I Mean, Look at This Chart

Nvidia reports off-cadence, so their latest quarter ended in April, not March like the other 2. (Quarterly earnings reports)

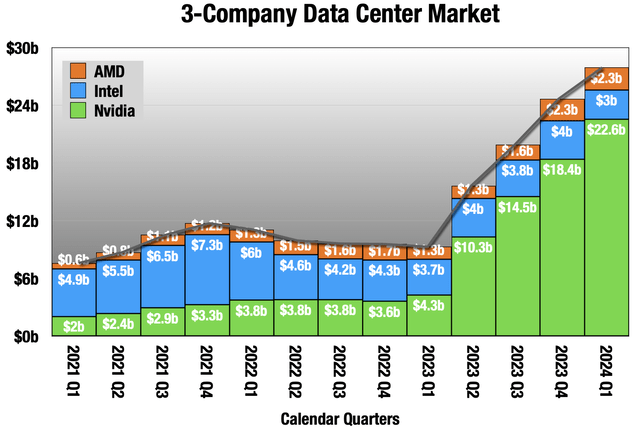

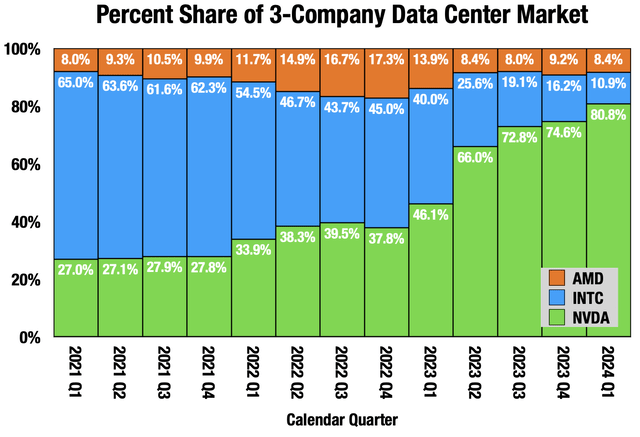

I struggle to find anything new to say about NVIDIA Corporation (NASDAQ:NVDA), and the rapid growth of their data center segment, up 427% YoY in their Q1 ended April. Nvidia is crowding out other data center investments, especially CPU servers:

Nvidia reports off-cadence, so their latest quarter ended in April, not March like the other 2. (Quarterly earnings reports)

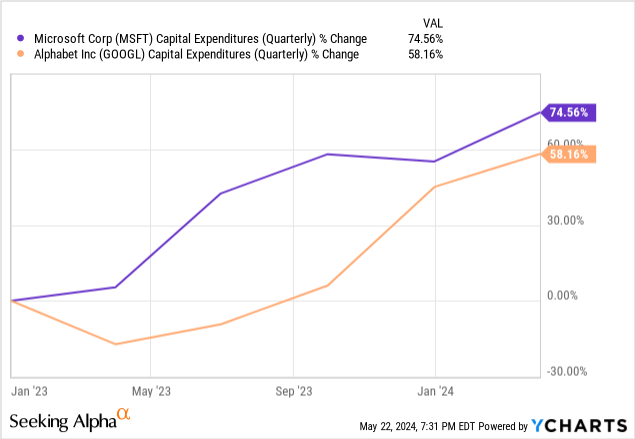

And they are causing ballooning capital expenditures for their customers.

Extraordinary.

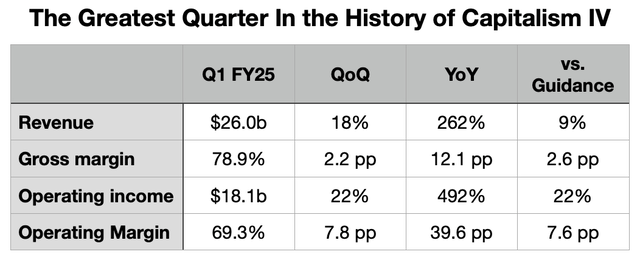

The quarter:

Nvidia Q1 reporting

Not only are they beating up their comps, but they are also beating up their own guidance from 3 months ago (right column). This is the 5th quarter in a row guidance has not been close.

What else is there to say about this kind of performance, except to ask when it ends? Not yet.

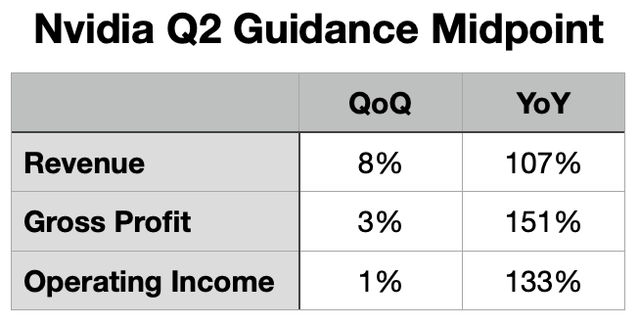

Guidance

Here are three things we know:

- Demand for Nvidia GPUs far exceeds their ability to supply.

