While there are many grades and qualities of crude oil, the global benchmarks are Brent North Seas petroleum, trading on the Intercontinental Exchange, and West Texas Intermediate crude oil, trading on the Chicago Mercantile Exchange’s NYMEX division.

WTI reflects the price of North American petroleum, while Brent is the benchmark for crude oil from Europe, Africa, Russia, and the Middle East. Brent reflects prices for around two-thirds of the world’s petroleum, while WTI is the pricing benchmark for the remaining one-third. Different grades trade at premiums or discounts to the Brent and WTI prices.

WTI is a slightly lighter and sweeter crude oil with a lower sulfur content, best suited for refining into gasoline, the most ubiquitous oil product. Brent is also light sweet crude oil but has a slightly higher sulfur content, making it appropriate for refining into distillate products, including jet and diesel fuels.

The crude oil price has been declining since mid-April, and the energy commodity could be near a significant bottom, given the geopolitical landscape. The United States Brent Oil ETF product (NYSEARCA:BNO) tracks the Brent Crude Oil price.

A volatile price history-The range has narrowed

Brent Crude Oil has experienced boom-and-bust price action over the past years.

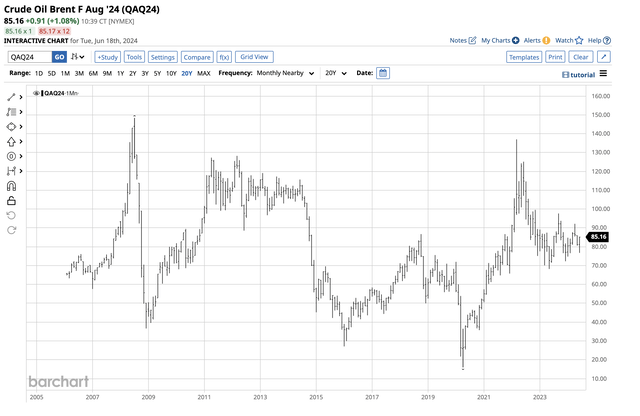

Twenty-Year Brent Crude Oil Futures Chart (Barchart)

The chart dating back to 2006 highlights the move to a multi-year $16 low in 2020 and a $137 per barrel high in 2022, the highest price since the 2008 $148.41 record peak.

Since 2022, Brent Crude Oil’s continuous contract trading range from low to high has narrowed:

- In 2020: $55.99 per barrel

- In 2021: $36.15 per barrel

- In 2022: $61.89 per barrel

- In 2023: $29.47 per barrel

- So far, in 2024: $17.39 per barrel.

The narrowing price range over the past three years is a consolidation pattern in the Brent Crude Oil futures market. Consolidation can continue, but it eventually leads to an up-or-downside technical break. In June 2024, long-term technical support is at the May 2023 $68.20 low, with resistance at the September 2023 $97.67 high. The consolidation has led to a pattern of lower highs and higher lows since the March 2022 peak and the May 2023 bottom.

A bearish trend since mid-April ends

Brent futures were in a short-term bearish trend until mid-June.

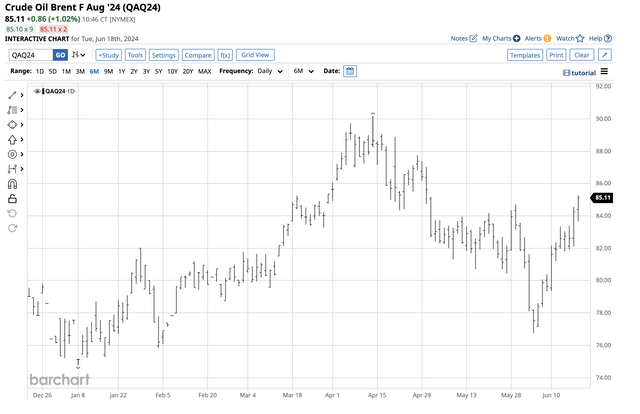

Six-Month Brent Crude Oil Futures Chart (Barchart)

The August 2024 ICE Brent Crude futures chart highlights the bearish trend that took the futures 14.90% lower from $90.18 on April 12 to $76.75 on June 4. After finding a bottom on June 4, the price rose above the first short-term technical resistance level at the May 29, $84.71 high, ending the bearish trend that had been in place since mid-April.

OPEC caused the latest selloff

At the June 1 biannual OPEC meeting, the international oil cartel extended most of its oil output cuts into 2025 because of weak demand, high-interest rates, and U.S. oil output at 13.2 million barrels per day. Meanwhile, OPEC+ (including Russia) will gradually phase out the production cuts of 2.2 million barrels per day from October 2024 through September 2025. The market interpreted the production policy as a bearish sign, and crude oil prices declined after the latest OPEC meeting.

