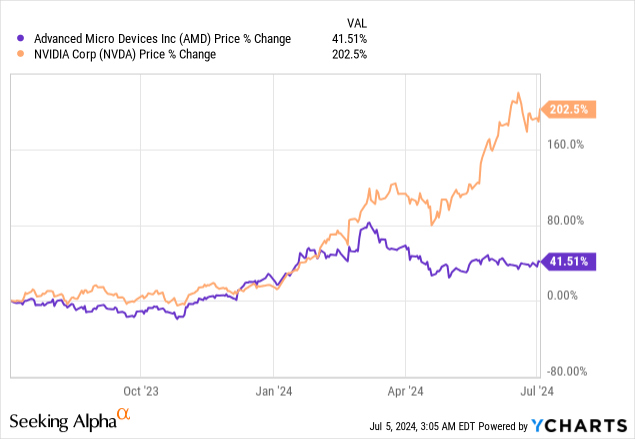

Shares of Advanced Micro Devices, Inc. (NASDAQ:AMD) have risen more than 41% in the last year, but are still widely trailing behind Nvidia Corporation (NVDA), which absolutely crushed expectations in the last year. Although AMD is lagging Nvidia in terms of its GPU proposition, the company is set to debut new products and ramp up shipments of the Instinct MI300X accelerator in FY 2024, which is meant to support AI workloads. AMD is also accelerating its GPU roadmap and looks to launch new Instinct chips in Q4 ’24 as well as FY 2025. These products are set to create significant top line and free cash flow tailwinds for AMD, and could help narrow the gap between AMD’s and Nvidia’s valuation!

Previous rating

I rated shares of AMD a hold in February 2024 — AMD Could Soon Have Its ‘Nvidia Moment’ — as AMD benefits from a tipping point in AI… which means companies are accelerating spending on the companies’ AI chips to scale their own businesses. AMD last month revealed two more processors that will be launched, the AMD Ryzen AI 300 Series processors which are built on AMD’s XDNA 2 architecture, as well as the AMD Ryzen 9000 Series processors for desktops that are built on the AMD Zen 5 architecture. AMD is also accelerating efforts to increase the line-up of its Instinct accelerators, which could lead to significant free cash flow tailwinds.

New product launches are set to challenge Nvidia

AMD is going to launch two processors in the near term, the AI 300 Series for laptops (set to launch July 17, 2024) and the Ryzen 9000 Series processors for desktops (shipments to start in August 2024). The AI 300 Series is aimed at content creators that need to handle demanding AI workloads. Both chips could provide tailwinds and catalysts for the company’s main processor business.

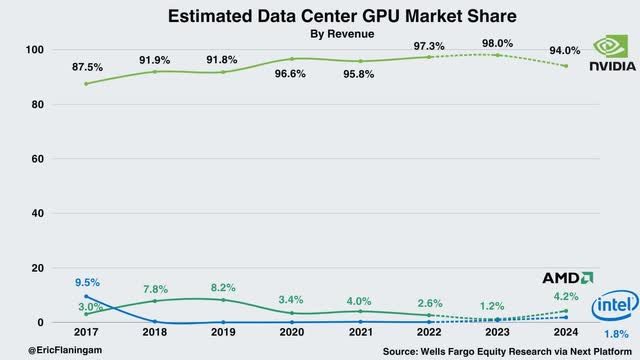

More importantly, however, AMD said in Q2’24 that it is accelerating its GPU product pipeline in a bid to become more competitive with Nvidia’s H100. AMD already launched the Instinct MI300X accelerator earlier this year, which is meant to directly challenge Nvidia’s leading position in the Data Center GPU market. Nvidia is leading the market by a mile, which has translated to soaring profits for the chipmaker: Profit Explosion And Stock Split Are Game-Changers.

As per information from Wells Fargo, Nvidia continues to have a massive 94% share in the Data Center GPU market. AMD is trailing far behind with a market share of slightly more than 4%, but the increasing density of AMD’s AI chip line-up could mount an effective challenge here and take some market share away from Nvidia in the coming quarters.

