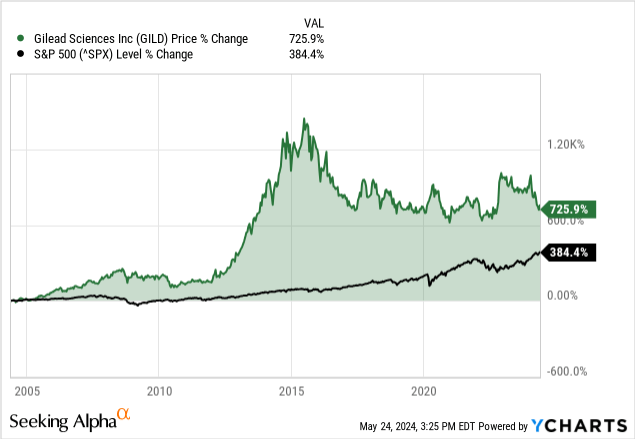

My last article about Gilead Sciences, Inc. (NASDAQ:GILD) was published in August 2023 and once again the stock declined while the overall market outperformed. Back then, the stock was trading for $77, and Gilead Sciences declined 12% while the S&P 500 (SPY) increased 20% in the same timeframe. But the story that Gilead Sciences underperformed the S&P 500 is not news at this point. Gilead Sciences underperformed the S&P 500 basically on every timeframe – 6 months, 1 year, 3 years, 5 years, or 10 years. We must go back about 20 years for Gilead Sciences to outperform the S&P 500.

I have published several articles in the last few years in which I stated that Gilead Sciences is undervalued and a great investment. In my last article about Gilead Sciences, I wrote:

Gilead Sciences remains deeply undervalued and so far neither the updated guidance nor the expanded label use for Veklury pushed the stock prices higher. It seems like Gilead Sciences is missing short-term catalysts, but in the end, Gilead Sciences also does not need a major catalyst to push the stock price higher in a single move. Often one single piece of information is enough to push a stock higher that is undervalued. For example, slightly better than expected results in the next quarter could be enough to initiate the next wave higher.

My last article was titled “Searching for a catalyst” and I still think Gilead Sciences needs a catalyst to push the stock price higher and sentiment must change – otherwise, the stock will not really move higher. However, Gilead Sciences also has to enter a path of solid growth as the last few years have not been great, and considering the results reported in the last few years we seriously have to ask the question if maybe I was wrong after all and Gilead Sciences is fairly valued at this point.

Fairly Valued After All?

Let’s start by looking at the intrinsic value and valuation multiples. I am constantly writing that Gilead Sciences is undervalued and that a higher stock price is justified. But maybe this assessment is just wrong.

