float market capitalization weighted and includes publicly traded securities on either the Hong Kong Stock Exchange, NASDAQ Stock Market, or New York Stock Exchange.”

Here is a chart that shows the Top 15 Holdings vs. the Constitution of KWEB’s Funds by categories.

Exhibit A: KWEB’s Top 15 Holdings, plus holdings by sector (etfdb)

Peer comparison

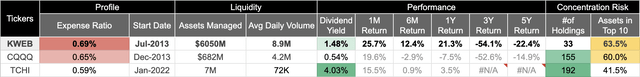

While analyzing KWEB, I also looked at some of its peers. I was focused on solely investing in the technology and e-commerce space, so I looked at only those peers that would compete with KWEB on a sectoral basis. I have added my peer analysis below in Exhibit B.

Exhibit B: KWEB’s fund metrics vs its peers (SA)

With over $6 billion in assets, KWEB is the largest fund of the lot that deploys its assets towards the Chinese e-commerce and technology space. I prefer larger funds because investing in some EM (Emerging Markets) economies involves some level of risk that I will outline in a later section and larger funds. Larger funds like KWEB provide a higher level of relative liquidity, as can be seen in Exhibit B, with over 8 million shares exchanging hands on a daily basis.

KWEB offers dividends, currently yielding 1.48% on an annual basis. This is far below one of its peers, as seen in Exhibit B, but I am not looking to hold KWEB for a long-term period. My horizon is short to mid-term because I can see from their past performance that KWEB, its peers, and larger Chinese-focused EM ETFs have delivered lumpy returns over the past years.

Also, KWEB may not be the most diversified fund of the lot, but that has not held the fund back from outperforming its peers on a relative basis, as seen in Exhibit B.

Outlook and Valuation: Softening policies, growing economy, appealing valuation, amid risks

Risks

I must note that the sentiment around Chinese stocks has been depressed given the number of events that have unfolded in the post-pandemic era. Rising trade tensions globally and a range of increasingly investor-unfriendly policies combined with a fragile property market in China have led to investors pulling their funds out of the country.

A strong U.S. dollar and one of the sharpest increases in interest rates by the U.S. Fed have further dented the outlook in all these years. This has created a clouded outlook on the Chinese economy, as market participants may believe that these risks could persist. This was also noted by the survey results published in this Bloomberg note:

Shorting China stocks is one of the most crowded trades, the survey showed, with only long US dollar and the “Magnificent Seven” of US tech stocks seen as more popular.

Outlook

However, I believe this could create the perfect situation for Chinese stocks to now be a contrarian trade as shorting Chinese stocks becomes a crowded trade.

Another note from J.P. Morgan analyzes some of the reasons for the depressed sentiment on a historical basis, but at the same time also notes that “policy action is becoming more assertive.”

In February this year, in a surprise move, the PBoC (People’s Bank of China) cut loan prime rates by 25 bp to 3.95%. Around the same time, Bloomberg also reported that China’s so-called ‘National Team’ corporations, like China Securities Finance Corp. or Central Huijin Investment, had reportedly invested ~$57 billion in onshore shares. According to the note:

More than 75% of the inflows went into products tracking the benchmark CSI 300 Index, while another 13% flowed to those mirroring the CSI 500 Index, according to strategists including Lei Meng. State funds have been key to stabilizing the latest stock rout, with Central Huijin Investment Ltd. saying earlier this month that it will continue to increase its ETF holdings. A flurry of trading volume spikes across a number of ETFs suggests authorities have been actively buying both blue-chip and small-cap stocks.

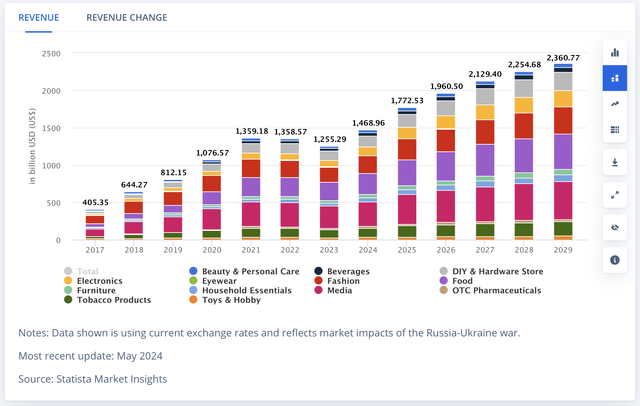

At the same time, I note that the Chinese e-commerce industry in China is expected to grow ~17% in FY24. Most of the stocks in KWEB are related to technology and e-commerce stocks, which puts KWEB in a position to benefit from structural realignments in the e-commerce space. Plus, China’s GDP numbers surprised on the upside, rising 5.3%, well above consensus estimates of 4.8%.

Exhibit C: China’s ecommerce market is expected to grow 17% in FY24 (Statista Market Insights)

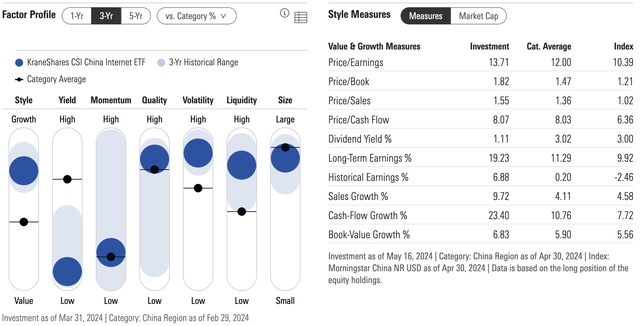

I believe this sets up KWEB well for gains in FY24. According to Morningstar in Exhibit D below, the companies in KWEB have delivered earnings growth of ~7% in line with the long-term earnings growth of the S&P 500. Its long-term growth rate is projected to be ~19%. In contrast to that, I believe KWEB’s is trading at quite a reasonable PE multiple of 13x.

Exhibit D: KWEB earnings growth rates and valuation multiple (Morningstar)

Takeaway

There are definitely risks to investing in KWEB today, but I believe the risk/reward looks attractive to me, especially given that the Chinese economy looks to be awakening and government policies look to be getting increasingly investor-friendly once again. The extreme pessimism toward the Chinese economy so far may be warranted, but the current setup looks favorable toward KWEB.

I rate KWEB as a Buy here.

Read the full article here