The Credit Suisse Asset Management Income Fund, Inc. (NYSE:CIK) is an under-followed closed-end fund, or CEF, that investors can employ as a method of boosting their incomes. That is a proposition that could prove very appealing to anyone who is dependent on their portfolios to support them, such as many retirees. The fund’s name may, however, discourage some potential investors due to Credit Suisse falling victim to the banking crisis that occurred in early 2023.

Ultimately, Credit Suisse, which had been plagued by various scandals for a long time preceding the crisis, ended up being acquired by UBS (UBS) before it could collapse because such a collapse would have devastated the global financial system. However, that does not appear to have had any significant impact on this fund, and it continues to operate as normal. It might be helpful if the fund were to change its name, but for now, investors should simply keep in mind that this fund should be evaluated based on its own merits and not on the fact that it was created by the now-defunct Swiss bank.

The Credit Suisse Asset Management Income Fund does reasonably well in the income department, as it boasts a 9.17% yield at the current share price. This yield compares reasonably well to that of the fund’s peers:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

Credit Suisse Asset Management Income Fund |

Fixed Income-Taxable-High Yield |

9.17% |

|

AllianceBernstein Global High Income Fund (AWF) |

Fixed Income-Taxable-High Yield |

7.49% |

|

Allspring Income Opportunities Fund (EAD) |

Fixed Income-Taxable-High Yield |

9.43% |

|

BNY Mellon High Yield Strategies Fund (DHF) |

Fixed Income-Taxable-High Yield |

8.71% |

|

BlackRock Corporate High Yield Fund (HYT) |

Fixed Income-Taxable-High Yield |

9.64% |

|

PGIM High Yield Bond Fund (ISD) |

Fixed Income-Taxable-High Yield |

9.78% |

As we can see, the Credit Suisse Asset Management Income Fund is not the highest-yielding fund that is available within the sector. However, its yield does still compare pretty well with most of the other funds within the sector, as most of them are within 50 basis points of each other. As I have pointed out a few times in the past, a fund whose yield is reasonably close to that of its peers is generally considered to be at low risk of a cut, so income investors should overall be reasonably confident in this fund right now.

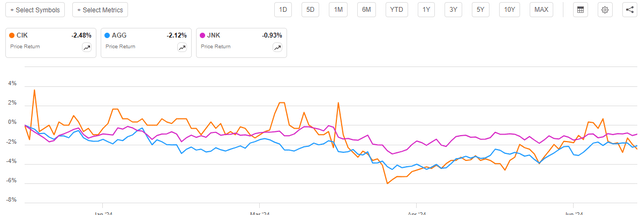

As regular readers can likely recall, we previously discussed the Credit Suisse Asset Management Income Fund in late December 2023. The bond market since that time has generally been fairly weak, as various market participants have come to realize that they were very wrong at the end of last year about the speed at which the Federal Reserve would reduce interest rates in 2024 and beyond. However, junk bonds, which are the primary securities that this fund invests in, have held up okay due mostly to demand from investors who wish to lock in high yields for an extended period of time. As such, we might expect that the Credit Suisse Asset Management Income Fund has delivered a weak, but not horrible, performance since the time of our previous discussion. However, this was not the case, as shares of the fund have declined by 2.48% since the previous article was published:

Seeking Alpha

As we can immediately see, the fund’s market performance was worse than that of either domestic investment-grade (AGG) or domestic junk bonds (JNK). That is certainly going to disappoint many potential investors, although it is perhaps unsurprising that this would be the case. In my previous article, I pointed out that the fund’s shares looked overpriced back in December, so some of this underperformance might simply be due to the fund’s shares coming back into line with where they actually should be. We will make that determination over the course of this article.

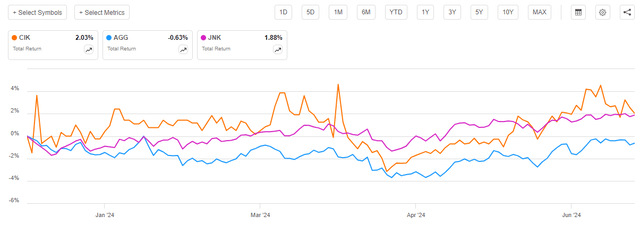

However, investors in the Credit Suisse Asset Management Income Fund actually did better than the above chart indicates. As I stated in a previous article:

A simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

The Credit Suisse Asset Management Income Fund has a substantially higher yield than either of the two major domestic bond indices:

|

Fund/Index |

Current Yield |

|

Credit Suisse Asset Management Income Fund |

9.17% |

|

Bloomberg U.S. Aggregate Bond Index |

3.43% |

|

Bloomberg High Yield Very Liquid Index |

6.59% |

As such, we can expect that the fund’s distribution boosts its total return over the period more than the distributions paid by the bonds in the two indices. Here is how the fund compares to the indices after we include all the distributions that the three assets paid over the period:

Seeking Alpha

As we can see, investors in the Credit Suisse Asset Management Income Fund ultimately did better over the past six months than investors in either of the two major bond indices. This was due to the fund’s high yield relative to the indices, and it shows the overall strength of the fund’s distribution-focused business model.

As six months have passed since we last discussed the Credit Suisse Asset Management Income Fund, we can expect that a great many things have changed. In particular, the fund has released an updated financial report, so we will want to pay close attention to that document as we continue with our analysis today. The recent comments by the Federal Open Market Committee are also of critical importance, as they strongly suggest that the market remains overly optimistic about the future trajectory of interest rates. Interest rates have a significant impact on the performance of the fund and the price of the assets that it holds, so we should certainly not ignore that.

About The Fund

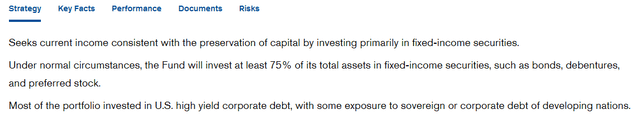

According to the fund’s website, the Credit Suisse Asset Management Income Fund has the primary objective of providing its investors with a high level of current income. This is not surprising given the fund’s classification as a junk bond fund, but the website’s strategy overview does not explicitly state how the fund will go about achieving its objective. Here is what the website states:

The High Yield team seeks to deliver attractive returns from U.S. high yield bond markets to investors. The platform offers access to a deep team of credit professionals, including sector analysts covering over 1,000 corporate issuers. The strategy aims to maximize total return from monetizing macro economic themes and exploiting sector and issuer performance and rating dispersion. The team’s proprietary credit ratings, trend outlook and spread volatility evaluation drive a disciplined portfolio construction process that has powered outperformance in the high yield bond asset class.

This description does make mention of high-yield bonds being included in the fund’s portfolio, but that is it. The fund’s description does not explicitly state whether high-yield bonds will be the only things included in the portfolio, or if it can also include other assets. Perhaps most importantly, the fund’s description does not specify whether the fund will include securities solely from domestic entities or if it can include both domestic and foreign issuers.

As regular readers might be aware, I am interested in the second question due to the very real possibility that the U.S. dollar will decline against the currencies issued by some foreign nations (especially emerging nations) over the next few decades. This is one of the reasons why I have been so focused lately on getting exposure to foreign equities and foreign debt in my own portfolio.

The website does include a section that touches on the two issues that I just raised in the previous paragraph. Here is the section in its entirety:

Credit Suisse Asset Management

We see here that the fund will invest at least 75% of its assets into fixed-income securities. It also states that the fund will invest primarily in domestic junk bonds but can include some foreign debt exposure. This is somewhat helpful, and it tells us that the fund will include some emerging markets exposure. However, I still have a few questions:

- Does the fund have a mandate requiring that it invest a set percentage of its assets in investment-grade debt? Is the 75% devoted to fixed income solely invested in junk bonds?

- How are the assets split between domestic and foreign securities? Is there a specific requirement that a certain percentage of assets be invested in foreign securities, or is it up to the fund managers’ own judgment?

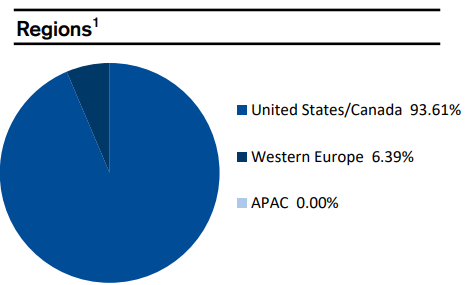

The fund’s fact sheet answers the second question somewhat. According to this document, 93.61% of the fund’s assets are invested in securities issued by entities in either the United States or Canada:

