1st Avenue in downtown Nashville, TN.

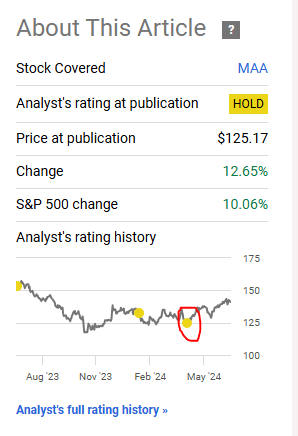

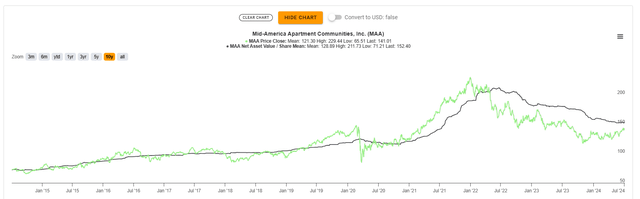

In our last coverage of Mid-America Apartment Communities, Inc. (NYSE:MAA) we reiterated that the analyst camp was still too optimistic about earnings. That coupled with the recency ZIRP (zero interest rate policy) bias meant that the collective was applying too high a multiple on this stock. We did love the company though and suggested investors could start angling in on any further declines.

Realistically, we see the trough FFO near $8.50, and you could easily see a 13X multiple on that. That number ($110.50), though, is not too far from here, and certainly, if you add up interim dividends, you are close to a low-risk entry. We love Mid-America Apartment Communities, Inc. stock and think investors could start averaging in under $120.00. For now, we continue to rate this as a Hold.

Source: The True Inflation Story

MAA unfortunately rallied straight up and did not give anyone a chance to average in below $120.

Seeking Alpha

We go over the Q1-2024 results and tell you why we are actually looking for an even lower start point for our entry.

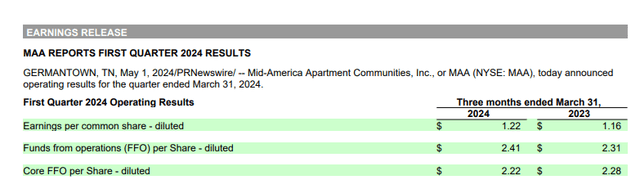

Q1-2024

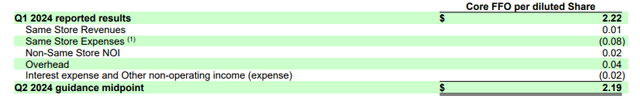

The Q1-2024 numbers looked ok on the surface. Funds from operations contracted slightly (from $2.28 to $2.22) but that was expected.

MAA Q1-2024 Financials

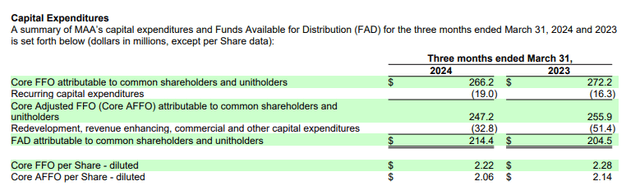

Adjusted FFO (AFFO), which takes into account recurring or maintenance capital expenditures came in at $2.06 and declined to a similar extent relative to Q1-2023.

MAA Q1-2024 Financials

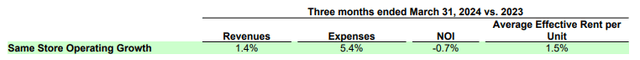

What caused this decline? After all, we keep hearing from the bulls about the unrelenting growth that investors will see in this sector. Well, this quarter too, we saw strong growth, a bit surprisingly, it was not in the revenues. Expenses marched up by 5.4%, at almost 4 times the clip of rent growth. The same property net operating income declined by 0.7%.

MAA Q1-2024 Financials

This is obviously the function of revenues being far higher than expenses. So that 1.4% revenue growth was enough to offset a 5.4% expense jump. But that will get dicey if revenues start to flat line or turn lower even as expenses keep rising. That is not some arcane fantasy, though. MAA is predicting rough seas ahead, with the gap between expense and revenue growth widening in Q2-2024. You can see that below as you move from Q1-2024 to Q2-2024. Same-store revenues will add 1 cent and same-store expenses will subtract 8 cents from FFO.

