Dear readers/followers,

Yara International (OTCPK:YARIY) has not been a superb performer for the past few months and a half-year. My last article in December has not outperformed the index, and we’ve actually seen a decent decline of about 12% negative RoR while the S&P 500 is up around 17%. You can find that article here, for perusal and comparison.

I frankly do not believe this reflects a downgrade or a disbelief in the quality of Yara. Instead, I believe that it reflects the broader macro. Despite challenges, Yara International’s thesis remains strong, with a fortress-type balance sheet and attractive long-term upside.

If you’re curious as to what is affecting company performance, we have profit and EBITDA margins, but positive trends include lower gas prices and higher deliveries.

But this article is primarily about 1Q24, which came about about two months ago and made it clear why I don’t believe the company will see any sort of significant reversal in the very near term.

However, this isn’t the same as the company not being investable. My investment strategy is more about finding undervalued gems when everyone is clearly against them – more than “jumping” on the train of what’s happening now.

Let’s look at what Yara is doing at this time.

Yara International – The upside exists, but is longer in the future now than I expected

The main problem Yara is facing is lower global prices for its products. Over the past few years, the company has been flying high on very high fertilizer prices and good premiums, but this situation is now over. While we’ve seen this for almost a year now, the company is still influenced by strong comps, meaning that even good or decent results here will see negative YoY because the periods in question were so very strong.

1Q24 is a good example of this.

EBITDA, despite decent, was still down 11% due to lower prices, and this is despite a 12% increase in Global deliveries and a 37% increase in European deliveries. The company is also successfully and continually lowering GHG emissions with the implementation of key projects.

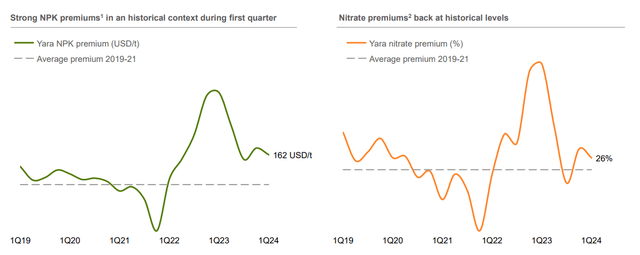

The aforementioned premiums in nitrates and NPK are seeing normalization down from the levels seen in 2022 and parts of 2023, which gave rise to the absolutely exceptional results during those years.

Yara IR (Yara IR)

What can the company actually do to even fight or go against this?

Well, the company can improve its production mix, make sure that the production mix and asset base are as flexible as possible for a start-up and run-down or pause, and try to add as much flexibility to this mix as possible without breaking its focus.

The company’s financial performance was so-so – not good if compared, but not bad if seen as a product of this particular environment. Yara managed over 430M USD in EBITDA, and EPS was at around $0.21/share, which is down from $0.4/share about a year ago. ROIC is unfortunately very low, and operational cash flows are down more than 80%. There’s a mix of reasons for this. Performance in Europe despite growth is still something that can improve. Deliveries, overall, are fairly stable on a YoY basis, which means it’s actually lagging the historical average in terms of growth.

The big picture sort of view that I want to give here is the following – and it remains crucial to have in mind here. There is a healthy underlying growth in demand that will eventually drive things upward here, and probably would drive it upward even now, if the company wasn’t dealing with a significant growth in new supply capacity. But this is the case.

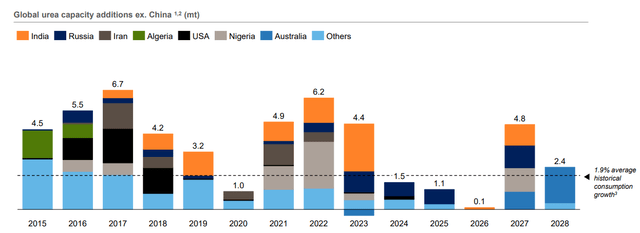

Current demand-driving pricing is about 2% per year – but there has been a strong growth in supply from urea, especially from China and India, and this impacts demand-driven pricing in 2023 with pricing above swing costs, as they are called.

The market needs to “absorb” this new supply before pricing can once again go up significantly and support a better trend for Yara here. Farmer incentives are as they should be here – at historically good patterns, but farmers have also moved more and more to a JIT (just-in-time) sort of purchase model, which results in low-value chain stocks.

Turning to overall project and product pipelines, there’s better demand visibility in a 3-5 year period, with the pipeline being extremely thin in 24-26 with almost no new projects coming online. This will improve pricing.

There’s also the heart of the matter, which is that Yara remains a premier play on tackling the global food question – and this is really the main reason why I continue to invest in Yara International.

Yara IR (Yara IR)

Key KPIs and trends will cycle – things like cash flows, including free cash flows have a tendency to move like a heartbeat, meaning going up and down quite violently at times. 1Q21 saw almost 1.7B USD, while 2Q22 saw less than 110M USD, while 3Q23 moved back up to over 2.1B USD. Yara is not for the faint of heart, but my argument continues to be an investment for the long term with plenty of positive payoffs if you manage to get in at a good price.

