BYD Company Limited (OTCPK:BYDDF) is a leading Chinese electric vehicle brand that continues to see strong momentum in its core market in China as well as abroad. BYD is aggressively expanding, seeking markets in countries outside of China in a bid to establish itself as a leading EV brand with global appeal. While the company is entering new markets, growing its deliveries, and already posting profits, the Chinese EV brand is massively undervalued, in my opinion, especially with regard to Tesla, Inc. (TSLA). I believe the risk profile is very much skewed to the upside with BYD, especially as the company recently launched the highly competitive Seagull EV with a domestic price sticker of less than $10k and I believe investors are overly fearful of investing in Chinese EV companies!

Previous rating

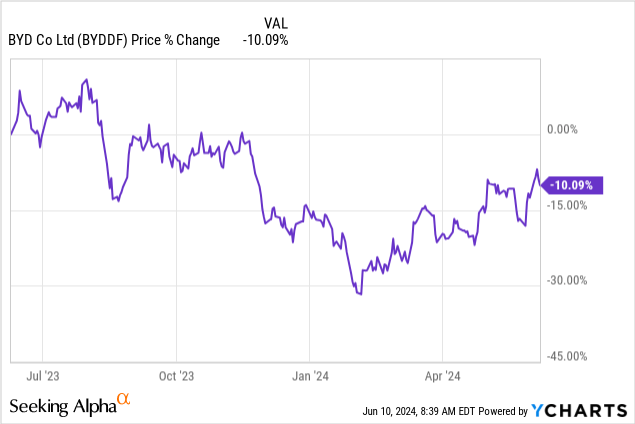

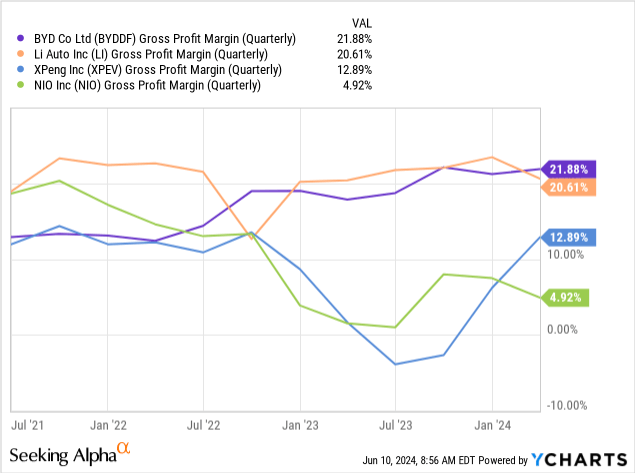

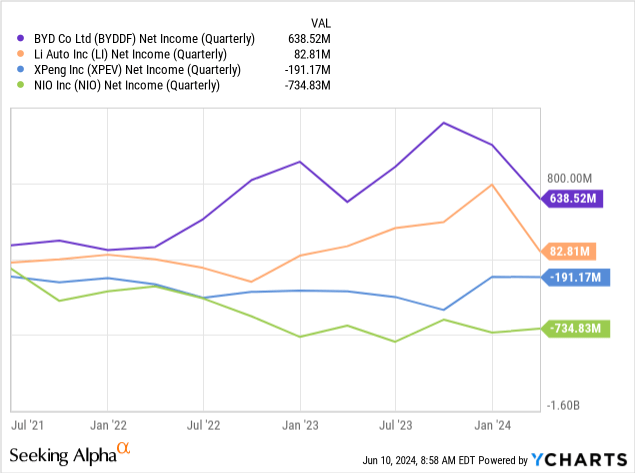

I recommended shares of BYD in March 2024 due to BYD’s combination of record deliveries and the fact that the EV company was already profitable, which is a key advantage over many start-up companies that are struggling with their vehicle margins in light of growing competition and waning demand: Why I Believe BYD Is The Lowest Risk EV Play. XPeng Inc. (XPEV) and NIO Inc. (NIO) especially struggled with their vehicle margins last year, although both companies have seen a bit of an improvement lately. BYD is leading the Chinese market segment in terms of gross margins and the company’s low-priced Seagull could strike fear into the hearts of its EV rivals.