U.S. inventories remain low-Russia needs higher prices

As of early June 2024, the U.S. Strategic Petroleum (“SPR”) reserve was at 370.5 million barrels. While the SPR has been rising as the U.S. has added barrels over the past months, it remains far below the June 2020 656 million barrel high. The SPR is unlikely to climb to the 2020 level anytime soon.

Meanwhile, Russia’s war effort in Ukraine comes with a significant price. As the most influential non-member of the international oil cartel, cooperating with production policy, Russia needs the highest possible crude oil price.

The war in Ukraine and the potential for an escalating conflict in the Middle East with Iran threaten crude oil production, refining, and the critical logistical route in the Persian Gulf and through the Straits of Hormuz. Over the coming months, the potential for upside spikes remains high.

Meanwhile, the U.S. currently produces 13.2 million barrels daily. U.S. petroleum production and consumption are on the ballot in the November 5, U.S. election as the incumbent President supports alternative and renewable fuels at the expense of fossil fuels. Another four years of the Biden Administration will favor OPEC+’s production policy dominance and will likely keep prices high. Former President Trump favors a “drill-baby-drill” and “frack-baby-frack” energy policy to achieve energy independence and increase exports, which will likely weigh on OPEC+’s dominance. A second term for the former President could cause oil prices to decline.

BNO is the Brent ETF product

Crude oil prices broke out of the recent bearish consolidation trading pattern. Brent Crude Oil is the leading global petroleum benchmark. The most direct route for a risk position in Brent Crude Oil is through the futures and futures options on the Intercontinental Exchange.

Market participants seeking Brent Crude Oil exposure without venturing into the leveraged and margined futures arena can turn to the United States Brent Oil Fund, LP ETF (BNO) product.

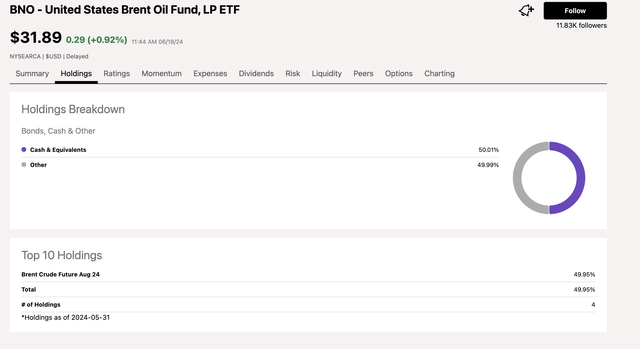

BNO’s top holdings include:

Top Holdings of the BNO ETF Product (Seeking Alpha)

The chart shows that BNO holds August Brent Crude Oil futures contracts. At $31.89 per share, BNO had nearly $127.8 million in assets under management. BNO trades an average of around 457,000 shares daily and charges a 1% management fee.

The most recent rally in the August Brent futures took the price 11.1% higher from $76.75 on June 4, 2024, to $85.27 on June 18.

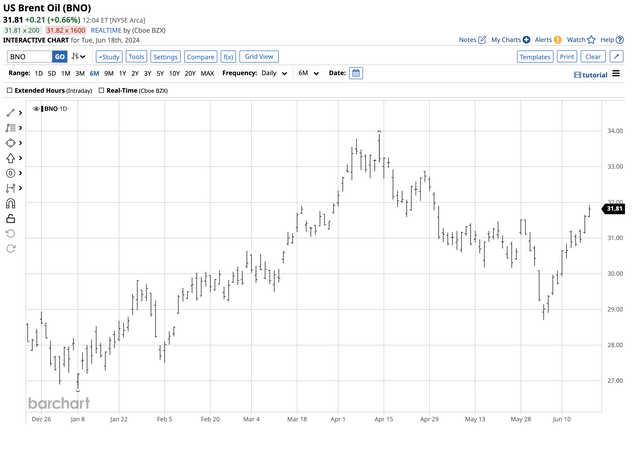

Six-Month Chart of the BNO ETF Product (Barchart)

The chart illustrates that over the same period, BNO rallied 11.2% from $28.70 to $31.91 per share. BNO did an excellent job tracking Brent Crude Oil prices, but the one drawback of the unleveraged ETF is that Brent futures trade around the clock, while BNO is only available during U.S. stock market hours.

I believe Brent futures are now in a bullish trend with an elevated chance of an upside price spike. The U.S. election could significantly impact crude oil prices for the coming years, so all bets are off after the November election, which will determine the path of U.S. energy policy.

Read the full article here