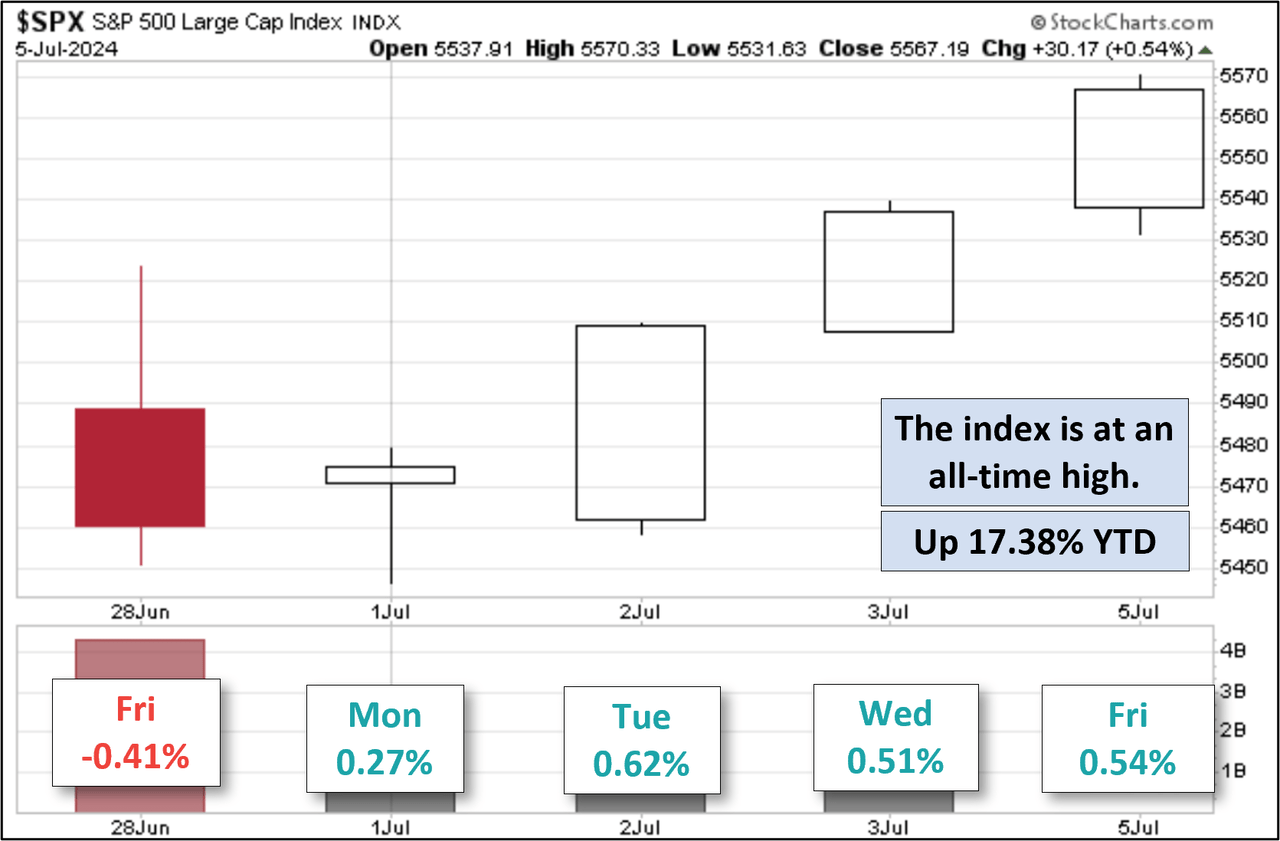

The S&P 500 kicked off the second half of the year with a new record high. The index is currently up 17.38% year to date and has recorded a new all-time high 34 times this year.