Continual export momentum, potential Seagull introduction in Europe, margin lead

BYD is possibly the biggest threat to Tesla, Inc. (TSLA) as the Chinese EV brand is focused on aggressive international expansion. The EV maker recently made waves by launching an electric vehicle model, the BYD Seagull, with a price sticker of less than 70k Chinese Yuan ($10k). The Seagull represents a considerable threat to higher-priced electric vehicle models, especially those produced in the U.S. where an EV easily costs $40k or more. A possible introduction of the Seagull in Europe, or the U.S., would also send shockwaves through the industry and indicate growing pricing pressure and rising margin woes at U.S.-based electric vehicle companies.

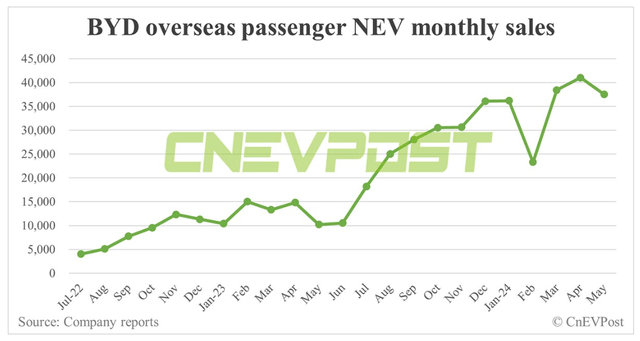

The Seagull is so far available in Mexico and Colombia, but the company is seriously evaluating bringing the Seagull to Europe and the U.K. in FY 2025 which could increasingly cut into Tesla’s market share and strike fear into other EV companies. BYD’s overseas sales are already soaring: in the month of May, BYD sold 37,499 electric vehicles abroad, showing a year-over-year increase of 267.5%. Earlier this year, BYD even said that it was looking at establishing local production in Hungary to service the European market. Hungary could therefore be a springboard for BYD and deliver significant market share growth.

BYD, InsideEVs

The company’s success in export markets has had a chilling effect on the competition which rightly fears that Western EV companies could lose out in a price war against lower-cost producers like BYD that bring more affordable EV options to consumers. BYD is the most profitable EV company in China and leads the industry in terms of gross margins.

CNEVPOST

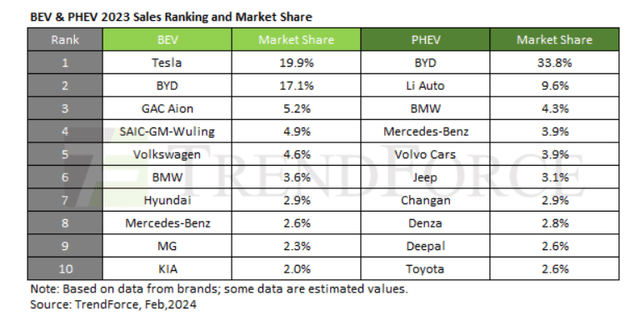

According to market research firm Trendforce, BYD is currently the second-largest battery-powered electric vehicle company in China, after Tesla, with a market share of 17.1%. BYD is leading in plug-in hybrid sales, however, where the company has a market share of 33.8%. BYD started selling its EVs in Europe only in FY 2021, so the company has a low market share in this region still. Company executives have said that BYD strives for a 5% EV market share in Europe (before the Hungary plant starts production in FY 2025). In FY 2023, BYD had a market share in Europe of approximately 1.1%. Growth in Europe, through the Hungary manufacturing plans, as well as expansion into Latin American markets are key catalysts for BYD’s top line and delivery growth in the near future.

Trendforce

One key advantage that BYD has is that it has considerable scale. The company produced 3.0M vehicles in FY 2023, 1.6M of which were battery-powered and the remaining 1.4M were hybrid models. Due to its early start in the industry and its large scale, BYD offers some of the highest gross margins in the sector… allowing the company to compete aggressively on price.

BYD has a gross profit margin of 21.9% in the last quarter and even beat Li Auto Inc. (LI) which has the highest margins in the start-up EV group consisting of Li Auto, XPeng Inc. (XPEV), and NIO Inc. (NIO).

