Introduction

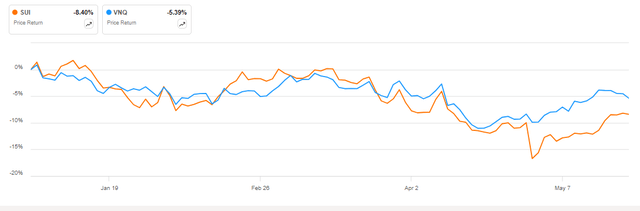

Sun Communities (NYSE:SUI) has marginally underperformed the Vanguard Real Estate Index Fund ETF (VNQ) so far in 2024, delivering a high single-digit decline:

SUI vs VNQ in 2024 (Seeking Alpha)

I think this has made the shares attractive, as the company offers a 6.3% yield on enterprise value, recession resilience given the nature of its low-end portfolio, and inflation-beating net operating income, or NOI, growth.

Company Overview

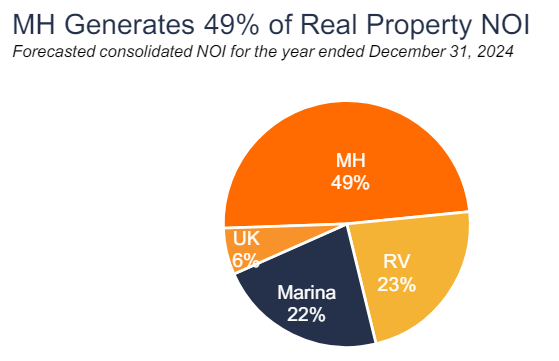

You can access all company results here. Sun Communities is a manufactured housing REIT with quite a diverse revenue base, with Manufactured housing (MH) accounting for 49% of NOI, Recreational Vehicles (RV) for 23%, Marinas for 22%, with a small UK footprint contributing the remaining 6% of NOI:

Net operating income breakdown in 2024 (Sun Communities May 2024 presentation)

Operational Overview

Sun Communities reports occupancy separately for the US/Canada and the UK, with the US/Canada MH and RV occupancy at 97.5% at the end of Q1 2024, up 0.6% Y/Y. In contrast, UK occupancy stood at 88.9%, down 1.2% Y/Y, indicating severe distress and underperformance of the UK portfolio.

Core FFO was $1.19/share in the quarter, down 3% Y/Y, driven by higher services and interest expenses, partially offset by revenue growth.

During the quarter, Sun issued $500 million of five-year senior unsecured notes with an interest rate of 5.5%.

Updated 2024 Outlook

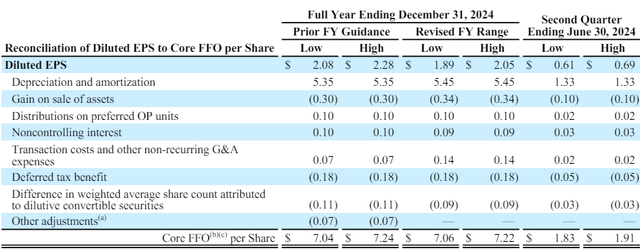

So far in 2024, there have been no major surprises in the company’s operations, hence management only narrowed its 2024 Core FFO outlook to $7.06-$7.22/share:

Updated 2024 Outlook (Sun Communities Q1 2024 Results Press Release)

As a result, Core FFO is expected to grow only 1% Y/Y in 2024.

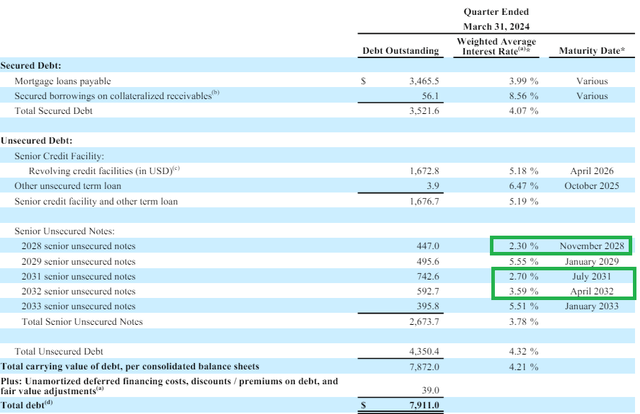

Debt Position

Sun Communities employs a conservative capital structure as net debt stood at just $7.8 billion, representing 33% of the company’s enterprise value. The debt is 89% fixed-rate, with a weighted average maturity of 6.8 years and an average interest rate of just 4.21%. Importantly, some 23% of the debt is fixed at around 3% with maturities in 2028, 2031 and 2032:

Debt overview (Sun Communities Q1 2024 Results Press Release)

The conservative capital structure allows the company to borrow at just 0.85% above the secured overnight financing rate (SOFR), which is currently about 5.3%, resulting in a marginal cost of debt at around 6% for its floating rate revolver.