Fund Fact Sheet

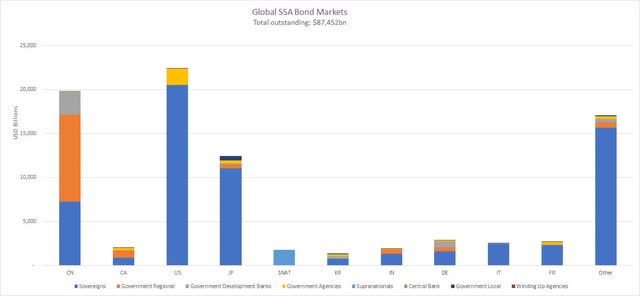

The overwhelming majority of this allocation is almost certainly American, as the Canadian bond market is much smaller than the one in the United States. According to the International Capital Market Association, the United States alone accounts for 17.46% of the global bond market. The United States, China, and Japan combined account for roughly 62% of the entire global bond market:

International Capital Market Association

Thus, we can conclude that the fund will be much more heavily invested in United States securities than in Canadian securities, due simply to the sheer size of the American market.

We can therefore immediately see that the Credit Suisse Asset Management Income Fund is not a particularly good choice for any investor who is looking for an opportunity to improve their foreign exposure. While the fund is technically a global fund, its non-U.S. exposure is too small to have any real impact on a portfolio as a whole. There are many other funds out there that do a much better job of achieving a high level of international exposure. This by itself is not necessarily the end of the world, as investors do need to have American bond holdings as well. However, the Credit Suisse Asset Management Income Fund should only be considered a substitute for other American bonds or bond funds that you might hold. It cannot take the place of a foreign or global bond fund.

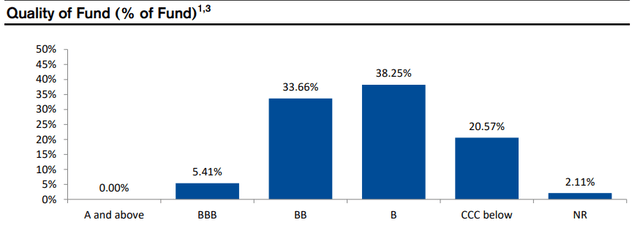

In the previous article on this fund, we saw that the Credit Suisse Asset Management Income Fund is primarily invested in junk bonds. In fact, as of right now, only 5.41% of the fund’s assets are invested in investment-grade bonds:

Fund Fact Sheet

The only investment-grade bonds currently held by the fund are ones with a BBB rating, which is as close to junk bond status as an investment-grade bond can attain. The fund has no AAA sovereign bonds at all, nor does it hold any corporate bonds with an A credit rating. Indeed, this fund has no sovereign bonds, despite its claims in the website’s strategy description. According to the fund’s most recent annual report, its asset allocation on December 31, 2023, was the following:

|

Asset Type |

% of Net Assets |

|

Corporate Bonds |

98.9% |

|

Bank Loans |

22.0% |

|

Asset-Backed Securities |

8.6% |

|

Common Stocks |

0.7% |

|

Warrants |

0.0% |

|

Money Market Fund |

5.3% |

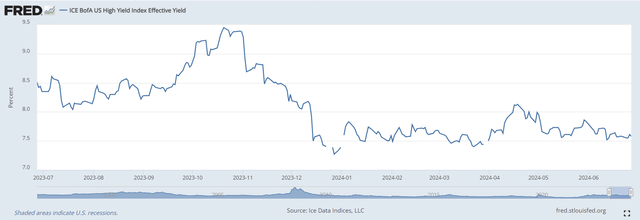

As we can see, the fund has no sovereign debt at all. This is both surprising and unsurprising. It is unsurprising that the fund holds no U.S. Treasury bonds. After all, the current yield of the ten-year U.S. Treasury note is 4.288%, which is highly unlikely to appeal to most income investors in an environment in which the ICE BofA US High Yield Index has an effective yield of 7.58%:

Federal Reserve Bank of St. Louis

Admittedly, the current yield is lower than the levels that the index had in the recent past, but it still beats U.S. Treasuries by a lot. In addition, as I argued in an article from yesterday, U.S. Treasury yields might not be sufficient to beat inflation over the long term. This is especially true if the securities are being held in any account in which taxes are a consideration. Thus, income-focused investors will certainly want to prefer investing in high-yield junk bonds, due to the simple fact that holding enough securities can reduce the default risk to a manageable level. The Credit Suisse Asset Management Income Fund has 292 holdings currently, so it should meet this requirement.

One thing that we notice in the chart above is that the Credit Suisse Asset Management Income Fund increased its allocation to investment-grade bonds very slightly since late December. The fund’s weighting to BBB-rated securities at the time of our last discussion was 4.94%, but today it is at 5.41%. Junk bonds have outperformed investment-grade corporates over the first six months of this year, so this change is not caused by these securities holding their value better than junk bonds over the period. This, therefore, is obviously a conscious choice for the fund’s management team to improve the quality of the assets in its portfolio.