BYD is also, besides Li Auto, the only (large-scale) EV company that is already generating profits. NIO and XPeng are lagging far behind and are not expected to be profitable at least until FY 2027.

BYD is a bargain

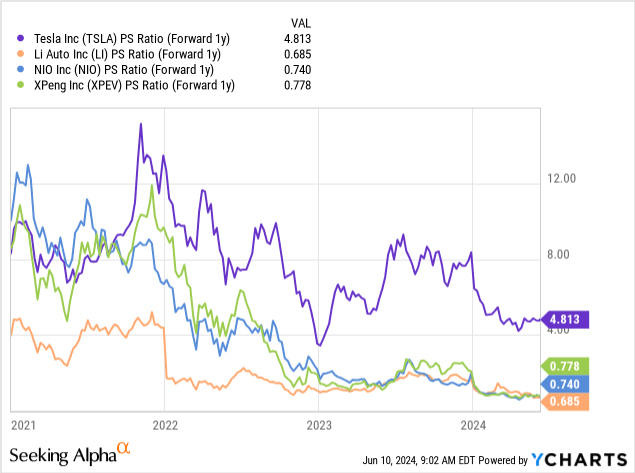

Besides considerable delivery momentum, strong margins and considerable profitability, I believe BYD convinces especially with its valuation. BYD is currently valued at a price-to-revenue ratio of 0.7X, which I have to use for comparison purposes. Most rivals in the electric vehicle market are not yet profitable, which means a revenue-based multiplier approach is the most reasonable.

Tesla obviously is still the biggest EV company in the world by market cap and revenue volume, but BYD is catching up… it even overtook Tesla in the fourth quarter in terms of deliveries, although the crown was handed back to the American company in Q1. Tesla is currently trading at a P/S ratio of 4.8X, which creates a significant valuation gap between the two companies. This gap is likely due to the fact that BYD is mainly operating in China which U.S. investors are not very comfortable investing in, in part due to the CCP’s attempts to interfere in corporate decision-making, especially in the technology sector.

I believe BYD could trade at least at a 1.0-2.0X P/S ratio as the company is already significantly more profitable than its Chinese rivals and is playing on the global stage. The EV firm also had a considerable delivery volume of 3M units in FY 2023 which makes it the most formidable competitor of Tesla. With a P/S ratio of up to 2.0X, shares of BYD could have a fair value of up to $84 and therefore have significant revaluation potential. BYD is expected to generate $122.2B in revenues next year and with a 2.0X price-to-revenue ratio, the EV firm could have a fair value market cap of approximately $244.4B. On a per-share level, this translates to approximately $84 as a fair value estimate.

For me, BYD is by far the most compelling growth story in the Chinese EV market, and even better than Li Auto’s, as the company went early into electric vehicle production… and the EV maker is now reaping the dividends.

Risks with BYD

The biggest risk for EV investors, as I see it, is an escalating price war in the industry that would hurt all companies, not just BYD. The proliferation of electric vehicles with low price points could exacerbate the margin situations of all EV companies, including BYD, smaller Chinese electric vehicle start-ups, and even companies like Tesla which are delivering a significant amount of EVs annually.

What I see much less as a risk is an investment in China itself… which I understand many U.S. investors disagree with. China’s CCP has tried to exert more control over the economy, especially during the 2020-2022 period, and cracked down hard on companies like Alibaba or Tencent that have monopoly positions in their respective industries. With the EV industry being competitive and consisting of multiple electric vehicle players, I don’t believe the industry is at risk of adverse government regulation or interference. BYD is also increasingly globally oriented which should help make shares of the EV firm only more interesting for electric vehicle investors.

Closing thoughts

I believe BYD is a top bet on the global electric vehicle market and the company is seeing considerable delivery momentum both in its domestic market and abroad. The introduction of the Seagull in international markets, but especially in Europe next year could boost the company’s EV market share and delivery volume, but it could also add margin pressure to the global electric vehicle industry. The biggest advantage that I see for BYD compared to Tesla especially is that the former is trading at a very attractive valuation, less then 1.0X revenue, which is a bargain considering how quickly the EV maker is growing its deliveries. In my opinion, BYD’s export momentum, strong profitability, and low valuation together make the EV company one of the most compelling investment options in the electric vehicle market!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here