- The primary bottleneck is Taiwan Semiconductor Manufacturing Company Limited’s (TSM) advanced packaging capacity. They have had to triple it over 18 months beginning last August. That makes them a little more than halfway through the build out in June 2024.

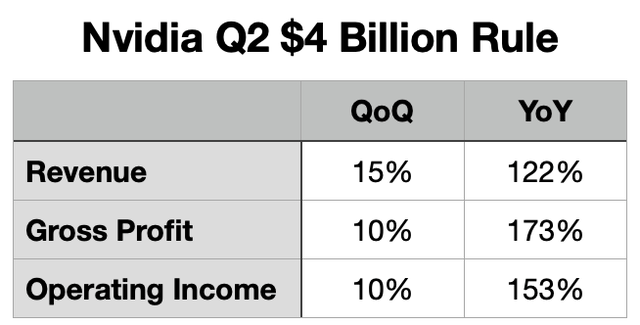

- Since TSM began that build out, Nvidia has been able to add roughly $4 billion to data center revenue in each of the 3 quarters so far.

- Nvidia’s guidance has been for adding about $2 billion a quarter, but the pace of TSM’s advanced packaging build out seems to be quite a lot faster than that.

When asked the morning of Nvidia earnings what I thought Nvidia’s revenue would come in at, I threw out $26 billion, glibly. What I really meant was roughly last quarter plus $4 billion. $26 billion turned out to be exactly right.

They are again guiding to that $2 billion lift sequentially.

Nvidia guidance; Trading Places Research

And here’s what it looks like with my “$4 Billion Rule” applied.

Nvidia guidance; Trading Places Research

If you note, those YoY numbers are still in the triple digits, but mark a rapid deceleration from the last 4 quarters. Revenue was up 262% YoY in the reported quarter. You may have noticed that this is The Greatest Quarter in the History of Capitalism IV, which by my count makes a year. So we are out of the easy YoY comps from before this all began in earnest, and into more difficult comps that will mean lower growth rates, though still triple-digits

That opens up the possibility of a deceleration narrative creeping in next quarter, despite the triple-digit growth rates. I think expectations are well anchored around this, but you never know what the reaction will be.

You may also notice a loss of margin built into those numbers. This comes from 2 sources:

- Cost-of-revenue has been depressed by lower component costs, which they have been warning us will end this year. They look to lose 2-3 percentage points of gross margin to this.

- Operating expenses are growing at 40%+ a year. With triple-digit revenue growth, that is of little concern, but at some point that will bite if they keep it up.

So the outlook is more outrageous growth, offset by some margin shaving. My modeling puts their 1-year forward PE as something like 33x, which is not that high for this growth and these margins.

Nvidia Is Taking All the Money

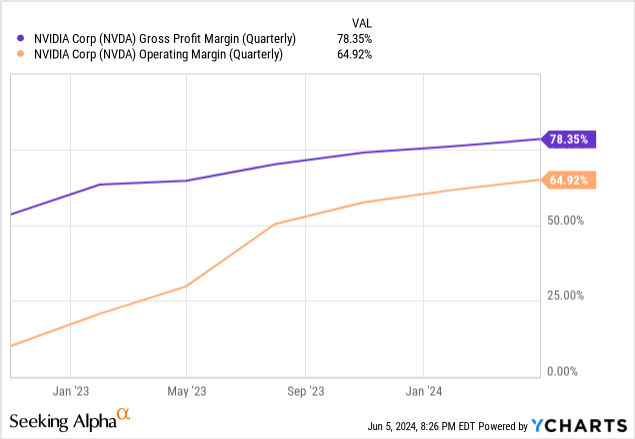

A couple of weeks after Nvidia reported, we got reports from 2 of their customers in the server market: Dell Technologies Inc. (DELL) and Hewlett Packard Enterprise Company (HPE). So much of the expense of these GPU servers goes into Nvidia hardware, and they are leaving scraps for everyone else. The best evidence of the supply-demand dynamics is Nvidia’s booming margins.

That 78% gross margin is unheard of for data center hardware. Nvidia can get that kind of markup because of the demand, and still constrained supply. They have little true competition (yet), and face little price pressure from that.