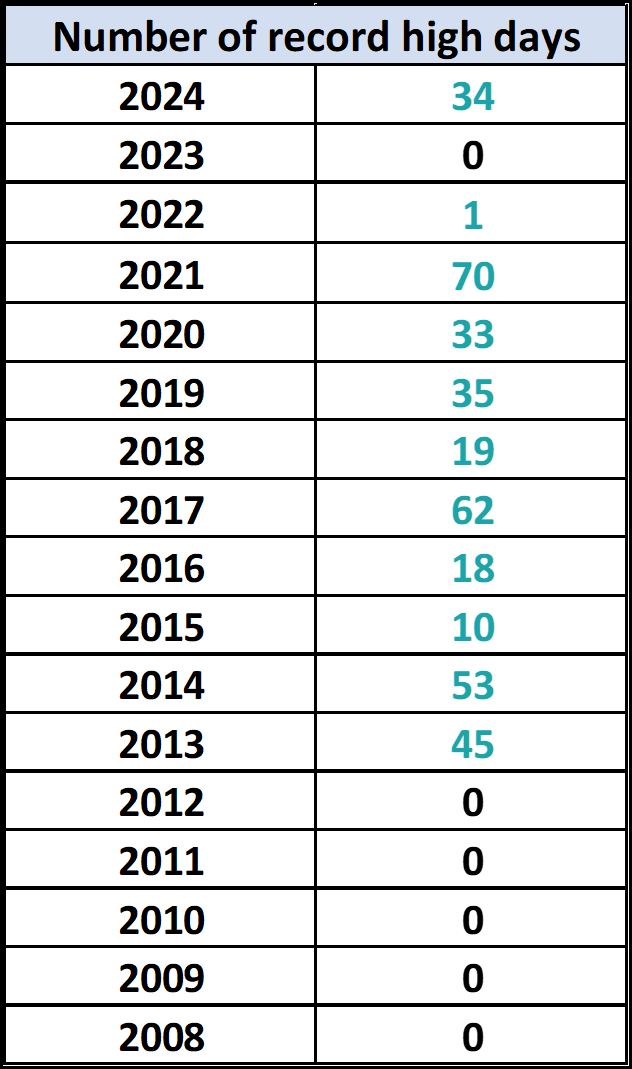

The table below summarizes the number of record highs reached each year dating back to 2008.

Here is a snapshot of the index over the past 5 days:

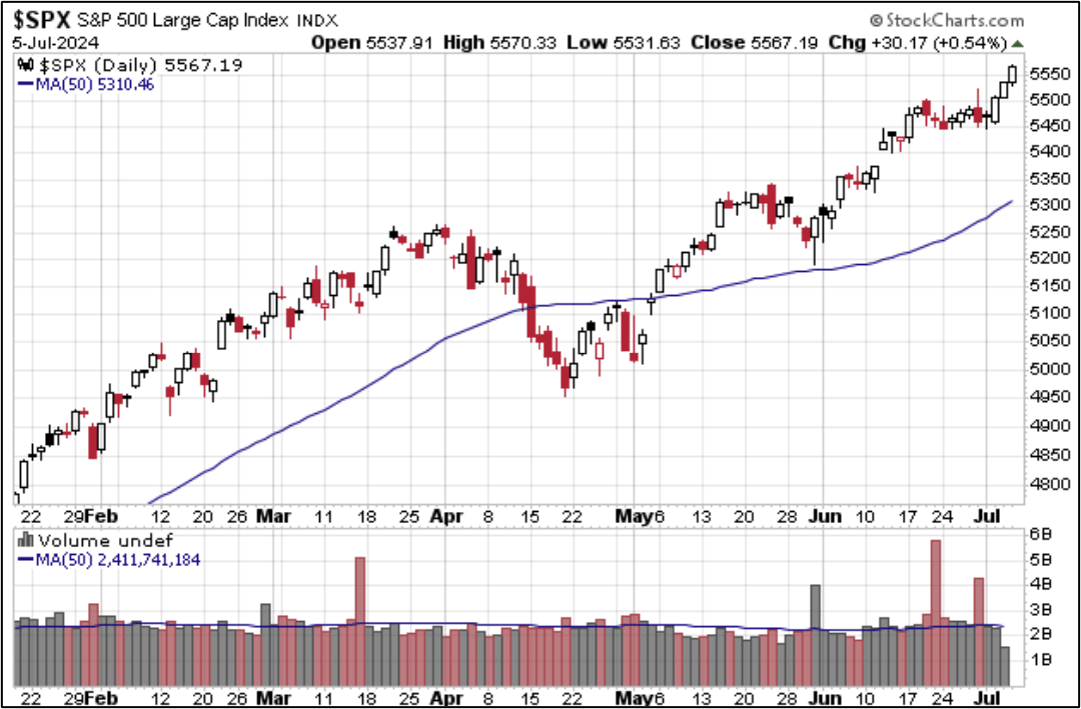

Here is a snapshot of the index from the past six months with a 50-day moving average:

The U.S. Treasury put the closing yield on the 10-year note, as of July 5th, at 4.28% which is above its record low (0.52% on 8/4/2020). The 2-year note is at 4.60%. ETFs associated with Treasuries include: iShares 1-3 Year Treasury Bond ETF (SHY), iShares 7-10 Year Treasury Bond ETF (IEF), and iShares 20+ Year Treasury Bond ETF (TLT). See our latest Treasury Snapshot here.

