Written by Nick Ackerman, co-produced by Stanford Chemist.

Calamos Long/Short Equity & Dynamic Income Trust (CPZ) provides investors exposure to a dynamic portfolio comprised of shorting the market and investing in some of the largest market names. This creates a situation where each sleeve of the fund is working against the other. Though, it can be utilized a bit as a hedge or more tactically, this is one of the main problems with the fund, in my opinion.

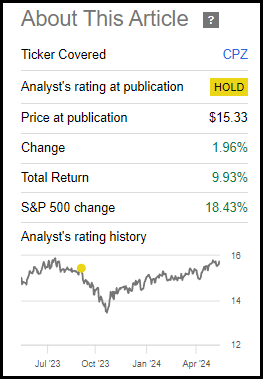

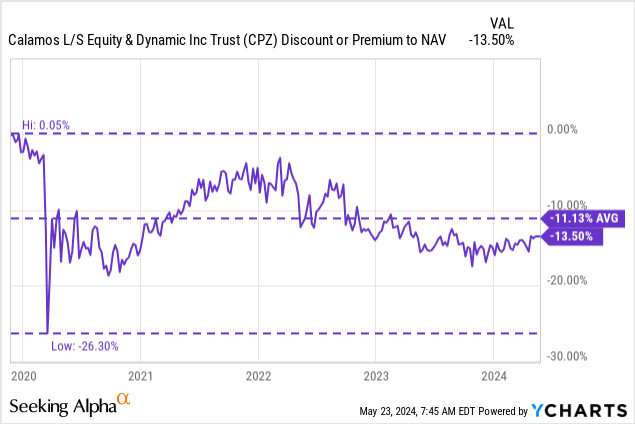

One of the more appealing features currently is the fund’s discount, which has slightly increased from our last update. The discount widening had a small impact on the fund’s total returns relative to the S&P 500 Index (SP500).

CPZ Performance Since Prior Update (Seeking Alpha)

CPZ Basics

- 1-Year Z-score: 1.18

- Discount: -13.50%

- Distribution Yield: 10.75%

- Expense Ratio: 2.11%

- Leverage: 25.42%

- Managed Assets: $472 million

- Structure: Term (anticipated liquidation date, November 25, 2031).

CPZ’s investment objective is to “seek to provide current income and risk-managed capital appreciation.” They also add that the fund “seeks to provide hedged market exposure built around Calamos’ time-tested global long/short equity strategy.” The portfolio fit they mention, “the fund may be appropriate for risk-conscious investors who want to put capital to work in pursuit of income and capital appreciation.”

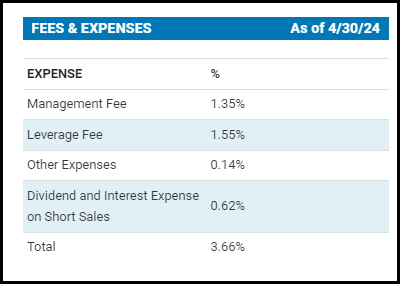

The fund’s expense ratio is high, and that comes with the nature of shorting investments. Being short means they are paying the dividend and interest expenses on those short sales. Further, the fund utilizes leverage to enhance overall performance. Leverage adds more volatility and risks, as the attempt to increase performance also means increasing the potential downside. Additionally, that leverage comes with its own costs, and when totaling it all up, the fund’s expense ratio comes to 3.66%.

CPZ Expenses (Calamos)

Limited Reasons To Own

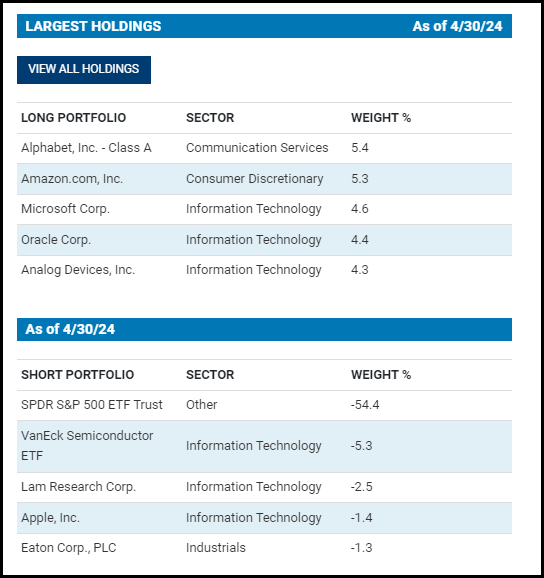

Over time, the stock market tends to have a general upward trend, which can make shorting extremely difficult. You have to get right on your timing and on what you are shorting to be successful. In CPZ’s case, they are interestingly shorting the SPDR S&P 500 ETF (SPY) while simultaneously being long the largest contributors to the index. Those include Alphabet (GOOGL), Amazon (AMZN) and the largest SPY position at this time, Microsoft (MSFT).

