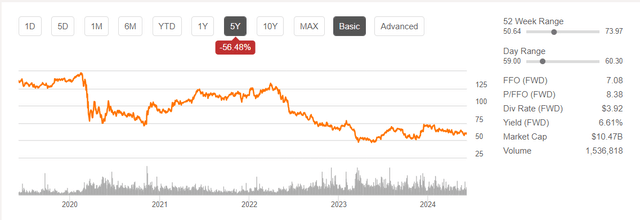

Boston Properties, Inc (NYSE:BXP) is a real estate investment trust (“REIT”) that specializes in owning/leasing primarily office buildings in major metropolitan areas across the United States. The challenges in office real estate have not evaded Boston Properties as the company’s share price is down more than 50% from early 2022. Recently, BXP announced that leasing activity had improved due to their increase in market share. Upon review of the company’s financial trends, I remain intrigued, but committed to the sidelines.

Seeking Alpha

Boston Properties First Quarter Financial Performance

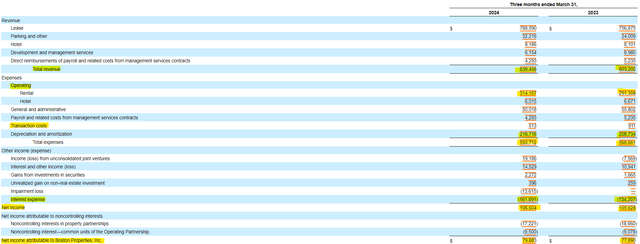

Boston Properties saw improved financial performance in the first quarter. The company’s revenues grew by $36 million to $839 million compared to the same period a year ago. Expenses grew, but by less than revenue growth, with operating expenses up $25 million and SG&A costs down $5 million. Boston Properties’ positive variance was nearly entirely consumed by the $27 million increase in interest expenses to $162 million. Overall, net income rose slightly, which may not be impressive in the grand scheme of things, but noteworthy for a company invested in office properties.

SEC 10-Q

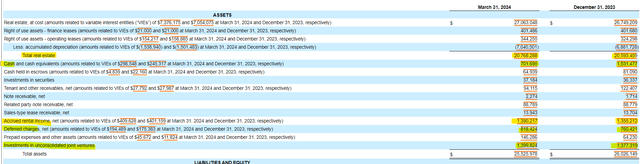

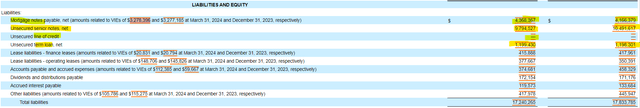

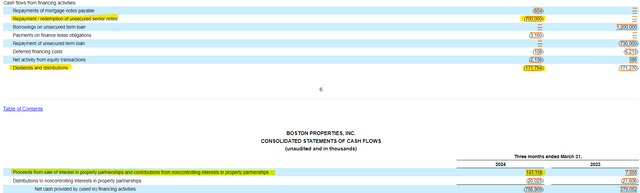

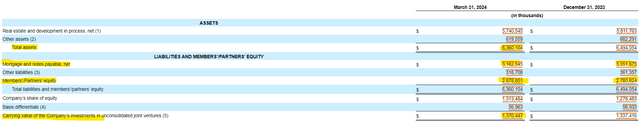

Boston Properties’ balance sheet had a rather uneventful first quarter. Investors should note that the primary asset on the company’s balance sheet is real estate assets, but accrued rental income, deferred charges, and investments in unconsolidated joint ventures are also notable components. Cash fell from $1.5 billion to $700 million in the first quarter. A good chunk of that cash decline likely came from the $700 million drop in unsecured notes, partially offset by the $200 million increase in mortgage notes. The company also has a rested line of credit. Shareholder equity grew by nearly $100 million to just under $8.3 billion in the first quarter.

SEC 10-Q SEC 10-Q

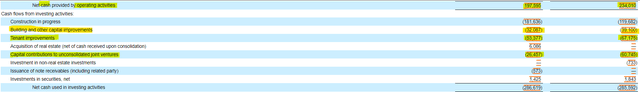

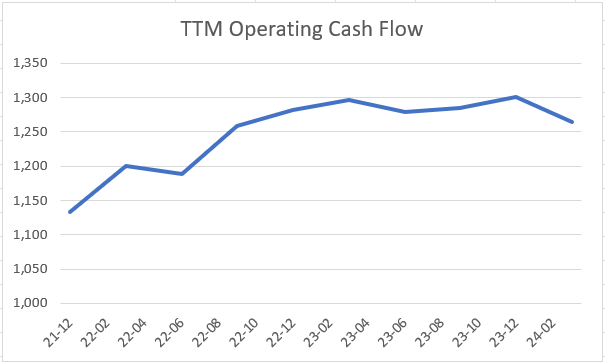

Boston Properties’ cash flow statement can shine some light on its ability to pay its dividend and pay down debt. Operating cash flow in the first quarter decreased by $37 million to $197.5 million. Excluding construction in progress, free cash flow was $86 million compared to $68 million a year ago. The increase in free cash flow was due to lower capital expenditure. Fortunately for investors, Q1 operating cash flow is historically the lowest quarter of the year and operating cash on a trailing 12-month basis has risen since 2021 and remains stable.

