Gilead Sciences (NASDAQ:GILD) is one of the world’s largest pharmaceutical companies with leadership positions in the global liver diseases and HIV therapeutics markets, and it also has an extensive portfolio of experimental drugs aimed at combating various types of cancer.

Investment thesis

Over the past five months, the company’s share price has fallen about 20%, reflecting growing skepticism among institutional and retail investors due to the disastrous results of clinical trials evaluating the efficacy of sacituzumab govitecan and magrolimab.

On the other hand, taking technical analysis into account, the situation looks optimistic for several reasons. First, the price of Gilead shares reached a strong support zone, located in the price zone of $64-$65, where financial market participants began to open long positions again. In addition, on the weekly time frame, the gap marked in the chart below remains, which, together with the RSI, continues to fluctuate around 30, indicating a potential trend reversal and the beginning of an upward movement.

Source: TradingView

In my assessment, in addition to the experimental drugs that will be discussed in more detail later in the article, I will highlight several well-known brand-name products that will continue to play a key role in improving the company’s financial position in the long term, as well as minimizing damage due to the launch of more and more generic versions of Truvada. These innovative drugs are Biktarvy, Vemlidy, Tecartus, Yescarta, and Trodelvy.

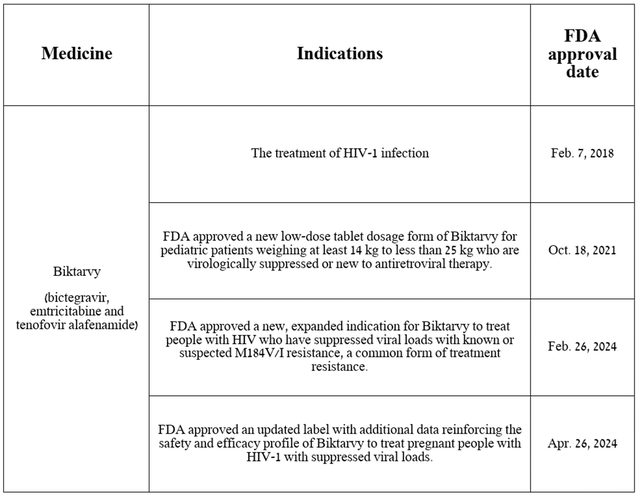

So, Biktarvy is a medicine that is used to treat certain patients with human immunodeficiency virus 1.

Source: table was made by Author based on Gilead Sciences press releases

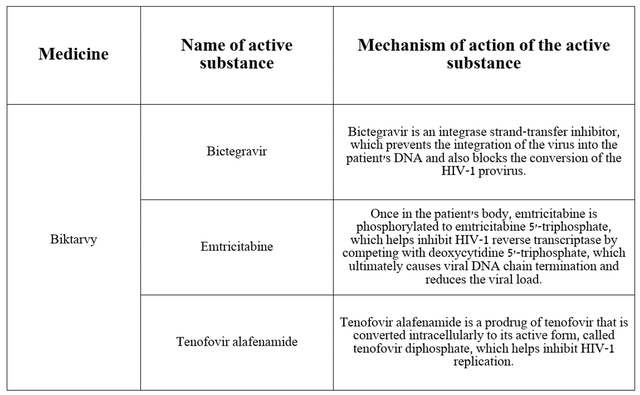

Since Biktarvy consists of three active substances, I believe that it is necessary to discuss the mechanism of action of each of them and its role in the fight against the virus.

Source: table was made by Author based on DrugBank

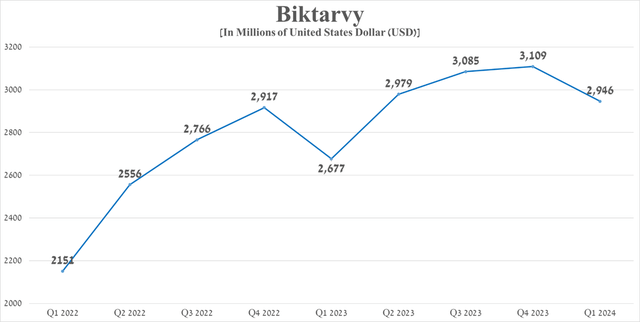

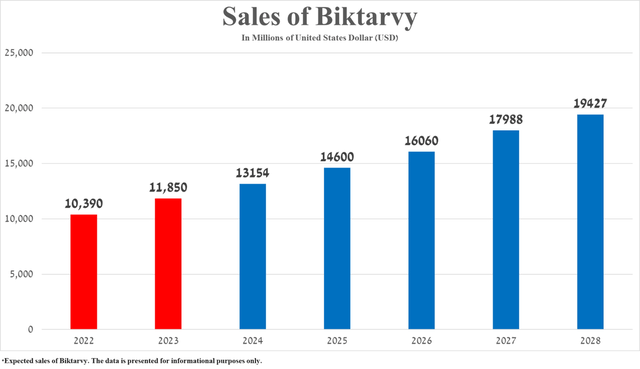

Biktarvy’s total sales were approximately $2.95 billion in the first quarter of 2024, up 10% year-over-year due in part to patients switching from the company’s other HIV drugs, the publication of additional data in early March 2024 at the 31st Conference on Retroviruses and Opportunistic Infections confirming its extremely high efficacy in treating HIV, and its label expansion.

