As interest rates remain higher for longer, there is one industry that has continued to be punished, and that is the real estate industry. In fact, we may not see rates come down for another 3-6 months, which may mean REIT stock prices could remain low. However, despite the macroeconomic impacts and many fears in the REIT space from an office-space perspective, Broadstone Net Lease (NYSE:BNL) shines bright, reducing those fears – due to their specific real estate concentration, balance sheet composition and performance. The specific concentration that calms the fears is Industrial. Why Industrial? Think – warehouse space for large consumer-driven companies (i.e., Amazon (AMZN), Target (TGT), etc.).

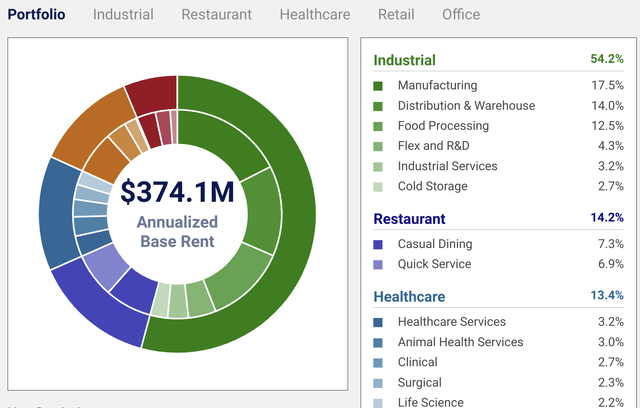

BNL is a diversified, single-tenant operated REIT. The concentration of industrial stands at 54.2% of their entire portfolio, but they also show diversification by being involved in restaurant (14.2%), healthcare (13.4%), retail (11.9%) and their lowest concentration – office (6.3%).

Broadstone Portfolio Page

Not only is the risk reduced, with their lowest concentration in office space, on a per tenant basis, all tenants lease under 5% of total available square footage. The largest tenant is an industrial client, Roskam Foods, with 4.2% of the portfolio. Therefore, not heavily dependent on one industry, nor one tenant.

In addition, BNL is very strategic with what type of buildings and tenants they have. Given industrial is their largest concentration, for instance, BNL states, “We look for industrial properties that are located in close proximity to major transportation thoroughfares such as airports, ports, railways, major freeways or interstate highways.” This makes complete sense, as this is what the tenants would want or their end users would want – speed. How fast can a product get picked up, stored and then shipped out? That’s what BNL likes to be in – a desirable location to satisfy the need for speed.

Therefore, it’s time to see if not only is the REIT industry a great space to invest right now, but specifically if BNL is a great stock to buy at current prices and hold for the long term. We’ll do so by looking at the balance sheet and the financial performance.

Balance Sheet

BNL’s balance sheet after the recent quarterly earnings release is quite interesting. Total assets slightly grew from year-end, but yet – liabilities are down.

Specific areas where liabilities were down was the $17M decrease in their credit facility. In a high-rate environment, that is a good thing, as that means the interest expense could be plateauing, which we will see more in the financial performance section.

BNL’s debt maturity schedule is broken out within the 10-Q footnotes, between unsecured and secured. The unsecured term loans mature in 2026-2029 at variable rates, which are approximately 6.00%-6.60% rates. When rates turn down, those rates will go down with it. The senior unsecured term loans mature 2027-2031 and are fixed, with the highest rate at 5.19% (which matures in 2029). The 2031 unsecured senior note has a rate of 2.60%, which is significantly a below-market rate and, fortunately for them, is the longest form of a maturity schedule. The secured mortgages, which are fairly insignificant overall at $78M (Insignificant because the unsecured term loans are over $1.7B), with rate ranging from 3.6%-4.9%, maturing from 2025-2028.

Overall, BNL’s debt schedule appears adequately managed, with the unsecured term loans being tied to a short-term variable rate, which is smart if rates start to turn south and anything that is fixed is at a low rate as well, with the highest fixed rate at 5.19%.

Rental property assets were down approximately $190M from year’s end, and you can see this is more than likely from the sale of 39 properties in the quarter, as part of their simplification of their healthcare concentration. Therefore, BNL used part of the proceeds to acquire $40M worth of properties, but the remainder moved to cash and equivalents.

After evaluating the balance sheet, it appears that BNL should be set up for further acquisition, due to the credit facility being down from year-end and cash and equivalents sitting at over $221.7M, up from $19.5M at year-end. Therefore, I would expect an active market for BNL in the upcoming 6 to 12 months. The last properties were acquired with an average capitalization rate of 8%, which I am sure that BNL would not want to go much lower than that.