CPZ Largest Holdings (Calamos)

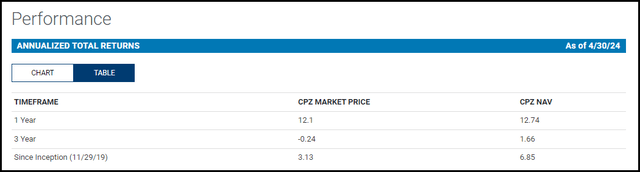

This can create a situation where one side of the portfolio is actively working against the other. The positioning here ensures you will never outperform in terms of beating out something like SPY. However, the fund has produced some positive results in its life-at least on a total NAV return basis-in each of the standard annualized measuring periods.

CPZ Annualized Performance (Calamos)

For some context, we can take a look at the fund’s performance over the last three years relative to SPY. To be fair, though, the fund also holds a meaningful sleeve of fixed-income and preferred instruments.

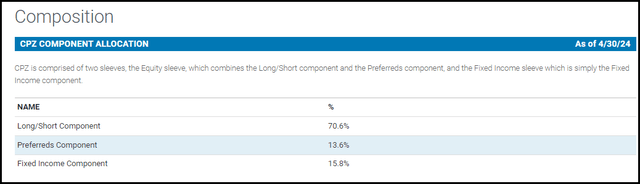

CPZ Asset Allocation (Calamos)

The fixed-income sleeve is primarily focused on high-yield corporate debt.

CPZ Fixed-Income Exposure (Calamos)

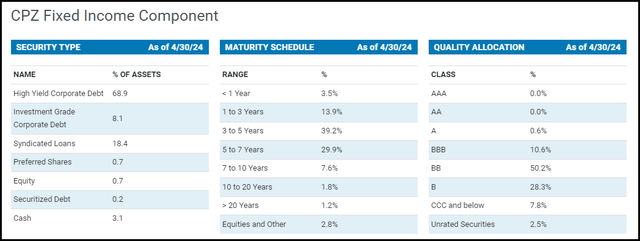

So, we’ll also include the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and the iShares Preferred and Income Securities ETF (PFF) for comparison purposes.

YCharts

When including those, we can see the relatively lackluster results, and that’s at least a partially contributing factor to CPZ’s weaker performance as well. Of course, with SPY returning 33%+ the last three years and the fund actively shorting the position, that isn’t going to help the fund either.

Shorting SPY isn’t anything new for this fund, either, as it is a regular staple in the fund and its “differentiating” factor. The last time we took a look at the fund, it was short at a similar weight of ~55%. Therefore, the actual stock picking on where they are choosing to be short doesn’t really appear to be what they are going for. Instead, they are just taking a buckshot approach and shorting the entire market.

Having a differentiating factor isn’t always a good thing either, but there are some limited cases where the fund could have appeal for an investor.

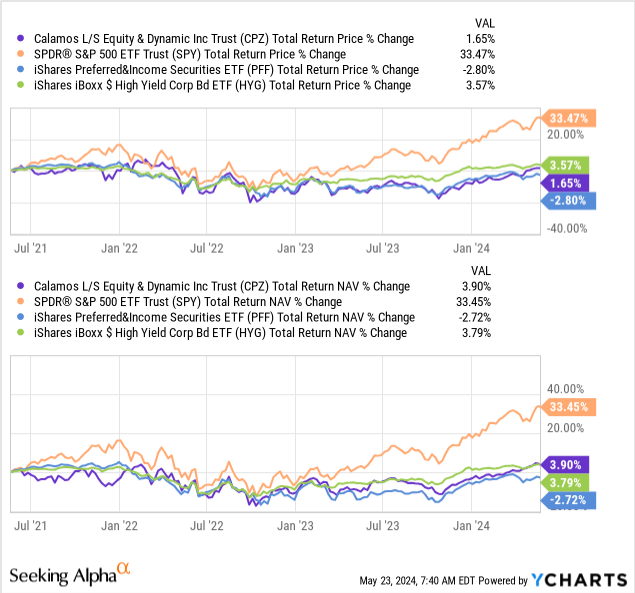

Reason #1: Appealing Discount

First, if they believe the fund’s discount may narrow in the future, that could be one of its attractive features currently. On that front, the appeal is limited because the actual relative discount to its historical level isn’t actually trading at an outsized discount. Even the 1-year z-score for the fund currently suggests that the fund is on the richer side on that basis.

YCharts

Unless an activist pushes the fund to do something about this discount, it wouldn’t appear that will be a major catalyst. Which, actually, just happens to look like Saba Capital Management does own around 5% of the fund. Saba nudged PIMCO into changing the PIMCO Dynamic Income Strategy Fund (PDX) back into a more PIMCO-like strategy of being a multi-sector bond fund, as it was formerly a fund focused heavily on energy.

Having Calamos switch CPZ into a long-only fund focused on equities and convertibles could be a viable strategy for the fund. Another interesting prospect could be to merge CPZ into their Calamos Strategic Total Return (CSQ) fund. So that will be something to keep an eye on if anything develops there. Saba seems completely focused on BlackRock more recently, so it could take a while.

As a term structured fund, one could expect to get NAV in the future. However, with the term not until 2031, there is some time before that becomes a real factor.

