Founded way back in 1836, Legal & General is a leading UK financial services group and major global investor and one of the world’s largest asset managers. They are a global leader in pension risk transfer, in UK and US life insurance, and in UK workplace pensions and retirement income. Their primary listing is on the FTSE [LGEN], but they have ADRs (OTCPK:LGGNY) and (OTCPK:LGGNF).

Legal & General is a household name in the UK (they helped me buy my first house in 1989) and is rated AA- by S&P.

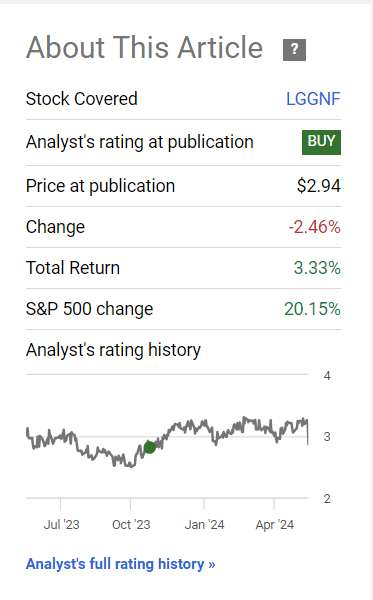

I have covered LGEN here and here. The first article took a deep dive into the business and its underlying advantages in the current macro environment, the second updated on business performance and introduced the new CEO, Antonio Simoes. In both articles, I rated LGEN a buy. Since my initial article, the share price has reduced by 2.45%, with a total return of 3.3% after the generous dividend.

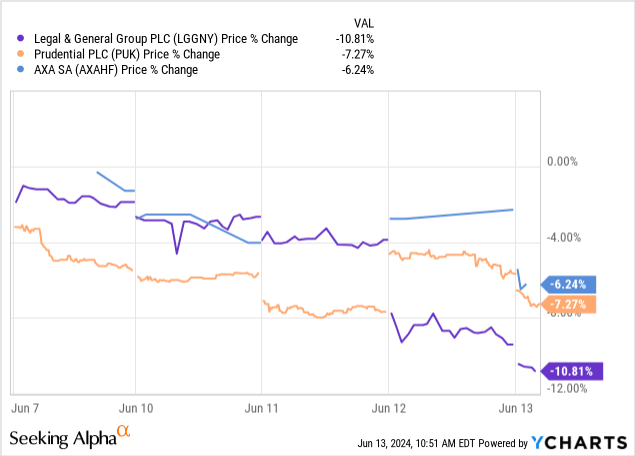

The share price movement is a tale of two parts, as initially the shares appreciated nicely, before a single day drop of some 6% on June 12.

Seeking Alpha

This clearly isn’t the way an investor likes to see his investments progress. It makes sense to have a look into the reason for the drop. This could be a trigger for a thesis revision, or an opportunity to add and dollar cost average.

So let’s see what is going on.

News On June 12

This was the day that CEO Simoes laid out his new strategic blueprint, during a special Investor Day. Here is the press release.

Key components

- Simplifying the operating structure – reducing from four to three operating divisions.

- Merging LGIM and LGC (profiled in my previous article) divisions into a single asset management business.

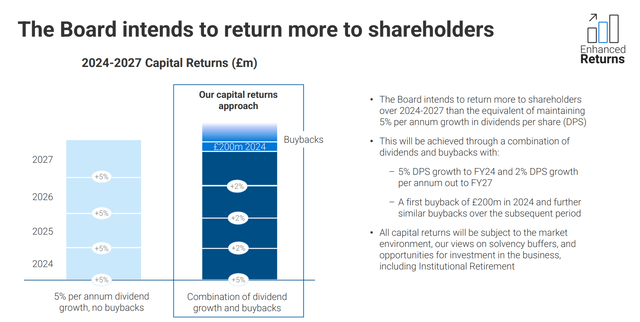

- Shifting from 5% dividend growth target to 2% dividend growth target

- Capital return via buybacks, starting with GBP 200m in 2024.

- New corporate investment unit to spin off ‘non core’ units.

- Grow operating profit by 6-9% CAGR 2024-2027.