To conclude, on the balance sheet, BNL has room to expand at the right opportune time, but can still earn a high rate on idle cash from their balance sheet. Next, BNL’s financial performance is on deck.

Financial Performance

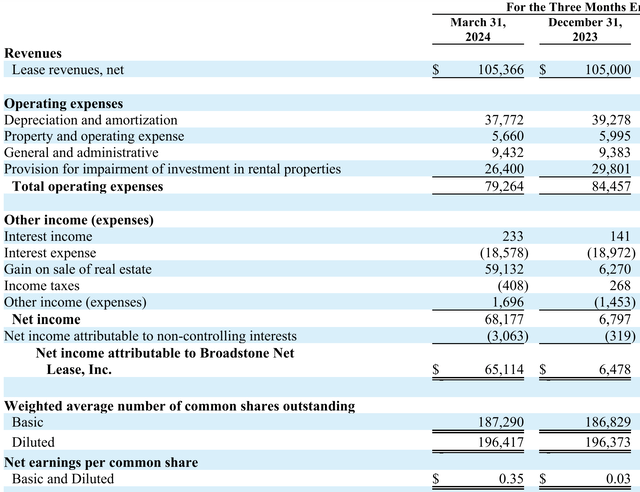

Echoing similar comments I made about the balance sheet, revenue for the first quarter of 2024 remained fairly flat/consistent to the fourth quarter of 2023, at $105M.

However, here are the bright spots:

- Expenses were down $5M

- Interest Income up $90K

- Interest Expense down $400k

- Gain on sale of real estate up $53M from the healthcare simplification discussed earlier.

Broadstone Net Lease Earnings Release

Adjusted funds from operations ended up at $0.36, which is only one cent higher compared to their basic and diluted EPS you see above. AFFO was also $0.36 the quarter prior and $0.35 the quarter before that. Therefore, AFFO growth is fairly low at the moment. This didn’t stop management from increasing their quarterly dividend from $0.28 to $0.285; which is still covered by funds from operations at $0.36.

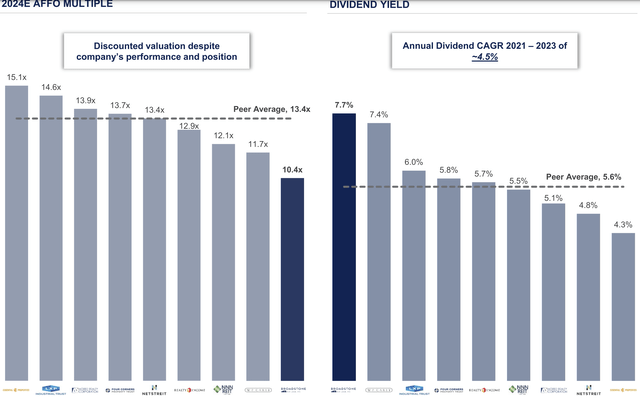

From a valuation perspective, BNL is trading at 10.5x price to forward AFFO ratio, based on forward guidance from management ($1.41-$1.43) and a stock price of $14.96 (May 28th close price).

Broadstone Net Lease Event Presentation for Last Quarter

My 10.5x calculation closely matches management’s presentation that you see above. Management compared BNL to their competition, including Realty Income (O), which has been a darling among dividend investors, and BNL shows they have the most undervaluation based on this metric. Among BNL’s peers for Price to Forward AFFO Ratio: Realty Income (O) has 12.9x, Agree Realty Corp (ADC) has 13.9x and even W. P. Carey (WPC) has 11.7x; one would say BNL is undervalued comparatively to their peers.

In conclusion, given BNL’s stronger balance sheet, liquidity being significant, paired with their diversification, believe a case can be made the company is undervalued in the current market conditions against their competition. It would appear BNL has upside from here, given the liquidity and the room to expand their operations post the healthcare simplification sales they had last quarter. Risk factors, though, would include if interest rates remain higher for longer, such as into 2026 and 2027, where a significant of their loans mature. Further, if we fall into a recession and consumers reduce spending, thus causing less of a need for companies to need industrial warehouse space, as goods would not be moving as swiftly as they are now, could pose a risk to BNL. To note, the dividend is safe and covered by AFFO, to which we should see another dividend increase possibly later this year, as BNL typically increases their dividend 2x per year. Therefore, income investors should keep their eye on BNL.

At current prices, I would be a buyer of BNL. Of course, I recommend performing your own research, as I am not an advisor. Thank you for reading, and I look forward to your comments.

Read the full article here