Jamf Holding (NASDAQ:JAMF) is a company developing device management solutions for Apple devices, such as Mac, iPad, iPhone, and Apple TV in work or office settings.

All-time share performance has been disappointing so far. JAMF went public in 2020 at $39.7, but after reaching an all-time high of $47 and trading sideways in the following years, shares price continued to trend lower. Much of the underperformance has happened in the last five years, where JAMF has been down by over -59%. Today, the stock is currently trading at $16.3, down -6% YTD.

I rate the stock a buy. My one-year price target of $18 per share projects about 11% upside. At this level, JAMF presents a decent buy opportunity. In my opinion, the recent feature launches to strengthen security for Apple Vision Pro could be a potential catalyst. Moreover, JAMF should also benefit from the growing demand to enhance the security of connected Apple devices in the workplace.

Financial Reviews

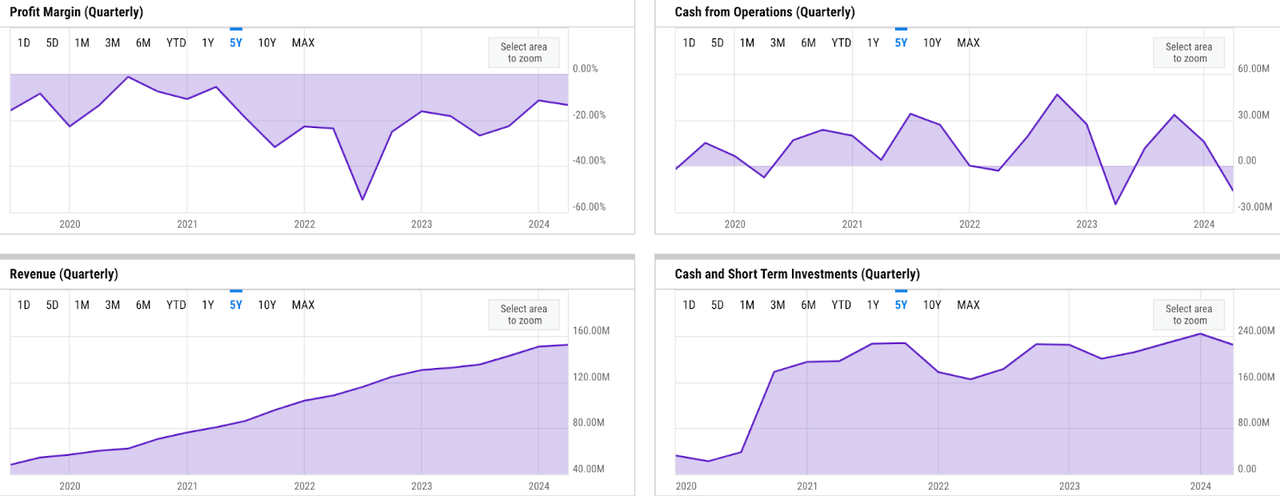

ycharts

Fundamentals have been mixed. Revenue growth has declined from over 30% to 15% YoY as of late. In Q1, JAMF delivered a revenue of $152 million, a 15% YoY growth. Likewise, operating cash flow (OCF) generation has also declined since 2022. In particular, it has been caused by considerable OCF burn in Q1 this year and also at the same time last year. In Q1, the key drivers of OCF burn have been the high expenses across system transformation and restructuring activities. This has negatively affected liquidity a little bit. JAMF ended Q1 with $224.5 million of cash and short-term investments, a slight downtick from that of the prior quarter. However, the relatively high SBCs (Share Based Compensations) have also been driving GAAP unprofitability for JAMF. In Q1, this did not seem to improve just yet. In fact, net loss margin actually widened to -13.5%, suggesting that JAMF is still a bit far from GAAP breakeven.

Catalyst

I believe there are a few catalysts for JAMF in FY 2024 and beyond. The noteworthy ones are the several feature launches for Apple Vision Pro, and also the continued expansion opportunities from the growing enterprise demand in securing connected work devices.