- ROE of 20%

- GBP 5-6bn of operating surplus 2024-2027.

On face value, this all seems reasonable. The only controversial part is the shift in a 5% dividend growth CAGR to a 2% dividend CAGR supplemented by share buybacks. Bearing in mind that the business is throwing off 8% plus dividends already, and seeks growth in a highly capital intensive industry, this makes sense to me. Management commits to increasing shareholder returns, but shifts the mix to buybacks. This allows more operational flexibility, so management can return capital when timing is optimal.

Ongoing Strategy

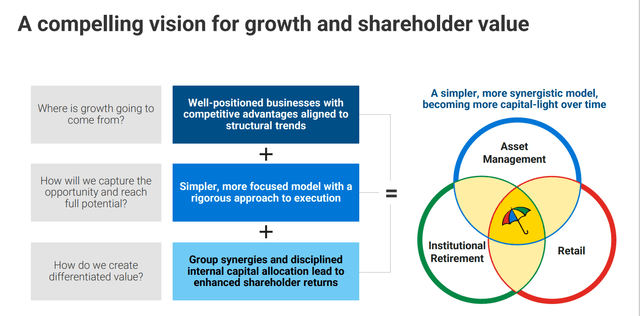

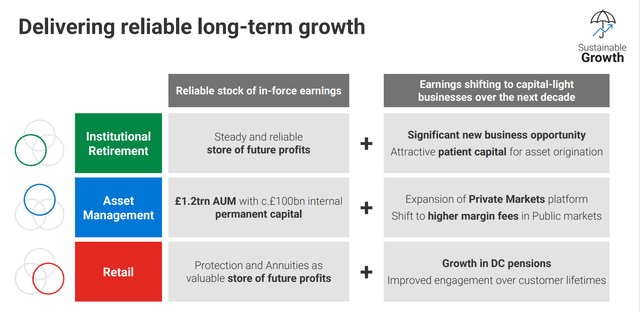

Simoes’ strategy is outlined in the Investor Day deck. The key focus is to support the structural shift in pension and savings from institution (employer and government) to individual responsibility. At the same time, a strong asset management arm to provide the long term revenue streams needed to finance longer living retirees. Other than the creation of the single asset management unit, this is consistent with the previous strategy.

LGEN

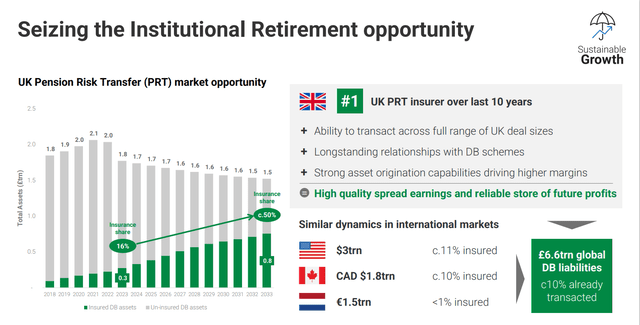

PRT continues to be a key area for growth – with a leading position in a growing UK market leading the way for PRT in US and other developed markets.

LGEN

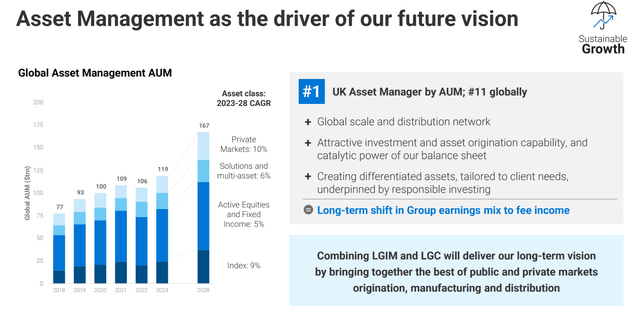

Combining the two asset management businesses into a single unit, to work across public and private markets. This should generate operation synergies and scale advantages for LGEN. I can see only upside from this change.

LGEN

Pushing the income mix towards fee generating businesses with lower capital requirements. Implicitly, lower capital business should mean lower volatility in earnings.