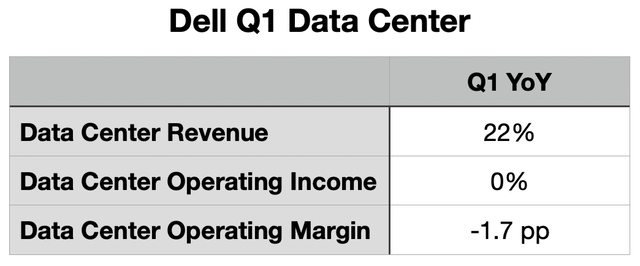

Nvidia is leaving scraps for their customers. Dell reported first, so let’s start with them:

Datacenter is about 40% of Dell’s revenue (Dell quarterly reporting; Trading Places Research.)

Data center revenue up 22% is pretty impressive, but much less impressive is flat operating income and operating margin loss. Effectively, Dell sold $1.6 billion in AI servers, and they came in at a 0% operating margin. Because Nvidia already took all the money.

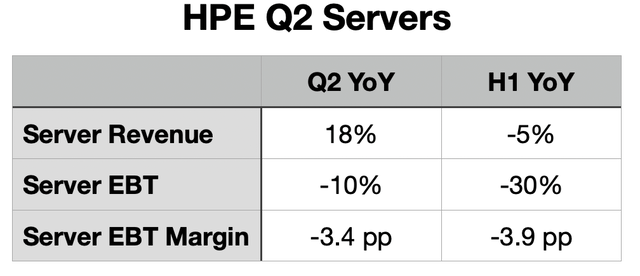

Moving on to HPE, it is even worse. They just reported fiscal Q2, so we can also look at how H1 went for them:

Servers are about half HPE revenue (HPE quarterly reporting; Trading Places Research)

Coming off a terrible Q1, server revenue rebounded, selling a lot more AI servers. The problem for them is that they seem to come in at negative EBT margins. Even though revenue grew 18% YoY, the EBT margin went from 14.4% to 11.0%, with EBT down 10%. When we add in the terrible Q1 for the H1 numbers, it looks even grimmer, with a full 4 points of EBT margin loss.

Because Nvidia already took all the money.

One company has never dominated data center spending like this, but here we are.

The Other Two Things

- A 10-for-1 split.

- By far their largest quarterly share buyback ever, $7.8 billion.

Neither of these was unexpected, and frankly a little late on both. I’ve been wanting them to split since they cleared $500 (every company should split at $500). I thought the share buyback acceleration would happen last quarter. But in any case, better late than never, and both are welcome news. The split will make the stock more accessible to more investors, and the share buyback should shave at least 1% off the share count in the next year.

Hilariously, they raised the meager dividend 150% to $0.10 a quarter so that it would not be under a penny after the split. The yield is, hilariously, 0.04%. Why bother?

The Upshot

I am seriously running out of things to say about this, and that is not normal. It is the most extraordinary thing I have seen in 4 decades of watching the market. Nvidia waited nearly 20 years for their data center GPUs to become an overnight success, but it was worth the wait. This is success on a scale that they did not even dare to dream.

They are sucking up data center spending, and crowding out everything else. They are ballooning capital costs to their customers.

Everything changed instantly, but I still view this as an investment bubble, albeit one with at least 3 quarters left to it. At Long View Capital, we’ve been discussing the “$200 Billion Question.” VC Sequoia Capital has many AI investments, and a lot of their money is going to buy GPU compute, but they are out with an unusually sober review of the landscape. They estimate that last year, $50 billion was spent just on Nvidia GPUs. They further estimate that the investment requires $200 billion in revenue to pay for the GPUs and all the rest and that there was only $3 billion of AI revenue in 2023. That’s the $200 Billion Question: where is the revenue going to come from to justify all this expense? Currently, investors are fine with the spend, but that could change in a heartbeat.

The questions remain: Where is the demand that will bring revenue? What is the value proposition? Microsoft Corporation’s (MSFT) very expensive Microsoft 365 Copilot is our best test case. It’s a $30 a month add-on to $22 a month Microsoft 365. Microsoft’s core competency is pushing new software through enterprise sales channels. If Microsoft’s sales team cannot make this happen, I don’t know who can.

The history of AI is marked by huge leaps followed by years of crawling. The last of these cycles began in 2012 with the famous AlexNet, and by 2015 it was AI Winter. Investment began to dry up as other software, particularly enterprise SaaS, looked more promising. This new cycle began in late 2022 with the release of ChatGPT 3.5, followed soon by the much more capable GPT 4.0. When will it end?

I think this Nvidia Corporation bubble has plenty of legs, at least 3 more quarters, but it is still a bubble. In another few months, we should have a better sense of how 2025 is shaping up.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here