SEC 10-Q TIKR

Boston Properties’ major cash drawdown came from the company paying off $700 million in unsecured notes. Most of the remaining cash burn was sourced from the construction in progress expenditures and to fund the dividend but was partially offset by the sale of interest in a partnership. While Boston Properties does not need to borrow or sell assets to fund its dividend, these cash flow metrics are worth continued monitoring.

SEC 10-Q

Strengths in Leasing Rates and Joint Ventures

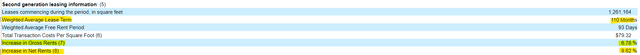

There are a couple of promising areas for Boston Properties. First, the company is seeing healthy increases in lease renewals, with the average lease renewal lasting nine years and increases just under 7% in gross rents and over 9.5% in net rents. The second area is the performance of the unconsolidated joint ventures which seem poised to return capital to the parent company as the culmination of joint ventures paid down debt by nearly $200 million in the first quarter.

SEC 10-Q SEC 10-Q

Identifying and Understanding the Risks

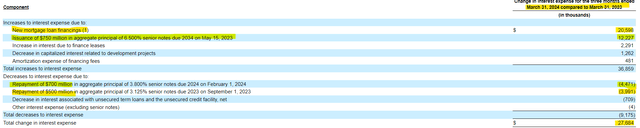

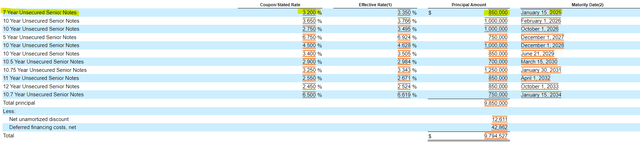

With the challenges facing the sector, investors should be extra vigilant when monitoring the risks associated with Boston Properties. The first risk is interest expense. Over the past year, Boston Properties has seen a $28 million increase in interest costs, associated with the issuance of new mortgage debt and a new unsecured bond. These increases came despite the payoff of an unsecured note with cash on hand and the overall decline in debt.

SEC 10-Q

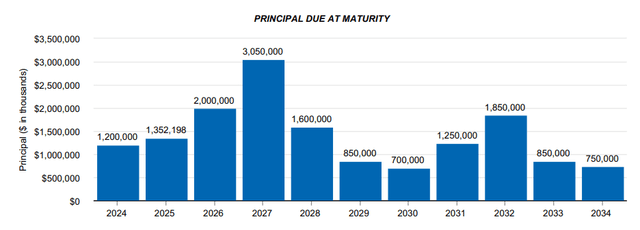

Over the next couple of years, the company will be experiencing an increasing amount of debt maturities, peaking at $3 billion in 2027. These maturities will expire at rates well below market and many will be refinanced at rates much higher. While investors expect interest rates to start easing soon, credit downgrades could further erode the cost of financing. Management is trying to keep up with this trend, but in the first quarter earnings call, they had to adjust FFO guidance lower to account for interest expenses.

Earnings Presentation SEC 10-Q Earnings Transcript

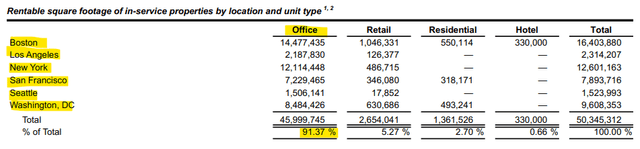

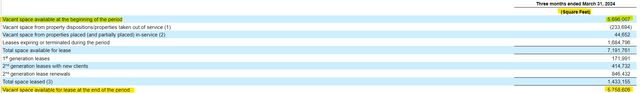

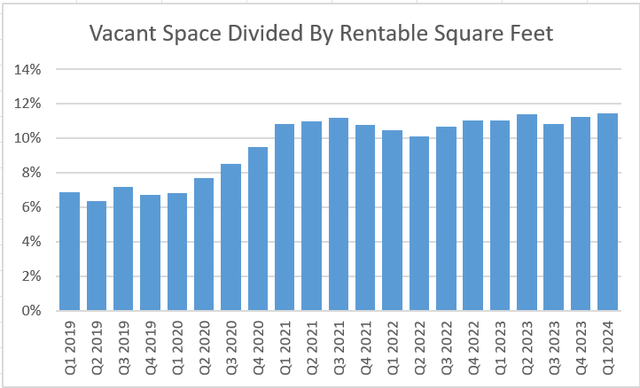

The other risk is vacancy. Boston Properties reports vacant space available for lease by square footage and total square footage, which is a useful way to monitor occupancy/vacancy. It’s important to keep an eye on this since Boston Properties’ portfolio is so concentrated in office and in metropolitan regions. Since early 2021, the vacancy rate has exceeded 10% after being around 7% prior to the pandemic. It was trending in the right direction in early 2022 but has since reversed and reached a new post-pandemic high. Meaningful progress here would go a long way towards making the stock attractive.

Earnings Presentation SEC 10-Q Calculation of Vacant Space to Rentable Space

Conclusion

Boston Properties has managed through the challenges of the office sector, but the recent pressure on its cash flow keeps me on the sidelines. The company is experiencing a slight tick up in vacancies and combined with higher interest expenses, is still facing headwinds. The premium between market capitalization and book value also raises the bar beyond what I am comfortable with. A positive change in occupancy on a sustained basis would go a long way to opening a position, until then, I will continue to wait.

Read the full article here