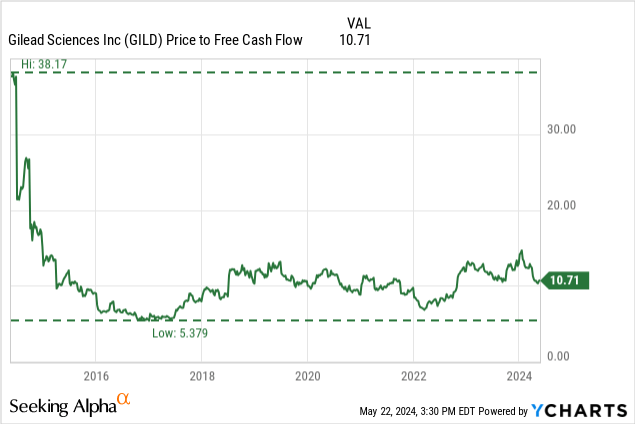

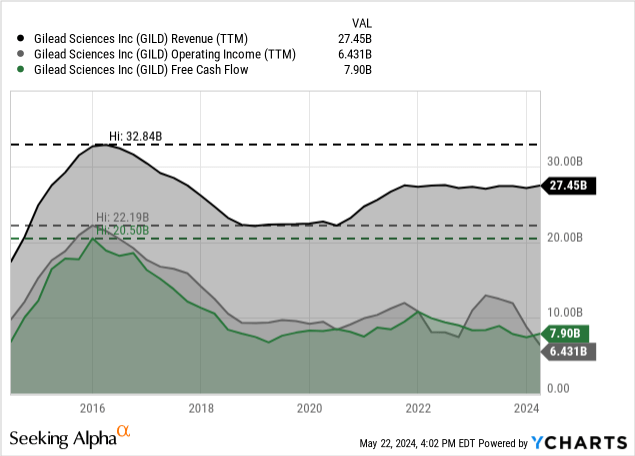

In the last few years, Gilead Sciences was trading for a price-free-cash-flow ratio around 10. Right now, the stock is trading for 10.7 times the free cash flow. I often claimed in previous articles that such a valuation multiple is not justified (and used an intrinsic value calculation to show that Gilead Sciences should trade for a higher stock price). But what if a valuation multiple of 10 is the appropriate valuation for the stock after all? A valuation multiple of 10 is often seen as appropriate for a business not able to grow and when looking at the last few years that description fits Gilead Sciences quite well. The company could neither grow revenue nor operating income or free cash flow.

I still think this point of view is wrong, and Gilead Sciences has the potential to grow its top and bottom line again. But in the last few years, it is understandable that such a perspective made sense for most investors, and therefore 10 times free cash flow was a reasonable valuation multiple that is ascribed to the stock.

In a very simplified theory, there are two ways a stock price will increase:

- Investors are ascribing a higher valuation multiple to the stock (sentiment).

- Growing free cash flow is leading to a higher stock price with still the same valuation multiple (fundamentals).

In the following sections, we will look at both – sentiment and fundamentals – to find out if Gilead Sciences has the potential to grow.

Quarterly Results

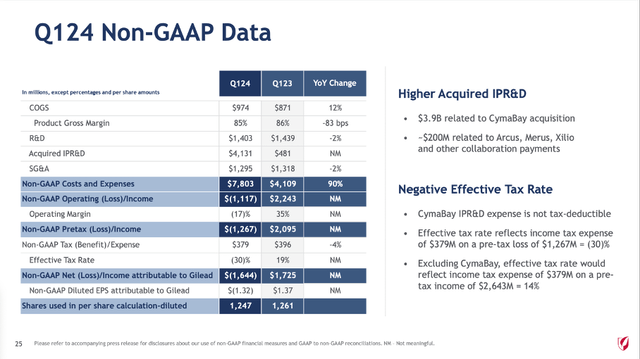

We start by looking at fundamentals and especially the quarterly results. When looking at Q1/24 it seems understandable – once again – that investor sentiment is not changing, and everybody seems to stay pessimistic. To start with some good news, Gilead Sciences increased total revenue from $6,352 million in Q1/23 to $6,686 million in Q1/24 – resulting in 5.3% YoY top line growth. But while the top line grew at a solid pace, the company had to report an operating loss of $4,322 million this quarter compared to an operating income of $1,705 million in the same quarter last year. And finally, diluted earnings per share also switched from an EPS of $0.80 in Q1/23 to a loss per share of $3.34.

Gilead Sciences Q1/24 Presentation

However, to put these results a little into context we must point out that the CymaBay acquisition had a huge negative impact. In Q1/24 – as a result of the acquisition – the company reported $2,430 million of “in-process research and development impairment” as well as $4,131 million of “acquired in-process research and development expenses”. Without this negative impact, the adjusted non-GAAP earnings per share would have been $1.82. To end with positive results, free cash flow increased from $1,635 million in the same quarter last year to $2,114 million – resulting in 29.3% year-over-year growth. And although free cash flow is an important metric and year-over-year growth a good sign, we should still not ignore the last few years.