Reason #2: Hedging

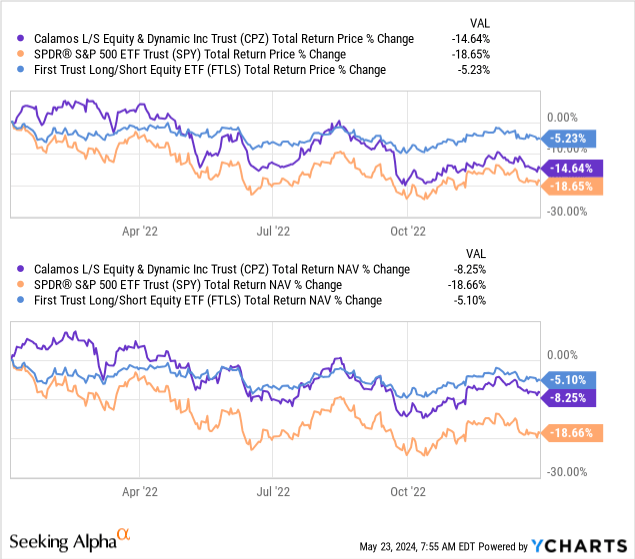

A second case to be made for this fund would be for hedging purposes. Having that short sleeve plus fixed-income component can mean more limited losses during a bear market. 2022 is the latest example of a longer, more drawn-out bear market. During that time, CPZ’s NAV declined materially less relative to SPY.

Given the discount/premium mechanic in CEFs, though, it meant that the fund’s total share price return was weak anyway. So, even this hedging factor can have limited success given the wrapper type of being a CEF and seeing wider discounts during volatile markets. Instead, something like the First Trust Long/Short Equity ETF (FTLS), being an ETF that doesn’t trade at the same type of wild discount/premiums, could have been a better bet.

YCharts

It also comes down to timing; if you can predict when the next bear market is, I guess you wouldn’t invest in these funds in the first place. You’d either go into heavier allocations of cash or simply short the market yourself.

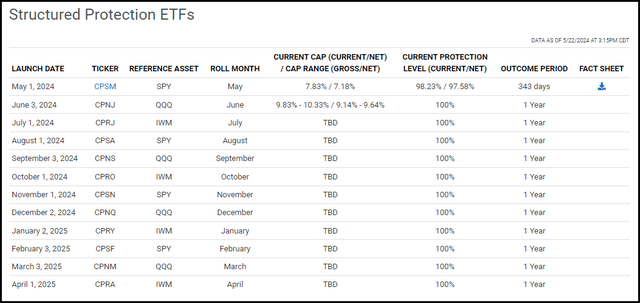

On this point as well, if you really want to stick with Calamos, they now offer “buffer ETFs” or “structured protection ETFs.” Those are ETFs designed to give limited downside, but that comes with limiting upside as well. The funds can participate in upside to a certain cap. Like any investment, though, the upside is not guaranteed. You could end up holding the fund for an entire outcome period and never make a return. In fact, if the market just moves sideways, you’d lose out with the 0.69% expense ratio.

Calamos Buffer ETFs (Calamos)

That said, if you are looking for funds that can provide hedging in the first place, the up to 100% downside protection that these buffer ETFs can offer should have some appeal. These new offerings were brought to my attention thanks to a reader recently; I had not previously realized that these ETFs existed, and they could be something worth exploring further in the future.

The Calamos S&P 500 Structured Alt Protection ETF (CPSM) is the only one currently trading, but they are set to launch a new one every month for the next year.

Reason #3: Distribution

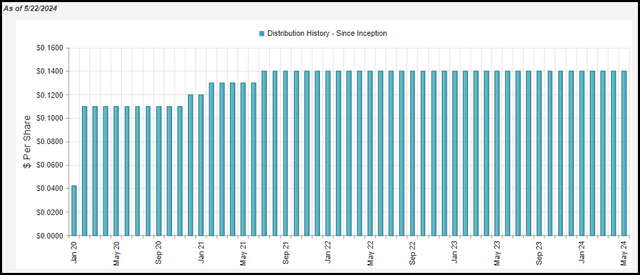

A third potential reason that an investor may choose CPZ could be for the monthly distribution. That certainly has appeal to income-focused investors.

CPZ Distribution History (CEFConnect)

On the other hand, a CEF can pay out what it would like as long as the NAV remains above $0. Therefore, the 10.75% distribution yield may have appeal, but it doesn’t mean it is being earned. At an NAV rate of 9.30%, that’s what the fund would have to earn going forward to support this payout. At least historically, we already saw that the fund wasn’t able to achieve that.

Conclusion

Given the unappealing positioning of Calamos L/S Equity & Dynamic Inc Trust’s portfolio-at least in my opinion-I would continue to lean toward being more negative on this fund. Even the reasons I could come up with to own the fund come with their own glaring issues.

I wouldn’t give it a “Sell” rating because the fund’s discount does have some appeal at this current level. Further, it isn’t that the fund will likely produce bad performance necessarily, but it should only continue to produce middling results. I’m a big fan of Calamos, but for me, Calamos L/S Equity & Dynamic Inc Trust ultimately remains a pass.

Read the full article here