Wells Fargo, Eric Flaningam

The reason I say this is that demand for AI GPUs is soaring, and Nvidia alone cannot fill the demand. With demand outstripping supply, AMD could be a big beneficiary here as it accelerates its own product release pipeline and its MI300 accelerator shipments likely picked up in Q2 ’24. AMD is further looking to release the AMD Instinct MI325X accelerator in Q4 ’24 and the AMD Instinct MI350 Series in FY 2025.

The MI350 Series, according to information provided by AMD, offers “up to a 35x increase in AI inference performance compared to AMD Instinct MI300 Series” which could make AMD’s chips increasingly interesting as an alternative to the high-priced H100 chips that Nvidia is selling. The AMD Instinct MI400 series is expected to debut in FY 2026, meaning AMD is moving closer to a yearly release cycle for its GPU products.

AMD is looking at a massive free cash flow ramp

AMD said in its last earnings report that it is seeing strong demand for the Instinct MI300 accelerator, and the chipmaker could be on track to see a serious ramp in free cash flow in the next several years. Its guidance for Data Center GPU revenue is more than $4.0B for FY 2024 and I would not be surprised to see a doubling of GPU-related revenues next year given how strong the demand for these products is right now.

AMD only saw 2% revenue growth, year over year, in the last quarter, while Nvidia crushed it with a 262% Y/Y increase. However, as AMD accelerated its Instinct MI300 shipments in Q2’24, AMD could be set to see much stronger revenue and free cash flow tailwinds than in the last quarter. This doesn’t mean that AMD will overtake Nvidia in the data center GPU market in the near term, but AMD’s free cash flow growth potential may be potentially underrated here.

AMD generated just $379M in free cash flow in the last quarter, which calculates to a FCF margin of 7% while Nvidia crushed it with $14.9B in FCF and a margin of 57%. Nevertheless, AMD’s free cash flow margin has improved from 4% in Q4 ’23 to Q1 ’24, in part due to the shipments of high-margin Instinct MI300 processors.

With GPU-related revenues potentially doubling next year to $8.0B (my personal estimate given the enormous supply demand imbalance in the GPU market), AMD is set to see a significant improvement in its free cash flow as well. AMD’s consensus top-line forecast for next year implies 28% year-over-year growth and $33B in revenues.

An increase in the free cash flow margin to a moderate ~15%, which is not an aggressive assumption considering the strength of demand for Data Center GPUs, could therefore imply a total free cash flow potential of close to $5.0B in FY 2025. This expansion in free cash flow margins could mainly be driven by ramping up volume shipments of the Instinct MI300 chip (plus launch of the mentioned new CPUs) as well as pricing strength for Data Center GPUs.

As AMD only achieved about $1.1B in free cash flow in FY 2023, the chipmaker could be on track to 4X its free cash flow by the end of FY 2025. This implied growth in AMD’s free cash flow may be underrated, in my opinion, as the market is mainly focused on the leading top-line growth rates and FCF margins of Nvidia.

| AMD, $millions | Q1’23 | Q2’23 | Q3’23 | Q4’23 | Q1’24 | Y/Y Growth |

| Revenue | $5,353 | $5,359 | $5,800 | $6,168 | $5,473 | 2% |

| GAAP net cash provided by operating activities | $486 | $379 | $421 | $381 | $521 | 7% |

| Purchases of property and equipment | ($158) | ($125) | ($124) | ($139) | ($142) | -10% |

| Free Cash Flow | $328 | $254 | $297 | $242 | $379 | 16% |

| Free Cash Flow % Of Net Revenues | 6% | 5% | 5% | 4% | 7% | 13% |

| Nvidia, $millions | FQ1’24 | FQ2’24 | FQ3’24 | FQ4’24 | FQ1’25 | Y/Y Growth |

| Revenue | $7,192 | $13,507 | $18,120 | $22,103 | $26,044 | 262% |

| GAAP net cash provided by operating activities | $2,911 | $6,348 | $7,333 | $11,499 | $15,345 | 427% |

| Purchases of property and equipment | ($268) | ($300) | ($291) | ($282) | ($409) | 53% |

| Free Cash Flow | $2,643 | $6,048 | $7,042 | $11,217 | $14,936 | 465% |

| Free Cash Flow % Of Net Revenues | 37% | 45% | 39% | 51% | 57% | 56% |

(Source: Author.)