LGEN

The pack also clarifies the shift in shareholder return strategy, to de-emphasise a dividend growth commitment, and replace this with a mix of dividend growth and buybacks. The slide below makes the point well, that, with a 2% dividend increase coupled with sizeable buybacks, total returns to shareholders should increase.

LGEN

And In Other News

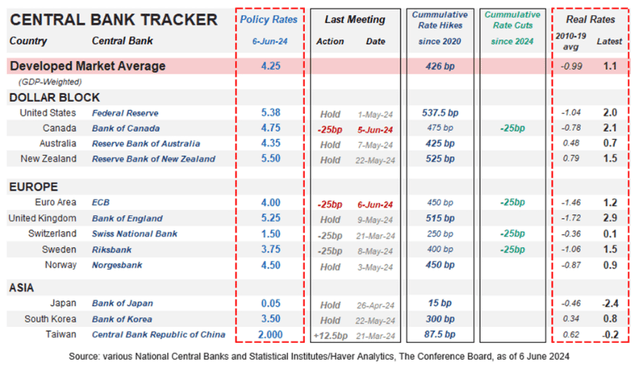

LGEN and other insurance stocks are great investments in higher interest rate environments, as they invest assets for the long term at current interest rates.

Although LGEN has a global business, the biggest currency exposure is in USD and GBP.

As per this article from Central Bank Tracker, interest rates are starting to ease in all the major currencies, with US and UK being the slowest.

Central Bank Tracker

However, coinciding with the June 12 Investor Day release, there was a very benign inflation print in the US. I am sure that readers are well aware of this, but in case Rip Van Winkle is out there, here is a Reuters report on the May data.

Comparing LGEN to European peers Prudential (PUK) and AXA (OTCQX:AXAHF) one can see that these softening rate expectations impacted the sector. Although LGEN has had the biggest decline in the group, not all can be put down to the strategy day ‘bombing’.

The Investment Thesis For LGEN

My investment thesis for LGEN was based on a strong strategic position to capitalise on key macro trends.

Interest rates higher for longer

The BOE has set the current GBP base rate at 5.25%. The expectation is that they might cut once or twice during 2024. In USD, there is a similar outlook. This is a mean reversion which benefits the LGEN business model. Their investment portfolio will generate higher returns, with the new premiums reinvested at higher rates. While rate reductions do impact their returns, recent new business written will be supported by long term investments at current rates, and future new business will be priced using forward looking rate assumptions.

Ageing population and welfare reforms

An uptick in the retirement population which is set to continue fuels business demand for LGEN pensions business. New business growth is further supported by reforms of the pension system, which empowers retirees to be more self-directed in their pension provisions.

UK economic recovery

The UK economy was badly impacted by Brexit going into Covid, and the subsequent shocks of Covid and recent inflation have created significant economic challenges. The UK economy however, is expected to return to growth, with forward estimates in the low 2% range.

In addition to these macro factors, LGEN sees significant growth opportunities in the US and Internationally with its expertise in PRT transactions. These transactions help companies and governments with large pension liabilities to reduce their exposure and access capital markets.

Of these macro trends, the only change is in the forward view of long term interest rates.

LGEN will clearly have factored in a moderating rate environment into their 3-year target of 6-9% CAGR in operating profits.

Summary & What I Will Do

- LGEN is a business which has managed well through difficult times.

- Recent results have shown improving performance.

- Valuation vs peers remains enticing.

- The business is well positioned for macro trends.

- The new strategy is VERY consistent with the existing, but with some added efficiencies and possible housekeeping to shed non core assets.

- Financial goals restated to offer a 6-9% CAGR in bottom line.

- The 8%+ dividend to grow at 2% vs 5% – but buybacks to more than fill the gap.

- Share-price gapped down on news which was overall positive, which begs the question ‘What were they looking for?’

In a nutshell, I can see no compelling rationale for the gap down in price. The price had not run up dramatically in anticipation of a game-changing strategy. What was delivered seems sensible, progressive, but appropriately cautious for a large risk taking business. At these levels, I am happy to own more LGEN in my own account. I have some short puts expiring Jun 21 at around today’s price, so expect these to be assigned. That will increase my position by 25%. Absent these puts, I would buy more.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here