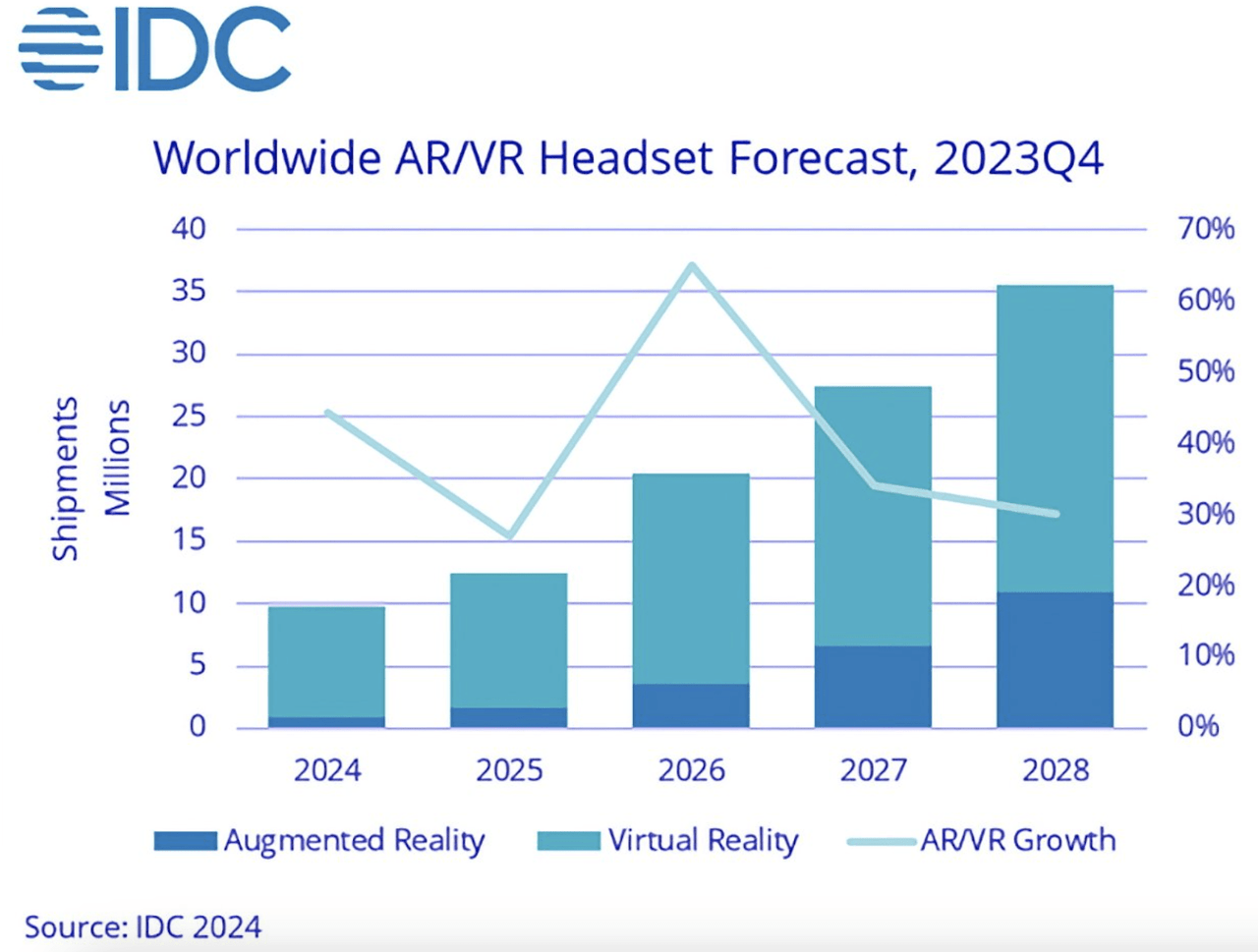

IDC

As a company developing Apple-focused offerings, JAMF should continue to benefit from the increased penetration of AR/VR headsets like Apple Vision Pro. With the market being at the early innings today and still growing at 30% YoY in 2028, there is a significant white space opportunity to capture here. Moreover, given the relatively high price of Vision Pro, I would expect the adoption rate for work uses to trend higher than the personal ones in the near term.