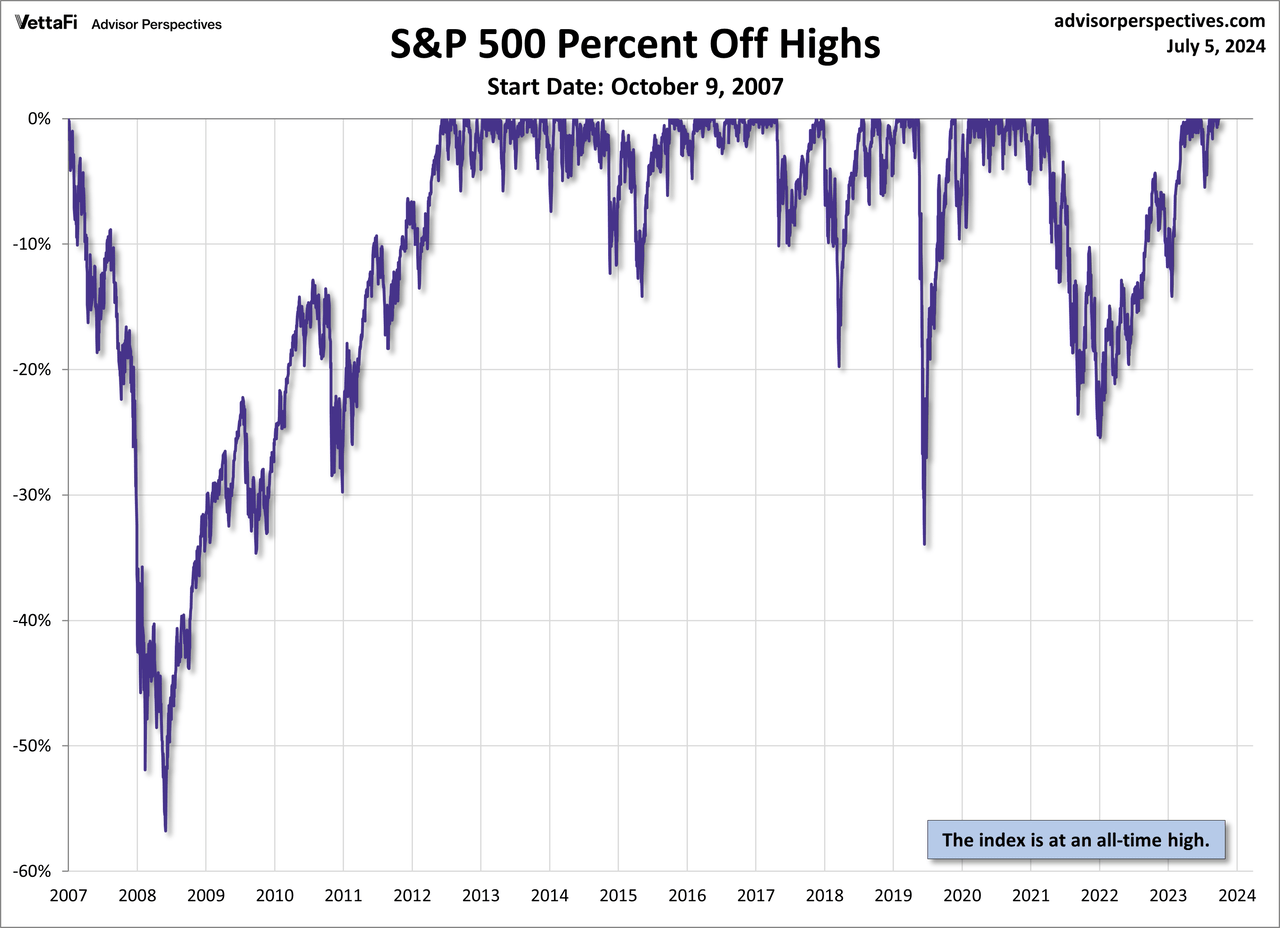

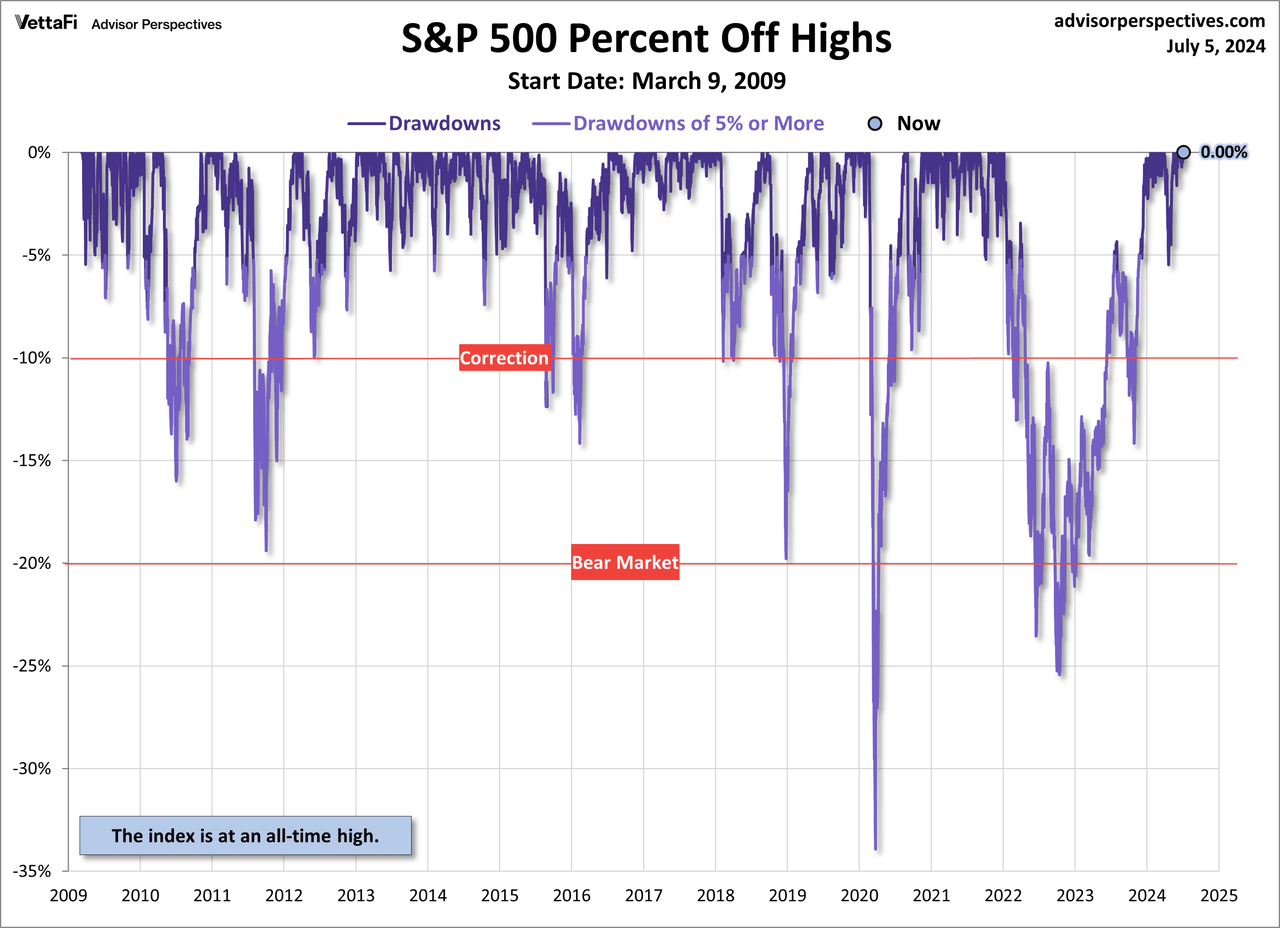

S&P 500: A Perspective on Drawdowns

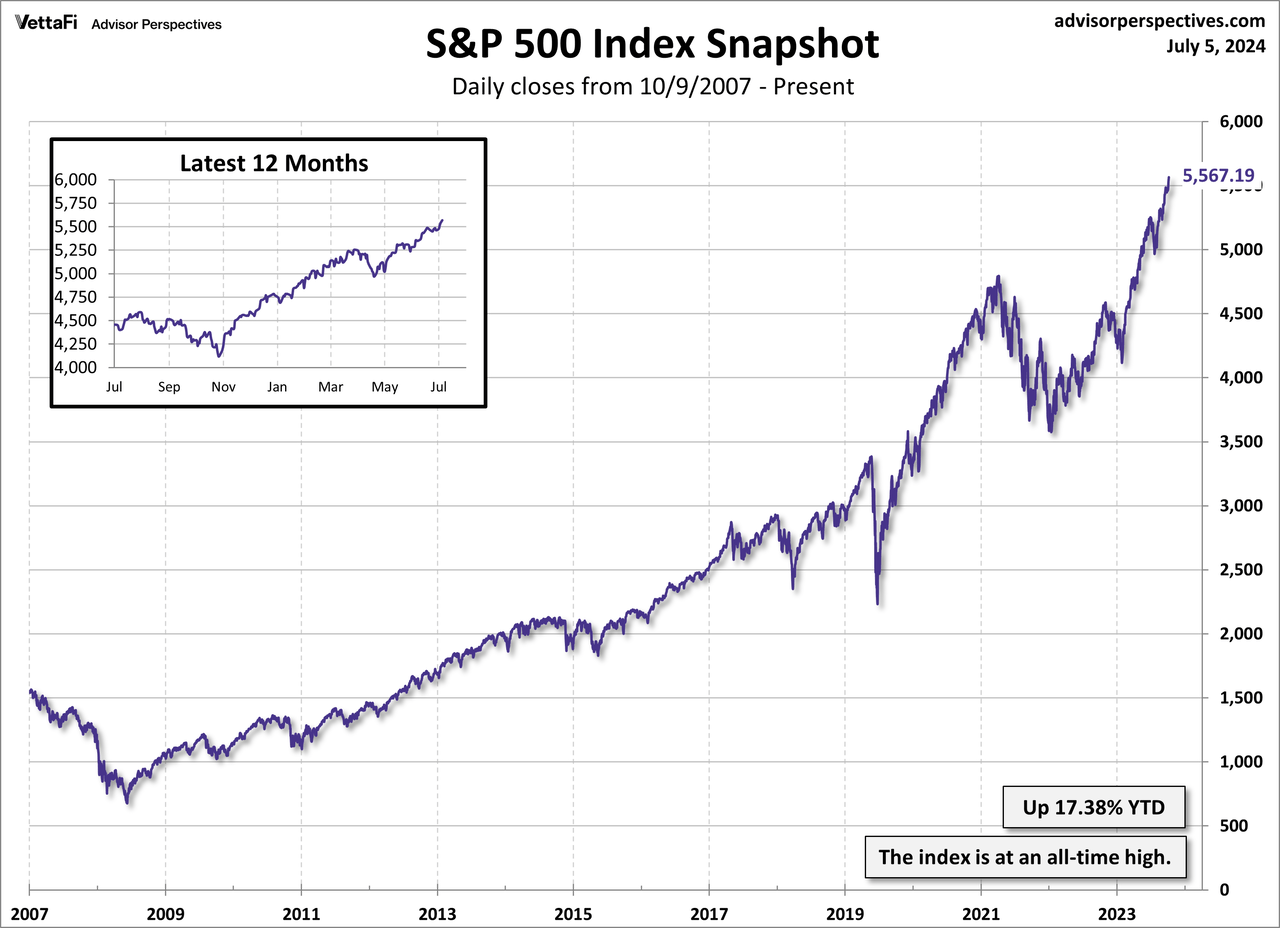

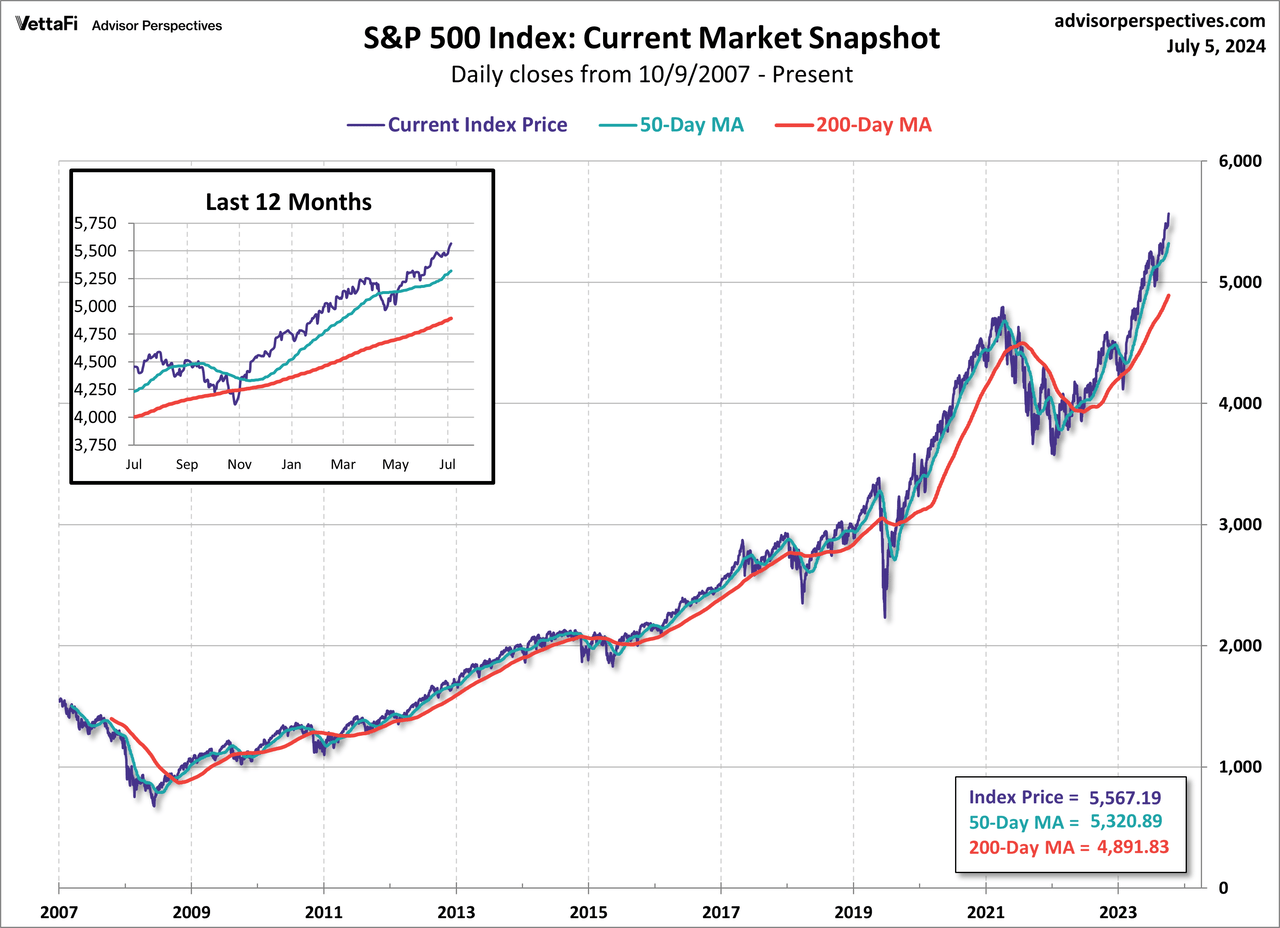

On October 9, 2007 the S&P 500 reached a then all-time high, closing the day at 1565.15. Then on March 9, 2009, the index dropped ~57% off of its high from exactly 17 months before, closing the day at 676.53. This time period became known as the Global Financial Crisis. It took over 5 years before the index reached a new then all-time high on March 28, 2013, where it closed out at 1569.19. The chart below is a snapshot of record highs and selloffs since the 2007 peak reached on October 9, 2007.

What happens if we take out the Global Financial Crisis? Here’s a snapshot of the same chart above where the start date has been changed to the trough reached on March 9, 2009. Note the recent selloffs in 2022.

