The Global X Variable Rate Preferred ETF (NYSEARCA:PFFV) is a Sell for three reasons.

- PFFV invests in Variable Rate Preferred Shares, which means that its dividend fluctuates with short-term interest rates. Most prognosticators forecast that the Fed will cut rates sometime in the next 3 to 12 months. More importantly, the Futures Market Contracts that allow corporations, banks, investors and speculators to trade short-term Interest Rate Markets has priced in lower rates. This collective judgement of the future path of short-term rates is backed by, literally, trillions of dollars.

- Over the last ten years, Preferred Shares as an asset class have underperformed in the last half of the year. Moreover, they frequently have negative returns in the autumn due to new issuance by banks that need to raise capital after the Fed’s Annual Stress Tests are performed. There is no upside for PFFV, only downside risk.

- Preferred Shares in general are a bad long-term investment, never the best choice, usually the worst choice. You don’t want to own them for the long term, even if you need income. Since being issued on June 22, 2020, PFFV has conformed to this pattern, and investors would have been better off rolling T-Bills.

Overview of the Preferred Share Market and PFFV

1) Preferred Shares in General

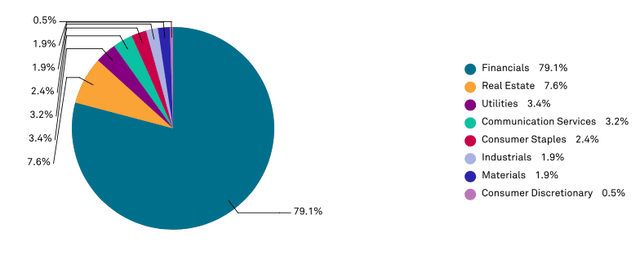

The S&P U.S. Preferred Stock Index (SPPREF) is comprised of 214 issues of Preferred Shares, that in aggregate have a par value of $100.4 billion. As per Chart 1, approximately 80% of the index are preferred shares issued by financial institutions, primarily banks, which can use the funds received as a type of quasi equity for regulatory purposes. Real Estate, the second largest sector, has a number of issues that were issued by mREITs, which, similar to banks, also consider their pref shares to be quasi equity.

Being a type of equity, issuers are unable to use dividends paid as a tax deduction, as is the case for interest payments used to service debt that they have incurred. However, this means that these same dividends usually receive favourable tax treatment for investors. This will vary by preferred share, and by the country where investors reside in. Investors should consult with their own tax advisors on this point.

As well as being concentrated by sector, the index is also heavily exposed to certain issuers. Four of the index’s top ten holdings are preferred shares issued by JPMorgan Chase & Co. (JPM), and three of the top ten are preferred shares issued by Bank of America Corporation (BAC), Citigroup Inc. (C), and Wells Fargo & Company (WFC).

Chart 1: SPPREF Sector Breakdown* as of June 28, 2024

S&P Global

* Based on GICS Sectors. The weightings of each sector are rounded to the nearest tenth of a percentage point, so the aggregate weights for the Index may not equal 100%.

Most preferred shares are issued at a par value, typically $25, or at a slight discount to par. As pref shares are usually callable at par, they have an asymmetric risk and return profile. Investors in preferred shares bear 100% of the downside risk associated with an issuer, but they do not have any of the upside associated with any improved financial performance it may experience.

Finally, most preferred shares are issued with a fixed dividend rate. Once again, investors have an asymmetric risk and return profile. If market interest rates increase, the prices of preferred shares with a fixed dividend will decrease. However, if market interest rates decrease, preferred share prices do not increase beyond their par value in any material way. Issuers will exercise their call feature, and replace existing preferred shares that now have an above market dividend yield, with newly issued preferred shares that have lower dividends.

2) The Global X Variable Rate Preferred ETF

PFFV invests in preferred shares where the dividend rate fluctuates with a reference rate. In the past, this rate was usually LIBOR, the London Interbank Offer Rate. LIBOR was phased out by regulators several years ago, and it was replaced with SOFR, the Secured Overnight Reference Rate, which is described in more detail in the next section. Some relevant statistics regarding PFFV are:

- PFFV’s AUM is $250.74 million, and it owns 55 different preferred shares.

- PFFV trades on the NYSE and its CUSIP is 37954Y376. Over the past 30 days, its medium Bid/Offer Spread was 0.08%.

- PFFV’s Expense Ratio is 0.25%.

- Dividends are paid monthly, and using the closing price on June 28, 2024 of $23.65, it yielded 7.06%.

- PFFV is heavily concentrated in a few issuers. Looking only at its Top 10 Holdings, which comprise 35% of AUM, its exposure to Goldman Sachs (GS) was 8.06% of AUM, Morgan Stanley (MS) was 4.49% of AUM, its exposure to Bank of America Corporation (BAC) was 4.39%, Athene Holdings (ATH.PR.D) was 3.55%, and its exposure to Anally Capital (NLY) was 2.97%.