So, on February 26, 2024, the FDA approved Biktarvy for the treatment of patients with HIV who have suppressed viral loads with known/suspected resistance to M184V/I mutation.

Source: graph was made by Author based on 10-Qs and 10-Ks

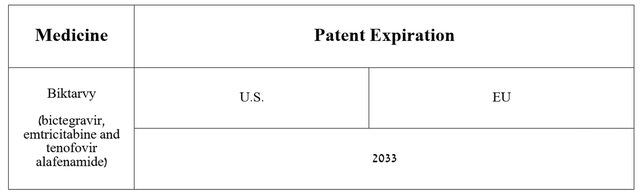

Additionally, I would like to point out that with numerous patents issued in the US and European Union, many of which do not expire until 2033 and which protect Biktarvy from generic versions being introduced into the market, then I believe that sales growth of Gilead Sciences’ blockbuster will continue in the long term.

Source: graph was made by Author based on Gilead Sciences’ 10-K

In my assessment, based on historical sales growth rates for Biktarvy, FDA approval of its updated label on April 26, 2024, including data confirming a favorable safety profile and efficacy for the treatment of pregnant women with human immunodeficiency virus type 1 with suppressed viral loads, as well as the published results of numerous clinical trials over the past twelve months, confirming its competitive advantages against “gold standards” in the fight against this sexually transmitted infection, its total sales will reach $19.43 billion in 2028.

Source: graph was made by Author based on 10-Ks

As a result, I’m initiating coverage of Gilead Sciences with a “buy” rating.

Prospects for Gilead Sciences’ business development in 2024

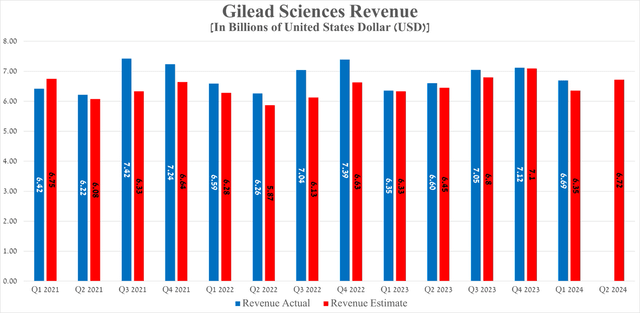

Gilead Sciences’ revenue for the first quarter of 2024 reached $6.69 billion, up 5.4% year over year and beating analysts’ expectations by $340 million.

Source: Seeking Alpha

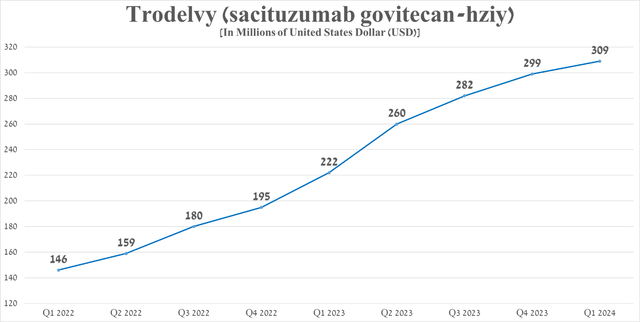

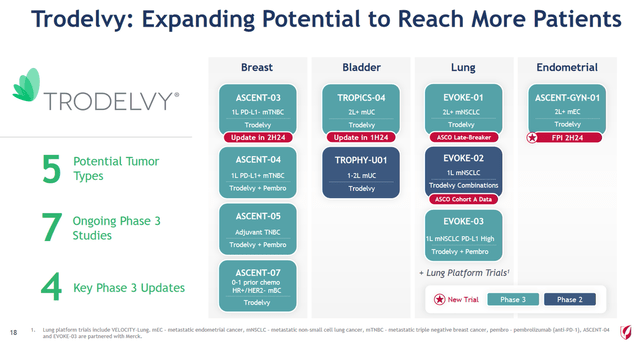

In addition to Biktarvy, Trodelvy is beginning to play a crucial role in increasing the company’s revenue after the end of the COVID-19 pandemic, which contributed to extremely high sales of Veklury between 2021 and 2023.

