Maybe I’m just odd, but I have always loved interesting companies that have interesting business models. The more peculiar the business is, the bigger a fan I tend to become. So you can imagine my elation when, in December 2022, I first stumbled across Bowlero (NYSE:BOWL), a publicly traded company that operates traditional bowling centers and other entertainment concepts. Examples of these include facilities that have lounge seating, arcades, enhanced food and beverage offerings, and more.

In my most recent article about the company, published in June 2023, I ended up rating it a ‘buy’. Strong same store sales growth and continued physical expansion impressed me about the company. Shares of the business were also attractively priced at the time. That led me to make the case that attractive upside could be on the table. But since then, things have not gone according to plan. Shares have actually seen a downside of 6.5%. That compares to the 25.3% increase seen by the S&P 500 over the same window of time. You would think, given this weakness, that the company’s fundamental condition was worsening. If we confine results to 2023, that would be false. But 2024’s results so far have been mixed. Despite this, shares look attractively priced, and the business appears to offer enough upside to justify the ‘buy’ rating I assigned it previously.

Not bad, but it could be better

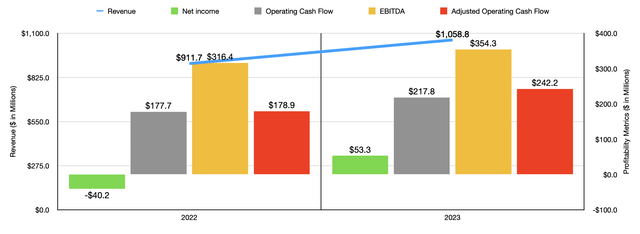

Fundamentally speaking, things have been mixed with Bowlero. In 2023, the company finally surpassed $1 billion in revenue, hitting $1.06 billion in all. This represents a 16.1% increase over the $911.7 million generated one year earlier. This increase was driven in part by a rise in the number of locations in operation from 317 to 328. The company also benefited from higher same store revenue in the amount of 12%. That increase was due to strong demand for the company’s services. In addition to this, the firm also benefited from a 51% surge in revenue associated with media, as well as new and closed locations, with most of that associated with the addition of locations that I mentioned.

Author – SEC EDGAR Data

With revenue rising, the bottom line for the company improved drastically. The company went from a loss of $40.2 million in 2022 to a gain of $53.3 million last year. Even though the firm’s gross profit margin contracted, its selling, general, and administrative costs decreased by $42.8 million. This was mostly thanks to the $68.4 million in transaction costs during the 2022 fiscal year that did not repeat in 2023. The company also benefited from an $84.2 million income tax benefit that dwarfed the $0.7 million benefit reported one year earlier. Without this, profits in 2023 would have been negative as well. Other profitability metrics followed a similar trajectory. Operating cash flow went from $177.7 million to $217.8 million. If we adjust for changes in working capital, we would see an increase from $178.9 million to $242.2 million. And lastly, EBITDA for the enterprise grew from $316.4 million to $354.3 million.

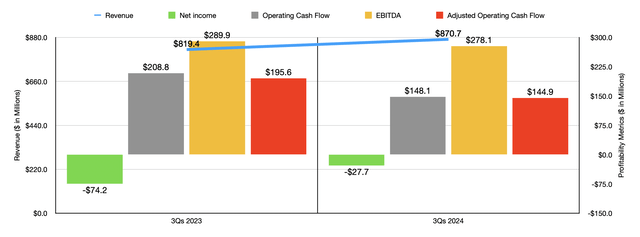

Author – SEC EDGAR Data

Strong performance for the business did not, unfortunately, continue into the 2024 fiscal year. The big exception to this was revenue, which grew from $819.4 million in the first three quarters of 2023 to $870.7 million at the same time this year. But the bottom line took a hit during this time. Part of this was because the firm’s gross profit margin contracted from 34.8% to 28.3%. That worsening was actually due to a rise in location count that caused various costs to grow to the tune of $88 million year over year. There were other pain points as well. For instance, net interest expense jumped from $80.1 million to $130.6 million. Higher interest rates, as well as an increase in debt, was responsible for this. Other profitability metrics also worsened during this time. Operating cash flow fell from $208.8 million to $148.1 million. On an adjusted basis, it dropped from $195.6 million to $144.9 million. And finally, EBITDA for the company contracted from $289.9 million to $278.1 million.

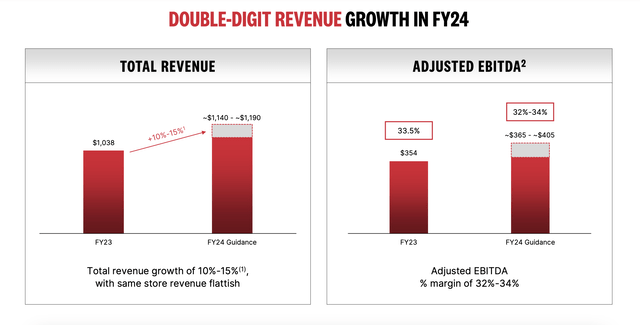

Bowlero

Despite these pain points, management seems optimistic. Excluding service fee revenue, the company expects revenue this year to grow to be between $1.14 billion and $1.19 billion. They also believe that EBITDA will come in at between $365 million and $405 million. At the midpoint, that would be 8.7% above what the company achieved in 2023. However, in the firm’s third quarter earnings release, it did say that investors should expect these results to be near the low end of the range. So for the purpose of this article, I’ll be using EBITDA of $365 million. This should translate to adjusted operating cash flow of around $249.5 million. This growth should be driven in part by significant investments being made. Management anticipates $190 million worth of acquisitions. That’s up from the $160 million originally planned for the year. This is on top of $40 million dedicated to new build facilities and $80 million spent on conversions and other growth initiatives. The latter of these is up from the $75 million initially planned for 2024. On top of this, the company also intends to spend $45 million on maintaining existing operations.