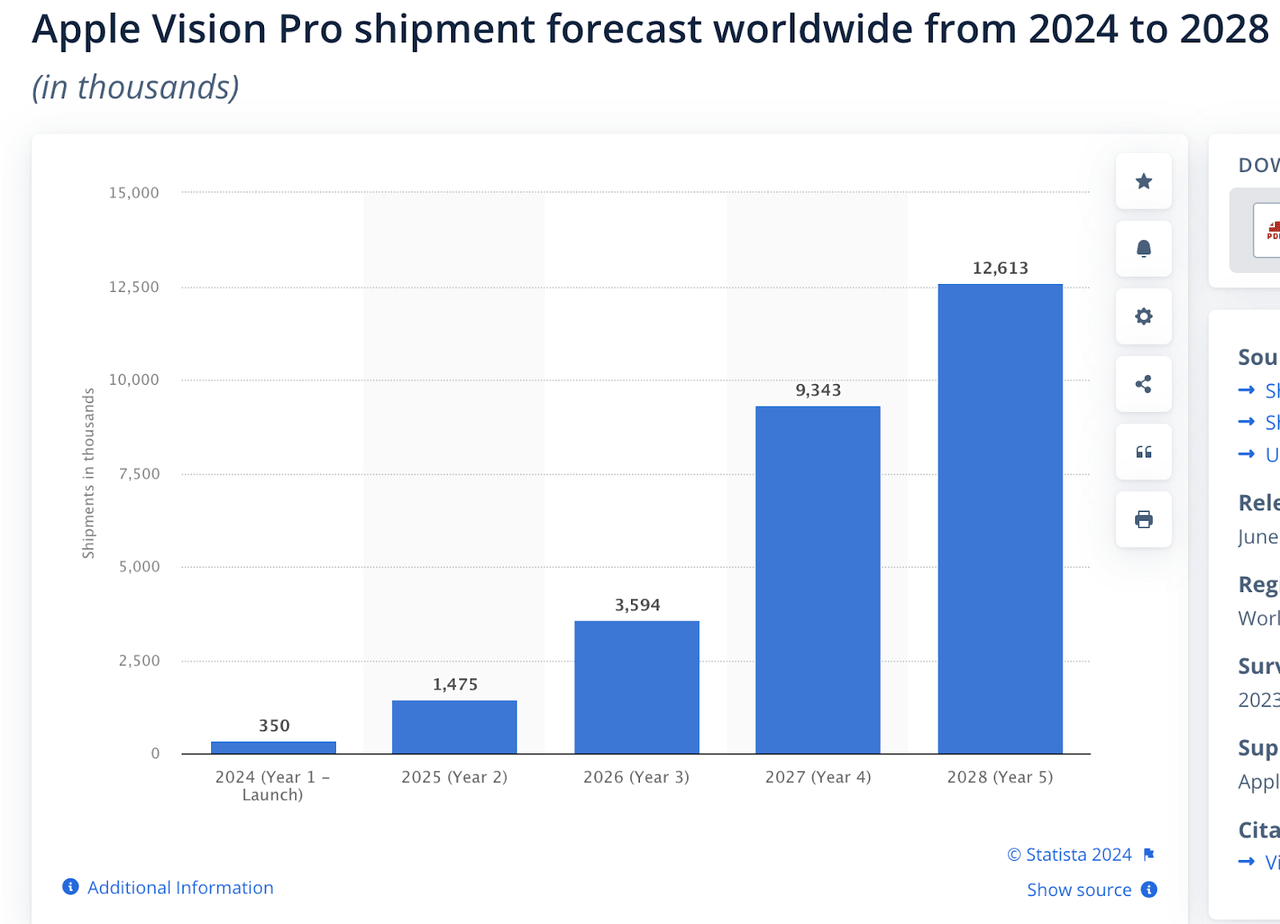

statista

On a more relevant note, with more than 1.4 million units expected to be shipped in 2025, Apple Vision Pro today would then possibly remain as the second largest player after Meta in the AR/VR space. In my opinion, the increase in Vision Pro usage at the workplace should continue to increase cybersecurity and unauthorized access threats, further driving demand for JAMF’s offerings. In Q1, JAMF appears to have anticipated this with the relevant feature launches for Vision Pro, which I believe should position it well to serve the growing enterprise demand:

With Jamf Pro, organizations can enroll and streamline deployment of enterprise apps and settings for Apple Vision Pro. Jamf Connect allows Apple Vision Pro to securely access enterprise resources for any of the web and native apps that require secure identity-based access controls. Jamf Protect extends the same mobile threat defense, network protection and content filtering use cases to the Apple Vision Pro.

