D-Market Electronic Services & Trading (NASDAQ:HEPS) reported its first quarter results, highlighted by strong growth and expanding margins.

The Turkish e-commerce player operating under the “Hepsiburada” brand has managed to navigate challenging economic conditions in the region through diverse offerings including fintech services, attracting a loyal customer base.

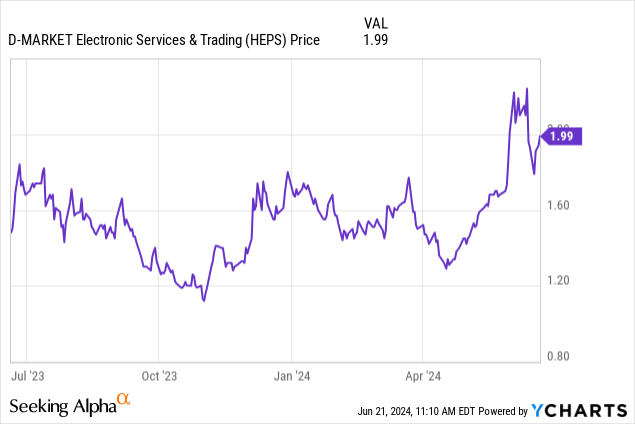

We covered some of these themes issuing a rare “strong buy” rating for the stock last year noting the company’s path to sustainable profitability deserved a closer look. In many ways, the trends have surpassed our expectations, and we can reaffirm a bullish view on HEPS, supported by solid fundamentals.

HEPS Q1 Earnings Recap

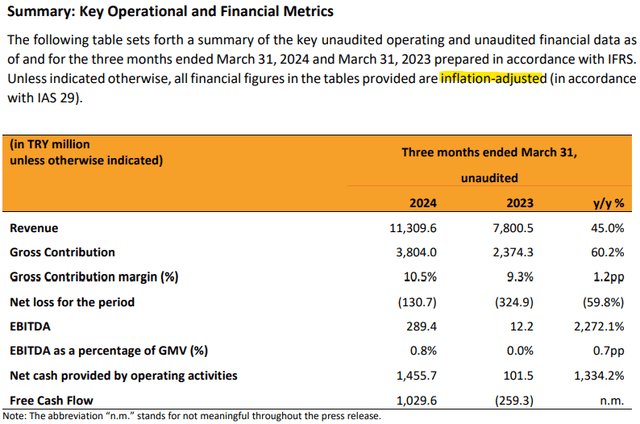

HEPS reported Q1 revenue of TRY 11.3 billion, or approximately $344 million, representing a 45% year-over-year increase.

Notably, the company presents the figures as inflation-adjusted, capturing the “real growth”. This is important as Turkey continues to deal with extreme inflation, where the CPI reached an annual rate of nearly 70%. This means that Hespiburada’s growth is in addition to the inflationary price impact.

From that top-line momentum, the gross contribution margin of 10.5% climbed by 9.3% in the prior-year quarter. Efforts to control costs and generate financial efficiencies are evident as net operating expenses as a percentage of the gross merchandise value (GMV) were flat over the past year.

This helped EBITDA ramp up towards TRY 289.4 million (around $8.9 million), compared to TRY 12.2 million in Q1 2023. Similarly, free cash flow has turned positive.

source: company IR

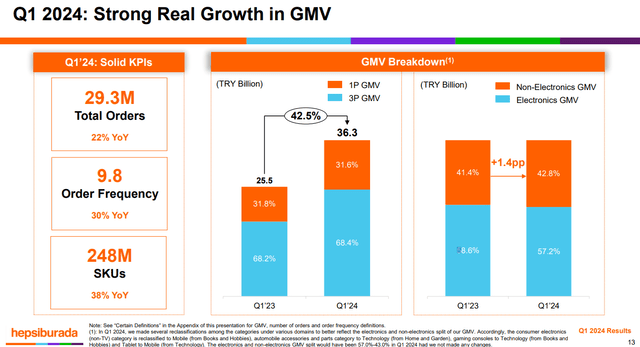

Operationally, the story was the GMV growth up 42.5%. That metric captures a 22% increase in total orders benefiting from an expanding selection of products, particularly in non-electronics categories.

What’s interesting is that while the number of active customers this quarter at 12.1 million was 1.4% higher than the 11.9 million in Q1 2023, the data suggests customers are ordering more frequently as a sign of brand loyalty and customer engagement.

source: company IR

The ongoing shift away from electronic categories in GMW can also be interpreted as customers choosing to make more purchases of staples and household products across both third-party marketplace and company-distributed merchandise. The company’s advertising business remains small but could gain importance

This tailwind bodes well for the company’s “Hepsipay” offering, which now counts on 15.7 million as an installed user base. The company believes the platform is on track to become Turkey’s leading digital wallet that is already integrated with 28 local retailers.

