The Canadian healthy foods company Borealis Foods (NASDAQ:BRLS) has had a good run at the stock markets since its SPAC listing in February. As of the last close, its price was up by 12.2% from the closing price on listing day. There’s certainly merit to the company’s products, as health consciousness rises and busy lives increase the attractiveness of convenient meals.

Just because a company has potential, however, doesn’t mean that it makes for a good investment right away. Keeping this in mind, here I assess how the upside for Borealis Foods stacks up against any weaknesses it might have.

The upside

#1. Big and growing market

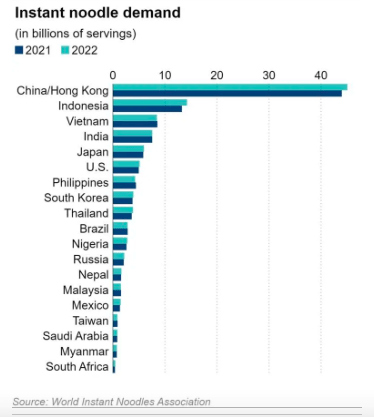

The company produces ramen, which is a massive USD 55 billion market globally. While demand is concentrated in Asia (see chart below), which is distinct from Borealis Foods’ market of the US, Canada, and Europe, the target market is large in its own right too. The company estimates its addressable market to be worth over USD 7 billion. In fact, as the chart below shows, the company’s focus US market is the sixth biggest.

Note: While the term ramen can be used interchangeably with instant noodles, there are differences. However, instant noodle demand is indicative of that for ramen too. (Source: World Instant Noodles Association)

Not only is the market big, it’s also growing. Between 2023 and 2028, it’s expected to see a compounded annual growth rate of 5.8% as per estimates available in the company’s prospectus, to reach a size of USD 70 billion by the end period.

#2. High protein ramen

So where does Borealis Foods fit into this big, growing market? Instant noodles, often get criticized for being low on the nutrition scale. And this is where the company comes in.

It has developed “the first high protein dough”, which translates into 20 grams of protein for every serving for ramen available under its brand Chef Woo. By comparison, the average ramen serving has just 5 grams of protein. Chef Woo also stands out for its endorsement by celebrity chef Gordon Ramsay, who’s both a stakeholder in the company and its brand ambassador.

Note that the company’s other retail brand, Ramen Express, however, is like any other ramen brand. It has exactly the same amount of protein as other brands, comes in multiple flavors and at a competitive price point.

Source: Borealis Foods

#3. Food service provides sales assurance

Lastly, the company’s whole grain-rich noodle brand, Woodles, is directed toward provision of school meals in the US. The food service not only addresses the challenge of inconsistent nutrition availability for students, it also has a big market, with 29.6 million lunches served on a daily basis. Since it’s a government funded, this revenue stream can be even more recession resistant compared to its other products. This is a particularly important point to consider right now when the US economy is likely softening.

#4. Robust revenue growth over time

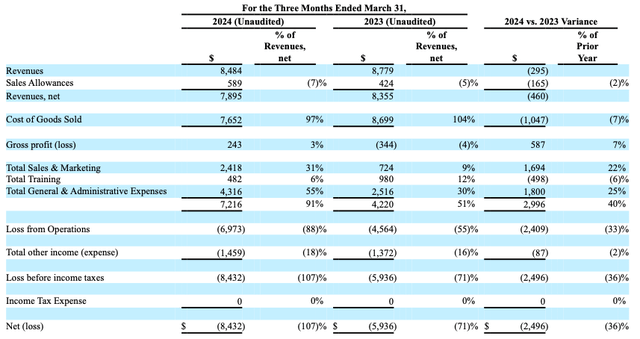

The company’s growth has been notable since its inception in 2019, with a CAGR for revenues at ~70%. At first glance, then, it’s a jarring contrast to see a 5.5% contraction in the number in the first quarter (Q1 2024). A closer look at the numbers reveals that this is largely because of a 39% increase in discounts and allowances, though.

However, the company’s gross revenues declined by 3.4% as well. The company attributes this to a seasonality in sales, with the first and second quarters being slow seasons. This indicates that revenue growth can pick up over the second half of the year, which is worth looking out for.

Source: Borealis Foods

#5. Gross profit positive

The company also clocked a gross profit for the second consecutive quarter. This is partly on account of a bigger 35% contribution to revenues by higher margin products compared to 10% in the same quarter last year. Also, raw material price stabilization is reflected in 12% decline in cost of revenues, compared with a significant 45.1% increase in Q1 2023.

However, the gross profit margin at 3.1% is significantly reduced from Q4 2023, when it was at a much bigger 22.4%. This can be explained by a far bigger drop in cost of revenues in Q4 2023. Realistically, with an unfavorable base going forward, it’s likely that the margin would remain small. However, I’d watch the number in any case to assess the company’s progress towards profitability

The downside

#1. Balance sheet can be stronger

The balance sheet, however, isn’t looking particularly positive. The current ratio is at 0.77x for Q1 2024, which is less than adequate. To be fair, it’s significantly improved from the 0.26x seen in the full year 2023. But it remains to be seen whether it can recover further in 2024.

Similarly, the debt-to-assets ratio isn’t the best either at 64.4x in Q1 2024. Like the current ratio, it too is better than the 113.5x for the full year 2023, which looked far more unsustainable, but it can still improve.

#2. Unattractive market multiples

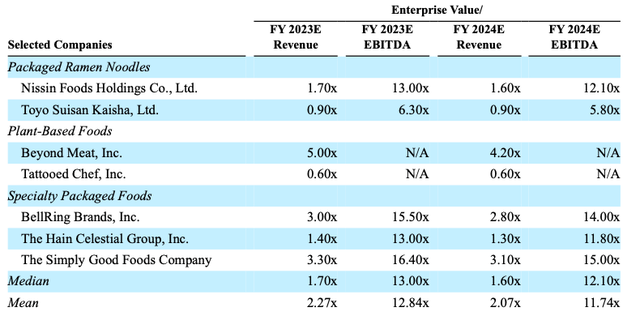

With the relatively high debt levels, it makes sense to consider the trailing twelve months [TTM] enterprise value-to-sales (EV/S). This number is at 7.9x, which is significantly higher than the 1.67x for the consumer staples sector. Even if it’s assumed that the revenues grow by another 70% (the CAGR since inception) in 2024, the forward EV/S is at 4.6x, which compares unfavorably to the company’s estimates for peers (see table below).

Market Multiples for Peers (Source: Borealis Foods)

What next?

The market multiples make it clear that the stock isn’t one to buy right now. Not when there are more established peers trading at lower multiples. It’s possible that as a smaller company, it can scale up faster and the EV/S would look better sooner than later.

However, we don’t know that for now. Especially not when its balance sheet can improve too. It would also be good to wait and watch if its revenues pick up in the second half of the year after contracting in Q1 2024 on lower seasonal demand.

It is, however, encouraging that the company has clocked gross profits for two quarters in a row now. And with an easing in costs, the trend could continue. Otherwise, there’s much to like about Borealis Foods. It is making a fast food like ramen healthier, while sustaining its convenience. It even has the endorsement of celebrity chef Gordon Ramsay, which provides it much needed marketing as it competes with far bigger players.

It’s definitely a promising stock, whose evolution would be interesting to watch. I’m going with a Hold rating on Borealis Foods.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here