Source: Q1 earnings call.

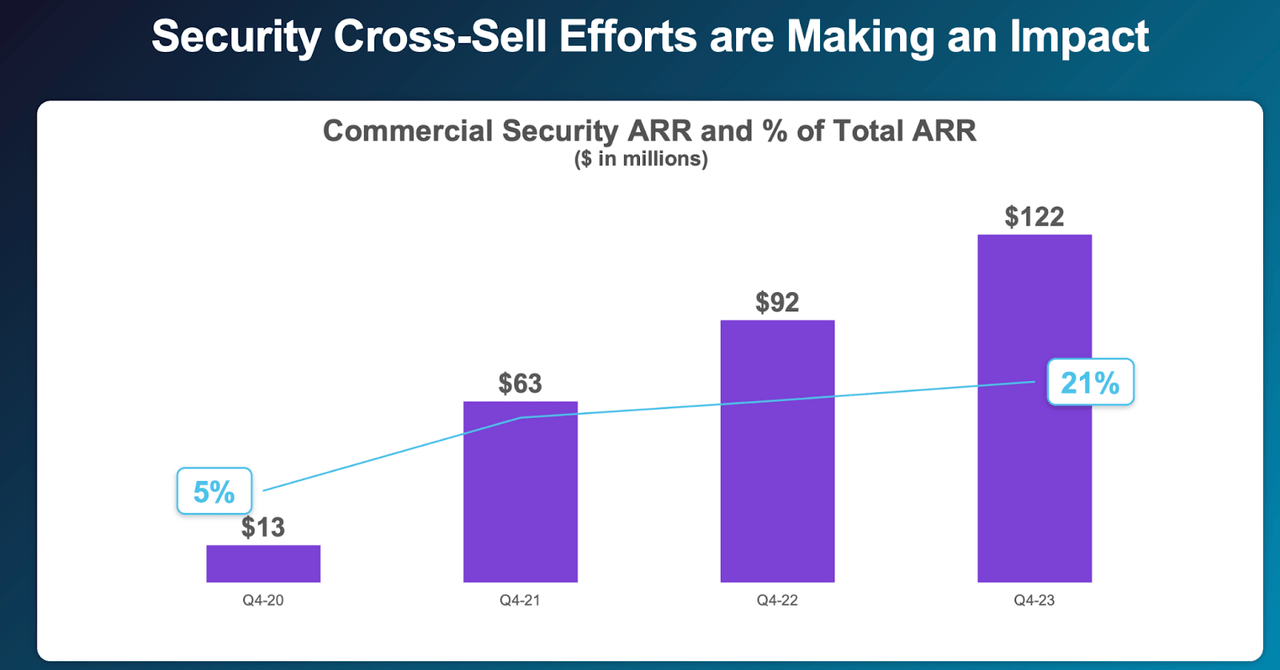

company presentation

The focus towards security has been paying off well for JAMF so far, with the share of the commercial security product ARR making up 21% of the overall ARR of the business. In my view, this should continue creating significant opportunities to grow subscription revenue further from install base expansions, which may also drive margin expansions from lower acquisition cost per customer.