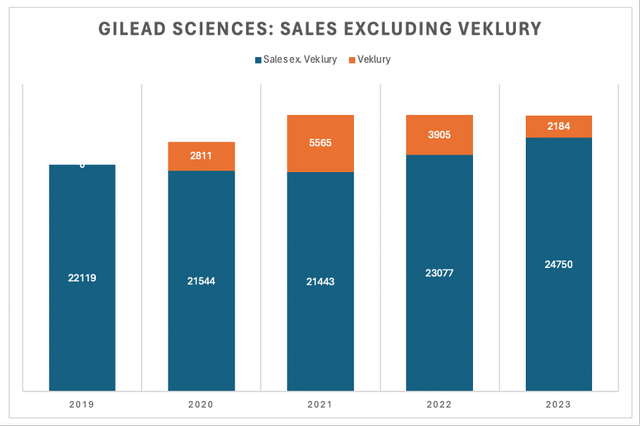

As mentioned above, Gilead Sciences was struggling in the last few years and could keep revenue as well as free cash flow “only” stable (as some drugs reported growing revenue and others declining revenue). There has been one “problem” for Gilead Sciences – Veklury. To be honest, it was not really a problem as Veklury generated huge amounts of revenue and free cash flow for Gilead Sciences but with Veklury sales declining again in the last few years it was difficult for Gilead Sciences to grow overall revenue.

Author’s work

But when excluding Veklury sales, we see Gilead Sciences being able to grow its top line quite well – 7.6% YoY growth in fiscal 2022, 7.2% YoY growth in fiscal 2023, and in the first quarter of fiscal 2024 sales excluding Veklury grew 6.3% YoY.

Acquisitions, Revenue, and Debt

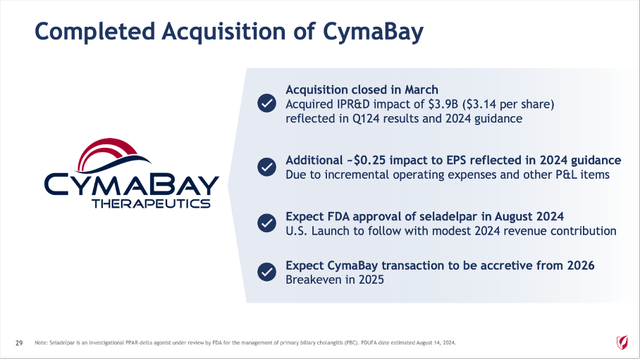

While excluding Veklury sales seems to improve the picture a little bit, Gilead Sciences’ acquisition strategy seems to be a disappointment. In the last few years, Gilead Sciences acquired several companies: In 2017, Gilead Sciences acquired Kite for $11.9 billion, and in 2020 the company acquired Forty Seven for $4.9 billion. And in March 2024, Gilead Sciences completed the acquisition of CymaBay Therapeutics for about $4.3 billion in total equity value (Gilead Sciences paid about $3.9 billion in net cash). The acquisition expanded Gilead Science’s liver portfolio to include seladelpar, an investigational PPAR agonist, which has been submitted to FDA and EMA for review and is intended to treat primary biliary cholangitis (PBC) including pruritus. A regulatory decision is expected in August 2024.

Gilead Sciences Q1/24 Presentation

The problem with Gilead Sciences’ acquisitions so far is that any meaningful impact on the income statement is missing. When spending several billions on acquisitions the expectation for the business is higher revenue and higher profit due to the acquired business. When looking at the CymaBay acquisition, Seladelpar is expected to have peak sales somewhere between $500 and $2 billion. But in an article about CymaBay Therapeutics SA analyst Edmund Ingham cited only peak sales of $300 million and that is the problem with estimates – we never know what sales certain drugs will actually generate and management might have been too optimistic about the acquired businesses.