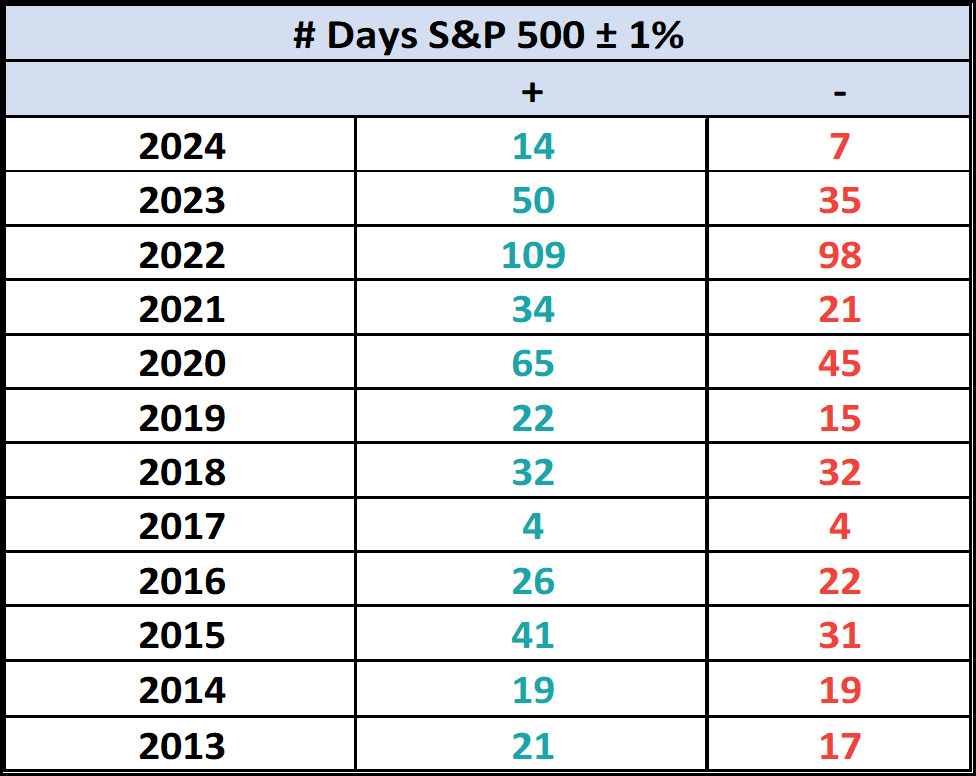

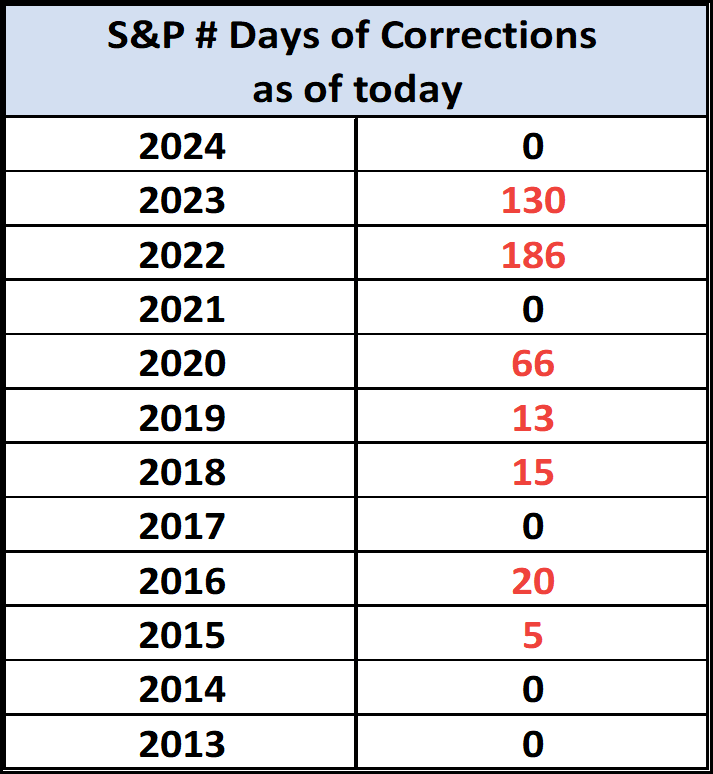

Here’s a table with the number of days of a 1% or greater change in either direction and the number of days of corrections (down 10% or more from the record high) going back to 2013.

|

|

Here is a linear chart of the index since October 9, 2007:

Here is a linearly scaled version of the same chart with the 