Market-implied cap rate

Due to embedded seasonality in the company’s operations (Q1 and Q4 are usually the weakest, with a peak of performance in Q3), annualizing Q1 performance is not a good starting point. Instead, I will use the $1.432 billion in net operating income generated in 2023 and apply a 4.5% growth rate in 2024, resulting in NOI of about $1.5 billion in 2024.

The company’s enterprise value is about $23.7 billion, taking into account possible conversions of preferred equity units. As a result, the market-implied cap rate stands at 6.3% – an attractive amount given the defensive nature of the company’s operations and solid growth prospects.

Recession resilience

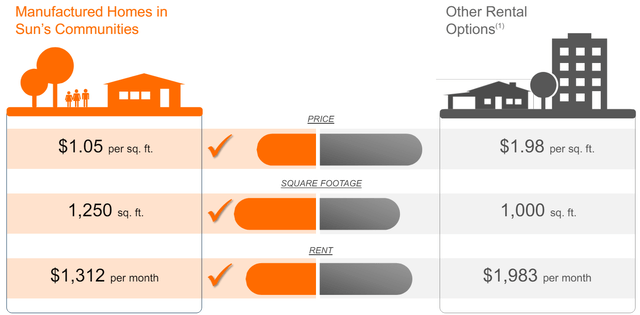

Residential property is generally one of the most resilient segments of the real estate market. This is especially true for manufactured homes which are priced at the low end of the property market. As highlighted by Sun Communities, manufactured homes provide 25% more space at ~50% less cost per square foot:

Manufactured housing vs other rental options (Sun Communities May 2024 presentation)

Given the low-cost nature of the company’s portfolio, a potential downturn may boost occupancy across the board. While occupancy in the US/Canada is high to begin with, this could help the struggling UK segment.

Risks

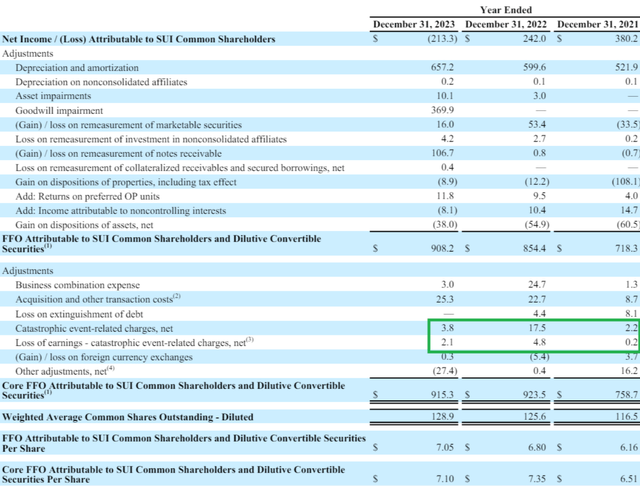

With steady growth and low leverage, there are no major red flags when it comes to investing in Sun Communities. That said, I would point to the company consistently adjusting Core FFO for catastrophic event-related charges ($7 million in Q1 2024), which is a recurring business expense if you look back at the 2021-2023 period:

Core FFO bridge 2023-2021 (Sun Communities 2023 Annual Report)

The same treatment is used for catastrophic charges when it comes to calculating NOI, hence it is reasonable to assume earnings are overstated by about 2%, especially in periods of elevated natural disasters, such as 2024 and 2022.

Conclusion

Sun Communities is a defensive stock, boasting robust growth prospects and moderate financial leverage. With indices at all-time highs and fears of a hard landing for the economy subsiding, Sun Communities has understandably underperformed both the broader market and sector real estate ETFs. This has resulted in the stock offering a 6.3% yield on enterprise value, with growth expected to at least match, and potentially exceed, inflation over the medium term. As such, with a high single-digit return potential, I think the shares are attractive at the moment, hence I rank them a buy.

Thank you for reading.

Read the full article here