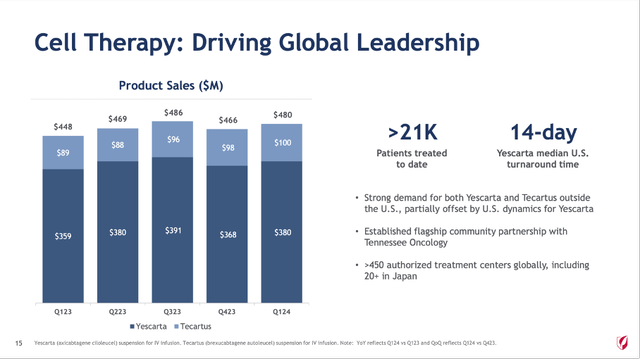

Don’t get me wrong – past acquisitions have contributed to Gilead Sciences’ business. The Kite deal, for example, led to successful drugs like Yescarta and Tecartus, which generated close to $2 billion in annual revenue for Gilead Sciences (combined). But overall, Gilead Sciences was unable to grow revenue or free cash flow in the last few years – and after several acquisitions worth several billion dollars this is rather a disappointment.

Gilead Sciences Q1/24 Presentation

While the acquisitions had no real positive impact on the income statement, they had an impact on the balance sheet as it led to higher debt levels. On the other hand, Gilead Sciences’ balance sheet is still acceptable. On March 31, 2024, the company had $3,667 million in short-term debt and $21,527 million in long-term debt. When comparing the total debt to the total shareholder’s equity of $17,455 million we get a D/E ratio of 1.44 – a little higher than I like to see but still acceptable. Additionally, Gilead Sciences has $4,718 million in cash and cash equivalents on the balance sheet and when subtracting that amount, we get a net debt of $20,476 million. In the last few years, Gilead Sciences could generate about $10 billion in operating income, and it would take about two years to repay the outstanding debt – another acceptable ratio.

Changing Sentiment

I mentioned above that there are two ways for Gilead Sciences’ stock price to trade higher. One was the fundamental business, which usually leads to a higher stock price when generating more free cash flow and growing at a higher pace. And Gilead Sciences clearly struggled on that front. And when the fundamental business is struggling, sentiment is often negative as well. But investor sentiment and fundamentals don’t have to go hand in hand – and again and again, we have examples where the two are decoupled from each other.

In the case of fundamentals, we can calculate an intrinsic value and determine stock prices – sentiment is much more difficult to grasp. There is simply no rule what valuation multiples are appropriate for a stock. It certainly makes sense to claim that most stocks will trade in a range between 5 times and 50 times free cash flow, and we can therefore determine a typical range of valuation multiples. But it is simply investor sentiment (and the current mood) that is determining if it is 10 times free cash flow (as in the case of Gilead Sciences) or 5 times free cash flow or 20 times free cash flow.

And negative sentiment holding the stock back is a problem Gilead Sciences is sharing with other businesses and stocks – like PayPal Holdings, Inc. (PYPL) or Alibaba Group Holding Limited (BABA). But compared to Alibaba or PayPal, Gilead Sciences has an even bigger problem. Alibaba and PayPal are at least growing its top line at a stable pace, and it is easier to see sentiment changing for these two. When looking at Gilead Sciences it is more difficult to be optimistic and assume growing revenue or growing free cash flow.

In my last article about PayPal Holdings, I wrote:

Being undervalued is not enough for a stock to really move higher. We need a catalyst or a clear reason for sentiment to change and as long as investors don’t see a reason to get more optimistic the stock won’t rise. In the short run (quarters or a few years) fundamentals don’t move the stock price, the biggest impact stems from sentiment. And as long as the stock remains undervalued (information investors already had before), the stock price won’t move as sentiment won’t really change. The reasons (or narratives) for a declining stock price need to be addressed.

Hence, Gilead Sciences needs some form of catalyst to change sentiment and mood again. And there are several different potential catalysts. It could be news about Gilead Sciences, the company reporting results, or a famous investor taking a stake in Gilead Sciences. But it could also be narratives about the pharmaceutical sector leading to a changing mood for Gilead Sciences as well.

