I think it is quite difficult to have an advantage in predicting the Fed’s actions. Thousands of analysts are looking at it, and we all have access to the same information. So, while I have my own opinions on if/when the Fed will cut, it is perhaps just as useful to know what the market collectively thinks will happen.

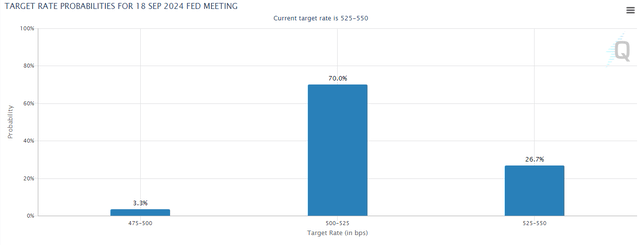

Using pricing on futures, one can calculate the market implied probability of rate cuts. As of 7/9/24, the market thinks there is a 70% chance of one 25 basis point cut in September from the current range of 525-550 down to 500-525.

CME Group

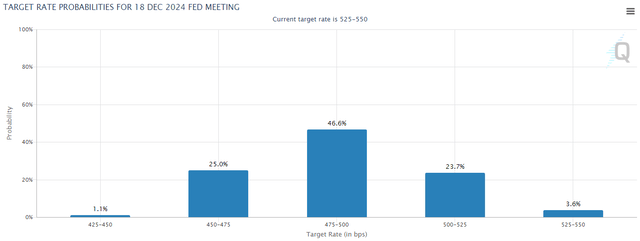

By December, the market believes there will be two 25 basis point cuts, with the runners-up being 3 cuts or 1 cut.

CME Group

That is a very clean bell curve of expectations centered on 2 cuts by year-end.

Consensus, of course, does not mean it is correct, but perhaps that is the best estimate available. I think the consensus also fits with fundamentals, as inflation has had multiple favorable reads in a row and employment is indeed showing signs of weakness. Thus, market consensus is consistent with the Fed’s dual mandate to both maximize employment and maintain price stability.

In recent public appearances, Powell has seemed to grow increasingly concerned about the employment side of the mandate and recognized the significant risks of waiting too long to cut.

So while cuts are still far from a certainty, the market, and fundamentals are both currently saying they are probable.

As such, it behooves us to develop an understanding of what the investment implications would be. I’ll leave the S&P implications to the generalists and focus on my area of study, REITs.

How rate cuts affect REITs

The conventional wisdom of the market is that REITs do poorly in rising interest rates and do well in falling interest rates. One would need look no further than the inverse correlation between the Vanguard Real Estate Index Fund ETF Shares (NYSEARCA:VNQ) and the 10-year treasury yield (US10Y). It has now been multiple years of REITs trading down on the majority of days on which interest rates went up.

As such, it would seem that falling rates should generally be a tailwind for REIT stock prices. However, I think it is better to understand it at a deeper level, so we shall examine the mechanisms through which interest rates impact REITs.

Positive impacts of falling interest rates on REITs:

- Cap rates decline (not parallel).

- Transaction volume returns.

- Cost of capital reduced, unlocking acquisitions.

- Multiple expansions.

- Interest expense reduced.

- TINA returns.

- M&A stimulated.

Negative impacts of falling interest rates on REITs:

- Construction becomes more feasible.

- Ownership becomes more viable (possibly reducing tenant demand).

Cap rates

In theory, properties should be priced at some spread over treasuries. If treasuries yield X, buying a property should yield X plus some sort of spread to make up for the risk.

Thus, in a theoretical world, cap rates would move in parallel with treasury yields. However, as the 10-year treasury yield went up 200 to 300 basis points, cap rates only went up about 100 to 200 basis points depending on the sector.

The reason cap rates did not move in parallel is because there is a growth component. Higher interest rates increase the long-term rental rate growth of real estate, such that a lower cap rate could be justified by higher growth.

I would anticipate a similar, not quite parallel move on the way back down. Furthermore, worth noting is that interest rates are unlikely to move all the way back down. Overall, in the cutting cycle, I think cap rates will come down maybe 50 to 75 basis points.

Cost of Capital (debt) – cheaper rates

The cost of capital should decline with interest rates through the obvious mechanism of mortgage and other debt being cheaper.

Cost of Capital (equity) – multiple expansion

REIT multiples have dropped from close to 18X in the low interest rate environment to a median P/FFO of 12.7X today.

That is how the entire market is supposed to work. The risk-free-rate should be a key component of the denominator in valuing anything. REITs trading at cheaper valuations in the higher interest rate environment is in-line with financial theory. The true phenomenon today is how the S&P and Nasdaq somehow avoided the denominator effect of a higher risk-free-rate and are presently trading at very high multiples despite the high risk-free-rate.

Assuming financial theory holds in both directions, a declining risk-free-rate should pull the multiple of REITs back up. I don’t think it will go all the way to 18X, but the median REIT trading back up to15X seems quite reasonable to me.

Transaction volume

Property transactions have been gummed up. Sellers would rather not sell at high cap rates because sellers believe cap rates will come back down when interest rates come down. At the same time, buyers cannot really buy at low cap rates because the cost of capital is presently high.

So there is quite a spread between the prices buyers and sellers of property are seeking, which has resulted in exceedingly low transaction volume.

A declining cost of both equity and debt would go a long way to opening transactions back up. There would once again be a window of mutual benefit in property transactions.

