The last two days have seen shock inflation reports in Canada and Australia after it had seemed that inflation had finally come under control. The Bank of Canada was so confident in its inflation outlook that it cut rates earlier this month.

These two inflation reports should be a stark reminder that inflation is tricky. The weak May inflation reports received in the US and the potential for a soft June print should not create too much complacency.

Canada

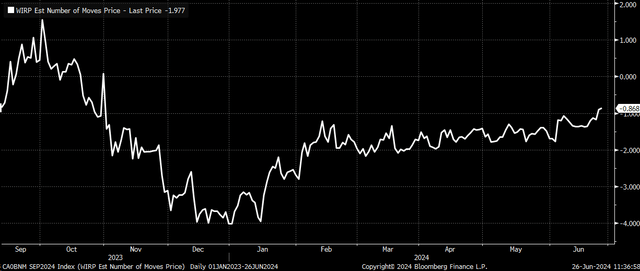

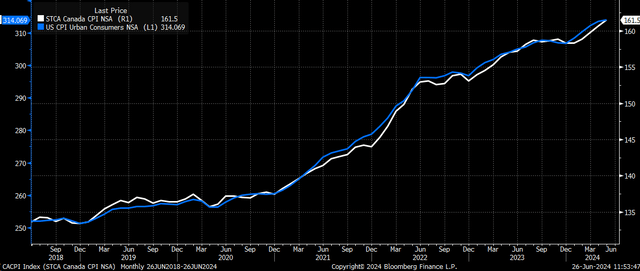

On June 25, the Canadian CPI non-seasonally adjusted rose by 0.6% m/m versus expectations for 0.3% and was hotter than last month’s 0.5% increase. Additionally, it rose by 2.9% y/y versus estimates of 2.6% and the previous month’s 2.7%.

The market had been set on the Bank of Canada cutting rates again in September. But after the hotter-than-expected CPI report, the market started thinking again about the path of rate cuts. It now prices an 86% chance for a cut in September and moves the expectations for the next full rate cut not coming until October.

Bloomberg

Australia

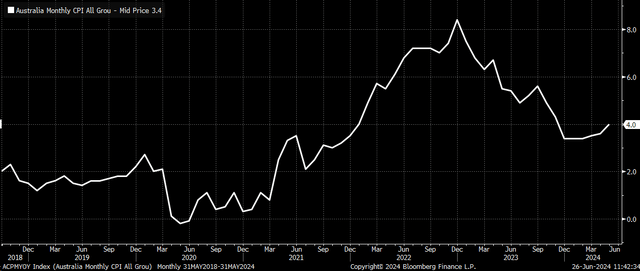

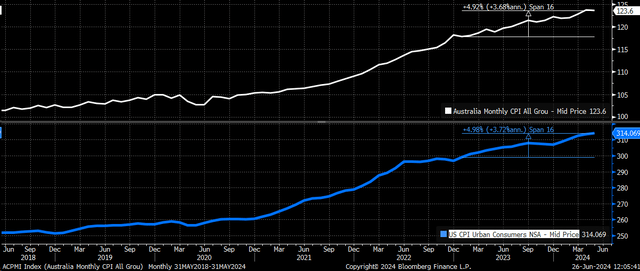

Australia’s May CPI came in at 4.0% year-over-year, much hotter than expectations for 3.8% y/y and higher than last month’s reading of 3.6%. The 4.0% reading was the second month in a row where the y/y measure for CPI increased, reaching its highest level since the end of 2023.

Bloomberg

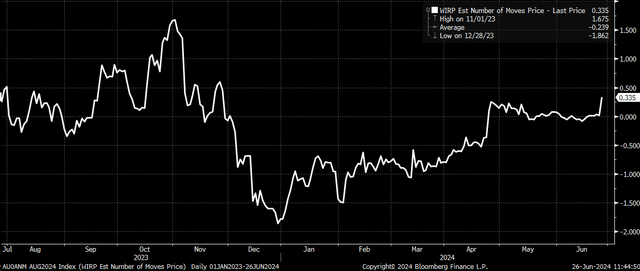

Australian markets went from pricing no action from the Reserve Bank of Australia to now assigning a 33% chance for a rate hike at the next meeting on Aug. 6. Another hot reading when the June CPI report comes could lead to the bank having to take action.