We also see that the fund’s management appears to be trying to improve the credit quality of its portfolio in the fact that BB-rated securities also experienced a weighting increase. When we looked at this fund in late December, it had a 31.58% weight to BB-rated junk bonds. Today, that weighting is 33.66%. This is probably not a bad move considering that the junk bond default rate was expected to spike in 2024. From the previous article:

According to an article that was published by in the Wall Street Journal back in June [2023], junk bond defaults edged up in the first half of 2023. In May 2023, the corporate default rate was 3.4% compared to 3.2% in April. That is still lower than the 4.1% historical default rate, however. Moody’s Investor Service projects that the default rate on junk bonds will continue to increase, peaking at 5.6% in January 2024.

Issuers with better credit ratings are less likely to default, so it makes sense for the fund to be improving the credit quality of the assets that comprise its portfolio in the current environment. This is simply a move to reduce the losses that the fund will ultimately suffer when and if defaults occur, which was undertaken at a time when analysts were expecting defaults to become a bigger problem for bond investors. Many income investors are at least somewhat risk-averse, so the fund’s actions in this case are likely to be welcomed.

Leverage

As is the case with most closed-end funds, the Credit Suisse Asset Management Income Fund employs leverage as a method of boosting the effective yield of its portfolio beyond that provided by the underlying assets. I explained how this works in the previous article on this fund:

In short, the fund borrows money and then uses that borrowed money to purchase junk bonds and similar high-yielding assets. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case. Unfortunately, this strategy is not as effective today as it was two years ago because the difference between the rate at which the fund borrows and the rate that it receives on the purchased assets is narrower than it used to be.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much leverage because that would expose us to an excessive amount of risk. I generally like a fund’s leverage to be under a third as a percentage of its assets for that reason.

As of the time of writing, the Credit Suisse Asset Management Income Fund has leveraged assets comprising 24.90% of its portfolio. This represents a substantial improvement over the 29.76% leverage ratio that the fund had the last time that we discussed it, which is actually pretty surprising considering that the share price has declined over the period.

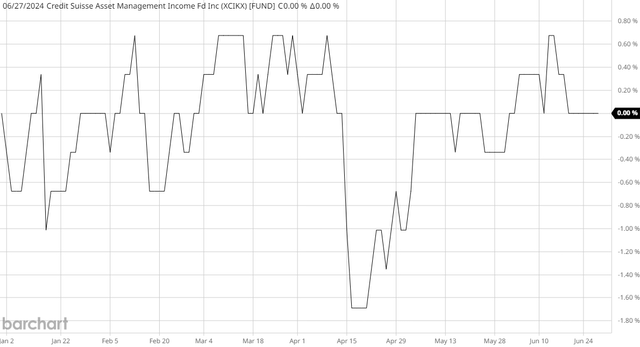

However, the fund’s portfolio itself did do better than the share price, as the fund’s net asset value was flat over the period:

Barchart

This does not explain the decline in the fund’s leverage, though. If the net asset value is flat, the only way in which the fund can decrease its leverage ratio is by paying off some of it and reducing the outstanding balance. It would be reasonable to assume that the fund’s management took this action in an attempt to reduce risk in an environment that was expected to result in greater default-related losses than average.

The decrease in the fund’s leverage ratio has also put it at a very reasonable level relative to its peers:

|

Fund Name |

Leverage Ratio |

|

Credit Suisse Asset Management Income Fund |

24.90% |

|

AllianceBernstein Global High Income Fund |

19.01% |

|

Allspring Income Opportunities Fund |

30.30% |

|

BNY Mellon High Yield Strategies Fund |

28.66% |

|

BlackRock Corporate High Yield Fund |

26.00% |

|

PGIM High Yield Bond Fund |

20.77% |

(all figures from CEF Data.)

As we can clearly see, the Credit Suisse Asset Management Income Fund has a lower level of leverage than quite a few of its peers. Overall, the fund’s leverage is just below the median (25.45%) of this group. That is a clear indication that the fund’s leverage is not excessive for its strategy. Risk-averse investors should not have to worry too much about the fund’s leverage here, as the current level should represent a very reasonable balance between the risk and the potential rewards inherent in leverage.

