Investment Outlook on ARS Pharmaceuticals After FDA Setback Recovery

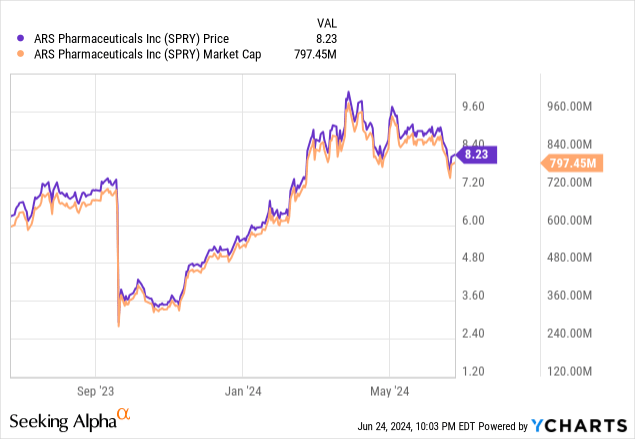

ARS Pharmaceuticals, Inc. (NASDAQ:SPRY) stock has recovered admirably since my last update, which followed the U.S. FDA’s Complete Response Letter [CRL] issued in September regarding their epinephrine nasal spray, neffy.

This event prompted me to downgrade my rating from buy to hold, noting:

The FDA rejection introduces volatility and uncertainty, necessitating a recalibration of growth prospects and adding an extra layer of risk for investors.

However, I did notice that ARS had the funds to see neffy through to completion, and the FDA requirements appear manageable, delaying neffy’s launch by only a year.

Remember that neffy is aiming for a $2 billion global epinephrine market and provides a unique and user-friendly administration method (nasal spray). However, ARS is not alone in its efforts to market epinephrine as a non-injectable, and the regulatory setback may diminish some first-mover advantages. ARS describes its competitors in its annual report.

We are aware of several companies developing higher dose intranasal candidates including Bryn Pharma, Hikma Pharmaceuticals, Inc. (previously INSYS Therapeutics, Inc.), Nasus Pharma, Orexo AB and Belhaven BioPharma. Amphastar Pharmaceuticals, Inc. is reported to be developing an intranasal candidate, but has not disclosed its dose. Aquestive Therapeutics is developing a sublingual candidate based on a prodrug of epinephrine.

Biotech Pharma Investor, a Seeking Alpha author, did an excellent job of covering neffy in relation to its competitors, particularly Aquestive’s (AQST) sublingual film. So I will not go into too much detail about this. It is worth noting that neffy still has a comfortable lead in being the first to market.

Peak revenue estimates for neffy typically range between $400 million and $750 million. In this context, ARS’ stock appears to be conservatively valued at approximately $800 million. I believe the valuation considers the significant competition between current (e.g., injections) and future (e.g., sublingual) treatments. This is unlikely to be a “winner-take-all” market, and several players, including conventional injectables, will compete for a piece of the pie. So, while I believe these estimates are achievable, they likely represent best-case scenarios for neffy.

ARS provided an update on neffy’s regulatory status in April. Since the CRL, the company has completed the PK/PD study mandated by the FDA (ARS once believed this study was unnecessary) and submitted a response. ARS expects a PDUFA date in October and a launch before the end of the year. The company is also looking for regulatory approval in Europe, with feedback anticipated very soon.

Financial Health

According to their balance sheet, as of March 31, ARS had $223.6 million in cash and securities. The company has no significant liabilities. Because they are not yet profitable, I will estimate the cash runway. Their net loss, or cash burn, in Q1 was $10.29 million. Dividing their cash and securities by this figure yields a cash runway through 2029. However, as neffy approaches launch, investors should expect rising expenses that could significantly shorten my cash runway estimate.

SPRY Stock – Risk/Reward Analysis and Investment Recommendation

In conclusion, investors who held on to their shares following the CRL have been rewarded. ARS has made significant progress, and neffy is still on track to become the first non-injectable epinephrine for Type 1 allergic reactions.

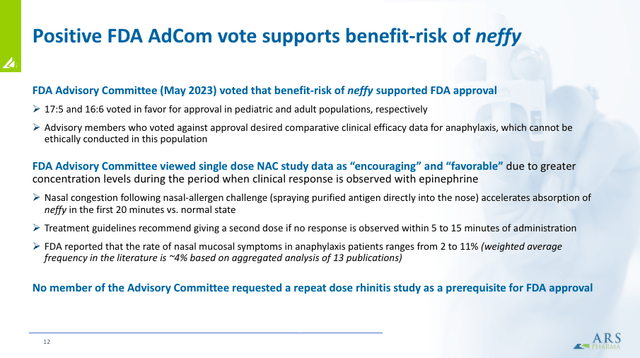

However, it would be a mistake not to consider all the risks. For starters, neffy still needs to obtain regulatory approval. Its marketization does not appear to be easy. Patients and providers will need to be convinced that neffy is as effective as conventional injections. This was elucidated upon when the FDA’s advisory committee discussed neffy’s application.

ARS

While they voted in favor of approval, there were real concerns about the relative efficacy. While the ease of administration will entice some, overcoming this perception will be critical for neffy. Furthermore, many companies are developing non-injectable solutions, with some expected to enter the market after neffy.

Importantly, despite the progress ARS has made since the CRL, there are long-term consequences that the company cannot overcome. The CRL reduced, to some extent, first-mover advantages while delaying their theoretical time to profitability. There is uncertainty about ARS Pharmaceuticals, Inc.’s ability to achieve profitability before their cash reserves run out. Of course, the company has many avenues for raising capital (e.g., equity, partnership, debt, licensing, etc.).

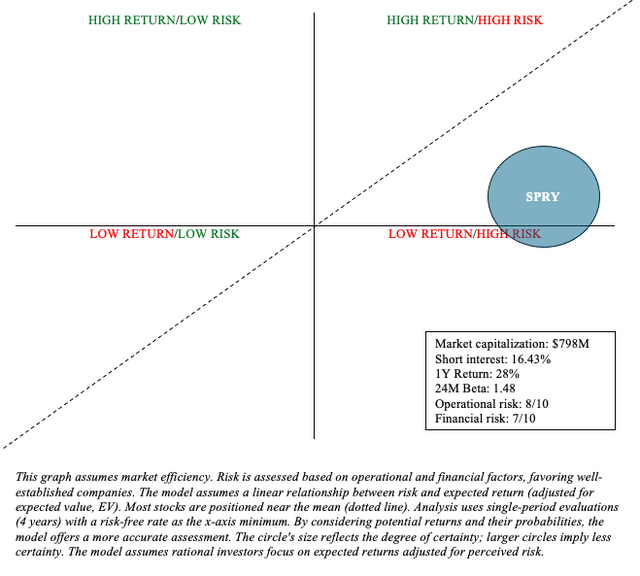

Having said that, ARS’ current market capitalization appears to account for these risks, though many continue to bet against it (16% short interest).

Author

ARS Pharmaceuticals, Inc. is a Quadrant 1 investment (high risk/high reward), so limiting exposure and keeping an eye on it are essential. SPRY is a hold, which may be especially beneficial for investors who use a barbell portfolio, in which 90% of funds are allocated to low-risk assets such as Treasuries and broad-market ETFs, with the remaining 10% allocated to alpha-generating stocks like SPRY.

Read the full article here