Risk

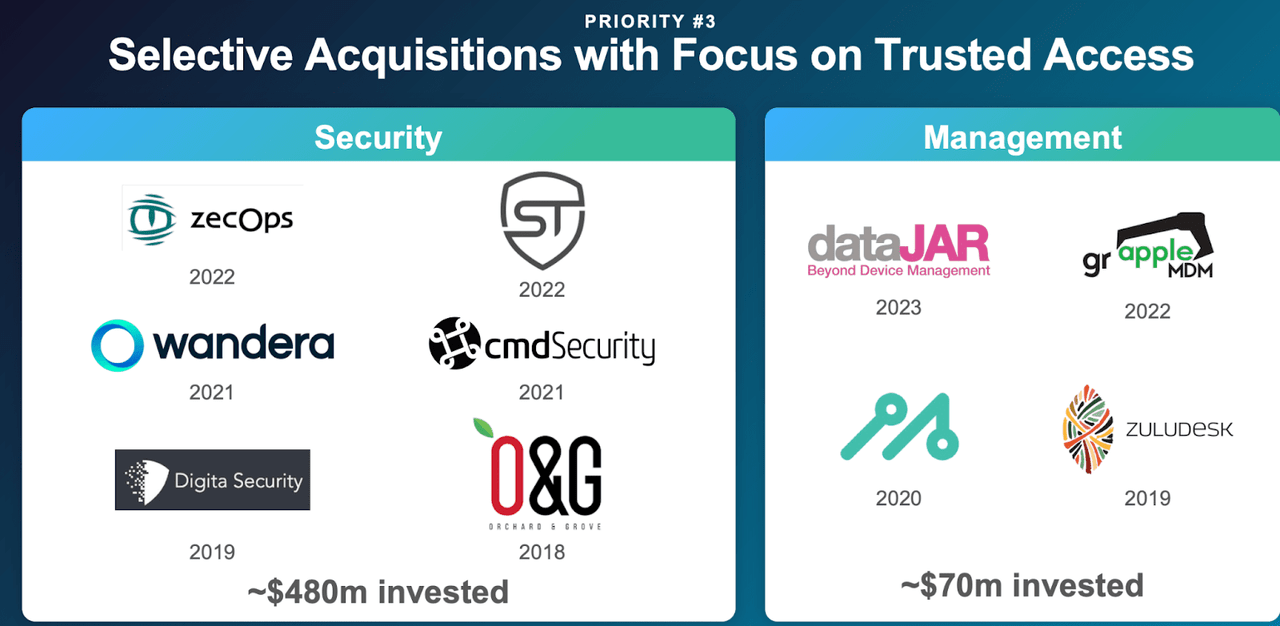

Though near-term structural risk remains minimal, I would note that JAMF’s continued focus to actively pursue inorganic growth opportunities from M&As could also present a bit of risk.

company presentation

So far, JAMF has made $550 million worth of M&As since 2018, with the number of companies acquired continuing to increase over the years as JAMF is able to generate more OCF. More recently, the M&As have been focused on strengthening the security capability, which seems to be a step in the right direction. On the other hand, though, there are a few risk factors to consider.

First, cybersecurity is a hot sector where companies may trade at a higher premium. Secondly, there is always integration risk where for instance, JAMF may spend more resources than it expects to successfully integrate its offerings with the target’s solutions and then bring them to market.

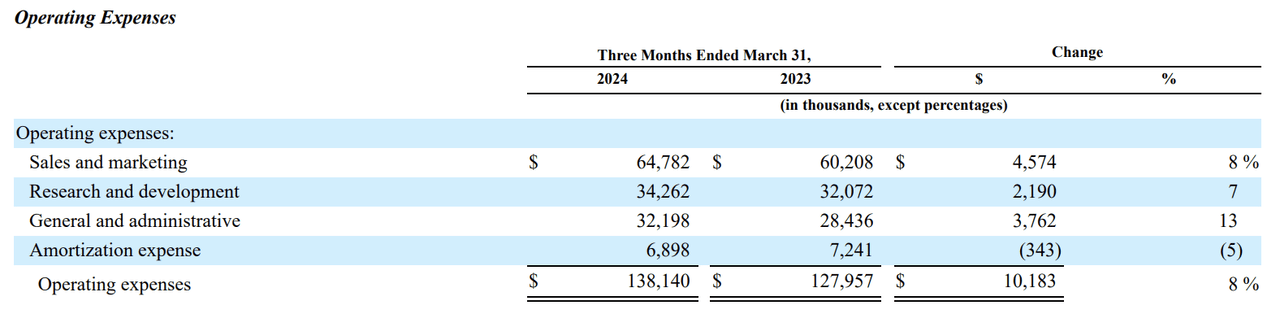

10Q

In the end, all of them will come down to bottom-line pressure. JAMF has not been GAAP profitable, as I mentioned earlier, and in Q1, SBCs remained quite high despite seeing a slight decline. But, the biggest operating cost drivers have been the 13% increase in G&A, which were negatively affected by what appears to be M&A-related activities, as per its 10Q:

For the three months ended March 31, 2024, general and administrative expenses increased primarily due to a $1.5 million increase in stock-based compensation expense and related payroll taxes, a $1.4 million increase in acquisition-related expense, a $1.3 million increase related to system transformation costs, and restructuring charges of $0.8 million,

Source: 10Q.