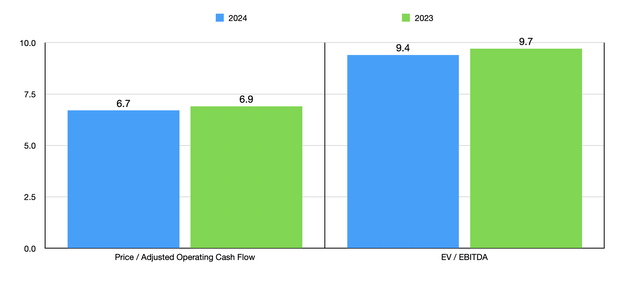

Author – SEC EDGAR Data

Assuming this comes to fruition, shares look quite cheap, both on an absolute basis and relative to similar enterprises. In the chart above, you can see how the stock is priced using historical results from 2023 and estimates for 2024. I then compared the company to five firms that have similarities to it as shown in the table below. On a price to operating cash flow basis, only one of the five companies was cheaper than Bowlero. This increases to only two of the five when using the EV to EBITDA approach.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Bowlero | 6.9 | 9.7 |

| Cedar Fair (FUN) | 6.0 | 8.8 |

| Six Flags Entertainment (SIX) | 7.6 | 12.6 |

| Topgolf Callaway Brands (MODG) | 8.7 | 10.6 |

| Xponential Fitness (XPOF) | 13.3 | 9.0 |

| Vail Resorts (MTN) | 12.6 | 12.8 |

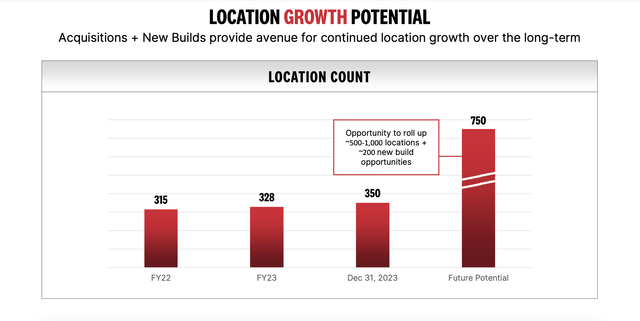

As value investors, we should also be focused on long term growth, not just short-term growth. And the good news is that management is very transparent about their goals. For starters, the company is working on converting over 150 of its locations to a more upscale format. This is costly but the end result is a 25% increase, on average, in total returns. Management is also looking at other opportunities. For instance, they believe that there exists around 200 new build opportunities on the market as the company scales from around 350 operating locations at the end of last year to the ultimate target of around 750. They did say that this number could grow to as much as 1,000 locations, and that’s excluding the 200 new build opportunities.

Bowlero

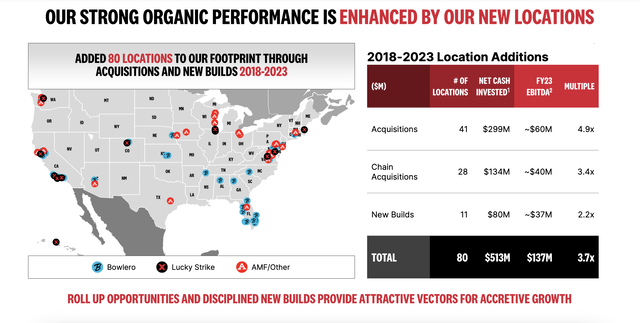

Of course, this doesn’t come cheap. From 2018 through 2023, for instance, the company acquired 41 different locations for $299 million. This was on top of 28 chain acquisitions for $134 million and 11 new builds for $80 million. All told, the cost to shareholders was $513 million. But the great thing is that the total effective EV to EBITDA multiple of these investments was about 3.7. That’s well below what the company as a whole is trading at during this time.

Bowlero

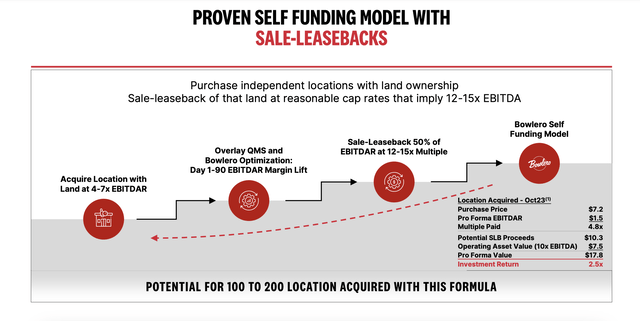

As the company expands, it is looking for other ways to create value for shareholders. It has already experimented in the past with sale leaseback transactions. In the image below, you can see precisely how that particular scenario has worked out in the past. And management believes that around 100 to 200 locations could ultimately follow this particular formula, with massive investment returns likely to follow.

Bowlero

Takeaway

Due to financial performance on the bottom line so far this year, shares of Bowlero have experienced some weakness. However, investors should be focused on the long haul. And even if financial performance doesn’t improve much from here and only matches what management forecasts, the stock looks very cheap, both on an absolute basis and relative to firms that have some similarities to it. Due to this, I see no reason to be anything other than bullish on the company long term. And because of that, I have decided to keep the firm rated a ‘buy’ for now.

Read the full article here