AMD’s valuation

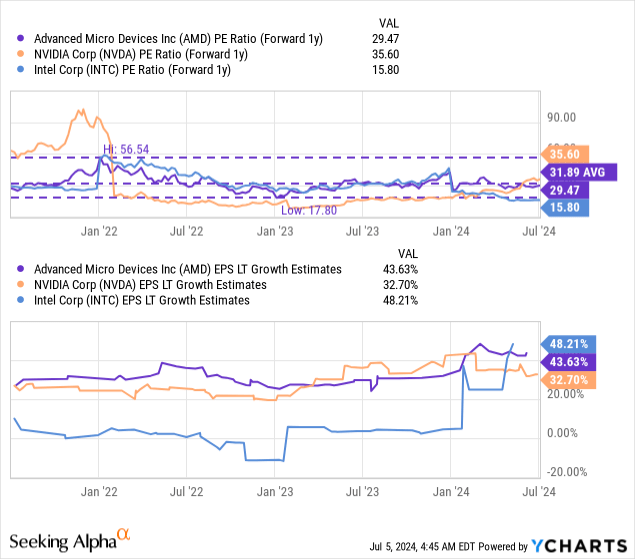

I like AMD chiefly because of its underdog status and its lower valuation relative to Nvidia. AMD is actually expected to grow its EPS faster than Nvidia over the long term, chiefly in my opinion because AMD’s GPU development pipeline has been trailing behind Nvidia. AMD, therefore, has considerable “catch-up” and revaluation potential. The same is true for Intel (INTC), which only recently launched its own AI chips, the Gaudi 3 AI accelerator, for the enterprise market. In the case of Intel, I believe the market is much too bearish, which is reflected in the company’s low P/E ratio.

Currently, shares of AMD are valued at a price-to-earnings ratio of 29.5X, which Nvidia surpasses with an earnings multiplier of 35.6X. Intel is by far the cheapest chipmaker with a P/E ratio of 15.8X, but Intel has had its own problems, including delayed processor launches. Nvidia did grow its Data Center and consolidated revenues a lot faster than AMD and Intel in recent quarters, but AMD is catching up here and has a very attractive risk setup given the Instinct MI accelerator pipeline.

I believe AMD could trade at Nvidia’s P/E of 35-36X if the company executes well with its Instinct chip releases, demand for GPUs remain high and AMD sees a significant free cash flow margin catalyst tied to its accelerating Instinct accelerator pipeline. A 35-36X P/E ratio for AMD implies a fair value range of $195-200. The aggressive product roadmap regarding GPU releases and associated FCF catalyst is why I am upgrading shares of AMD to buy.

Risks with AMD

AMD is trailing behind Nvidia in terms of GPU-related revenue growth and market share, but AMD does have an opportunity to narrow the gap between its fiercest competitor through the successive launches of new Instinct chips… that are coming to market at a time of escalating demand. Since AMD has still not really benefited from the ramp of Instinct MI300 accelerator sales (given that shipments only started in Q1 ’24), the company is set for a serious free cash flow upswing going forward. What would change my mind about AMD is if the company were to see weakening demand for its flagship Instinct MI300 chips, and if AMD and Nvidia were to see drastically falling GPU prices.

Final thoughts

AMD is currently the underdog in the AI GPU market, which Nvidia easily controls and dominates. However, AMD is not sleeping at the wheel and is set to debut a number of AI-focused processors that could lead to an acceleration of the company’s top line/free cash flow growth and help the chipmaker narrow the gap between itself and Nvidia. Importantly, I believe AMD has a valuation advantage over Nvidia, although the chipmaker is not growing its top line as quickly as its biggest rival in the market.

I really like AMD’s underdog status in the AI market, and believe that the upcoming launch of AI-supportive processors and new GPUs of the Instinct Series could make AMD more attractive from a free cash flow point of view. With a P/E ratio of less than 30X, AMD’s risk profile is heavily skewed to the upside!

Read the full article here