50- and 200-day moving averages. As of November 3rd, the index has been above both its 200-day moving average. As of May 6th, the index has been above its 50-day moving average.

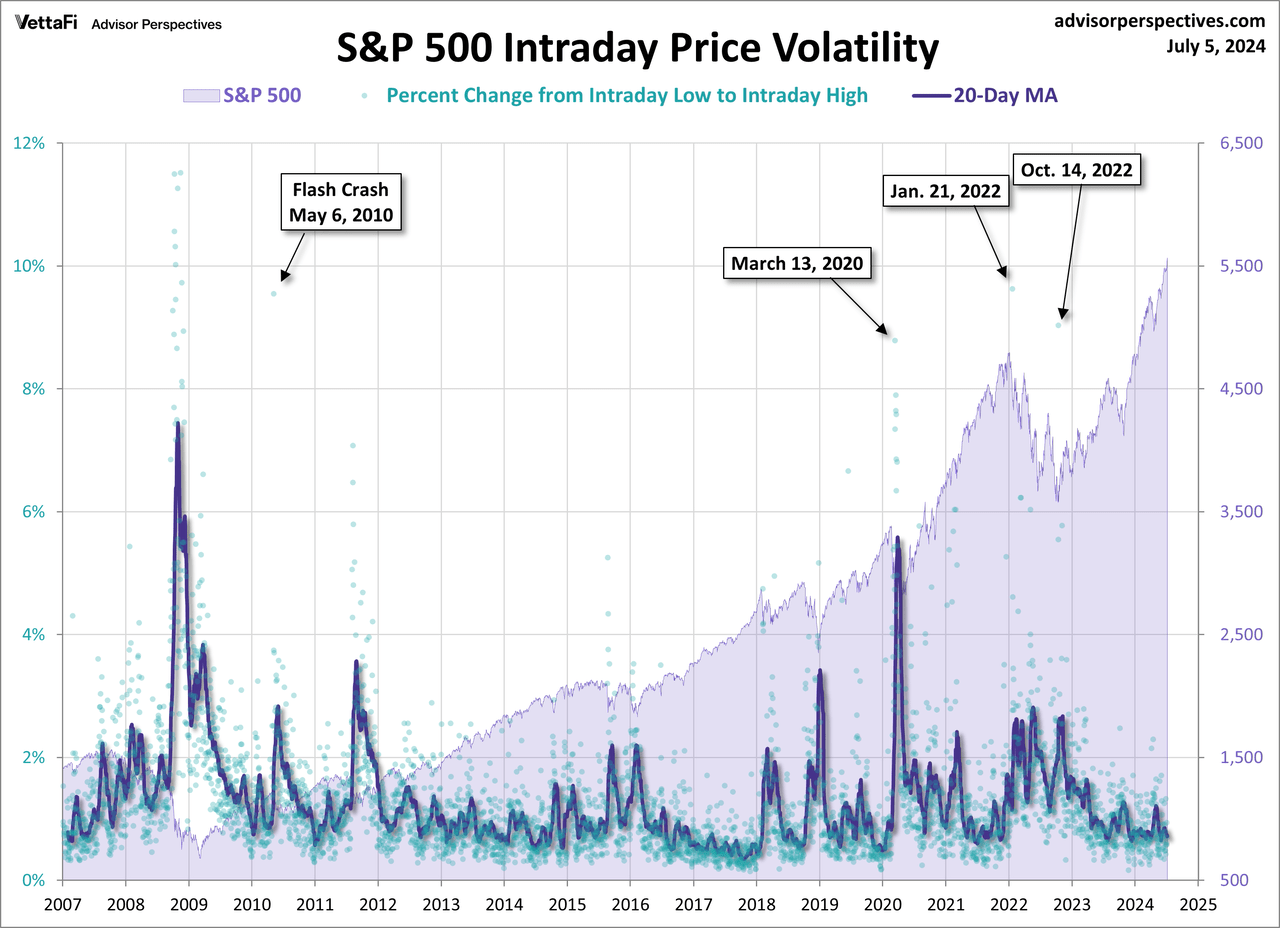

S&P 500: A Perspective on Volatility

S&P 500: A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. I’ve also included a 20-day moving average to identify trends in volatility.