MAA Q1-2024 Financials

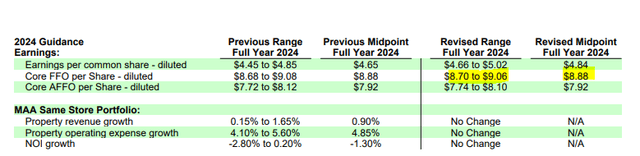

MAA has maintained its guidance range, but we think it will likely hit the low end and the range itself might be lowered after Q2-2024.

MAA Q1-2024 Financials

We will get into those reasons in our outlook.

Outlook & Valuation

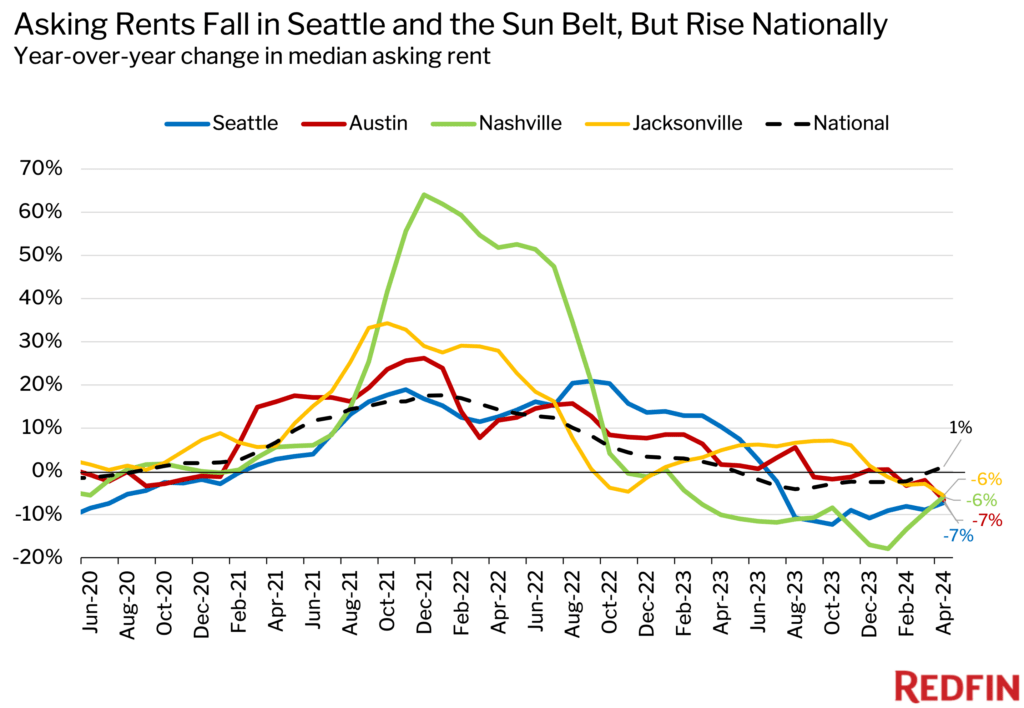

The sunbelt oversupply story has been known for about a year. But the full impact is just beginning. Yes, we are aware that Seattle is not in the sunbelt, but look at the remaining names.

The median asking rent in Seattle fell 7.3% year over year in April—the biggest drop among the U.S. metros Redfin analyzed. Next came Austin, TX (-6.6%), Nashville, TN (-5.9%), Jacksonville, FL (-5.6%), Miami (-5%), San Diego (-4.7%), Phoenix, AZ (-4.6%), Charlotte, NC (-4.5%), Tampa, FL (-4.3%) and Orlando, FL (-3.2%).