The positive news for the company as of 1Q24 is that capacity additions are now mostly behind us – the trends just need some time to catch up, at which point we’ll see result improvements as well.

Yara IR (Yara IR)

When they do, this company will go back up again as well – which actually makes this a not terrible time to add or to consider adding to the company. Going forward, I continue to forecast an earnings normalization for 2024-2026 as well as a continued dividend moderation with potential for raises when the earnings allow this. However, remember, my own entry into this particular company was made below 300 NOK and because I believe I know this company quite well, this is not an uncomfortable position in the least for me.

It continues to be a good position for me, and one I happily hold onto in a “storm”.

Risks & Upside

The risk to Yara here remains a continued weakness in product pricing and potential spikes in energy pricing due to an unfavorable energy market as well as a poor supply/demand situation.

As mentioned before, this could once again come at a time when product prices are low already – not like it was before – then this will cause a double sort of decline, where earnings may trough even further and go down to levels from 5-7 years ago. This can happen again, and I would say it’s going to happen because volatility in this company is one of the “facts” here.

So the trick with Yara remains expecting and accepting the volatility, and now accepting that we’ll likely move up a bit.

However, the company still doesn’t cycle quickly. If you look at the history, it has been many years since we saw a price consistently below 300 NOK, despite the company’s earnings-related uncertainty and volatility. Remember, for years the company generated less than 30 NOK/share in earnings per year. That, and including what we’ll see in the valuation portion, is why I consider this such a unique upside.

Yara International Valuation – The upside is there, but requires consideration for the long-term and portfolio allocation

So, the positives first. Yara International, if you expect the company and it’s trends for the next 2-4 years, is now at a cheap price, and my rating and thesis reflect this.

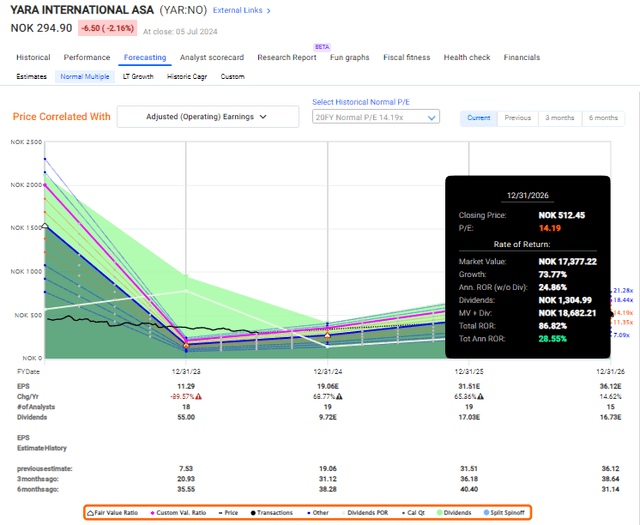

The reason is simple. In 2024, 2025, and 2026, the company is expecting a significant earnings increase (as are analysts), based on the aforementioned supply/demand trends.

At 294 NOK, which is where the company trades today, the company yields only 1.7% – but again, this is due to the very low dividend based on the company’s current earnings. A better-normalized dividend level, if we take the current company earnings expected for the next few years (F.A.S.T Graphs Paywalled Link), it’s more likely to be a current yield of at least 5-6%.

Let’s say that you wanted to forecast Yara at the lowest possible, longest-term possible level with the most conservative assumptions out there. Not a problem – let’s do that. This would come to around 14.2x P/E for a company that’s currently expected to grow at least 40% on average for the next few years, but we can do 14.2x.

That would still entail an annualized growth rate of around 28.5% per year.

F.A.S.T Graphs Yara Upside (F.A.S.T Graphs Yara Upside)

So some of you might expect that I’m a bit more careful here – and I have become so – because Yara is no longer my largest position, and I have cut out my position to about half with a very nice profit a few months back before we hit sub-370 NOK. However, at under 300, I’m looking to get back in, and I thus maintain my overall rating of “BUY” for the company.

Furthermore, the risks for Yara by far, to my mind, are made up for by the upside in the company here. And as long as you invest for the long term, there’s a whole lot to like here.

I will, however, lower my price target to a somewhat more conservative estimate here as well, now going to 400 NOK/share.

Thesis

- Yara is one of the best/most appealing fertilizer businesses on earth and by far the most attractive with a combination of quality/fundamentals and upside that I see. The company combines legacy appeal with future-proofing, and I see only limited downside at any sort of conservative valuation.

- This goes for both my private investment account, as well as my commercial/corporate account where I invest proceeds and profits from my business dealings. My position is now smaller than it was before, but i would still consider the company very attractive here.

- Yara is a “BUY” here, though every investor, of course, needs to look at their own targets, goals, and strategies. I would also always consult with a finance professional before making investment decisions such as this.

- I give the company a PT of 400, which is lower than my last article, NOK for the common.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I will no longer call Yara cheap for what it offers at these levels. It’s an attractive “BUY”, but the upside now is a bit more muddled, and after the dividend is paid out, I now forecast only a 5-6% yield here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here