The best case would be Gilead Sciences finally growing its top and bottom line at a solid pace. This would justify higher stock prices from a fundamental point of view and might also lead to a changing mood and sentiment leading also to higher valuation multiples.

Intrinsic Value Calculation

Now after we look at fundamental data and sentiment, let’s calculate an intrinsic value once again. And this time we are not looking at valuation multiples, but calculating an intrinsic value by using a discounted cash flow calculation, and as such a calculation is more precise and can also include future growth rates.

As a basis for such a calculation, we use the free cash flow of the last four quarters, which was $7,900 million and as Gilead Sciences generated more or less the same free cash flow in the last few years this seems like an amount we can take as a basis in our calculation. Additionally, we calculate with 1,246 million shares outstanding and a 10% discount rate. Now if we assume 0% growth in the next few years, Gilead Sciences is fairly valued (or even slightly overvalued) with the intrinsic value being $63.40 and the stock trading for $66 at the time of writing.

But I still think we have reasons to be a little optimistic and assume at least growth rates in the low-to-mid single digits (maybe 3% or 4% growth annually). In the last two or three years the company could grow revenue in the mid-to-high single digits when excluding Veklury (and sales are now probably close to the level where sales might bottom out). And when assuming at least 3% growth right now, the intrinsic value for Gilead Sciences should be $90.50 – an intrinsic value being realistic for Gilead Sciences.

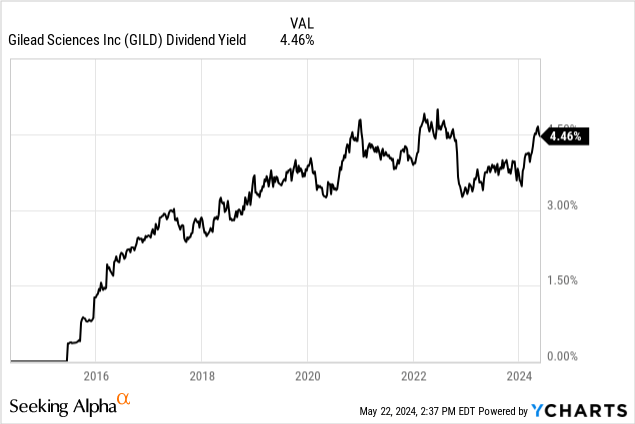

Dividend

And while the stock performance was far from great in the last few years and the stock being caught in a sideways range between $60 and $90, a reason to hold the stock nevertheless is the dividend. Gilead Sciences started paying a dividend 8 years ago and although the company is not increasing the dividend at a high pace, it increased the dividend with a CAGR of 5.23% in the last five years.

Right now, Gilead Sciences is paying a quarterly dividend of $0.77, which is resulting in an annual dividend of $3.08 and a dividend yield of 4.6%. Although interest rates are much higher than a few years ago, this is still a solid dividend yield making the stock interesting for dividend investors. The dividend can also be described as well covered by the free cash flow the company can generate. In the last few years, the company was able to generate about $8 billion in free cash flow, and in the last four quarters, Gilead Sciences paid out $3,830 million in dividends leading to a payout ratio below 50% and therefore no reason to worry.

Conclusion

At this point, I would argue we can certainly buy Gilead Sciences. The stock is close to the lower end of the sideways range in which it has been caught in the last few years. And I don’t think the stock will drop any lower than $60 and find its bottom. And while waiting for Gilead Sciences to finally start growing again as Veklury probably found its bottom we can collect dividends close to 5%.

I also admit that Gilead Sciences is probably not the best investment we can make as the stock is certainly not deeply undervalued and the sentiment is still rather negative. But in the long run, fundamentals win (over sentiment) and we have every reason to believe in at least an annual return of 10% from an investment in Gilead Sciences.

Read the full article here