Source: Redfin

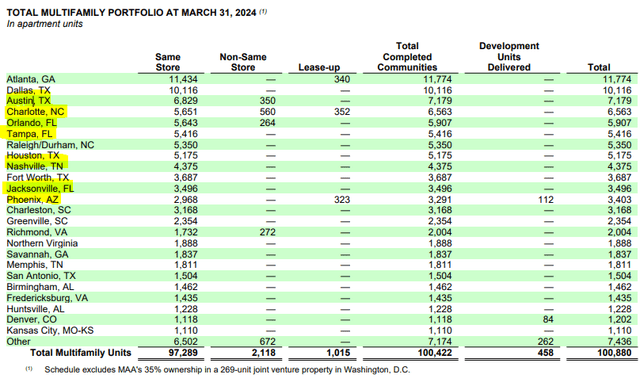

Guess where these cities fit into MAA’s portfolio?

MAA Q1-2024 Financials

You can also see the impact of the sunbelt (and Seattle) versus the rest of the country in the next chart.

Redfin

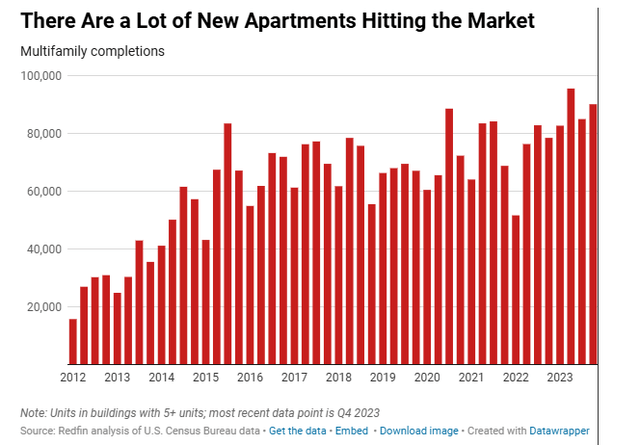

The report skipped a mention of Atlanta, Georgia, the number one location for MAA. But other reports have suggested that rents in Atlanta are falling fast, and the city has one of the highest supply of new apartments in the pipeline. The overall supply of apartments across the country is fairly brisk, and there is a lot more where that came from.

Redfin

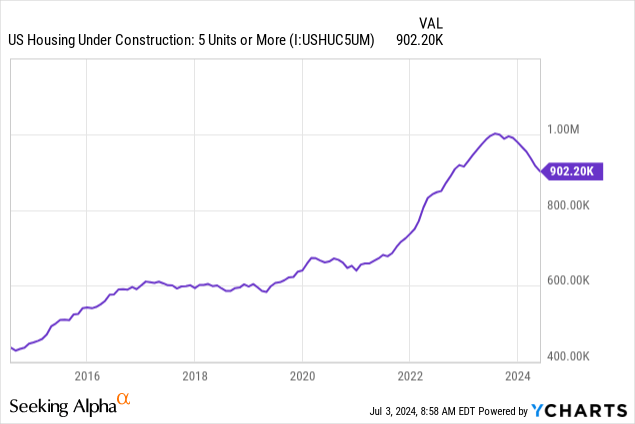

As we have shown before, the new units under construction are just beginning to taper, so expect the actual supply of new units to drop significantly within 4–6 quarters.

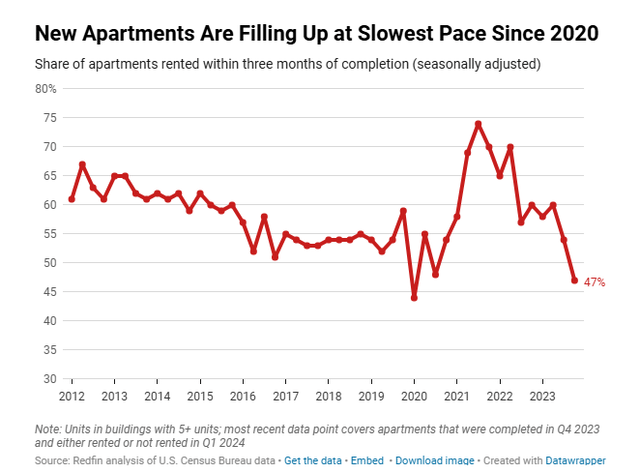

In the interim, filling new apartments remains a challenge.