Valuation / Pricing

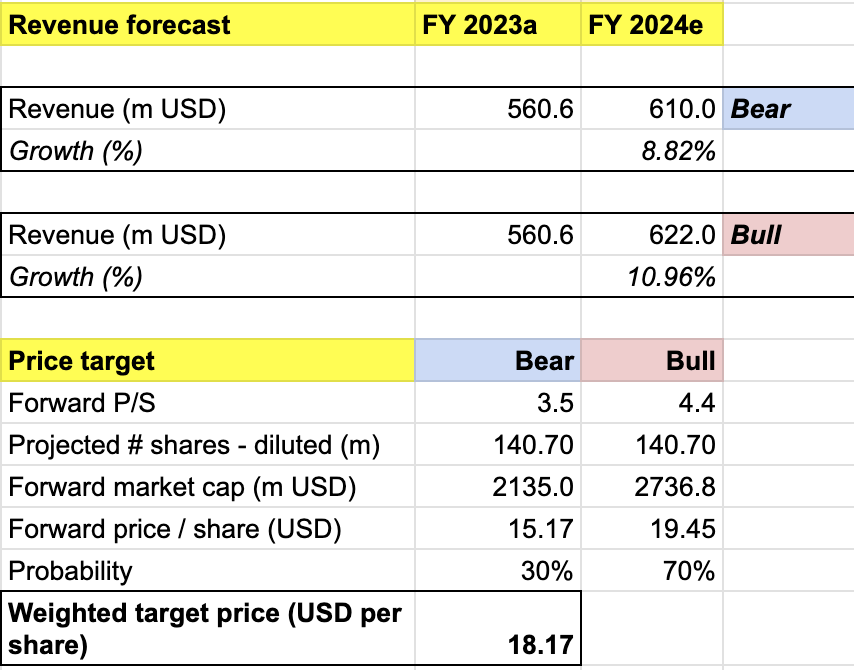

My target price for JAMF is driven by the following assumptions for the bull vs bear scenarios of the FY 2024 projection:

-

Bull scenario (70% probability) assumptions – I expect revenue to grow by 10.96% YoY to $622 million, in line with the company’s guidance. I assume forward P/S to expand to 4.4x, implying a share price appreciation to $20 price level. I assume that JAMF’s P/S will reach its YTD high once it is able to deliver its FY 2024 target as promised.

-

Bear scenario (30% probability) assumptions – JAMF to deliver FY 2024 revenue of $610 million, a 8.8% YoY growth, which is $8 million lower than the company’s low-end target. This will result in a correction to $15.2 per share.

own analysis

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of $18.2 per share, a projected 1-year upside of about 11%. I would rate the stock a buy.

My 70-30 bull-bear probability assignment is based on my belief that the growth catalyst should remain strong into FY 2024, further providing JAMF with enough visibility into the FY revenue. This is also partly demonstrated by the company’s narrow guidance range. On the flipside, I also lowered my bear case revenue projection by $8 million, which was a conservative assumption.

Conclusion

JAMF is a company providing device management and security solutions for Apple devices. It should continue to benefit from the growing adoption of Apple offerings in the workplace settings, such as Apple Vision Pro. As such, the latest product enhancement to help secure Vision Pro use at work could potentially be a strong catalyst for JAMF. Meanwhile, JAMF’s focus on M&As may also continue to pressure bottom-line from GAAP standpoint if not executed well. Today, JAMF is still a solid business that generates consistent OCF, despite the GAAP unprofitability. My price target of $18 per share projects an 11% upside. I rate the stock a buy.

Read the full article here