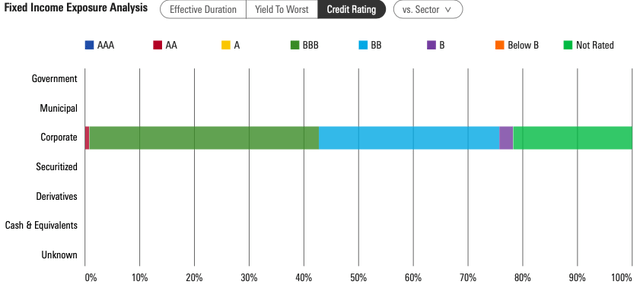

- As per Chart 2, the assets it holds are at the lower end of the credit rating spectrum. BBB rated securities, the border between investment grade and non-investment grade, comprise 58.92% of AUM, while Non-investment grade securities comprise 34.64% of overall AUM.

Chart 2: PFFV Holdings By Credit Rating and Maturity*

Morningstar

* As of June 27, 2024

The relatively poor credit quality of the assets held by PFFV partially explains its 7% dividend yield. The other reason for this relatively high yield is, the fact that the Yield Curve is inverted, and short-term interest rates are currently higher than long-term rates.

Short-Term Rates – What Interest Rate Markets Are Pricing In

An Interest Rate Swap is a contract between two parties, where one party makes a fixed interest rate payment to a second party, usually quarterly. In return, the second party pays a floating rate interest payment to the first party. The value of the floating rate payment fluctuates in line with a reference rate. For decades, the relevant reference rates were called LIBOR, and they were set by the British Banker’s Association. However, during the Credit Crunch, it became apparent that LIBOR could be, and was, manipulated. A number of banks eventually paid fines in excess of $1 billion. The final five USD LIBOR based reference rates were discontinued on June 23, 2023, and they were replaced with SOFR, the Secured Overnight Reference Rate. The following quotation gives an idea of the scale of these markets:

SwapClear clears more than 50%* of all OTC interest rate swaps and more than 90%* of the overall cleared OTC interest rate swap market. We regularly clear in excess of $3.5 trillion* notional per day and have more than 3 million cleared trades outstanding.”

The notional value of US dollar interest rates swaps outstanding that were cleared by SwapClear, was, as of June 27, 2024, $135.2 trillion. This implies ($135.2 trillion / 3 million trades) that the size of the average trade is $45 million. It should also be noted that not every interest rate swap is cleared.

Not every corporation or investment fund has access to the Interest Rate Swap market, and indeed, many are expressly forbidden from participating in it. As a result, there are now 13 one-month SOFR Contracts, and 5 three-month SOFR contracts that trade on the CME. A corporation that forecasts that it will have excess cash in the future, which it will want to put on deposit for a month, or for a three month period, can now lock in the interest rate for the relevant period. Similarly, other corporations can now hedge the risk of rising interest rates, when they have a forecasted need for liquidity in a future period of time.

Table 1 shows what the market’s collective judgement is regarding where short term interest rates will be in the near future.

Table 1: CME 3 Month SOFR Contracts*

| Contract | Maturity | Price | Average Overnight Rate (100 – Price) |

|---|---|---|---|

| SQU24 | Sep ’24 | 94.85 | 5.15% |

| SQZ24 | Dec ’24 | 95.145 | 4.855% |

| SQH25 | Mar ’25 | 95.435 | 4.565% |

| SQM25 | Jun ’25 | 95.685 | 4.315% |

| SQU25 | Sep ’25 | 95.88 | 4.12% |

* Closing Prices June 28, 2024

The Fed Funds Policy Rate is currently 5.25% to 5.50%, depending on if a bank is borrowing money from the Fed, or if it is placing funds on deposit with it, and SOFR closed at 5.34% on Friday, June 28, 2024. As per Table 1, the market is forecasting that rates will fall in the near future. Should this occur, holders of PFFV will not receive a 7% yield in a year’s time, unless the quality of its assets has deteriorated, and the NAV / Market Price of PFFV has decreased materially.

Seasonality in the Preferred Share Market

Banks, the largest issuers of preferred shares, get a number of free rides. The FDIC guarantees a portion of their deposits, making them essentially risk-free. This allows them to pay a lower rate for funds. As well, the Fed’s discount window allows banks to access hundreds of billions in debt almost instantaneously. This backstop allows them to secure better terms from private credit markets. Finally, a number of them are considered to be “too big to fail”.

Once upon a time, banks gave up relatively little for the various government support mechanisms that they enjoy. That all changed during the Credit Crunch. Banks are now subject to increased oversight, and there are also a number of constraints that have been placed upon the types of activities they are permitted to engage in, and upon the amount of capital they need to be able to support these activities.