Overall, our takeaway is that the trends mark a solid start to 2024 with the company executing a profitable growth strategy. Keep in mind that HEPS maintains a net cash balance sheet, ending the quarter with nearly the equivalent of $250 million between cash and short-term investments against under $20 million in financial debt.

What’s Next for HEPS?

The attraction of D-MARKET Electronic Services & Trading starts with its unique exposure and positioning within a major emerging market economy. Turkey makes headlines for underwhelming economic growth, persistent inflation, and a delicate political environment, but the growth trends right now from HEPS speak for themselves.

The company benefits from ongoing digitalization, where shoppers in the region are increasingly moving purchases online with significant room for e-commerce adoption compared to developed markets.

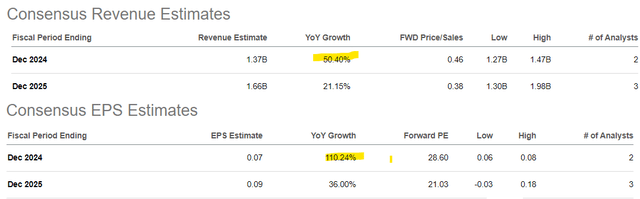

According to consensus, HEPS revenue is expected to climb 50% this year towards $1.4 billion and maintain a solid 21% growth rate into 2025. The outlook for earnings is even stronger with a forecast 2024 EPS of $0.07, more than doubling from 2023. Further upside is expected next year with an EPS estimate of $0.09.

Seeking Alpha

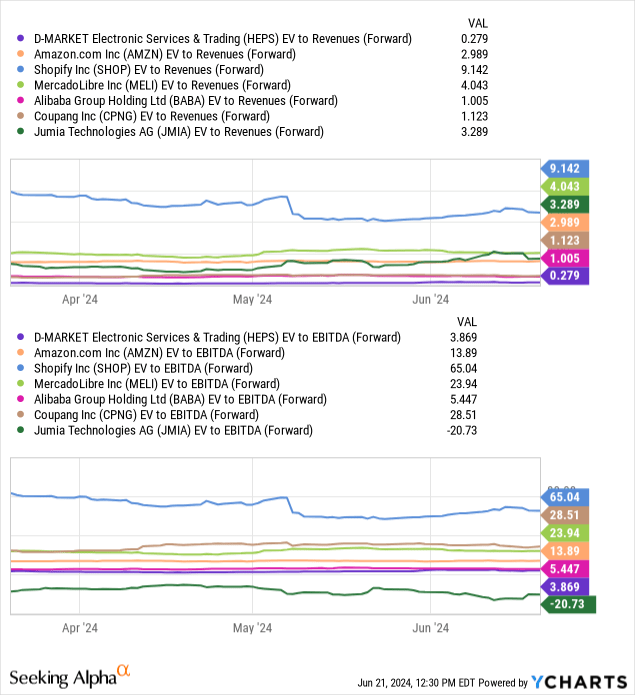

Ultimately, the setup is very compelling in the context of global e-commerce peers. HEPS trades at a deep discount to other emerging market e-commerce names like MercadoLibre, Inc. (MELI) operating in Latin America or even Jumia Technologies AG (JMIA) as the major player in the African continent.

In our view, HEPS’s enterprise value to forward EBITDA multiple of 3.9x could be too cheap to ignore compared to an emerging market leader like Alibaba Group Holding (BABA) at 5.5x and MELI at 24x by the same metric.

One explanation for the depressed valuation goes back to the risks associated with the Turkish market. Beyond FX volatility and potentially unstable political environment, the market appears skeptical that HEPS will be able to maintain its recent operating momentum.

This dynamic opens the door for the upside potential in shares if the company can continue delivering on its earnings trajectory. Management making a strategic push to drive profitability higher should be rewarded by the market in our opinion.

Final Thoughts

It’s fair to keep HEPS in a speculative category of growth stocks, considering its current small-cap profile and operations in a risky emerging market. Still, the stock could emerge as a big winner going forward, adding to its allure on a risk-adjusted basis. We believe a small position in the stock can work in the context of a diversified portfolio.

Monitoring points over the next few quarters include the evolution in the gross margin, cash flow, and GMV trends.

Read the full article here