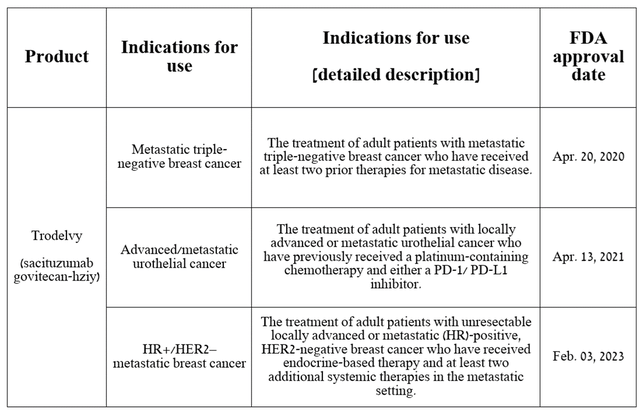

Trodelvy was developed by Immunomedics, which was then acquired by Gilead for $21 billion in 2020. It is an antibody-drug conjugate that binds to the trophoblast cell-surface antigen 2 (TROP2), which is expressed on the surface of various cancer cell types. Subsequently, SN-38 is released intracellularly, an antitumor drug that acts as a topoisomerase I inhibitor, which ultimately helps prevent the replication and division of cancer cells.

Currently, Trodelvy is approved by the FDA for the treatment of certain patients with breast cancer and urothelial cancer.

Source: table was made by Author based on Gilead Sciences press releases

Its sales were $309 million in the first quarter of 2024, up 39.2% year over year, driven by its EMA approval for the treatment of a select group of patients with breast cancer at the end of July 2023, as well as continued strong demand for the medication in the US.

Source: graph was made by Author based on 10-Qs and 10-Ks

On a larger scale, despite the disastrous results of the Phase 3 EVOKE-01 study, I believe in the commercial success of Trodelvy as Gilead continues to advance research evaluating its efficacy and safety profile as monotherapy and in combination with other drugs for the treatment of blood cancer, breast cancer, and endometrial cancer.

Source: Gilead Sciences

Moreover, the Seeking Alpha platform offers financial data as well as Wall Street analysts’ forecasts for Gilead Sciences’ revenue and earnings per share up to 2033.

So, its revenue for the second quarter of 2024 is expected to be in the range of $6.31 billion to $7.01 billion, which is $120 million more than the previous year.

On the other hand, in the long term, I believe that in addition to the strong sales of key FDA-approved medications discussed earlier in the article, an additional factor in improving Gilead Sciences’ revenue and EBIT growth rates is its aggressive R&D policy. The goal of which is the development and subsequent commercialization of next-generation product candidates capable of becoming “gold standards” in the treatment of HIV, inflammatory diseases and cancer.

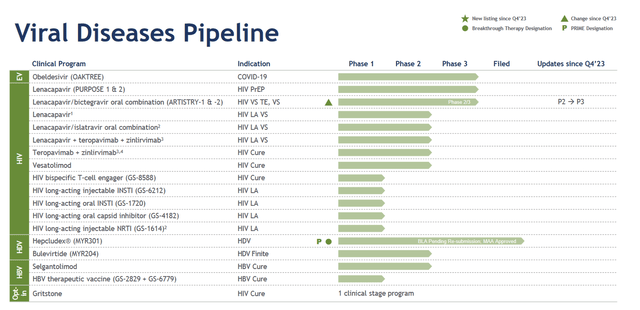

So, in my assessment, one of the most promising drugs is lenacapavir, whose mechanism of action is based on its ability to bind to the HIV-1 capsid, followed by blocking its interaction with such host proteins as CPSF6 and Nup153, which ultimately not only disrupts the replication of HIV-1, but also inhibits the synthesis of viral DNA.

Lenacapavir, whose brand name is Sunlenca, received its first FDA approval in late December 2022 for the treatment of patients with multidrug-resistant HIV-1.

Gilead Sciences is currently evaluating its efficacy relative to other FDA-approved drugs, as well as its ability to reduce the risk of sexually transmitted HIV in adults and adolescents. However, given the data from the CAPELLA clinical trial, and also that Gilead Sciences’ product is the first and only medication taken every six months to combat HIV infection, unlike its key competitors GSK (GSK) and Pfizer’s Cabenuva (PFE) and Johnson & Johnson’s Symtuza (JNJ), which need to be taken more often, then I believe that Sunlenca will become the “gold standard” in the treatment of this virus.