Redfin

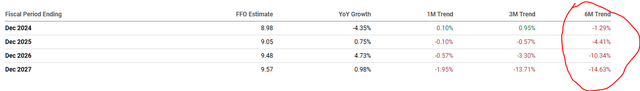

The caption on that picture above is really misleading. We are comparing to 2020, but it is plain as day that we are really at least 13-year lows. So in the face of this information, we are sticking with our thesis that the FFO estimates for the years ahead are wrong. In fact, our earlier estimate of $8.50 through FFO may itself have been too optimistic. Analysts are moving in the right direction, but most of the expectations are being trimmed for the 2026-2027 timeframe.

Seeking Alpha

MAA does not look spectacularly cheap today in relation to its NAV. You can see below that the NAV estimates have continued to drop, and we still think they are a bit off (overestimated).

TIKR

But even if you assume they are accurate, you are buying it at 0.93X of NAV.

TIKR

For this to work out, the NAV has to stop falling, and we think there are risks simply from the expense side rising faster than rents. We are seeing this trend across all apartment REITs. Whatever cap rate you choose and throw on your NOI, you will land up with a lower NAV when your NOI contracts. We are maintaining a “hold” on the company and would now only accumulate under $115.00 (versus $120 previously). Value stocks are fairly cheap today, but we would not put MAA as one. We remain cautious here in the face of heavy headwinds and think better opportunities lie elsewhere.

Mid-America Apartment Communities, Inc. PFD SER I (NYSE:MAA.PR.I)

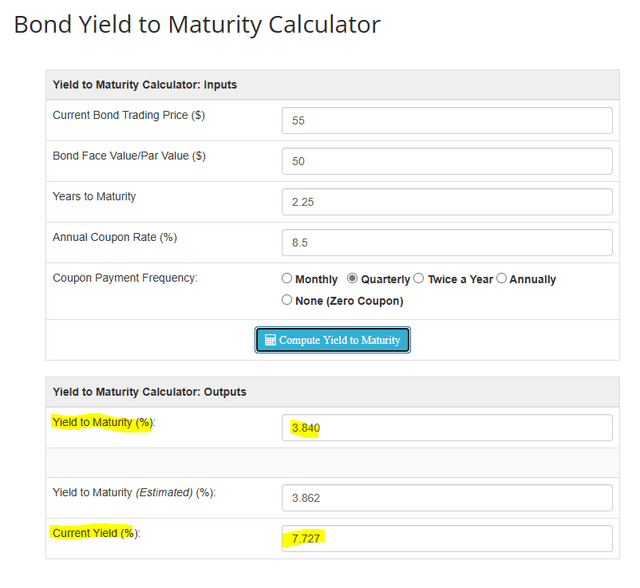

While the common likely makes a poor investment at this point, yield chasers continue to keep MAA.PR.I afloat at a ridiculous price. These are callable in October 2026, and we cannot envision any reasonable scenario in which they are not called. The coupon is 8.5% and the current yield is near 7.72%. But the yield to maturity is just 3.84%

DQYDJ

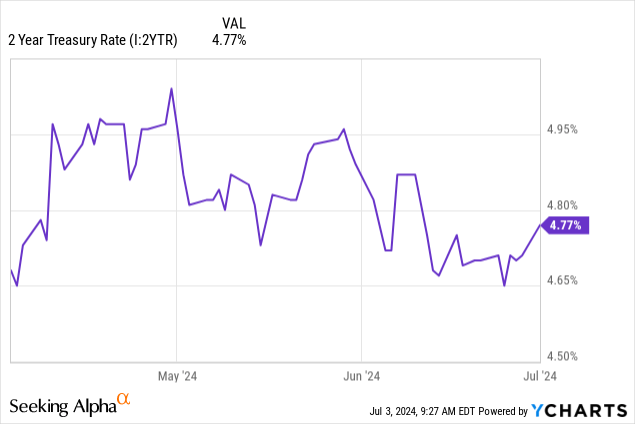

Even two-year Treasuries have a better yield to maturity.

You can probably get about 6.25% without any undue risks in a two-and-a-half-year timeframe. So when you see that 3.84% yield to maturity, you know that this is the prototypical income chaser at work with zero regard for guaranteed capital loss coming down the line. We continue to rate this a Sell for guaranteed underperformance relative to risk-free rates.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here