TINA Returns

TINA or There Is No Alternative was a term referring to the paucity of income investments available during the low interest rate environment. Neither treasuries nor corporate bonds could fulfill investors’ need for income, so many of those who would normally stick to fixed income were pushed out on the risk curve into equities.

REITs became the target of income investors, resulting in REIT share prices reaching all-time highs in 2021 during the zero interest rate environment.

If rates drop, TINA will come back, although likely in a weaker form as rates are probably not going back to 0.

The multiple expansion for REITs discussed above is the rational and fundamental response, while TINA is more of a constituency effect. In other words, REIT multiples fundamentally should expand due to a lower denominator, while a diminishing number of high-yield investments pushing investors toward REITs affects the market prices in non-rational ways.

During 2021, the constituency effect pushed REITs above fair value. In today’s environment, REITs are trading so far below fair value that I see it as more of a catalyst to help them get to fair value.

M&A stimulated

Just as transaction markets were gummed up, M&A has been on the light side within real estate for similar cost of capital reasons.

As capital gets looser, we anticipate more mergers between public REITs and more private equity buyouts of public REITs.

The negatives

Each of the above mechanisms favors either the fundamental value of REITs or the market pricing of REITs.

There are, however, also some negative impacts of falling interest rates.

Long-term real estate rental rate growth is related to the relative cost of owning versus borrowing.

If it is very expensive to own, companies and individuals will be willing to pay significantly higher rent to forego that cost of ownership.

The high interest rates of 2023 and 2024 have substantially stifled construction activity, making existing real estate have less competition, and it is the higher interest rates that have ushered in the rapid rental rate growth REITs have been enjoying.

As rates fall, construction will start to pencil again and as supply picks up, rental rate growth will start to decline back to more normal levels.

Since construction activity takes a long time to plan, there is a 1-to-4-year lag in these effects depending on property type, location, and scale. Essentially, the low levels of construction starts in 2023 and 2024 will benefit REIT FFO growth in 2025-2027.

If interest rates start going down in 2024, it would moderately reduce the outsized rental rate growth beyond 2027.

I believe this is the component of interest rates that is most broadly misunderstood by the market.

The zero interest rate environment was a terrible thing for REITs. Unhealthily low interest rates shortly after the pandemic are the main reason that FFO/share growth has been weak in 2023 and 2024.

I view the rapidly rising interest rates of recent years as a sort of medicine for REITs. It tasted bitter going down, but it has restored underlying fundamental health.

The primary barrier to entry for real estate is the massive up front capital cost. In a world where capital was free, real estate lost its incumbency advantage. The barrier to entry has been restored, which shut down construction and caused occupancy as well as rental rates to begin rising across the majority of property types.

Overall impact of interest rate cuts

I think cuts will be quite beneficial to the market prices of REITs through restoring FFO multiples to more normal levels.

Fundamentally, interest rates are more neutral. REITs function best when the 10-year Treasury yield is somewhere between 2.5% and 6%. A couple of cuts is fine and probably beneficial because it will help the yield curve un-invert, but we would rather not see a return to zero-interest-rate-policy.

REITs best positioned to take advantage of falling interest rates

While it could be a tailwind for REITs in general, there are 2 categories of REITs that, I think, will particularly benefit:

- Discounted preferreds.

- Moderate to high leverage with strong business.

Discounted preferreds

The idea here is basic. They have traded well below par to make the current yield appropriate for the high interest rate environment. As rates drop, they would return closer to par, resulting in capital appreciation along with the dividends.

Leverage is good if the business is good

Leverage has been a dirty word lately in REITs with the magnitude of selloff in REIT market prices directly correlated with the leverage of the given REIT.

Indeed, leverage is a bad thing if the business is struggling, but those with strong underlying companies that just so happen to have high leverage would disproportionately benefit from falling rates. Many of these companies have sold off on fears of debt servicing costs rising, but that may no longer be the case. With stable or even potentially declining cost of debt, the underlying strength of the business will show through.

Many of the REITs in this category are trading around 8X to 11X FFO, so they have quite a bit of room for multiple expansion as fears subside.

A preview of how the market seems to respond to dropping interest rates

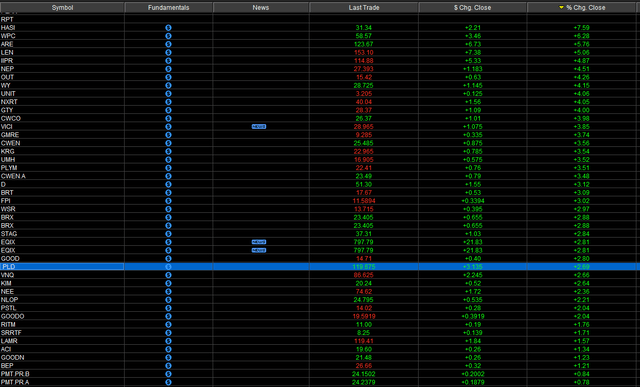

On 7/11/24 an inflation report came in very low, further igniting hopes for a near term rate cut. Here is how the market responded.

E-Trade Streamer intraday 7/11/24

REITs were up 2.66%. Of course, this is just a single data point, but I think it is consistent with the way the market has viewed interest rates and REITs for a long time.

Conclusion

The above mechanisms are useful in figuring out which REITs are best positioned for the environment. If interest rates do indeed fall, REITs might have a tailwind in market prices for the first time in years.

Read the full article here