As detailed in this article, prior to the Credit Crunch, the common equity of US Money Center banks had a much higher average return in the first half of the year than they did in the second half of the year. That is no longer the case; for the past ten years, the second half of the year has outperformed the first half. Preferred shares have the exact opposite pattern.

After the 2008-2009 financial crisis, the Fed introduced annual stress tests for large banks, currently defined as those with more than $100 billion in assets. Smaller regional banks with more than $50 billion assets, but less than $100 billion, are tested every two years. The tests were formally implemented in 2011, and results are released at the end of June.

Poor results affect the existing preferred shares issued by banks in two ways. First, the market’s perception of the credit quality of the banks in question, and of their preferred shares, is adversely impacted. Second, the Fed often makes banks raise capital, and one way they do this is by using new preferred shares. This increased supply causes the prices of existing preferred shares to decrease.

The Fed released this year’s results on June 26, 2024. They showed that if the scenario outlined in the stress test were to actually occur, the 31 banks that were tested would suffer collective losses of $685 billion. While the banks’ capital would not fall below their statutory minimum levels, this loss rate exceeded the hypothetical losses of 2023.

I don’t know how the market will perceive these results, but I strongly believe that any upside from a positive reception will accrue entirely to common equity holders. The reaction of pref shares towards a positive test result will likely be, “Meh”. After all, if the banks in questions are suddenly perceived to be of much higher credit quality, and pref shares start to rally as a result, the banks in question will call their existing issues, and replace them with new issues that are cheaper.

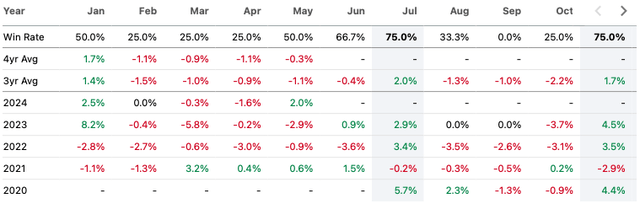

Table 2 shows the monthly returns for PFFV since it was issued in 2020. As can be seen, the upcoming calendar months have not been good ones for holders of PFFV. August and October have the lowest average returns for the entire year, and there has never been a September with a positive return.

Although July is usually a good month, there is no upside to holding preferred shares past this month, the only downside.

Table 2: Monthly Returns Since Inception – PFFV

Seeking Alpha

Preferred Shares Have Been, And Will Continue To Be, Poor Long-Term Investments.

As outlined above, preferred shareholders have asymmetric returns. They have all of the downsides associated with common equity, and none of the upside. Per this article, banks and corporations that issue preferred shares would not do so if it wasn’t a good deal for common shareholders. After all, this is who they have a fiduciary duty to, and the stock options the management receives are for common shares, not for preferred shares. In other words, banks and corporations will only issue pref shares if they can convince investors to take an expected return that does not compensate them adequately for the risk they are taking.

And as for any potential protection in a bankruptcy, this too is illusory. Historically, the median recovery rate for Junior Subordinated Corporate Bonds, which rank above preferred shares in the waterfall of creditors, is circa 5% to 15%, depending upon the period that is being analyzed.

Are preferred shareholders rewarded for the risk that they take? Not when compared to almost every asset class in question, when analyzed over a variety of time periods.

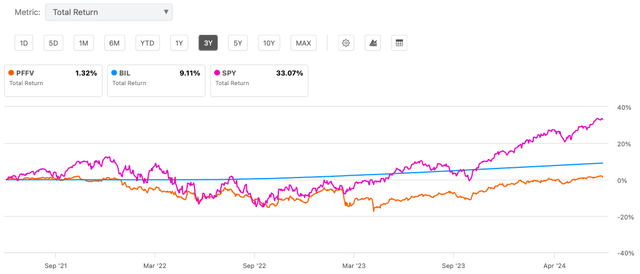

And with regard to PFFV? The last three years have been great ones for the S&P 500, and short-term rates have been above 5% for well over a year? So how is it that PFFV has only been able to breakeven over the past three years, while underperforming T-Bills by 7.8%? Variable Rate Preferred Shares are supposed to fluctuate in line with short-term interest rates, while proving an additional credit spread.

Graph 1: Total Returns PFFV Since Inception Versus T-Bills and S&P 500

Seeking Alpha

Conclusion

As has been outlined in this article, as well as this one, preferred shares are poor investments in almost every type of market – you don’t want to hold this asset for the long term. Often, rolling T-Bills has produced a superior total return, and that is the case for PFFV over the past three years.

We are entering a period in the year, where preferred shares have exhibited seasonal weakness over the past decade. There is only downside to holding them during this period of time, and no upside.

Most prognosticators who read the tea leaves of the Fed, also referred to as minutes of its various meetings, are of the opinion that the next move in the Fed Funds Rate will be down, and not up. Futures contracts that reference SOFR, the Secured Overnight Financing Rate, imply that short-term rates will be approximately 100 basis points lower this time next year.

All in all, PFFV is a Sell.

Read the full article here