Source: Gilead Sciences

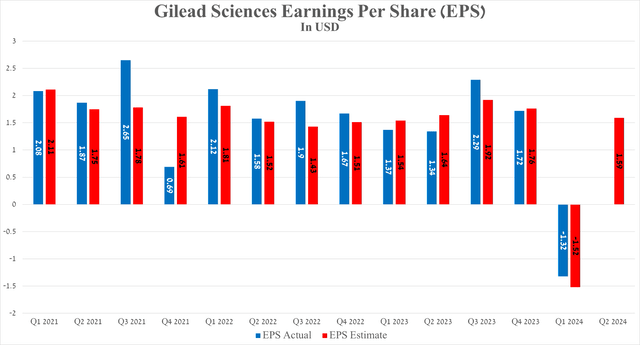

Gilead Sciences’ earnings per share for the first quarter of 2024 were -$1.32, beating analysts’ consensus estimates by 20 cents. The negative value of its EPS was not associated with disastrous drug sales, and the only reason for the sharp drop in this financial metric was the acquisition of CymaBay Therapeutics.

On the other hand, its EPS is expected to be in the range of $1.41 to $1.70 in the second quarter, up about 18.7% year-over-year.

Source: Seeking Alpha

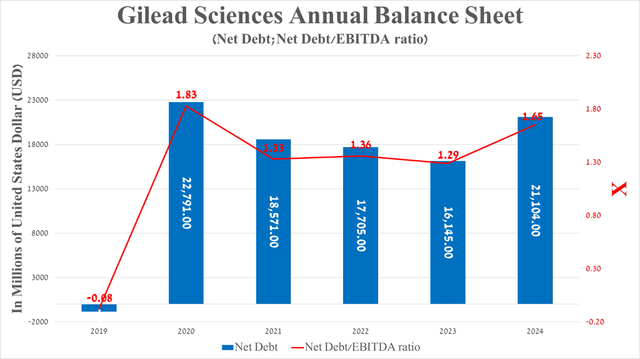

Before moving on to the risks section, I’d also like to discuss Gilead Sciences’ debt, which, in my assessment, does not pose a significant risk to its financial position. So, its net debt amounted to about $21.1 billion at the end of March 2024, increasing by $4.96 billion compared to December 31, 2023, due to the acquisition of CymaBay Therapeutics in mid-February of this year.

The deal allowed Gilead Sciences to acquire seladelpar, which not only met primary and secondary endpoints in a pivotal clinical trial but, more importantly, was more effective than Genfit’s elafibranor (GNFT) and Intercept Pharmaceuticals’ Ocaliva in treating patients with primary biliary cholangitis, which affects approximately 58 out of every 100,000 women in the United States.

Source: Seeking Alpha

Risks

Before jumping to a conclusion, I would like to highlight some of the major financial risks that could affect Gilead’s share price in the short and medium term. These risks include a potential continued decline in Veklury sales due to lower COVID-19 hospitalizations, the negative impact of President Biden’s Inflation Reduction Act on the pharmaceutical industry, as well as increased competition in the global non-Hodgkin lymphoma treatment market, which could ultimately negatively impact the sales growth rate of Yescarta and Zydelig.

Takeaway

In recent quarters, Gilead Science has continued to change its business development approach to reduce dependence on sales of its HIV and HCV drugs by accelerating the pace of development of next-generation product candidates to treat patients with liver disease, as well as lung, breast, and colorectal cancer.

So, on May 18, 2024, the company published additional results from the Phase III ASSURE study, in which seladelpar confirmed its competitive advantages over elafibranor and Ocaliva, which consist of a significant reduction in itching in patients with primary biliary cholangitis, as well as significant improvements in markers of cholestasis.

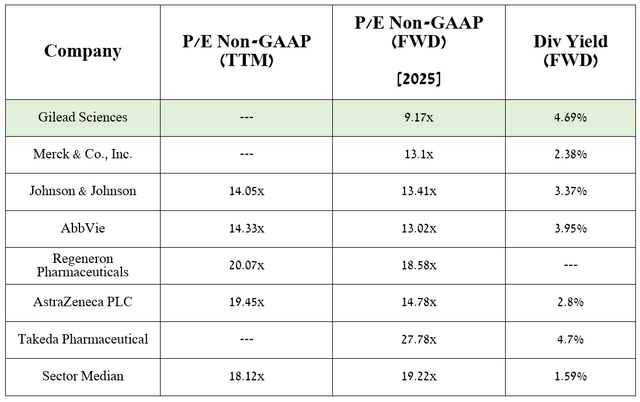

Additionally, according to my assessment and analysts’ expectations, thanks to drugs already on the market, as well as domvanalimab, lenacapavir, and the anticipated label expansions for Trodelvy, the company’s EPS in 2025 will reach 9.17x.

Source: Seeking Alpha

Thus, this indicates that the company is trading at a discount to many of its peers, and given its 4.69% dividend yield, Gilead Sciences represents an attractive asset for conservative investors looking for beaten-down stocks in the healthcare sector.

Read the full article here