S&P 500 versus S&P Equal Weight

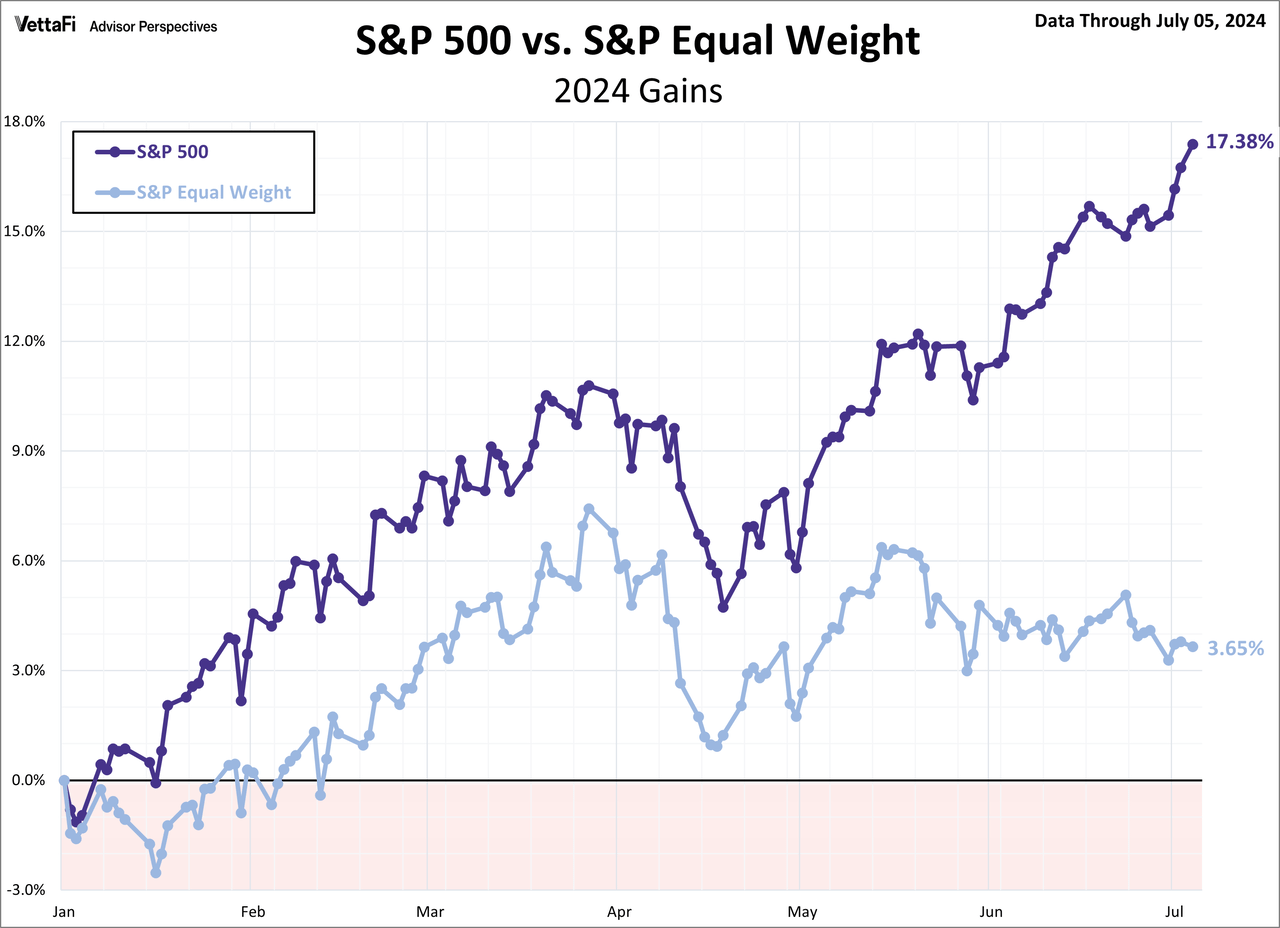

The S&P 500 is a market cap-weighted index which includes roughly the 500 largest U.S. stocks spanning 11 sectors. The S&P 500 Equal Weight Index includes the same constituents as the S&P 500, but each company is equally weighted at a fixed weight. So how do these two indexes match up against each other this year?

The S&P 500 is currently up 17.38% year to date, while the S&P Equal Weight is only up 3.65% year to date.

ETFs associated with the S&P 500 include: iShares Core S&P 500 ETF (IVV), SPDR S&P 500 ETF Trust (SPY), Vanguard S&P 500 ETF (VOO), SPDR Portfolio S&P 500 ETF (SPLG), and Invesco S&P 500® Equal Weight ETF (RSP).

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here