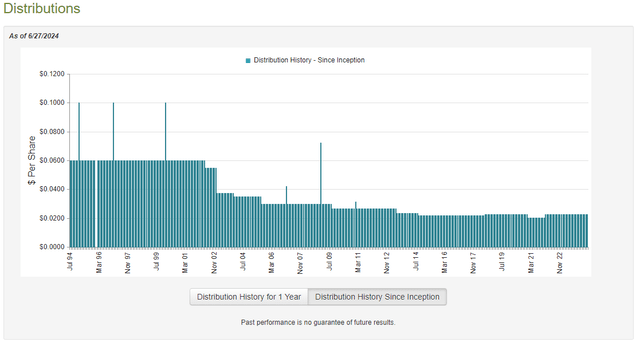

Distribution Analysis

The primary objective of the Credit Suisse Asset Management Income Fund is to provide its investors with a very high level of current income. To that end, the fund pays a monthly distribution of $0.02250 per share ($0.27 per share annually). This gives the fund a 9.17% yield at the current share price, which as we saw in the introduction, is very reasonable compared to its peers.

Unfortunately, the fund has not been especially consistent regarding its distribution over its history:

CEF Connect

As I described previously:

As we can clearly see, the fund’s distribution has varied considerably over its lifetime, although it has been more consistent than many other fixed-income funds since the middle of the last decade. However, the fund’s long-term history might still prove to be a turn-off for some investors who are seeking to earn a consistent level of income from the assets that are in their portfolios. This is one of the few fixed-income funds that did not cut its distribution in response to the 2022 shift in monetary policy that caused bond prices to decline and bond funds to suffer large losses. We should investigate why the fund was able to accomplish a feat that so many of its peers failed to accomplish as we do not want it to be maintaining a distribution that it cannot actually afford and destroying its net asset value in the process.

As was mentioned in the introduction, the Credit Suisse Asset Management Income Fund released an updated financial report earlier this year that we can consult for the purposes of our analysis today. This report corresponds to the full-year period that ended on December 31, 2023, and a link to it was provided earlier in this article. This report will not include any information about the fund’s performance year-to-date, which is rather disappointing as we are obviously missing six months of data. However, it is still newer than what we had available the last time that we discussed the fund, so it will still work fairly well for update purposes.

For the full-year period that ended on December 31, 2023, the Credit Suisse Asset Management Income Fund received $17,657,715 in interest and $2,932 in dividends from the assets in its portfolio. When combined with a small amount of income from other sources, the fund achieved a total investment income of $17,735,264 for the period. The fund paid its expenses out of this amount, which left it with $13,108,888 available for shareholders. That was not sufficient to cover the $14,214,231 that the fund paid out in distributions over the period.

Fortunately, the fund was able to make up the difference through capital gains. For the full-year period, the Credit Suisse Asset Management Income Fund reported net realized losses of $11,717,283, but these were more than offset by $24,611,831 in net unrealized gains. Overall, the fund’s net assets increased by $12,240,585 after accounting for all inflows and outflows during the period.

Thus, the Credit Suisse Asset Management Income Fund technically managed to cover its distribution during the period, but it only managed to do this because of its unrealized capital gains. Unrealized capital gains can be erased by a market correction, and the bond market has been down this year, so there is a very real chance that some of them have been erased.

Fortunately, that does not appear to be the case. This chart shows the fund’s net asset value from December 29, 2023 (the last trading day of that year) until today:

Barchart

As we can see, the Credit Suisse Asset Management Fund had a net asset value that was overall flat so far this year, but it did have some volatility. This tells us that the fund has managed to cover all the distributions that it paid out over the period, although barely.

For the most part, the distribution appears to be safe, but any volatility in the bond market could quickly change that as the fund has no buffer of excess returns to absorb market declines.

Valuation

Shares of the Credit Suisse Asset Management Income Fund are currently trading at a very slight premium of 0.34% to net asset value. That is more expensive than the usual 0.68% discount that the shares have possessed on average over the past month. It is also quite a bit more expensive than many other junk bond funds.

As such, investors can probably get a better deal by waiting for the price to shift to a discount.

Conclusion

In conclusion, the Credit Suisse Asset Management Income Fund continues to look like a relatively decent domestic junk bond fund that investors can purchase in an attempt to achieve their income goals. The fund does not receive much attention from most investors or in the media, but it does still trade at a premium (unusual for under-followed funds). The fund appears to be covering its 9.17% distribution and can probably sustain it unless the bond market collapses. The only real problem here is that the fund seems a bit expensive.

Read the full article here