Bloomberg

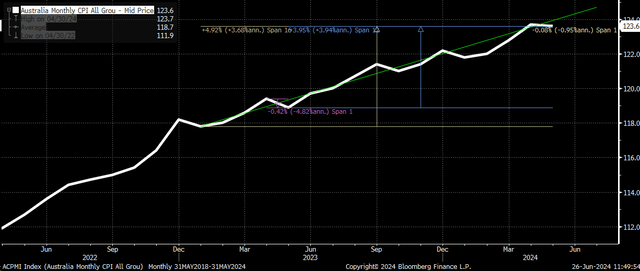

Base effects could have been at play in the Australian CPI when looking at the non-seasonal adjusted chart, which is how the y/y number is reported. In May 2023, the index saw a nearly 0.4% m/m decline. In May 2024, the index declined by just 0.1%, which caused the reading to be slightly hotter than expected. But still, inflation in Australia has been trending around 3.7% over the past 16 months.

Bloomberg

Trends

The path of inflation in Canada has not been all that dissimilar to what has been taking place here in the US. The two paths are nearly identical, with both seemingly pivoting sideways or higher around the same time. This is why it’s essential to be aware of trends in inflation in other developed economies.

Bloomberg

What’s also interesting is that the US inflation rate took off sooner than the Australian inflation rate. Still, over the last 16 months, the US and Australian non-seasonally adjusted growth rates have remained around 3.7%.

Bloomberg

Market Impacts

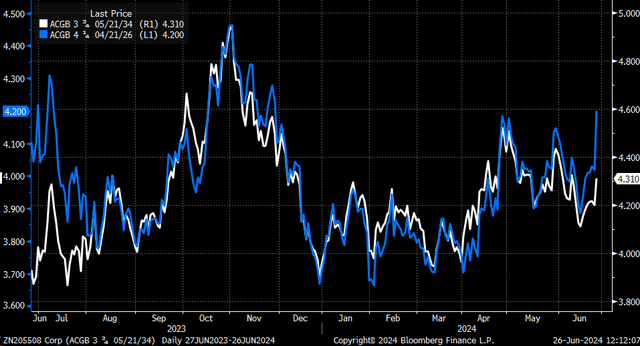

This also has implications for US markets because Australian rates exploded higher following the data. The Australian 2-year rose by 18 bps, climbing to 4.2%, as the 10-year rate rose by around ten bps to 4.31%.

Bloomberg

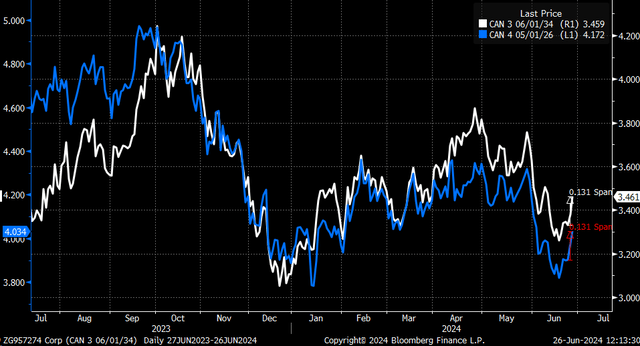

Meanwhile, the 10-year and the 2-year in Canada rose by around 13 bps over the past two days, with the 2-year jumping to 4.03%, as the 10-year climbed to 3.46%.

Bloomberg

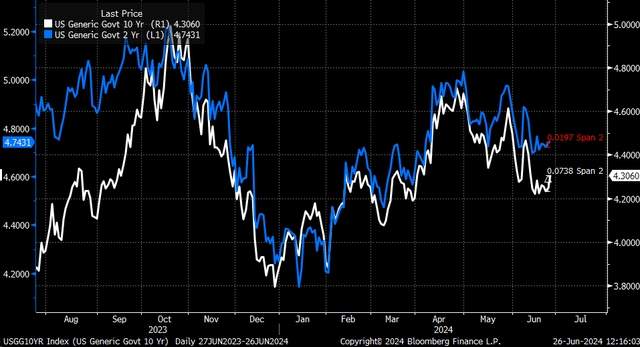

Yields are generally rising worldwide due to this, and the US Treasury is no exception, with the US 10-year rising over the past two sessions by more than seven bps and the 2-year trading higher by around two bps. It is nothing dramatic, but it appears to have reversed a steady trend lower over the last month and a half.

Bloomberg

If anything, the data from Canada and Austria should serve as a reminder that inflation does trend and doesn’t usually change trends out of nowhere for no apparent reason. If the inflation rates suddenly start declining in the US, the most likely cause would be the US entering a recession. Otherwise, inflation should be expected to be a longer-lasting problem.

Join Reading The Markets

Reading the Markets helps readers cut through all the noise, delivering daily video and written market commentaries to prepare you for upcoming events.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

Read the full article here